Ethical Investor: The 4 possible climate scenarios, and what investors should do to navigate them

News

News

A recent report has mapped out a set of future climate scenarios, and provided tips on how investors can navigate their portfolio as uncertainties arise.

The authors, GIC and Ortec Finance and Cambridge Econometrics, said that without drastic and immediate carbon emission cuts, our window will be fast closing on achieving the Paris Agreement target.

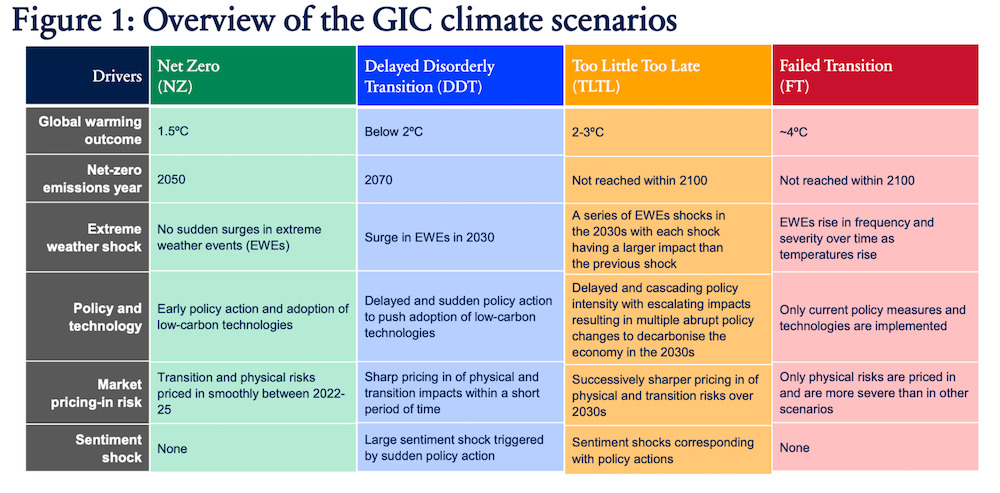

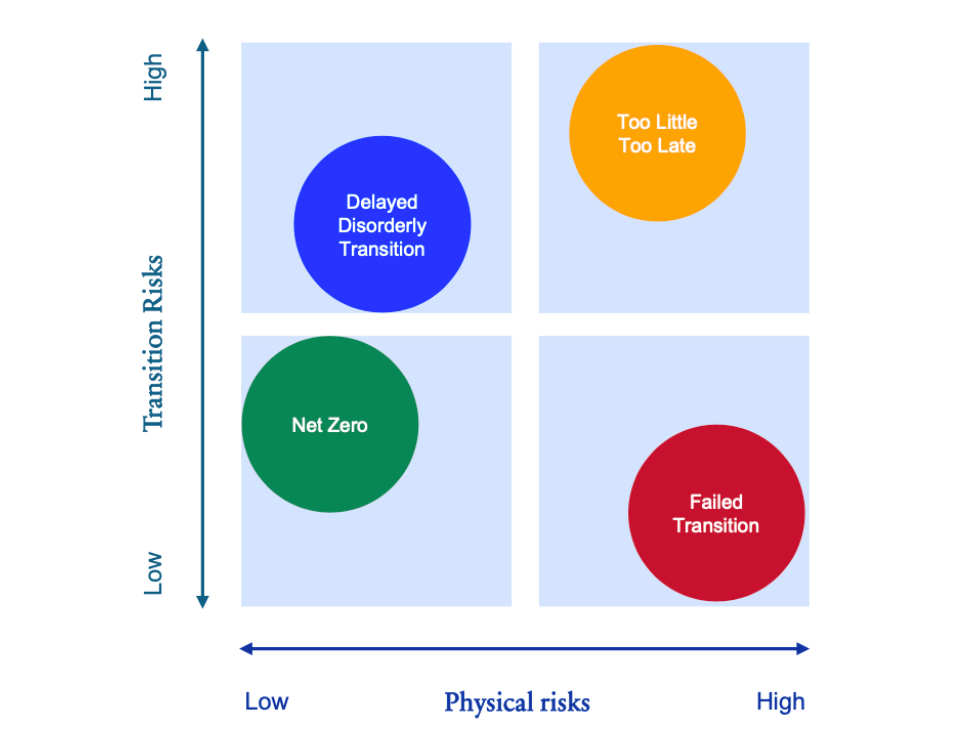

The report says there are four possible scenarios or outcomes for our climate transition – Net Zero, Delayed Orderly Transition (DDT), Too Little Too Late (TLTL), and Failed Transition.

Other than the two extreme scenarios which reflect the binary outcomes of either a successful net zero or a failed transition, the middle scenarios of DDT and TLTL will depend on policy-making and market responses.

But the authors were sure on one thing – that the transition will result in market volatility.

“Our analysis based on the most recent scenario sets and signposts is clear: expect greater volatility, continued uncertainty, heightened transition and physical risks, and disruptive change on the horizon.”

According to the report, the Net Zero scenario represents the best outcome – where climate policies are introduced in an early and orderly manner, enabling the world to reach net zero by 2050.

The most pessimistic outcome, the Failed Transition scenario, instead foresees severe climate-related physical impacts, as the average global temperature increases to over 4C above pre-industrial levels by 2100.

The Delayed Disorderly Transition scenario describes a world that is slow to implement climate policies until a surge in extreme weather shocks causes public pressures to rise, compelling governments to act.

“Due to this delay however, much more drastic measures would have to be executed within a much shorter time period,” said the report.

Under this scenario, markets would over-react to these extreme weather and policy shocks, before the sentiment shock dissipates and markets recover.

Meanwhile under the Too Little Too Late scenario, we see policy-makers similarly stall on enacting climate policies, and only respond to public pressure following a series of extreme weather shocks.

Unlike in Delayed Disorderly Transition, these policy responses are not made in time or of sufficient magnitude, resulting in a global warming outcome of 2-3C by 2100.

“This scenario also sees increased market volatility as a result of multiple abrupt extreme weather shocks and policy changes,” the report said.

Depressingly, the report went on to say that Too Little Too Late was the most likely scenario, followed by Failed Transition, Delayed Disorderly Transition and Net Zero.

“Importantly, however, none of the scenarios have a more than 50% probability, which highlights the highly uncertain outlook that investors need to navigate.”

According to the report, investors should prepare for more macro and market volatility, with risks evolving in a disruptive manner.

“For example, in the Delayed Disorderly Transition and Too Little Too Late scenarios, sharp policy responses to the onset of extreme weather shocks will see both GDP and inflation fluctuate widely,” it said.

Second, investors must take a balanced approach to managing both transition and physical risks, given the considerable uncertainty over which scenario would eventually materalise.

“It is also important not to optimise only for one particular scenario due to the range of possible outcomes,” the authors advised.

Third, market beta (a stock’s return compared to the overall market) is likely to be negatively affected by climate-related drivers, especially physical risks, over the long term.

“However, the growth and returns impacts vary widely across scenarios, countries and sectors.”

The report also said that a hypothetical portfolio consisting of 60% equities and 40% bonds will continue to generate positive returns over a 40-year period.

“But the underperformance is stark, and climate change will reduce returns by roughly 10 to nearly 40%,” the authors warned.

Yet there is potential upside as well: equity markets with low exposures to low-carbon utilities, such as those in emerging markets, have the potential to outperform.

The authors say that one of the limitations of current climate-related financial models is that they are not able to fully capture the upside from decarbonisation solutions.

This is because companies with the required climate technologies may not exist yet, or are in very early stages of development.

“Spending on climate adaptation and the resultant investment opportunities is an additional area that climate models have not fully incorporated yet,” said the report.

Investors must therefore ultimately manage their portfolios nimbly, and integrate both climate risks and opportunities in the investment process.

This applies from top-down asset allocation, to risk management, and bottom-up security selection.

“These climate scenarios and signposts are not meant to predict the future, but they will help us prepare for the transition that will come to bear.

“We just hope it is not too little, too late,” concluded the report.