Explainer: What is a ‘sophisticated investor’ and what doors open when you become one?

What is a Sophisticated investor under Australia's Corporations Act

Just what are “sophisticated investors” under Australia’s Corporations Act?

If you’ve had success in the stock market you may think of yourself as a sophisticated investor but you may not be from a legal standpoint.

For one thing, being a sophisticated investor in Australia means you get access to deals not available to retail investors.

So what are the qualifications to become one?

What is a sophisticated investor?

Stockhead spoke with Joe Durak from Canary Capital for a first-hand perspective.

“To be a sophisticated investor you need to have made either $250,000 per year gross for the last two tax years, or you need to have an accountant sign off saying you have assets of at least $2.5 million,” Durak explains.

The legal definition of a sophisticated investor is defined under Corporations Regulation 6D.2.03, which in turn is made under the Corporations Act.

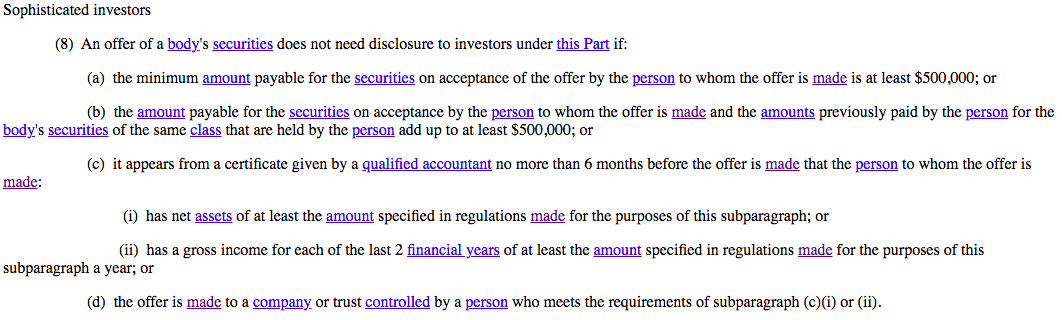

The rules governing how sophisticated investors can participate in capital raisings are outlined in s708(8) of the Corporations Act:

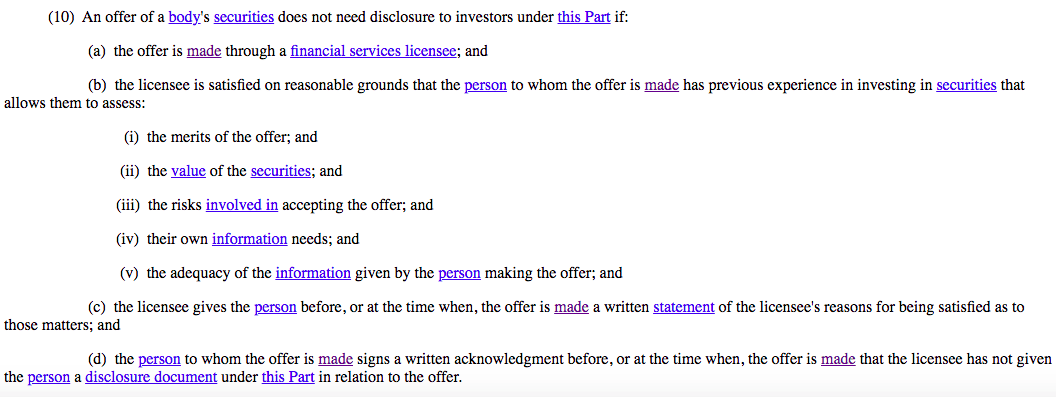

The relevant section of the Act also makes allowances for similar treatment with professional investors and experienced investors (s.708(10)) – although the latter term isn’t explicitly used to describe them.

s.708(10) includes investors for whom a broker can be satisfied that they have the experience to act without a disclosure document.

“The broker needs to be comfortable you know what you’re doing and you can make decisions,” Durak said.

“The onus falls back onto the advisor if something goes wrong and someone isn’t too happy with the way something has performed.

“So you really need to know your clients; not every broker will allow clients to participate in deals through 708(10).”

“But 708(8) is where most of the money gets raised outside professional investors.”

What’s advantage do sophisticated investors offer brokers?

s.708 of the Corporations Act lists sophisticated investors (among other groups) as parties for which disclosure documents do not have to be prepared.

Durak noted this means companies can raise money a lot faster than with retail investors.

“The advantage for a company in doing one of these sophisticated investor or excluded offers essentially is that you don’t have the time lag involved,” he said.

“[There’s] obviously a lot of cost in doing [a] prospectus, [but] you can get one of these placements very quickly after you’ve done your due diligence.

“You can put a term sheet together, send it to your clients and have the money raised in a week or two.”

“When you’re doing a prospectus, with ASX and ASIC these days, it can take 4-6 months to do an IPO.”

“There’s obviously an element of uncertainty if you have to wait several months.”

The exemption

However, one instance in Australia where deals can take longer, even with sophisticated investors involved, is where the capital raised involves a higher proportion of companies’ listed shares.

If companies are raising capital they can only raise up to a certain amount, as a percentage of listed shares, without shareholder approval.

This limit is to ensure shareholders who are not among the select few to whom shares are ‘placed’ are not unduly diluted by multiple capital raisings.

Companies often deal with this by splitting capital raisings into multiple parts, or tranches. The first tranche (under the limit) often goes through without shareholder approval, while the second one requires shareholders to sign off.

“If it’s a bigger raise sometimes you need to go to a two tranche placement and that would require shareholder approval,” Durak explains.

Sophisticated investors hungry for more in 2021

In 2020, ASX companies raised over $51 billion in new capital, the most in five years.

While 2021 is only a few weeks old, Durak notes the equity capital markets (and by extension sophisticated investors in Australia) have shown similarly positive signs.

“It’s still early days but there still seems to be a lot of appetite around,” he said.

“Normally January would be fairly quiet, but there’s still a lot of IPOs coming through and obviously strength at the small/micro cap end of the market.”

Durak also noted that since COVID-19 companies have pivoted from face to face meetings towards virtual meetings and this has enabled companies to reach more investors.

“These days it’s so easy to raise money,” he declared.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.