The top 3 trades for 2021, from Bank of America’s global fund manager survey

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

- The top 3 trades for 2021 are emerging markets, the S&P500 and oil

- BofA’s global fund manager survey also showed pro investors are shifting into small caps over large caps

As 2020 draws to a close, global investors are officially bullish about 2021.

That’s the “bottom line” takeaway from Bank of America’s (BofA) latest global fund manager survey (FMS), released earlier this week.

Among other things, it showed the economic growth outlook has risen to a 20-year high.

In addition, a “big majority” of those surveyed (66 per cent) think the post-Covid economic recovery is still in its early phase.

And with dual tailwinds — positive vaccine results and relative clarity around Joe Biden’s presidential win – the November survey showed fund managers have reduced cash holdings and allocated capital to equities.

Top 3 trades for 2021

With broader economic sentiment at historic highs, some interesting trends emerged in how fund managers are actually allocating capital.

Overwhelmingly, emerging markets (EM) are back in vogue with around 50 per cent of respondents choosing EM as their preferred long position in 2021.

Rounding out the top three were the S&P500 and oil prices, which together picked up around 40 per cent of the vote.

That left around 10 per cent of the pie for the gold bugs and Bitcoin bulls, along with a smattering of votes for US housing and 30-year US treasuries.

In addition, the percentage of professional investors who think small caps will outperform large caps rose to multi-year highs:

So while about 25 per cent of the fund managers surveyed expect US stocks to outperform, those gains are forecast to skew to the smaller end of town.

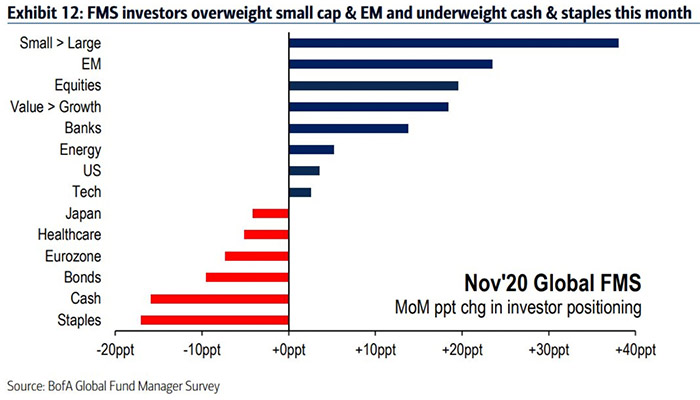

This chart shows the reallocation of capital along those lines, as the “small cap > large cap” category had the largest monthly change in investor positioning for November:

All in all, the November survey showed an “unambiguous rotation” to emerging markets, small caps, value stocks and banks that were funded by a lower allocation to cash and bonds.

And although oil is a top three pick for 2021, rotations into energy stocks have so far lagged the bullish Q4 trading activity.

‘Full bull?’

Although the November survey was the most bullish of the year so far, BofA said the results also threw up a couple of warning signals for investors to note.

For example, cash levels among fund managers fell to just 4.1 per cent, bringing them below pre-Covid levels (of 4.2 per cent in January).

That’s now right on the line to trigger the FMS’ “cash rule” sell signal, which activates when cash levels fall below the four per cent mark.

“The reopening rotation can continue in Q4 but we say ‘sell the vaccine’ in the coming weeks/months as we think we’re close to ‘full bull’,” BofA said.

In addition, a post-vaccine rebound in 2021 economic growth is also expected to give rise to some unusual activity in the bond market.

No less than 73 per cent of respondents expect the yield curve to steepen on benchmark US government bonds – a record high.

That means the yield on longer term government debt (e.g. 10 years) is expected to rise faster than the short end (e.g. 2 years) – a possible indicator of increased inflation expectations down the track.

A total of 190 participants who collective manage $US526 billion of assets participated in the latest survey, which took place between November 6 and November 12.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.