China’s graphite imports are now up 2000% over the last ~18 months

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

China continues to ramp up natural graphite imports to meet rising domestic demand from its lithium-ion battery sector.

According to Roskill, monthly imports are now up 2000 per cent since the end of 2017, with almost all new supply coming from Mozambique and Madagascar.

- Scroll down to see how ASX graphite stocks have performed over the past 6 months >>>

Prior to the end of 2017 China imported less than 1000 tonnes a year. In May 2019 imports exceeded 22,000t.

China has significant resources of battery-grade graphite, Roskill says, but many of the deposits being exploited are getting deeper and more expensive to mine.

“Coupled with rising environmental costs and other costs of production, China is looking increasingly to foreign sources of supply, in particular, those in Africa,” Roskill says.

In 2017, Western graphite’s own ‘tip of the spear’ Syrah Resources (ASX:SYR) began production at its large-scale Balama project in Mozambique.

The miner, which is still having trouble hitting production targets, ships most of its graphite into the Chinese battery industry.

Triton Minerals (ASX:TON) is also aiming to get the Ancuabe graphite project in Mozambique up and running in late 2020.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

In Madagascar, several companies are looking to ramp up production of flake graphite, including Bass Metals (ASX:BSM) and Blackearth Minerals (ASX:BEM).

Tanzania is also a real hotbed of ASX-listed graphite development, with players like Graphex Mining (ASX:GPX), Black Rock Mining (ASX:BKT), Kibaran Resources (ASX:KNL), Volt Resources (ASX:VRC) and Magnis Energy Technologies (ASX:MNS) all moving projects toward first production.

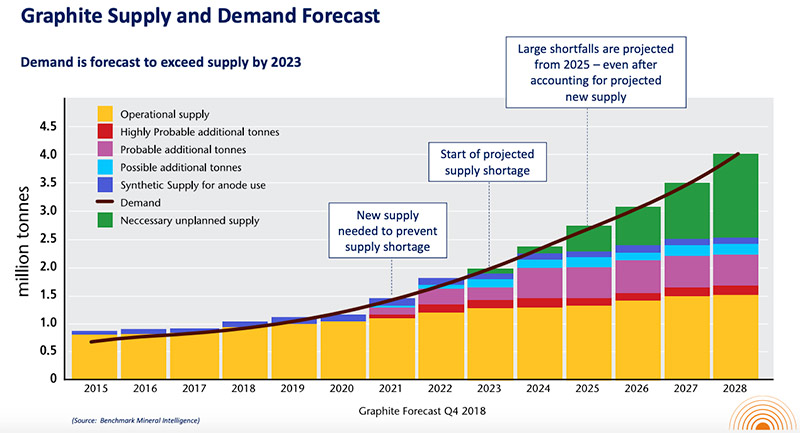

In June, David Christensen, boss of Australian based Renascor Resources (ASX:RNU), told Stockhead there was a “paradigm shift” happening where there won’t be enough graphite, either synthetic or natural, for the growing lithium-ion battery market.

“The demand is the growing use of graphite in lithium-ion batteries, whether it is synthetic or natural flake, and we’re reaching a tipping point,” he says.

“By 2021 it looks like the natural flake graphite market will be in slight undersupply, even with new projected supply from sources like Syrah, but by 2023 that becomes quite acute.”

NOW READ: As graphite approaches ‘tipping point’, buyers are eyeing Australia

Here’s a table of ASX stocks with exposure to graphite>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| Ticker | Name | 6 Month Return % | 1 Year Return % | Share Price [Wed July 24 intraday] | Market Cap |

|---|---|---|---|---|---|

| WKT | WALKABOUT RESOURCES | 215 | 186 | 0.3 | $99,791,088.00 |

| AXE | ARCHER EXPLORATION | 92 | 33 | 0.15 | $27,592,850.00 |

| SRK | STRIKE RESOURCES | 48 | 19 | 0.068 | $11,365,130.00 |

| SVM | SOVEREIGN METALS | 46 | 31 | 0.12 | $41,316,472.00 |

| BKT | BLACK ROCK MINING | 34 | 81 | 0.084 | $45,672,968.00 |

| TLG | TALGA RESOURCES | 31 | -22 | 0.45 | $96,802,840.00 |

| GPX | GRAPHEX MINING | 30 | -19 | 0.23 | $21,638,720.00 |

| BEM | BLACKEARTH MINERALS | 17 | -46 | 0.075 | $6,508,598.50 |

| CGN | CRATER GOLD MINING | 15 | -25 | 0.015 | $18,412,438.00 |

| TON | TRITON MINERALS | 4 | -10 | 0.052 | $48,211,184.00 |

| RNU | RENASCOR RESOURCES | 0 | -5 | 0.017 | $20,761,638.00 |

| QGL | QUANTUM GRAPHITE | 0 | -98 | 0.002 | $15,321,162.00 |

| KNL | KIBARAN RESOURCES | -8 | -20 | 0.12 | $35,114,516.00 |

| LML | LINCOLN MINERALS | -17 | -81 | 0.005 | $2,874,918.50 |

| VRC | VOLT RESOURCES | -17 | 0 | 0.019 | $28,050,154.00 |

| MNS | MAGNIS ENERGY TECHNOLOGIES | -32 | -37 | 0.235 | $143,616,960.00 |

| PSM | PENINSULA MINES | -33 | -67 | 0.003 | $3,038,616.25 |

| BAT | BATTERY MINERALS | -33 | -56 | 0.014 | $18,453,282.00 |

| BSM | BASS METALS | -36 | -68 | 0.009 | $25,288,872.00 |

| HXG | HEXAGON RESOURCES | -36 | -50 | 0.093 | $27,135,856.00 |

| OAR | OAKDALE RESOURCES | -43 | -29 | 0.012 | $2,504,764.25 |

| SYR | SYRAH RESOURCES | -45 | -64 | 1.04 | $429,909,376.00 |

| MLS | METALS AUSTRALIA | -50 | -63 | 0.002 | $4,390,796.50 |

| CRL | COMET RESOURCES | 7 | -29 | 0.003 | $6,910,000.00 |

At Stockhead, we tell it like it is. While Triton Minerals is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.