ASIC report notes Gen Y taking loans to pay their BNPL loans; market DGAF

Picture: Getty Images

- A long-awaited ASIC report says while the BNPL industry works for most users, some are “suffering harm”

- But the agency said that regulation was a matter for Parliament, which isn’t interested

- One brokerage on Tuesdy raised its price target on Afterpay to $140 a share

Buy now, pay later companies are breathing a sigh of relief after a long-awaited Australian Securities and Investment Commission report scrutinising the industry stopped short of imposing new regulations on the sector.

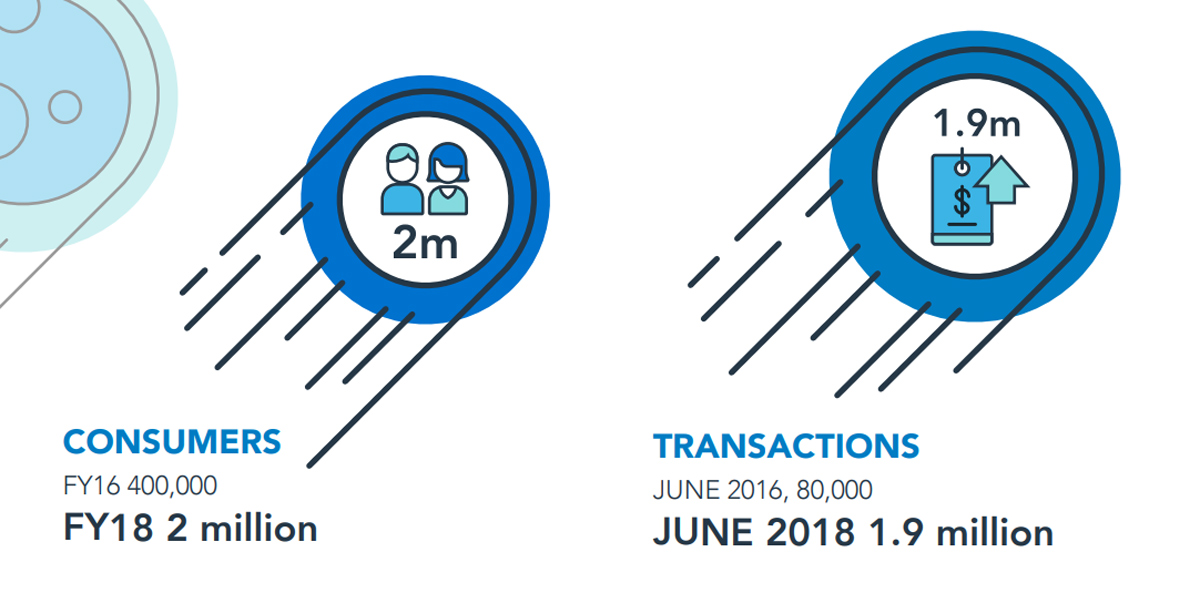

First, the big numbers from the report, which was released on Monday after being delayed because of the pandemic:

Quite the growth. ASIC notes the total balance of outstanding debt from these arrangements “grew from $476 million in April 2016 to over $903 million by June 2018”. And that was two years ago.

The kids love BNPL. An over-represented 60% of the buy now pay later users in ASIC’s review were aged between 18 and 34 years old. They noted the arrangements “allowed them to”:

- buy more expensive items that they otherwise could not afford in one payment (81%)

- spend more than they normally would (64%), and

- make more spontaneous purchases (70%).

Overall, ASIC found that one in five consumers had missed payments, and in 2018/19 missed payment fee revenue for the year totalled over $43 million.

But 15 per cent had taken out additional loans to pay their BNPL debt. Half of those 15 per cent were under 30.

And some 70 per cent of those who had taken out another loan to make their BNPL payments on time had also missed a payment.

“While working for the majority of users, some consumers are suffering harm,” the agency said.

But here’s what the market heard – ASIC said that “policy and regulation of the buy now pay later industry remain a matter for Government and, ultimately, the Parliament.”

So generally, it was high-fives all round.

So far, the Parliament hasn’t shown much appetite for regulating the industry. An interim report by Senate in September concluded it could self-regulate.

“Because innovation like ‘buy now, pay later’ often occurs on the fringes of regulation, it is inappropriate to force each innovation into a one-size-fits-all approach,” the Senate Select Committee on Financial Technology and Regulatory Technology concluded.

Industry welcomes ASIC report

Four of the six companies ASIC scrutinised – Afterpay (ASX:APT), Zip (ASX:Z1P), Openpay (ASX:OPY) and humm owner Flexigroup (ASX:FXL) – said they welcomed ASIC’s report. Their share prices didn’t seem much budged by the news, either.

Zip co-founder and chief operating officer Peter Gray said the report showed the continued growth and popularity of the BNPL sector in Australia.

“We have just been through the biggest economic shock for decades and the BNPL sector has held up extremely well, with the flight to online spend and very low levels of consumer hardship – a point recognised by the report,” he said.

Just 1 in 100 Zip Pay customers are late every month, and the company makes less than one per cent of its revenue from late fees, he said.

Zip Co shares dipped 0.6 per cent to $5.965 on Tuesday and fell 0.8 per cent on Monday.

Afterpay said in a statement authorised by chief executive Anthony Eisen said the report “demonstrates that BNPL is a collective term to describe a range of new businesses with fundamentally different business models.

“Why Afterpay is clearly the largest of the companies profiles (73% of the total value of BNPL transactions), Afterpay represents a relatively small proportion (27%) of BNPL related consumer debt,” the company said.

“Afterpay has never enforced a debt nor does it sell debts to collection agencies,” it added.

On Tuesday afternoon APT shares were down 4.5 per cent to $96.77 on the day of its annual general meeting, after dipping 0.4 per cent during Monday’s brief 24-minute outage-plagued trading session.

Humm owner Flexigroup – whose shares were up 1.2 per cent on Tuesday after a flat brief session on Monday – said the report recognised the sector had added a range of protections and safeguards since ASIC issued a previous report in November 2018, such as preventing consumers from making a purchase once they’ve already missed a payment and transparent contract terms for merchants and customers.

The updated report “demonstrates ASIC’s tailored and proportionate approach to regulation of the Buy Now Pay Later sector, recognising the importance of striking the correct balance between supporting competition and innovation, while effectively addressing areas of emerging risk,” Flexigroup says.

Flexigroup chief executive Rebecca James said the Senate committee’s decision in September to allow the industry to self-regulate was a “ringing endorsement of the industry’s commitment to good consumer outcomes”.

Openpay chief executive Michael Eidel said the company was “grateful for ASIC’s ongoing review of the sector and welcome the implementation of the BNPL Code of Practice, which is expected to come into effect in early 2021.”

The other two BNPL offerings that the ASIC report scrutinized are Brighte, an offering by private company Brighte Capital, which helps Australians afford solar, batteries and home improvements; and Payright, which last week announced plans to list on the ASX.

Bullish on Afterpay

Bell Direct market analyst Jessica Amir said the broker raised its price target on Afterpay on Tuesday, from $137 a share to $140, following the fintech leader announcing at its AGM it would be expanding into Asia and Europe following its launch in Canada in August.

The company also announced that co-founder Nick Molnar would resume his co-CEO role with Anthony Eisen and relocate to the United States as soon as possible.

But Amir said in the short term, the BNPL might be due for a breather share price wise after its tremendous run in 2020.

“The sector is losing a bit of heat because of the rotation into cyclicals,” she said.

“The momentum is still there but do I think a little cream will come off the tech sector? Yes”

| CODE | COMPANY | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| SZL | Sezzle Inc. | -14 | -20 | 215 | 175 | 6.39 | $670.4M |

| Z1P | Zip Co Ltd. | -9 | -16 | 92 | 44 | 5.93 | $3.1B |

| LBY | Laybuy Group Holding | -7 | -16 | 0 | -2 | 1.38 | $245.1M |

| APT | Afterpay Limited | -7 | 1 | 137 | 197 | 97.7 | $28.9B |

| SPT | Splitit | -6 | -7 | 236 | 67 | 1.36 | $454.8M |

| ZBT | Zebit Inc. | -5 | 0 | 0 | -28 | 1.13 | $109.8M |

| OPY | Openpay Group | -3 | -7 | 143 | 73 | 2.76 | $222.5M |

| FXL | FlexiGroup Limited | 5 | -5 | 16 | -48 | 1.06 | $517.6M |

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.