Kick Back: The biggest stories you might have missed on Stockhead this week

An altcoin buyer receiving some responsible guidance yesterday. Picture: Getty Images

Welcome to a week where we finally created a half-human half-monkey.

Which is good news. After several recent years of tearing down everything smart people taught us, and dismantling all notions of success being a kind of cool thing, could evolution be back on track?

Nope:

Let’s try to forget this is happening and skip straight to the comfort of relatively stable ASX small caps.

Here’s what went on this week.

Explainer: Can I access pre-IPO deals in Australia and what are the risks involved?

No. You can’t.

Well, enough of you can’t that we’re fairly confident saying that. Because to access pre-IPO deals you need to have made either $250,000 per year gross for the last two tax years, or have assets of at least $2.5 million. So that knocks it down a bit.

But for the 5 per cent of you reading this and asking what is this clown on about, doesn’t everyone earn $250K a year, the next question is – will the company I just bought into a pre-IPO with have to IPO?

Ha. No.

So while it may look like getting into an IPO before launch is an easy way to make instant cash – because they ALL pop on debut, right? – here are some very good insights from Conrad Capital’s Tom Fairchild on why it’s not the be-all, end-all.

Also, you might consider these takeaways – a) stop trying to make instant cash; and b) for the love of everything, please. stop. reading. Twitter.

Nuix (ASX:NXL) shares drop again after revising prospectus forecasts

And pre-IPO success isn’t always guaranteed. If you need proof, we can put it in a drawing for you:

Nuix (ASX:NXL) was supposed to be an IPO rock star.

And for a while, it was, rising as high as $11.86 in late January. But it crashed in March after its first set of financial results fell short of its prospectus forecasts. And again on Wednesday after it fell short of a revisions to those forecasts.

Nuix is holding the line though, citing this good thing for its long-term growth prospects.

And yesterday, the ASX welcomed another Australia-based games developer in Adelaide headquartered company Mighty Kingdom (ASX:MKL). Unfortunately for MKL’s early investors, they didn’t even get the chance to sell out on the instant pop.

Mighty Kingdom didn’t exactly nosedive, but it’s unusual to see a stock drop immediately. It’s trading a couple of cents below its 30 cent list price.

And even 2021’s biggest IPO so far is underwater. Latitude Financial (ASX:LFS) hit the bourse with a $2.6 billion valuation after raising $200 million at $2.60 per share.

It offers several lines of credit including personal loans and credit cards as well as insurance and digital payment products.

It rose as high as $2.70 and is now 1c under its list price.

Three in a week. Huh.

That should make you feel better about not being eligible for pre-IPOs. See what we did there?

Not the sexiest stocks, but these 10 ASX small caps have been paying dividends for years

This is one of those ‘growth versus value’ things everyone’s banging on about in 2021.

Today, we’re talking about value, but not all value is the same. There’s the type that comes from steady capital gain, and the type that puts a nice little chunk of cash in your pocket on a regular basis.

You might know the second one as “dividends”. Or not, because the companies that pay them aren’t the sexiest of stocks. Banks, mainly.

You won’t find GameStop in this list of 10 ASX small caps that are happy to share their profits. But you will find the one that pays out the most has been doing so for 160 years.

What happens to my Afterpay stock if it moves to the NASDAQ?

In ‘Bound To Happen News’ this week, homegrown tech and market darling Afterpay (ASX:APT) announced its plans for a NASDAQ listing are “well advanced”.

This week’s solid quarterly results all but shut the coffin on the likely move. They showed North America is now the largest contributor for the company; the first region to record more than $1 billion in underlying sales in a single month.

Blah blah. WHAT ABOUT OUR ASX SHARES?

We asked financial advisor, Adam Dawes of Shaw & Partners is current APT shareholders whould be concerned about the move and he replied: “Not overly.”

OK.

Here’s all you need to know about what happens when your stock leaves you hanging redomiciles to a more suitable market environment.

Resources Top 5: Green hydrogen deals and a mammoth zinc-lead discovery

It’s been a rock star week for miners and explorers coming clean.

Province Resources will potentially partner with French power producer Total Eren to build an 8GW green hydrogen project in WA. (Pop 30pc)

AVF will supply hydrogen energy to Magnum Mining at a discount of 10 per cent to market rates. (Pop 15pc)

Sweetman Renewables is undertaking a $2.5m pre-IPO raise to help set up its goal of becoming one of Australia’s largest true green hydrogen producers

And Lion Energy has committed to explore opportunities in green hydrogen in Australia as well as on Seram Island, Indonesia. (Pop 70pc)

At this rate we’ll have the planet back to a more comfortable, life-supporting climate by EOFY!

Sigh. Or at the very least, fundies can keep these guys on their ESG-approved list for another year or two. And we can rest easy knowing those ASX announcement copywriters are earning their keep.

Barry FitzGerald: 10 copper juniors to back in Goldman’s boom time

If you really want to impress the market, get in Garimpeiro’s good books.

He’s been covering the resources industry for …well, it’s almost impolite to say. Let’s just leave it at “long enough to know what extraordinary times look like”.

Times like these a-coming for ASX-listed copper producers, developers and explorers, if Goldman Sachs’ super bullish call on the outlook for copper is to be taken seriously.

It’s tipping prices to boom in coming years to a staggering peak in 2025 of $US15,000/t ($US6.80/lb).

Barry reckons at those prices “producers will make money hand over fist” and developers, which have generally used $US7,000/t prices for planning purposes, “will be wetting themselves to get into production”.

Without getting into too much details, here are Barry FitzGerald’s 10 copper juniors to back in Goldman’s boom time.

One of them is already up 1,300% over the past 12 months.

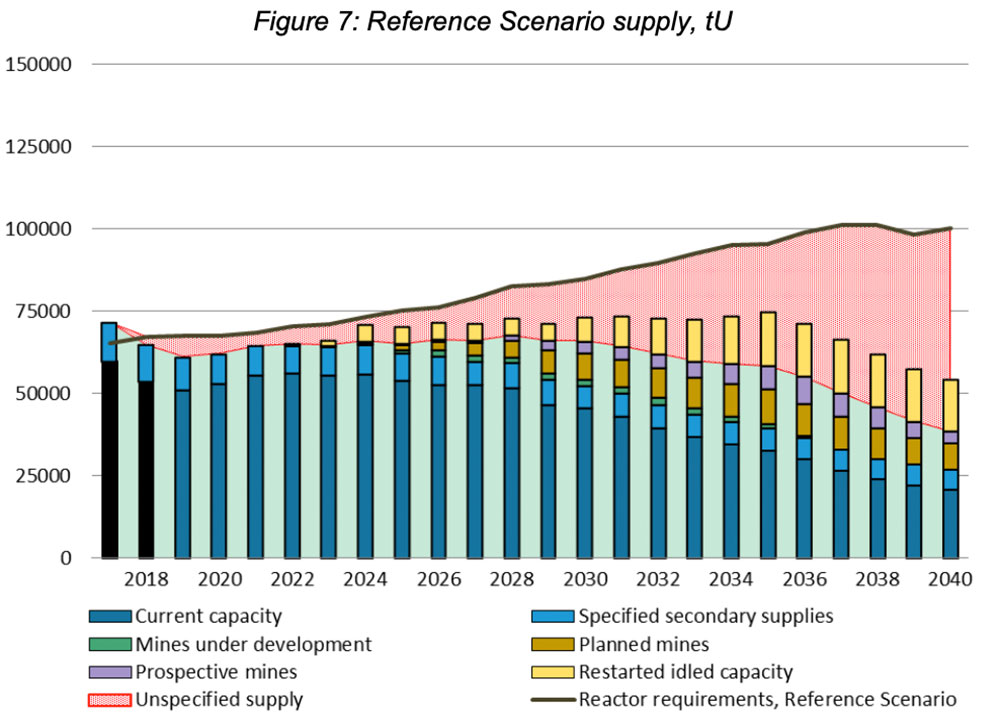

Uranium supply is falling well behind demand. These ASX stocks are rushing to fill the hole

Also in short supply:

In fact, even if every single idled mine and planned project goes into production, we won’t have enough uranium to meet demand in 2030. Look:

But it seems we’re in a bit of a standoff right now. Companies are refusing to build new mines until contract prices rise enough to justify said new mines.

Stock prices are surging. Uranium prices are… moving. A bit.

But savvy investors are happy enough to chuck cash at developers in some fairly significant recent cap raises.

This is basically as close as you can get to a sure thing, barring the odd nuclear meltdown.

So, who stands to benefit from the pending bull market? Here are 16 ASX stocks with skin in the game.

The Secret Broker: The FT has gone digital and I’m still alive to see it!

He made it!

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is… reading the Financial Times online!

What a day! New outfits were ordered, appointments to hairdressers were made and holiday plans approved and booked.

No more waiting around for TSB spending hours trying to blag free versions of FT articles. Now he can read them at the restaurant table while ignoring his more obnoxious relos.

Actually, this is quite a big deal for anyone who takes trading seriously. Especially when the local competition can only offer news on just 2.1% of global stock market valuations…

Here’s why TSB – and you should – prefers a rag that’s read by more people that populate Australia and New Zealand combined.

Have a good weekend. Try not to buy any s..tcoin.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.