Kick Back: The 10 biggest stories you might have missed on Stockhead this week

They're just as sick of you. Picture: Getty Images

Welcome to the end – for most – of the first working week back after school holidays.

It can be a tough one. You’re probably still thinking about that holiday you just had, to somewhere warm. And those moments you had on the beach where you thought “you know, this could be my life. I could just day trade for a couple of hours each morning.”

Hahahaha… sigh.

But if you’re still determined to follow that dream, make today’s knock-off drink a large one, and settle in. We’ve got a few pointers from the week gone by that you might have missed, but lots of other Stockhead readers didn’t.

1 – High Voltage: EU electric vehicle penetration is about to take off big time

It feels like we’re close to nailing down the moment when EVs can be taken seriously, and it’s getting closer.

Analysts aren’t talking in terms of “by 2030” or “by 2050” anymore. The more sophisticated take is “around the time Taika Waititi’s new Thor film is released”.

In other words, timid EV growth will end within two years. IHS Markit reckons EU carmakers will be offering 214 electric models in 2021, about triple that were pootling silently around at the end of last year.

And here come the giant lithium-ion battery cell plants…

2 – Here are the ASX resources plays that famous prospector Mark Creasy backs

Mark Creasy goes alright.

The 74-year-old has a combined wealth of $660m, largely accumulated by having his finger in a lot of exploration pies.

His biggest listed investment is Coziron Resources (ASX:CZR), a junior gold and iron explorer that has 53.34 per cent of its stock held by Creasy.

And on Monday morning, Creasy agreed to loan CZR another $685,000.

Result? Coziron shares got a nice 22 per cent kick.

What else is Creasy invested in, we hear you ask.

3 – Expert view: Here are 3 things we learned about where the cannabis industry is headed

So you’ve invested in the cannabis industry, eh? Then by now, you know there’s never a dull moment.

Especially in Australia, where the industry seems to be on a perpetual will-it-or-won’t-it footing.

Michael Curtis, the Toronto-based managing director of production and investment company Embark Inc, reckons we’re close to waving the “Cannabis 1.0” dream goodbye, and ushering in “Industry 2.0…where people that’ve run very large businesses enter the industry, with a focus on financial metrics and profits.”

Embark received a $2.65m investment from ASX-listed MMJ Group Holdings (ASX:MMJ) in 2018 and oversees MMJ’s cannabis investment portfolio.

So if you need some pointers on where your pot investment is headed, Curtis is your guy.

Here are his thoughts on the future of an industry that, while moving slowly, has “never actually gone backwards” over the last 25 years.

4 – More than 30 ASX small caps have tripled this year – here are 2019’s biggest gainers so far

It’s your half-time report.

For the calendar year fans, we’ve pulled together 2019’s top-performing stocks and found while the average ASX gain is just over 6 per cent, 31 stocks have gained over 200 per cent.

And then there are the six stocks you really wished you’d backed. At the top of those is Netlinkz (ASX:NET). Its tech lets people connect over the internet invisibly and without fear of network failure.

If you’d got on in January – before it revealed its half-yearly revenue rose 1,797 per cent, and had secured an all-important China deal – you’d have made, ooh, 696 per cent?

You can click here for the other five in the 400 per cent club, thanks very much.

And a word of warning for the hodlers. Of the 16 stocks that gained 200 per cent or more over the first half of 2018, only three sit higher a year on.

5 – Are lower vanadium prices triggering a wave of giant new VRFB developments?

Let’s have another look at EVs and your battery metal investment.

Sure, there’s going to be a lot more EVs on the roads sooner rather than later. So, lithium.

But remember when way back in 2018 everyone got excited about vanadium redox flow batteries (VRFBs), but then the vanadium price soared to the point where VRFBs couldn’t afford vanadium?

Vince Algar, managing director at advanced explorer Australian Vanadium, calls it a “near-death experience”.

Now the heat has come off, battery producers are scrambling to lock in a ‘Goldilocks’ price, because VRFBs are great for that other darling of renewable energy, stationary storage.

And the race to build the biggest VRFB facility has seen monstrous projects like this lighting up the feeds:

HOT NEWS #Vanadium #Dalian City has just signed a syndicated loan agreement to fund the first stage of 200/800MWh #VRB. First stage of the project would be 100/400MWh. Construction has officially commenced and the first stage is expected to be completed by Mid 2020.

BIG !!! pic.twitter.com/BrsfktEbDN— Mastermines (@VanadiumWorld) July 23, 2019

That one alone in the Chinese port city will suck up about 6 per cent of the current annual global production of vanadium.

6 – China’s graphite imports are now up 2000% over the last ~18 months

We’re on a roll this week with the China-batteries-lithium thematic.

But the thing about lithium-ion batteries is that lithium is hardly a scarce resource. A ropey report recently suggested Chinese scientists stumbled upon some 5 million tonnes of the stuff in Yunnan wilderness.

But your regular lithium-ion battery also needs graphite. About twice as much graphite as lithium, in fact.

And whatever graphite is left in China is subject to some very harsh production restrictions due to environmental concerns.

According to Roskill, China’s monthly graphite imports are now up 2000 per cent since the end of 2017.

While Africa is the continent of choice for graphite supply, even so, demand for flake is now expected to outstrip supply by 2023.

So, here’s all you need to know about the ASX small caps ready to jump in.

7 – West Africa is suddenly an even riskier place to mine as terrorist activity escalates

Also, in regard to any kind of resource supply out of Africa, it’s suddenly an even riskier place to mine as terrorist activity escalates.

Control Risks’ “Risk Map 2019” says so – and it’s not just a bit of the old terrorism that’s causing problems.

According to the Australia Africa Minerals and Energy Group (AAMEG), threats over the past 12 months have shifted from historic religious drivers to varied and overlapping factors, including income and protection.

Security expert Philip Kent-Hughes gave us some advice about how miners should set up safely in Africa; notably, not “book their flights with Flight Centre and get the Flight Centre travel insurance”.

And the Australian government also has some tips. You might consider all this as handy information for your do-your-own-research files on ASX-listed African miners.

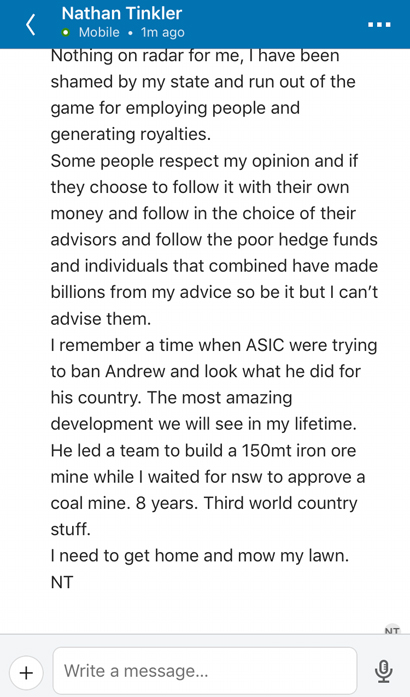

8 – ‘I have been shamed by my state’: Nathan Tinkler says he isn’t rushing back into resources

Sometimes it’s worth throwing a line out to shamed and banned former mining executives, just to see if they’re still chatty.

It’s still surprising to get replies, though:

There were a couple of those, just as entertaining, and proving that Tinkler is still far from irrelevant, they’ve coasted into Stockhead’s top 10 for the week.

But it wasn’t a completely random request, though. Angela East wanted to know why the company Tinkler’s listed as CEO of, Bentley Resources Pty Ltd, has been named as one of the buyers of the Lady Annie copper mine currently owned by CST Group.

Tinkler said there’s “nothing on the radar” for him.

9 – Hot Money Monday: The most in-demand stocks on the ASX right now

A rare feat for HMM this week – WA gold miner Tribune Resources (ASX:TBR) has topped the list of stocks running maybe too hot for the second week running.

The stock posted a two-week RSI of 87.95, and the share price is still climbing, up to $7.63 from the previous Friday’s close of $7.11.

With no recent announcement, we’re putting it down to a possible tug-of-war for it between Evolution Mining (ASX:EVN) and Northern Star Resources (ASX:NST).

Cynata Therapeutics (ASX:CYP) also had small cap investors clamouring after receiving a non-binding takeover offer from Japanese pharmaceutical company Sumitomo Dainippon. Cynata’s the stock that crashed a bit earlier this year when a deal with Fujifilm was put on hold until September.

ICYMI in one of our explainers over the past few weeks, an RSI over 70 is generally accepted as the level at which a company’s been overbought.

You might find some gems amongst those running cold though.

10 – The Secret Broker: Tips for a winning edge that you will definitely not get in business school

And now for something completely different.

We never pegged The Secret Broker as a coconut milk-slurping UrthChild, but then again, we have no idea who he – or she – is. We discussed the idea of “alternative broking advice” in basement food court in Kings Cross and contact details from a fortune cookie “Make you Happy” note our CEO half-ate after the special chicken.

So far, most of the copy TSB slides under the door has aligned with everyone’s purposes, so no harm done.

And when it comes to trading, any edge is an edge, right?

Even if it means taking your Mum to AGMs, electrifying yourself, and eating pills made out of thistles.

You can’t teach this sort of thing.

Captain’s Call – Sorry, the $4.6 million Buffett lunch is closed

There will come a day when cryptocurrency can be taken seriously.

But it definitely won’t happen while this idiot somehow stays out of jail.

That is all. Enjoy your weekends, Stockheaders.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.