Did retail investors get shafted in the ASX’s post-Covid capital rush? Yes. Yes they did.

Pic: d3sign / Moment via Getty Images

Among its many impacts, COVID-19 was the catalyst for a boom in ASX capital markets activity.

Through the peak of the pandemic, ASX companies raised more than $30 billion in equity capital — more than double that of the previous year.

By the end of 2020, that figure had risen above $51bn across more than 1,200 deals (the highest level in five years).

And perhaps not surprisingly, larger institutional investors snapped up the lion’s share of all that additional equity.

Data from Melbourne-based investment bank Vesparum indicates of that ~$38bn ultimately raised in the COVID-19 period, just $5bn went to retail investors.

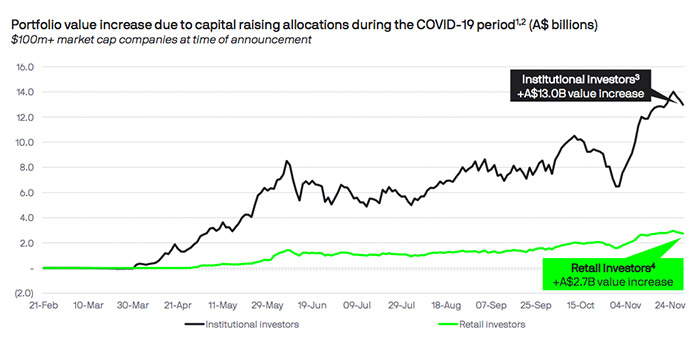

That also means they missed out on the subsequent gains, Vesparum said.

Most capital raisings and share placements are conducted at a discount to current the market price.

And with the help of the post-Covid bull market, investors were rewarded for their equity funding.

According to the Vesparum data, the $38bn outlay flowed through to a $15.7bn increase in portfolio values as equity valuations rose.

But again, most of those paper gains (83 per cent) were reaped by the big instos, who saw a $12bn uplift compared to just $2.7bn for retail investors.

So the net effect was that retail investors got in on just 17 per cent of the share placement gains.

Vesparum reckons that for a typical ASX company, retail investors comprise around 40 per cent of the shareholder base.

Extrapolating those numbers, Vesparum said retail investors should’ve been eligible for around $6.3bn of those gains if the share placements were conducted evenly (rather than the $2.7bn they got).

It follows that “inequitable capital raising structures and allocations have resulted in a wealth transfer from retail investors to institutional investors of $3.6 billion”, the company said.

In addition, Vesparum said that having participated in a share placement, retail investors typically show strong on-market support for the company they invested in.

In other words, they hold the shares with a longer-term view that the company’s management will use the funds effectively to support further growth.

Instos, on the other hand, are prone to some opportunism.

As an example, Vesparum cited the capital raising carried out by diversified media group Ooh!Media (ASX:OML) in the last week of March (at the height of the pandemic).

The company raised ~$156 million from in a share placement to institutional investors at 53c per share. A few weeks later it raised another $14m in a retail entitlement offer.

OML retail investors maintained their long positions throughout (and beyond) the period when shares were allotted.

Conversely, in the week between when the insto placement was announced and when it was allotted, there was a material increase in short-selling as hedge funds looked to take advantage of the short-term arbitrage opportunity.

Vesparum contrasted OML’s capital raise to that of data centre group NextDC (ASX:NXT), which didn’t have such a glaring post-raise discrepancy in the behaviour of retail and institutional shareholders.

The bank attributed that to NXT’s capital raising process, which was “influenced by a policy to allocate away from hedge funds”.

In conclusion, Vesparum says that “a deep understanding of investor behaviour is critical when making capital raising allocations to optimise aftermarket performance”.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.