War. Our economy. Your money. And the value of a proportional response

Pic: Getty

So we’ve moved fairly quickly from Russian troops massing in the Ukraine to our first glimpse of what Western punitive economic deterrents look like and now, unhappily, there is war again in Europe.

The ASX 200 was not alone in having it’s worst day in a very long time. It’s hard to single out the benchmark when there is global wilting under the pressure of where we all find ourselves.

Both the ASX200 and the broader All Ordinaries as indexes have shed near 3%, the worst day for local markets that’s had nothing to do with the global pandemic, since the global pandemic.

CommSec: Full on war will cut global markets by up to 20%

CommSec senior economist Ryan Felsman says there will be a clear and present economic blowback should Russia just drop the pretense and go the whole hog and invade Ukraine entire.

And even engage NATO. Yes, the alliance has its own – as yet untested – multinational unit of about 40k troops, as well as a multinational brigade somewhere in Romania. There’s also a Very High Readiness Task Force. The VJTF. Never used, but apparently really, really ready to deploy.

This all adds up, Felsman says, to “a big negative for risk assets, with global markets potentially shedding 10-20%.”

“For share market investors, the benchmark US S&P 500 index has already entered correction territory, also weighed down by the prospect of aggressive monetary policy tightening,” he adds.

Volatility and safe havens

So far, safe havens have played out with the USD holding its own in a tight range, gold looks comfy at eight-month highs and government bonds have rallied in concert with the intensification of geopolitical risk.

#Gold hits fresh highs $XAU pic.twitter.com/dH6P6v5pxC

— David Scutt (@Scutty) February 24, 2022

Volatility across equity markets and beyond is with us for the foreseeable future, Mark Todd from the Bank of China says.

“We might be approaching the first rate-hike from the Fed, but we won’t be seeing the end of volatility until inflation recedes or Putin recedes, or preferably both,” he added.

But when it comes to equities, CommSec is staying on message and giving the macro-economic implications of war a wider berth.

“Central bank’s tightening of monetary policy still remains the key risk to shares in our view, as policymakers attempt to re-anchor inflation expectations,” Felsman warns.

Here’s why

Russia’s economy might not be that globally significant – at circa 3% of global GDP, it’s no California. But full on war has full on economic costs and most critically, fragile energy markets could easily flop into an energy market crisis, which of itself can drive a global economic downturn.

Felsman says prolonged elevated oil prices would “prove negative for Australian consumers, and thus for Australian retailers and transportation companies.”

But, on the flip side, if the step-by-step approach to sanctions pushes Russian resources and commodities out of tight global markets, then, “Aussie mining, energy and agricultural producers have potential to benefit from an exit of Russia from global export markets, benefitting from higher demand and prices.”

Of course, he adds, those benefits would be for little if the conflict turns total and delivers a knockout blow to the global economic recovery.

So what’s in our favour?

A disunited response

Markets are wrestling with a few challenges right now.

Guesstimating and then pricing in sanctions is not an easy task, especially when the talk is all multilateral but the responses are all unilateral.

Overnight the EU slapped 23 high-ranking, probably scary Russians with measures which froze their foreign assets, locked up bank accounts and restricted movement. Over in the States, US President Joe Biden seems to be favouring a more gradual squeeze.

And as the PM showed yesterday, that’ll be our song sheet too.

Proportional responses

On Monday, after Russia officially recognised Eastern Ukraine’s self-proclaimed, Donetsk People’s Republic (DPR) and Luhansk People’s Republic (LPR), Mr Biden responded by applying measures targeting trade in the two territories.

The next day, when President Vladimir Putin sent in his Russian ‘peacekeepers’, Biden lit sanctions under two Russian banks, aiming at the country’s sovereign debt and a bunch of random Russians the White House called members of Putin’s inner circle.

Tranche warfare: phased sanctions from AUKUS

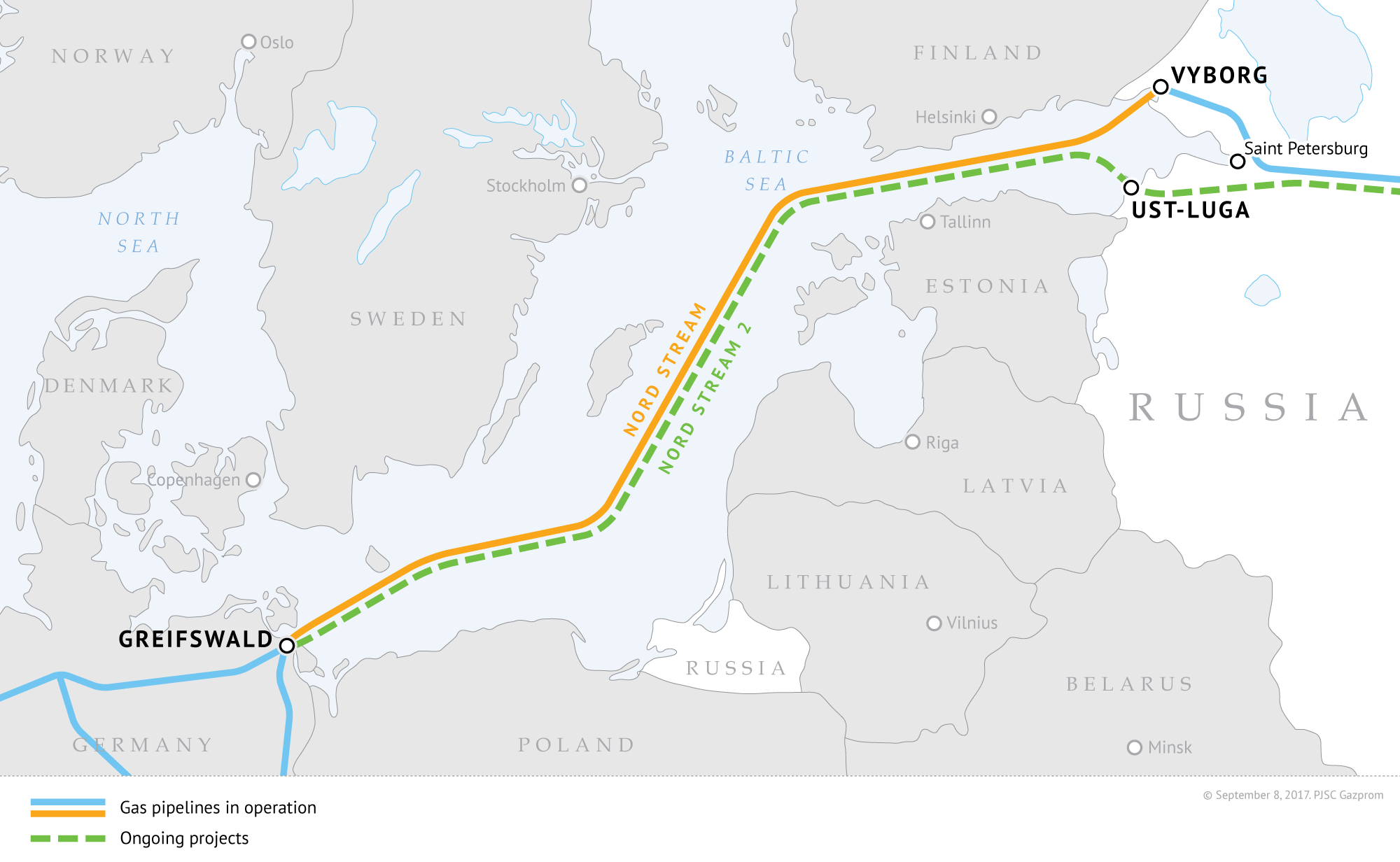

The next phase – they’re being called tranches – of sanctions out of the US have walloped the builder of the Nord Stream 2 pipeline, Gazprom and friends.

“These steps are another piece of our initial tranche of sanctions in response to Russia’s actions in Ukraine,” Biden said.

“As I have made clear, we will not hesitate to take further steps if Russia continues to escalate.”

American policy has always leant toward a ‘proportional response,’ as entirely proven here by fake but very impressive former Democratic US President Jed Bartlett:

Good one Jed, you really make our PM’s morning press conference seem a little tepid.

Tepid talk, tepid sanctions. But there’s a good reason for that too.

Our sanctions

Yesterday, Morrison told reporters the Governor-General signed off on amended sanctions which become law today but won’t come into effect until the end of March.

The amendments give the government the ability to make being incredibly wealthy a bit harder for individuals backing Russia in Ukraine.

The sanctions cherry-pick eight cronies inside Moscow’s Security Council, the banks on Biden’s list, and likewise follow US sanctions targeting key sectors in Donetsk and Luhansk.

The PM said the measures, “give us scope to cover people and entities of economic and strategic interests to Russia.”

“It’s a broad remit,” he added.

But it isn’t really.

“This goes direct to those who are at the heart of this bullying.”

It doesn’t.

“It stops them from having holidays in countries like Australia… or shopping at Harrods.”

Ouch. That’s really mean.

“There must be a price. This cannot be a consequence-free action.”

We guess that’s true.

“Last night I spoke with Ukrainian Prime Minister to confirm our unwavering commitment to Ukraine’s territorial sovereignty and the Ukrainian PM was deeply grateful for our support.”

No doubt they feel safer already.

And when asked about the implications for the economy and Australian businesses engaged in the region, the PM said:

“Our trade with Russia is actually quite minor compared to many other countries in making the decisions yesterday, the Treasury Secretary attended that meeting and gave us advice that we could impose these sanctions with minimal impact on Australian businesses, but it is important, as I said under the Autonomous Sanctions Legislation, that there’s a period of time for businesses to make adjustments to their arrangements as appropriate…

We’re not overly concerned when it comes to the direct impact of our supplies…”

But we should be

Russia is home to vast natural resources critical to the global economy. An economy which, despite the PM’s chillaxedness, we’re still a part of.

This gives the Kremlin power to retaliate during a period of immense global economic fragility and an enduring energy squeeze.

Russia is the world’s number three oil producer, exporting about 5m mboe of crude and around 2.5m barrels a day of petroleum – some 60% landing in Europe.

Then, the EU relies on Russia for 40% of its natural gas and a third of its crude oil, according to CommSec.

These resources are vital for the EU due to the ongoing shortage of energy supplies and it has led directly to record high LNG prices, economists at the ANZ say.

Russia is a seriously global commodities producer and has a major hand in the flow of critical metals and minerals, commodities and resources from palladium, titanium, natural gas, platinum, wheat, nickel and aluminium.

“A potential conflict between Russian and Ukraine is increasing fears that global commodity markets will experience a supply shortfall, disrupting car manufacturing and even the aeroplane industries. This threat has contributed to the rally in commodity prices in recent months,” the ANZ warns.

The next step in the conflict could see Western Europe cut-off from those giant imports of natural gas and oil.

Already crude oil and natural gas prices are going gangbusters at a time when global inflation rates are punching way above their weight at multi-decade highs.

And from Australia to Austria, rising costs are, “unnerving consumers faced with higher mortgage repayments, rising petrol, electricity, food and goods prices.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.