Kick Back: The 10 biggest stories you might have missed on Stockhead this week

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

This was the week when the story of retro US video games retailer GameStop (NYSE:GME) went viral, breaking out of trading bulletin boards and into the mainstream media.

Hitherto known mostly to younger video gamers, GameStop had fallen on hard times and had attracted the attention of certain hedge funds.

A number of these funds had taken short positions in GameStop’s shares, expecting its share price to sink, but they did not reckon on a plucky band of Reddit stock followers.

The US retailer retains the affection of video gamers and high profile investors like Michael Burry who was portrayed in the film The Big Short by screen actor Christian Bale.

GameStop fans started an online campaign to encourage their followers to buy GameStop stock, and boost its share price, thereby forcing short sellers to cover their positions.

A frenzy of buying ensued, and as the share price of GameStop went higher, the more it was costing short sellers as they had to buy too to offset their growing losses on trades.

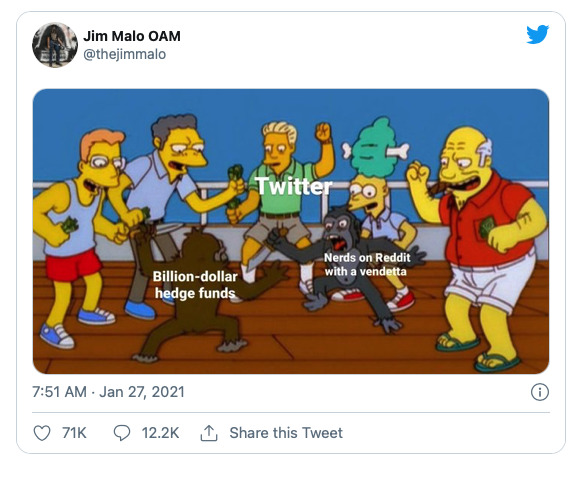

The to-ing and fro-ing over market positions in GameStop led to all sorts of analogies, from the Star Wars showdown between Obi-Wan Kenobi and Darth Vader, to this one below.

Image: Twitter

The video game retailer’s share price took off, rallying 1,700 per cent to reach a market value of $US24bn ($31.3bn) at one stage, and putting it into the Fortune 500 club.

Meme traffic on GameStop spread over the internet as Tesla boss Elon Musk joined in and tweeted the message ‘GameStonk!!’

The wild ride appeared to come to an end — for now — on Friday, when some US brokerage firms declined to allow their customers to trade in GameStop shares.

The GameStop theme even crossed over to Australia, when a resources stock with a similar price ticker started to go up sharply.

Resources Top 5: Meme stocks and battery hopefuls beat the market

The stock in question was battery metals company GME Resources (ASX:GME) which went up in leaps and bounds this week without issuing any substantive news.

GME Resources acknowledged its share price may have been caught up in the GameStop saga by accident in a response Friday to an ASX question about its share price.

“The company notes recent media reports concerning trading activity in a US listed technology company called GameStop which also has an exchange ticker code ‘GME’ but notes this company is not related in any way to GME Resources,” the company said.

Gold price settles into narrow trading range, silver comes alive on speculative interest

Flushed with success from their campaign against GameStop short sellers, Reddit stock followers have turned their attention to the silver market.

Applying the same crowd-sourcing methods as they employed in the GameStop battle, they hope to build a groundswell of support to take on short sellers in silver’s derivatives market.

The stock battlers may have bitten off more than they can chew, as the silver market is much larger and some of its market participants have very deep pockets.

Commodity markets are also different to stock markets, as additional supply from mines and scrap sources can easily be rustled up to meet increased demand for physical deliveries.

Well have to see on this one, but it will be interesting nonetheless.

Resources Top 5: Tesla and EV-linked lithium and battery stocks pull ahead

Which brings us back to Elon Musk again, and any Stockhead story that mentions the Tesla chief executive and all-round entrepreneur always sparks debate among readers.

This one did too, as we reported that Sayona Mining (ASX:SYA) has started drilling at its Quebec lithium projects.

This is after Tesla supplier Piedmont Lithium (ASX:PLL) acquired a strategic 19.9 per cent stake in Sayona Mining in mid-January.

Other ASX lithium stocks, including, Galan Resources (ASX:GLN) and Lake Resources (ASX:LKE) with projects in Argentina’s famed ‘Lithium Triangle’ also saw their share prices increase this week.

Immutep Covid-19 trial moves forward in Czech Republic

The scourge of COVID-19 is a blight on humankind and any progress to counter its terrible effects both medically and otherwise is greatly welcomed.

Immutep (ASX:IMM) shares soared nearly five per cent after the Sydney biotech said a trial of its lead drug to treat COVID-19 would move forward in the Czech Republic.

Six Covid patients have been treated with eftilagimod alpha injections for the initial part of the study and all have been discharged from hospital, with no adverse events reported, Immutep said.

After a review by a Data Safety Monitoring Board, the trial will move into a randomised study, which involves treating up to 110 COVID-10 patients at University Hospital Pilsen.

Clinical Trials Tracker: 2022 and beyond

Stockhead medical sector journalist Derek Rose put together a comprehensive round-up of clinical trials planned by ASX biotech companies over the next two years.

The guide builds on Derek’s extensive list of clinical trials taking place in 2021 that was published earlier.

The detailed report is high-value reading for investors in the ASX biotech space and an important reference article that will undoubtedly be well read.

Quarterlies Top 5: Investors swoop on COG Financial, Secos and Booktopia after solid results

It is always interesting to know which ASX companies share buyers are following, and the ones in which they are putting their hard-earned cash.

Nick Sundich crunched the numbers for us, and analysed the results for the best-performing ASX stocks for the quarterly reporting season that ended Friday.

Among the investor favourites this time are a finance broker, compostable plastics company, an online books seller, and a sports and hospitality software firm.

Stock investors seeking pointers for US stocks which stand to benefit from a Joe Biden presidency can find some here.

Battery metal prices in China are pushing higher. The rest of the world will soon follow

Now back to resources, and Stockhead resources journalist Reuben Adams looked into the ASX battery metals stocks that could do well from rising prices.

Data from Benchmark Mineral Intelligence pinpoints growing Chinese buying interest for a range of metals including, cobalt, graphite, lithium and nickel.

“Historically, price rises that occur in China are usually experienced in the rest of the world 3 to 6 months later,” said BMI.

Did retail investors get shafted in the ASX’s post-Covid capital rush? Yes. Yes they did.

More than $50bn in capital was raised from equity investors in 2020 — three times that of 2019’s amount — and perhaps inevitably, not all of it was well spent.

Stockhead journalist Sam Jacobs looks into where the money from 2020’s capital raisings went, and which stocks offered poorer value than others.

“A deep understanding of investor behaviour is critical when making capital raising allocations to optimise aftermarket performance,” said the Melbourne investment bank that analysed the data.

Australian LNG output flagged to rise after hitting new record

Is there any part of the resources sector that is not enjoying rising prices for its products at the moment? I’ll answer that question in a minute.

Stockhead resources journalist Bevis Yeo reports that Australia’s LNG industry achieved a record shipment volume of 78 million tonnes in 2020, despite COVID-19.

China is neck and neck with Japan for the title of the largest customer for Australian LNG, and China could overtake Japan this year going by recent trade data.

And coming up on the inside is Vietnam. The south-east Asian nation has plans for 30 LNG-fuelled power plant projects for a total capacity of 93 gigawatts.

Although not all of these may see the light of day.

While Australian LNG producers have done well from strong demand and high prices from Asian customers during the northern hemisphere winter, it has not all been plain sailing.

Credit ratings agency S&P Global Ratings has signalled it is reviewing the credit ratings it has for Woodside Petroleum (ASX:WPL) and Santos (ASX:STO).

Bitcoin correction tests investor resolve, but crypto markets remain active

Finally, to finish, where would we be without a cryptocurrency story to round off the week’s digest of Stockhead news and reports?

Bitcoin has had an eventual January that featured record highs, a 20 per cent market sell-off, and much volatility besides.

From a high point of $52,350 ($US40,520) to a low of $38,700 ($US29,500) on Wednesday, Bitcoin’s price drop has triggered shockwaves through the cryptocurrency community.

Stockhead looks into the reasons for the market correction, and with the help of crypto market experts looks at what might be next for the world of crypto.

That’s it for this week. Have a good weekend, and happy trading!

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.