Kick Back: The biggest stories you might have missed on Stockhead this week

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Happy Friday. What’s been interesting this week?

The US President getting impeached is kind of interesting. But it’s happened several times before and all that led us to is… this.

US politics might still be interesting without Trump, because Marjorie Taylor Greene got elected and she is a deadset nutjob. She just filed to have Joe Biden impeached for “abuse of power”.

(Note to Marjorie: Biden hasn’t even been given the “power” yet.)

Bitcoin is always interesting. So interesting this week, in fact, that sassy ECB president Christine Lagarde has finally noticed it and decided it needs regulation on a global level.

She told Reuters it’s a “highly speculative asset which has conducted some funny business and some interesting and totally reprehensible money laundering activity”.

It’s definitely global – this miner is braving the cold of the Arctic circle and life in general in one of Russia’s most polluted cities to scratch around for BTC without the huge power bills.

The cricket is getting interesting, but we know where that led to last week. So right now’s a good time to ignore it completely and focus instead on what you might have missed on Stockhead this week.

The potential life-changers on Tolga Kumova’s radar in 2021

If you missed this, you’re in a very exclusive club. Because when we say everything Tolga Kumova touches turns to gold, that includes stories with Tolga Kumova in it.

But we didn’t do it for the clicks. We asked one of the most astute resources investors in Australia for his 2021 stock picks because we care about you, the readers.

And you, in turn, care about what Tolga cares about. We know, because here’s how those stocks picks were holding up 24 minutes into trading on the day that was published:

“If you put $30,000 into something that goes up 50 times, and you have the courage to hold it, then it will change your life,” Kumova told us. “These are the companies I’ve picked out specifically for this.”

Chimeric IPO: What ASX stockspert Bhavdip143 likes so much about the $35m CAR T play

Or you could put your faith in any one of the growing number of social media gurus happy to share their wins (and there’s your cautionary note right there, astute observers).

People like @eunicedwong, @bossivic, @longhorncapital and @8020invest.

We like @bhavdip143. Mainly because he talks to us, but also because he seems to have a pretty good handle on IPOs. And he got banned from Twitter recently, so he must be doing something right.

Lately, Bhavdip Sanghavi, as he’s also known, has been chatty about the IPO for Chimeric Therapeutics, which lists on the ASX on Monday.

It’s a big one, too – initially the company was seeking $25 million, but had to raise that by another $10 million.

Why? It’s developed a therapy treatment for solid tumours based on research at the City of Hope Cancer Centre in Los Angeles. A CAR T cell treatment.

This one in particular uses a peptide discovered in scorpion venom, to reprogram a patient’s T cells to target cancer cells.

But don’t take our word for it. No really, don’t, because then we would have wasted our time getting @bhavdip143 to talk it up.

How CAR T cancer treatment saved Laurie Adami’s life

So is CAR T the cure for cancer?

Such an excellent question, that we asked someone who claims CAR T cell therapy was a cure for cancer. Laurie Adami was diagnosed in 2006 at the age of 46 with advanced, incurable blood cancer.

Except, it wasn’t.

In 2018, after 12 years of failed treatment, and the growth of 3.6kg of cancer in her body, Adami gave CAR T a chance. Result:

And yes, Chimeric aren’t the only ASX stock dabbling in it.

Bulk Buys: Iron ore closes in on $US180 per tonne, coal hostage to uncertainty

What happened in iron ore this week? Let’s just roll with:

“The price of iron ore for delivery to China has (insert surge price here) in a week to (insert new daily high price here), a (insert new yearly high) here.”

S&P Global Platts reports Chinese ports had 125 million tonnes of stockpiled iron ore last week, and port stocks have been above this level since October 2020. That sounds like a lot.

But if it stopped arriving today, at China’s current production rate for steel it would be consumed by lunchtime, Tuesday.

Fortunately for China, shipments of iron ore from Brazil are starting to move again after the disastrous Vale dam failure back in- oh, wait:

I introduce to you $VALE the clusterfuck that keeps on clusterfucking.. this is one of their Iron Ore ship-loaders on fire.. https://t.co/zE5UPkt2C1 pic.twitter.com/gVVPy2Xohh

— Nick Fabrio (@longhorncapital) January 15, 2021

That was Thursday. And yes, it looks like it might be a little bit market-moving.

Australia down to two uranium mines after ERA confirms Ranger mine’s production halt

Also on the subject of constrained supply, there’s been a lot of talk growing about uranium’s future as a clean energy resource looking a little brighter.

Uranium oxide prices have rebounded from their March 2020 low of $US24 per pound and were trading around $US30.65 per pound this week.

By 2025, according to Bannerman Resources (ASX:BMN), the uranium market will start to go into significant deficit, then “widen dramatically” by 2028.

Who’s going to step into the breach? Not Australia. Last week, the operator of the Ranger uranium mine east of Darwin confirmed it has halted processing operations. That leaves BHP’s Olympic Dam and Quasar Resources’ Four Mile remaining as Australia’s only operating uranium mines.

And that can only mean one thing here at Stockhead – here are the ASX uranium explorers poised to benefit from Ranger’s closure.

Resources Top 5: ASX lithium stocks have the power

Last week, we told you lithium prices were waking up again.

If you’d paid attention, you might have picked up lithium player Sayona Mining (ASX:SYA) at 0.014.

And then sat back with a juicy steak after it announced an an investment and off-take agreement with US-based Tesla supplier Piedmont Lithium (ASX:PLL). Right now seven days later, Sayona’s up about 350% on that 0.014.

Here’s more on that and four other stocks that, like He-Man, have the power.

The Secret Broker: Heads I win, tails you lose, plus you choose how much you lose. Deal?

If you had the chance to double $100,000, with the chance to lose the whole lot on one ASX stock, would you do it?

If it were your last $100K, probably not. If you had another million, the chances are better you’d say yes. And if you were a young Secret Broker, reslendant in your Tommy Nutter suit as you belted on down to the City of London Club in your TVR Wedge, then… definitely.

But TSB has traded the TVR in for a something with sensible mileage, and shoes that accommodate random swelling.

He doesn’t have enough time left on his genetic clock to make back $100K, and even if he had to, there are much more fun ways to do it, with the same amount of risk as what some of these hot-blooded kids are taking on in 2021.

Here’s his advice. At least you can “sip on a cocktail and watch your capital go round and round, instead of down the toilet”.

Who’s buying Bitcoin for $30k? Data suggests it’s all the biggest BTC hodlers

Let’s check in with Tolga again this week:

Does anyone know a person who paid $36000 for a $BTC #bitcoin and why? pic.twitter.com/Rx3CDzVza1

— Tolga Kumova (@KumovaTolga) January 7, 2021

It’s a great question. If Tesla hit $36k, would you buy a single stock?

But guess what – somebody does have the massive cojones to buy $36k Bitcoin. And according to data from Dublin-based platform Crypto Parrot, it’s the whales.

This week, the company published data which suggested that from December 11 to January 11 — when crypto prices doubled from $US20,0000 to $US40,000 — major Bitcoin accounts were heavily involved in the buy-side.

According to the ‘Parrot’, 36 of the top 100 largest Bitcoin addresses recorded inflows of 354,381 BTC.

This is the difference between a serious crypto hodler and a stock holder – when your stock runs up 1000 per cent in eight months on no news, buy with your ears pinned back.

But first – make sure you know where your password is kept. Otherwise, you might end up like Stefan Thomas, a German-born programmer in San Francisco. He’s got two guesses left to remember his digital wallet password, or IronKey will shut his account forever.

In it, 7,002 Bitcoins. About $US220 million ($280 million) worth.

The stakes are high – will Strike strike out or hit a gas home run?

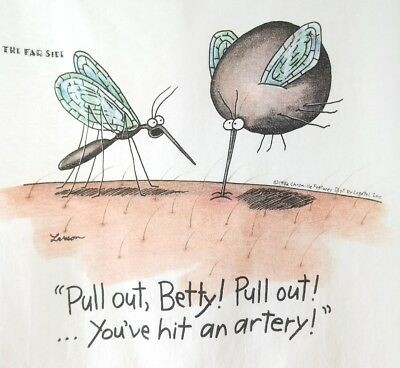

Sometimes when you’re drilling for gas, you hit so much gas things all turn a bit Far Side:

Most often, the risk outweighs the reward. You up stumps and head for the next, more stable resource.

Kind of like Strike Energy (ASX:STX) did when it suspended its West Erregulla-3 well last week after intercepting an abnormally over-pressured Permian gas column.

Except Strike isn’t walking away just yet, and neither have shareholders, who sent shares in the company climbing more than 17 per cent since the announcement was made to 34 cents.

That’s because the gas produced during flaring of West Erregulla-3 also confirmed its composition was just too similar to gas produced during flow testing at the West Erregulla-2 appraisal well.

And at $4 per gigajoule, Strike’s West Erregulla’s 1.2TcF resource has a rough in-ground value of, ooh, about $5 billion.

And yes, nearology plays are not just limited to gold rushes.

Go on Strike. Have a crack.

It’s been an interesting week, and it’s not done yet. Here’s to Monday and all the US brings.

See you then.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.