Kick Back: The 10 biggest stories you might have missed on Stockhead this week

Om nom nom. Picture: Getty Images

It’s hot out there on the eastern seaboard.

Although, not as hot as the heat Rudy Giuliani was feeling in a bizarre press conference in which he did his best Joe Pesci impression, floated conspiracy theories, and claimed his mate Donald Trump won the election – again.

Here’s the moment when all those present realised “America’s Mayor” was struggling to even believe himself:

Rudy’s hair dye fiasco up there with Nixon sweating pic.twitter.com/FANQH4XtZ3

— Helen Kennedy (@HelenKennedy) November 19, 2020

Wear sunscreen. Don’t get caught in a lie. And don’t miss these most popular Stockhead stories from the past week that you might have missed.

1. ASX won’t resume trading today following outage

An exciting day of learnings came on Monday for everyone. Well, mainly newcomers to trading, and the ASX IT department, which migrated to a new trading platform over the weekend and promptly crashed just after opening Monday morning.

After a series of “we’ll be back up in 30 minutes” announcements, the ASX eventually gave up for the day. Welcome to having your cashflow frozen for 24 hours, all you 400,000 new CommSec sign-ups this year.

The reaction over at ASX_bets was:

The stick in the spokes was a new “Trade Refresh” trading system that was all set to roll after four weekends of “dress rehearsals”.

And it was – the next day.

2. The Secret… Borker? When an upgrade becomes a downgrade

Our pet warhorse trader had a few choice words for accident-prone Steve in the ASX IT department after Monday’s outage.

But then, this is today, and technology will have its yips. Back in 1990, even an IRA bomb in the stock exchange toilets couldn’t stop an evacuated TSB and his lairy mates just setting up shop for an hour outside the pub down the road.

Anyhoo, not being able to trade is just one lesson a bunch of trading noobs got this week, so while we’re at it, here are a few more things TSB says you need to learn to to watch out for.

Because not a lot has actually changed in 200 years, when it comes to making money.

3. Money Talks: Could any of these 3 ASX explorers be the next $1bn success story?

One of those fundamentals that hasn’t changed is that while picking the right stock is important, it’s also important to know when to sell.

That’s the bit where you cash in.

Simon Popple, of UK-based Brookville Capital, told us way back in September 2019 that gold miners Silver Lake Resources (ASX:SLR) and Chalice Gold Mines (ASX:CHN) were pretty good value at 94c and 22c respectively.

“Today the prices are $1.88 and $3.75 respectively,” Simon reminded us this week. This is why we feature smarty pants experts like Simon on a daily basis.

He’s back with three more picks you might want to consider, right here.

And in other expert news, the Bank of America released its latest global fund manager survey this week. It showed the economic growth outlook has risen to a 20-year high, and a “big majority” of those surveyed (66 per cent) thinking the post-Covid economic recovery is still in its early phase.

Heady stuff. Here are the top three trades for 2021, according to fund managers around the world.

4. Bitcoin closes in on all-time high of $US20,000 as institutional buyers load up

If there’s one certainty in this crazy life we’ve wandered semi-deliriously through for the past four years, it’s Bitcoin.

Bitcoin goes up. Bitcoin goes down.

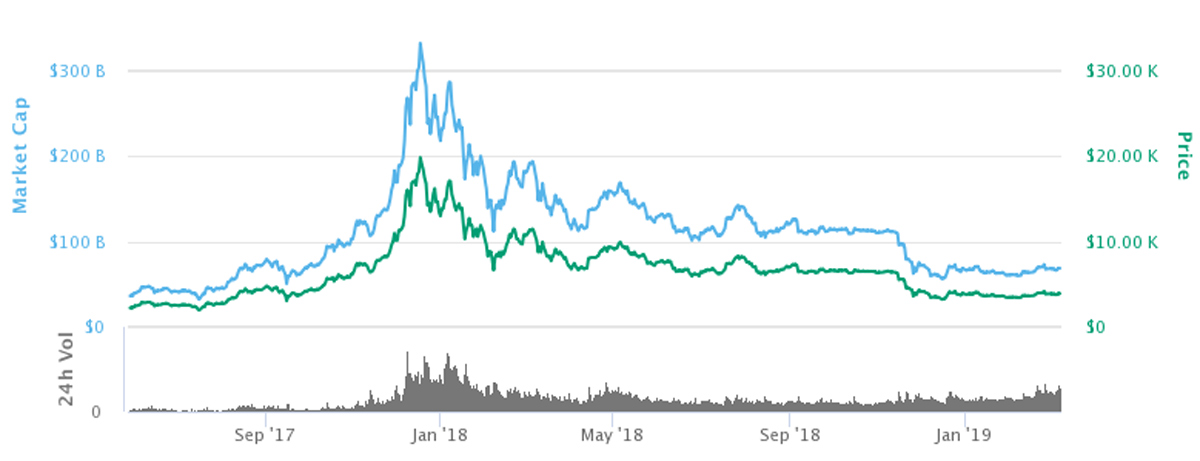

Except sometimes Bitcoin goes up for quite an extended period – like it has since March, when it hit a low of US$4600. Then an eight-month bull run kicked in and this week, a single BTC was worth US$18,000. This happened once before, back in December 2017, and here’s what happened in the year that followed:

Back down to US$4000.

This time around, there are some noteworthy differences. For one, the run has been significantly propped up by a much more positive news tone than in 2017, when everyone was laughing about how ridiculous Not Money was.

But in a year like 2020, well… it takes a lot to stand out. And BTC’s run has aligned with developments such as PayPal accepting BTC payments, and stories of well-to-do companies like Square piling in.

And here’s something new – The Tokenist had this great take on how in 2020, the crypto pundits aren’t madly Googling “what is BTC” this time around:

Enough talk of price action. Here are the answers to your burning BTC questions:

- How long does it take to mine Bitcoin?

- How to add Bitcoin and cryptocurrencies to a self-managed super fund

- How does Bitcoin compare with major assets?

5. ASIC report notes Gen Y taking loans to pay their BNPL loans; market DGAF

Enough with this money-from-air silliness. Let’s talk about something that absolutely, definitely, categorically, undeniably isn’t a bubble – BNPL stocks.

We know it’s true because ASIC just said so, finally releasing that report that tells everyone it’s fine to keep piling into Afterpay and Zip because Australians are excellent at managing debt.

“The BNPL sector has held up extremely well,” Zip co-founder Peter Gray said after the report dropped. “Afterpay has never enforced a debt,” APT chief Anthony Eisen noted. Humm owner Flexigroup said the report “demonstrates ASIC’s tailored and proportionate approach to regulation of the Buy Now Pay Later sector”.

ASIC notes the total balance of outstanding debt from these arrangements grew from $476 million in April 2016 to over $903 million by June 2018. One in five consumers had missed payments, 15 per cent had taken out additional loans to pay their BNPL debt, and 70 per cent of those who had taken out another loan to make their BNPL payments on time had also missed a payment.

Nothing to see here. Carry on.

6. Rick Rule on the gold bull market, currency wars and the liquidity trap

Last week, we were lucky enough to get to speak to Rick Rule, the 40-year gold industry veteran who now heads up the US division of $US17 billion asset management firm Sprott Inc. You liked it so much, we dragged Rick back in to face the camera with former fund manager and finance academic, Dr Nigel Finch.

Here’s your 27 minutes free time with one of the best brains on gold on the planet:

7. Superbugs will kill 22,000 Australians annually by 2040; but these stocks are trying to stop that

It’s World Antimicrobial Resistance Awareness Week, but you probably already knew that. If you didn’t, you might want to tune in for a bit, because Monash University reckons superbugs could kill 22,000 Aussies annually by 2040. They call it “a slow and silent emergency”.

ASX small caps are there for you. These are the home-grown champions finding ways to keep super-infections at bay, including:

- The $200m company targeted bacteria’s biofilm “armour”

- An antibiotic that treats sepsis, which it kills more people in the US than prostate cancer, breast cancer and HIV/AIDs combined; and

- The antimicrobial gel made from cannabis that fights golden staph.

Go you good things. They’re all here.

8. Here’s why hemp is a unique opportunity within the cannabis sector; and who’s in it on the ASX

While we’re on cannabis, hands up who knew hash brownies were good for you?

(No, “good” as in “healthy”.)

(You people.)

Australian Primary Hemp (ASX:APH) boss Neale Joseph told Stockhead hemp is “one of those great superfoods with all of the great nutritional outcomes with no fat and incredible replacement in protein”.

Yeah, but dope cakes taste like butts, right? Apparently not, because Joseph has convinced some big-hitters to stock APH’s hemp snacks. This week it unveiled a deal with 7-Eleven outlets to stock them, beginning from March.

It looks like hemp is forging its own path. Here’s another company making Personal Protective Equipment out of weed fibre, and a hemp-derived dietary supplements and skincare product seller.

9. TruScreen’s ASX listing will bring Aussie cancer-screen technology home

More inventions! How good are they?!

This first one’s a bit controversial. It’s actually an Aussie invention, but some Kiwis are claiming it. Only this time they’re allowed to, because back in 2010, a bunch of them bought University of Sydney cancer specialist Malcolm Coppleson and Sydney gynaecologist Bevan Reid’s “Polarprobe”.

Polarprobe’s IP revolved around it being a better pap smear. (Read: “No scraping”) Now, with the help of Kiwi investors, the device is called TruScreen, and it’s a much less trauma-inducing pen-like wi-fi connected wireless wand.

More importantly, like bungee jumping and pavlova, it’s coming back home to Oz. TruScreen is raising $NZ2 million ($1.9 million) in a “compliance IPO” and is scheduled to make its ASX debut next month.

Also in inventions this week:

– Memphasys (ASX:MEM) has started production of the most complex component of its automated sperm-separating Felix device and is targeting first sales by the end of the year. Felix can extract viable sperm from poor-quality samples.

– And MGC Pharma has achieved positive results in pre-clinical trials for a cannabinoid treatment for a brain cancer, and is is moving towards clinical trials in 2021.

10. Re-rate in lithium stocks is imminent, Ausbil says

And finally, look who’s back:

That’s John Lovitz playing lithium in this week’s most popular post about battery metals.

Aussie investment fund manager Ausbil reckons lithium is once again the best option for anyone looking for near-term exposure to the forthcoming EV boom.

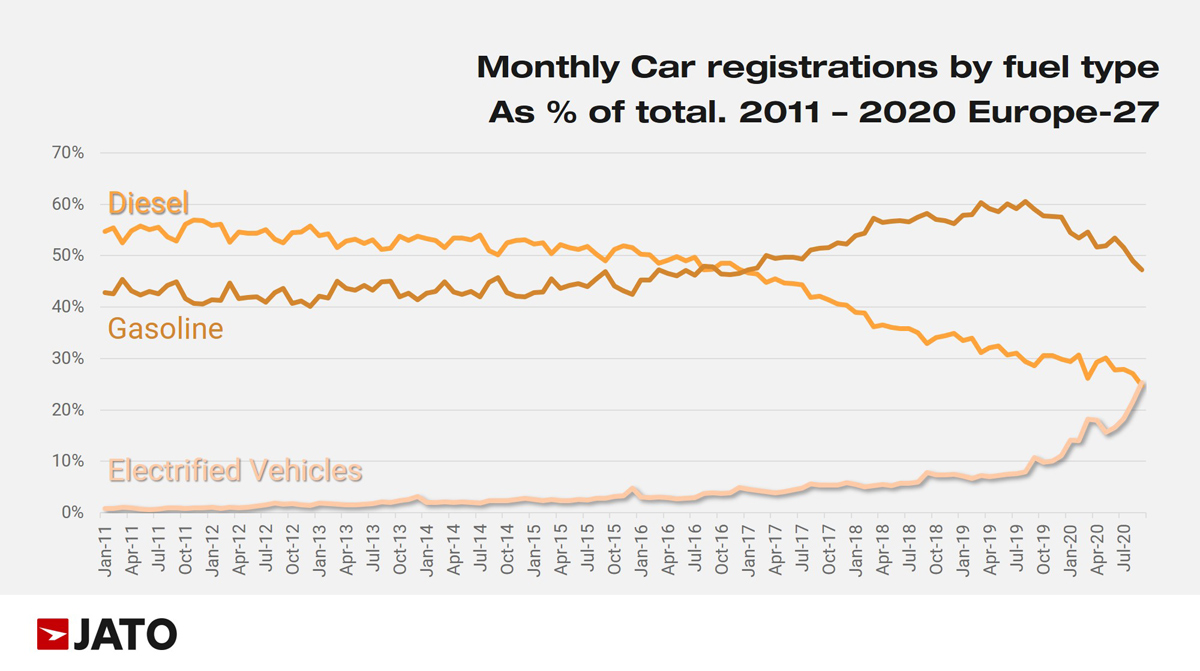

And it is forthcoming – here’s a chart straight out of Europe from last month which shows diesel losing the ultimate ground to batteries:

But what about pure-play cobalt companies? Hard to find globally, Ausbil says. And the nickel market is currently dominated by stainless steel demand.

That’s all. Thanks for tuning in.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.