- Institutional investors have queued up to buy stock in Chimeric’s IPO

- ‘CAR T cell therapy is one of the hottest areas in biotech’ ASX stocks commentator Bhavdip143

- IPO for $35m will fully fund stage one and two clinical trials for CAR T cell treatment

CAR T cell treatment company Chimeric Therapeutics (ASX:CHM) is understood to have easily achieved its IPO fundraising target of $35m ahead of its ASX listing timed for Monday.

Institutional investors have expressed strong interest in the IPO priced at 20c per share, along with sophisticated investors, leading to the offer being heavily oversubscribed.

“The capital raising for $35 million is all done and came in early,” said a source close to the IPO that closed to investors in mid-December.

Chimeric Therapeutics initially intended to raise only $25m in its IPO, but according to the source, this target was raised by another $10m such was the interest from long-term institutional investors.

The company has developed a therapy treatment for solid tumours based on research at the City of Hope Cancer Centre in Los Angeles.

Known as CLTX-CAR T the therapy uses chlorotoxin, a peptide discovered in scorpion venom, to reprogram a patient’s T cells to target cancer cells.

The therapy is currently undergoing phase one clinical trials at the City of Hope Cancer Centre in treating glioblastoma, an aggressive form of brain cancer.

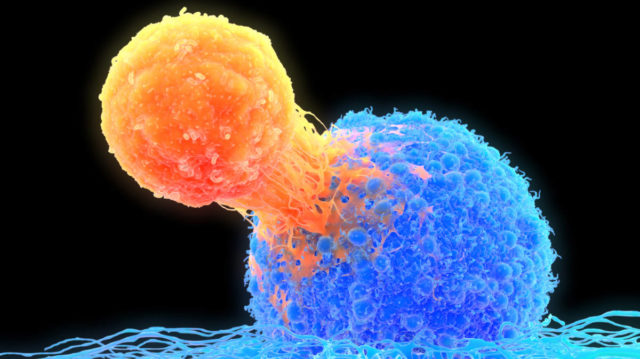

A type of immunotherapy, CAR T cell treatment is short for Chimeric Antigen Receptor T-cell therapy.

It involves taking some of a patient’s white blood cells, re-engineers these in a laboratory to more effectively target cancer cells, and re-injects them into the patient.

The company wishes to move on to a patient study involving 50 to 75 people following the completion of its phase one clinical trial later this year.

Prescient Therapeutics is another CAR T therapy company

Chimeric Therapeutics is following in the footsteps of another ASX-listed CAR T cell therapy company, Prescient Therapeutics (ASX:PTX).

The company has a research partnership with the Melbourne-based Peter MacCallum Cancer Centre to produce technology that can complement CAR T treatments.

The company’s CAR T cancer treatment reprograms the Chimeric Antigen Receptors (CAR) on the outside of T cells to enable them to better target and eradicate cancer cells within patients.

Prescient develops personalised medical approaches to cancer including targeted and cellular therapies such as its OmniCar immune receptor platform, an advanced version of its CAR T cancer treatment.

The company’s CTE programs aim to create efficacy and efficiency enhancements that are relevant to third parties in the cell therapy field, namely CAR-T, which may incorporate these into their own programs under licence.

Prescient carried out a $6.5m capital raising via a share purchase plan last year to further expand its line of cancer treatments including clinical trials for its PTX 100 and 200 products, and OmniCAR platform.

One of the CAR T cell therapy’s success stories is American woman Laurie Adami whose medical case was brought to light by Prescient to highlight the treatment.

Adami underwent CAR T cell therapy in 2018 in a clinical trial at the University of California, Los Angeles, and her full story is featured here.

Stocks commentator Bhavdip143 is investing in Chimeric IPO

Legendary ASX stocks commentator Bhavdip Sanghavi is one investor who has participated in the IPO for Chimeric Therapeutics.

Sanghavi has a large and loyal following among investors on Twitter where he posts his views on ASX stocks and IPOs under the handle of Bhavdip143.

Briefly banned by Twitter in December after he was goaded by trolls, the former stockbroker quickly returned to Twitter after receiving a groundswell of support from investors and followers.

He told Stockhead why he has personally invested in the IPO for Chimeric Therapeutics and why he believes the company has bright prospects.

“CAR T cell therapy is one of the hottest areas in biotech and Chimeric is involved in treating Glioblastoma (GBM) using a novel therapeutic known as chlorotoxin (CLTX)-CAR T cell therapy,” he said.

Experienced leadership team with proven success in CAR T therapy

Sanghavi is impressed by the company’s leadership team and the depth of experience of its directors, including executive chairman Paul Hopper.

“The directors and scientific advisory board have extensive experience and proven success in the field of CAR T cell therapy and other cancer therapies,” Sanghavi said.

Hopper has served in leadership roles in 14 companies including Imugene (ASX:IMU), Prescient Therapeutics (ASX:PTX), Polynoma and Suda Pharmaceuticals (ASX:SUD).

Imugene, Prescient and Suda prices today:

Non-executive director Dr Lesley Russell with experience in hematology and oncology has worked in senior roles at Amgen, Imugene, Cephalon and Eli Lilly.

Chimeric Therapeutics’ senior management team includes highly-experienced CAR T specialists with experience at leading CAR T companies.

Sanghavi said that while the IPO for Chimeric is quite large at $35m, he believes there is strong investor appetite for the company’s shares.

“The IPO is for $35 million which is a lot for a biotech company, but on the plus side the capital raising will mean Chimeric is sufficiently funded for phase 1 and phase 2 clinical trials,” added Sanghavi.

Joint lead managers for the IPO are Bell Potter Securities and Baker Young.

Other successful ASX biotech IPOs

“There has been some very successful biotech and medtech IPOs over the past year or two, including, Atomo Diagnostics (ASX:AT1) and Invex Therapeutics (ASX:IXC),” Sanghavi added.

Medical devices company Atomo Diagnostics manufactures products used for the detection of a range of infectious diseases and chronic medical conditions.

Invex has repurposed Exenatide for the effective treatment of neurological conditions developed from hypertension, strokes or brain injuries.

Other biotech companies that have caught Sanghavi’s interest are cancer therapy company Patrys (ASX:PAB), and Recce Pharmaceuticals (ASX:RCE) which is developing synthetic anti-infectives to counteract antibiotic resistant superbugs and pathogens.

At Stockhead we tell it like it is. While Prescient Therapeutics is a Stockhead advertiser, it did not sponsor this article.

You might be interested in