Lie back and think of Russia: Trouble has come to the Asia-Pacific and it’s time for you to make some hard choices about the ASX

Pic: Getty

From this distance, it might still be hard to believe there’s a war happening in Europe but as the fighting in Ukraine enters its seventh dreadful week, very soon some resource-exposed nations across the Asia-Pacific are going to start sitting up and taking notice.

According to new research out of the Economic Intelligence Unit, some of us will feel it as pain, while others are about to feel the profit.

The EIU says Russia is a central piece of a supply chain puzzle which includes everything from weapons to metals to tourists.

We’ve all seen the excitingly unhinged way global prices for oil, gas and grains have been behaving since the war started – a lifetime ago – in the last week of February.

Both sides, Russia and Ukraine, play a major role in the distribution of the world’s interconnected supply for many of these critical commodities. And our region is no exception.

“Niche dependencies include reliance on Russia and Ukraine as a source of fertiliser and grain in South-east and South Asia, which could cause disruption in the agricultural sector,” the research firm says.

CBA’s director of agri-business Tobin Gorey has been a madman as per, tracking the global volatility across grains with a relentlessness that belies this photo taken back when Stockhead deputy editor Sam Jacobs and I were at Business Insider with the wonderfully relentless Paul Colgan.

“Wheat supply from the Black Sea remains on the agenda, but shipping is reportedly becoming more expensive. Shipping rates from Russia have leapt since the invasion. Insurance costs are adding substantially to those costs… Insurers are putting a surcharge on vessels in those waters which is now more than the shipping cost,” Gorey says.

Wheat futures are still up 65% compared to a year ago while corn futures are up over 40%.

Check this out:

Cereals out of Russia:

- Pakistan (sources about 40%)

- Sri Lanka (already in economic armageddon gets more than 30%)

- Bangladesh (more than 20%)

- Vietnam (circa 10%)

- Thailand and the Philippines (about 5%)

- Indonesia, Myanmar and Malaysia (less than 5%)

Cereals out of Ukraine:

- Pakistan (doing it very tough also nearly 40%)

- Indonesia (more than 20%)

- Bangladesh (nearly 20%)

- Thailand, Myanmar and Sri Lanka (nearly 10%)

- Vietnam, Philippines and Malaysia (about 5%)

Well, it could be worse.

When it comes to Russian weaponry Mongolia gets 100% of their arms from the world’s second largest dealer.

Some will benefit, some are vulnerable

Aside from guns, food and energy, there’s always metals. Leaving aluminium aside, Russia, for example, is the world’s third-largest supplier of nickel.

“There will be export benefits for some countries from higher commodity prices and a global search for alternative supply,” according to the EIU.

Regional economies which stand to benefit from higher commodity prices:

- Coal exporters: Australia, Indonesia, Mongolia

- Crude oil exporters: Malaysia, Brunei

- LNG: Australia, Malaysia, Papua New Guinea

- Nickel suppliers: Indonesia, New Caledonia, Australia

- Wheat suppliers: Australia, India

Datt Kapital: Where are sanctions taking us now?

Heaps of Western nations have used fairly wide-ranging economic sticks as a means of deterring Russia’s invasion of Ukraine – to little effect so far. The US has led sanctions on energy, while the Brits say they will follow suit by year’s end, but a far more exposed European Union is struggling with its own intense dependence on Russian resources.

Emanuel Datt, founder and CIO of Datt Capital, says these might not have stopped a war, but they have enormously impacted the broader energy and commodity markets.

Russia supplies enough of the world’s energy, food and metals for these actions to turn a complex global system way off course, Datt told Stockhead.

“Although Western sanctions have been oriented specifically towards maintaining the continuity of supply for critical goods… however, we have seen a strong ‘self-sanctioning’ effect amongst traditional customers of Russia. For instance, a commodity trading house may struggle to obtain the requisite insurance and finance to cover the purchase and transport of a shipment of Russian-origin commodities.

“As such, almost overnight, we’ve seen an enormous uplift in demand for commodities of non-Russian origin to fill this sudden supply gap.”

Newcastle thermal coal futures, an export-focused commodity, surged 46% in a single session last week, to close at US$446 a tonne. This is in contrast to prices of ~US$190 a tonne only two months ago.

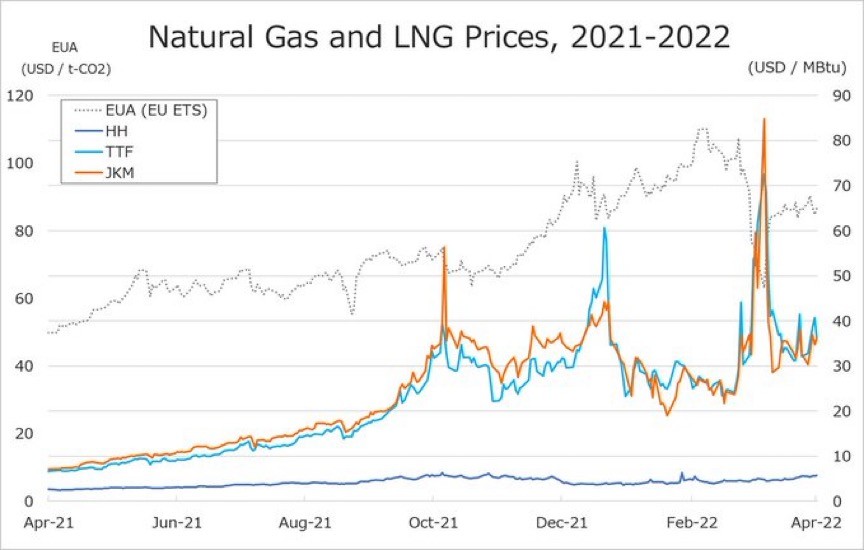

“The important Asian LNG benchmark, the JKM index, is currently trading ~US$35/MMBtu; significantly higher than in recent months. In addition, the price of crude oil has exploded with the Brent benchmark currently trading at ~USD$116 a barrel vs USD$77 a barrel two months ago,” Datt says.

“These unwelcome circumstances have thrown open unique opportunities for Australian focused investors to capitalise upon,” Datt says.

Datt’s ASX-listed small caps worth keeping a close eye on:

Metals X (ASX: MLX) – own 50% of the world class Renison tin mine in Tasmania. One of two listed tin producers on global markets. Tin is in a structural deficit with no new sources of production expected for at least three years, despite rising demand from the computer chip manufacturers.

Red Dirt Metals (ASX:RDT) – Western Australian lithium explorer with significant upside via the resource definition process. Appears to be significantly undervalued relative to peers. Lithium is expected to be in a structural shortage in the next 1-2 years.

Ardea Resources (ASX:ARL) – Western Australian nickel laterite developer and nickel sulphide explorer. Ardea have a globally significant and advanced nickel laterite resource located near Kalgoorlie. We expect this resource to be progressed rapidly given the large nickel supply shock caused by Russian sanctions. ARL are also following up promising nickel sulphide hits which could be more easily commercialised in the case of exploration success.

Carnarvon (ASX:CVN ) – Carnarvon hold a significant interest in the Dorado and Pavo offshore oil discoveries in Western Australia. Industry leader, Santos, hold the majority of the project stake and another exploration well (Apus) is underway presently. Oil has appreciated significantly due to Russian sanctions and we expect CVN’s assets to remain highly attractive to an acquirer especially in the case of exploration success at Apus.

NiCo Resources (ASX:NC1) – hold a globally significant nickel laterite deposit located in Central Australia. The company are continuing commercialisation studies over this resource which will benefit from the strong price environment being experienced by nickel.

Among the big names:

Datt is keeping an eye on Whitehaven Coal (ASX:WHC):

“WHC produces high-quality thermal coal in NSW for export primarily to Japanese and Korean customers. Russia coal imports supply an estimated 15-20% of Japanese and Korean coal demand. Consequently, WHC’s customers will likely be willing to increase purchase volumes from Whitehaven at higher prices than has been traditionally achievable.”

As seeming confirmation, in a note this week, Morgans hoisted Whitehaven Coal’s price target to $5.10 from $3.72 adding the the stock could well hit $6.53. In Jedi-esque language Morgans said, “we sense recent energy market dynamics has awakened a wider investor set to the importance of thermal coal.”

As well as:

New Hope Corp (ASX:NHC) produces thermal from its majority-owned Bengalla mine located in NSW. New Hope trades at just over 1x expected EBITDA at current thermal coal spot prices and is due to pay an interim fully franked dividend of 30c a share (equating to over 12% yield grossed up). The company has one of the highest franking credit balances of any company on the ASX and we expect the board to release this embedded value to shareholders in a timely manner.

South32 (ASX:S32) is a diversified miner that was demerged from BHP in 2015; holding most prominently a range of aluminium, coking coal and base metal assets. S32 is highly capital disciplined and has been buying back its shares on market since 2017 and this continues today. These repurchases have been highly value accretive to shareholders and the company trades at approximately 2x EBITDA at current spot prices.

Bluescope Steel (ASX:BSL) is a diversified steel producer with major operations in the US and the ANZ region; that was demerged from BHP in 2002. Bluescope is buying back approximately 10% of its shares on-market and trades at circa 2x EBITDA despite the strong fundamentals underpinning forward steel prices and demand.

Vulcan Steel (ASX:VSL) is a steel distribution business with operations in the ANZ region, recently listing on the ASX. Vulcan is experiencing excellent tailwinds from these inflationary markets with reported EBITDA per tonne of steel sold doubling in HY22 relative to FY2022. The business has several attractive qualitative factors which make the present value quite compelling and we value the business around 50% higher than present market prices.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this

article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.