CoreLogic: Australian home prices are face-planting the fastest on record and it’s the RBA’s fault, baby

Trained Stockhead actor simulates face plant. Via Getty

This is interesting.

No, not as interesting as the thinking achieved in Hobart today, and made fiscal fact by the top minds at the Reserve bank of Tasmania and unleashed on a highly suspicious Aussie public just before the Cup.

To catch you up, it’s a gentler-than-many-anticipated rogering of 25 basis points. That spells trouble with an 8 x capital city index.

Because, according to CoreLogic, ‘Strayan property prices fell in October for the sixth straight month across the 8 x capital cities.

That brings national average property prices down 6% from the high over six months ago.

From Commsec. Because bad news in violet ain’t that bad:

The Reserve Bank (#RBA) has raised the official cash rate by 0.25% at its November meeting to 2.85%. This is the RBA’s seventh straight rate hike. pic.twitter.com/MiBaUhIgh4

— CommSec (@CommSec) November 1, 2022

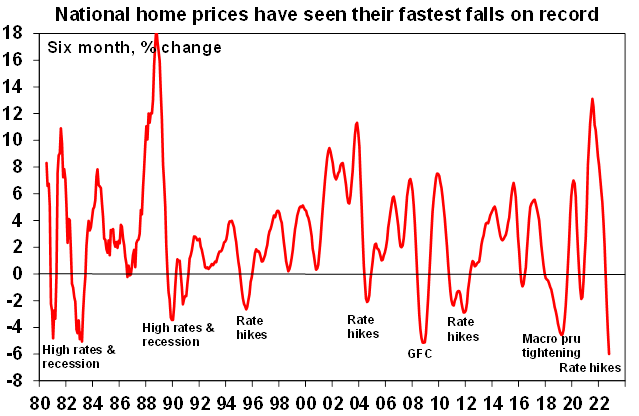

This the single fastest rate of falling home prices ever recorded by CoreLogic with archivists still digging through records which stretch back as far as 1980.

“The rapidity of the decline in home prices this time around likely reflects the de facto tightening that started with rising fixed mortgage rates a year ago, the speed of RBA cash rate hikes and heightened household sensitivity to rising interest rates flowing from much higher debt levels now along with the extent of the prior boom,” says AMP Capital’s Shane Oliver.

Up, up. Prices are up

The RBA’s seventh straight interest rate hike, driven by raging inflation, takes the cost of money from its record low 0.1% to 2.85%.

The highest in almost a decade, which doesn’t count to much since Governor Dr P. Lowe also scrapped the bank’s previous economic forecasts, saying that inflation will now go higher and endure longer than they thunk before.

Needless to say then that further rate hikes are in the post, the latest quarterly indicators last week clocking inflation surging at its fastest in 32 years.

They’re tipped to pass on another 0.25 percentage point rate hike in December, just as the inflation rate is expected to begin peaking.

“The size and timing of future interest rate increases will continue to be determined by the incoming data and the Board’s assessment of the outlook for inflation and the labour market,” Dr P. Lowe said in a statement, which was almost certainly written in Hobart, a great city for writing.

“As is the case in most countries, inflation in Australia is too high.

“Over the year to September, (still P. Lowe here) the CPI inflation rate was 7.3 per cent, the highest it has been in more than three decades. Global factors explain much of this high inflation, but strong domestic demand relative to the ability of the economy to meet that demand is also playing a role.

“Returning inflation to target requires a more sustainable balance between demand and supply.”

Down down, prices are down

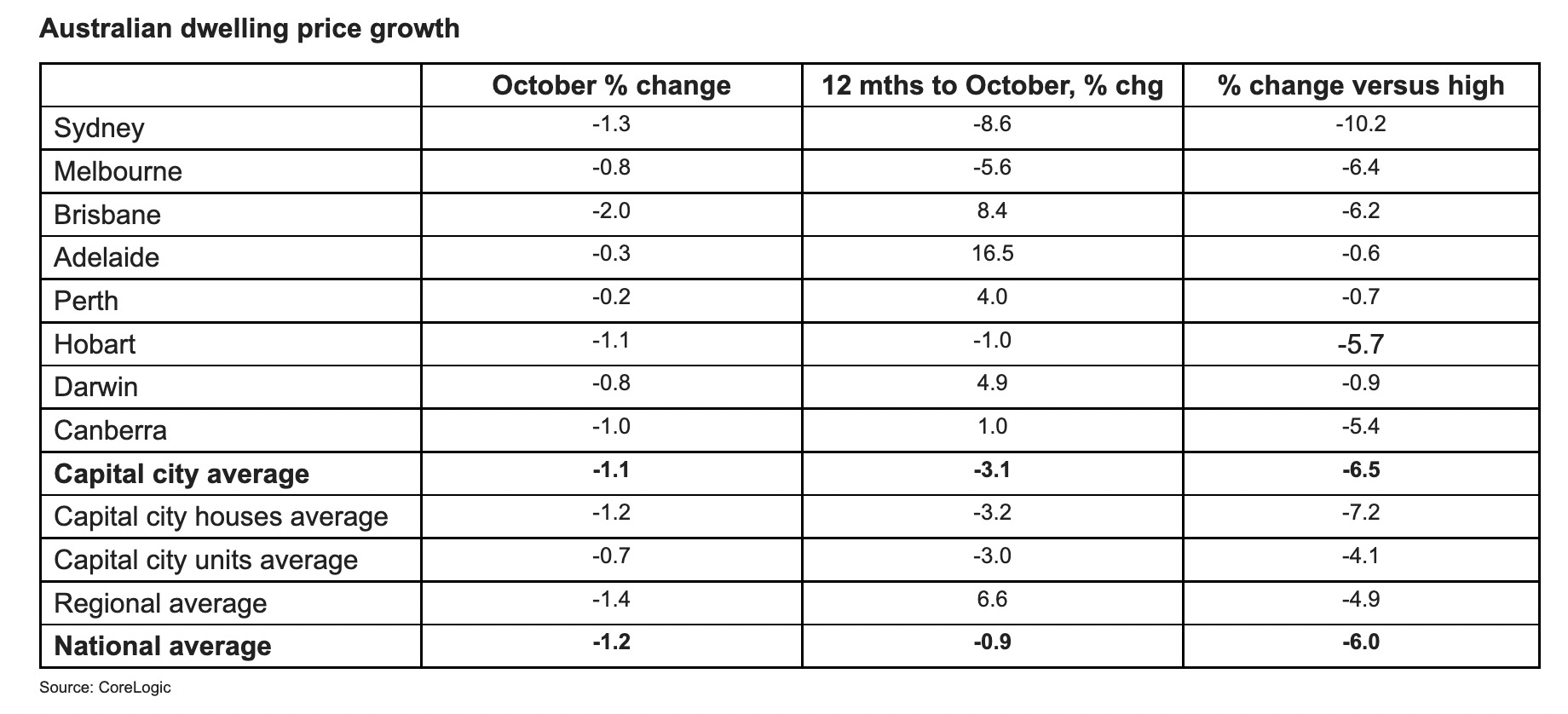

The 1.1% backward step, as described in loving detail in CL’s latest 8 x capital city benchmark index, followed as hotly as months can from the 1.4% fall in September.

Home prices across the 8 x Aussie capital cities are now down by 6.5% from their (and let’s remember this note: insanely high) April peak.

More than just a Freudian slip

The record April high, recorded in April, made its haughty progress ever upwards upon the steam of furious, possibly pandemic-inspired buying.

As something of a gun at mapping the hidden connections – however spurious or misguided – between unrelated events, I parse out what’s happened to property prices and the pickle they’ve put us in, thusly:

It’s well-known that near death experiences can produce a burst of life-seeking or life-confirming behaviour. That’s probably why the French have, on occasion, been known to refer to the orgasm as ‘la petite mort’ or ‘the little death’. It’s either that or the French are just a brutal, confusing, but beautifully clothed people.

The point being, obviously, that throughout 2021, locked-in Australians clearly tiring of pizza, Netflix and sex, turned to that other national comfort food – Oz properdy – to reaffirm the thrill of living under the shadow of death, or in COVID-19’s case, coughing a lot.

Next week, I’ll explain the link between falling home prices and colonoscopies.

Meanwhile, in October…

Yes. Aussie capital city home prices slid again, down -1.2% nationally. And the experts tell us the rate of declines are wonderfully diverse.

After going on a 28.6% rampage between the momentary pandemic low of circa September 2020, to the awesome high of April, the average national property prices have now backtracked 6%.

Price falls appear to be spreading – like some kind of new and unpredictable virus. From Sydney and Melbourne down to all the other capital cities and across to their regional brethren.

In Bris Vegas, for example, prices are now falling faster than Sydney.

Around the 8 x capital city traps we go from the extreme -2.0% falls from up in Brisbane, to the fringe -0.2% slide in the capital city of The Other Australia, Perth.

Good news for me – yay – Sydney prices are falling with less velocity, down -1.3%.

Melbourne’s down -0.8%, while in Darwin, home values fell into negative territory for the first time since November 2021 (-0.8%).

According to CBA’s lead numbers man, Gareth Aird, prices have weakened significantly across regional Australia too.

CoreLogic’s regional benchmark index shows further falls in October of 1.4%.

Home prices in regional Australia are down 4.9% from their June peak (that’s in just four months).

Across the rest-of-state regions, monthly falls of more than -1% were recorded in Regional NSW (-1.7%), Regional Victoria (-1.4%) and Regional Queensland (-1.3%).

Regional SA was the only broad market to see values rise (+0.1%).

House prices hurting more than unit prices

House prices are down by 7.2% since April while unit prices have fallen by 4.2% over the same period.

A this chart from CNA shows… wait, actually… well it cuts off what the unit sales volumes are actually hitting, but the point remains the same – er… unit sales are off the charts?

The slowing of unit prices is a reversal of last year, Aird notes, when the prices of homey-houses rose at a faster pace than units.

Through the upswing, capital city house values increased by 29.9% which was more than double the rise in unit values at 13.2%. Since peaking in April, capital city house values have reduced by -7.2% while unit values are down -4.2%.

CoreLogic’s unrelenting research director, Tim Lawless, says units fell by less basically because they have more affordable price points across the medium to high density sector, ie: they haven’t got as far to fall.

“The gap between median house and unit values increased to record levels through the COVID upswing. With borrowing capacity being hit hard as interest rates rise, it’s likely more housing demand has been diverted towards more affordable sectors of the market.”

Supply and demand

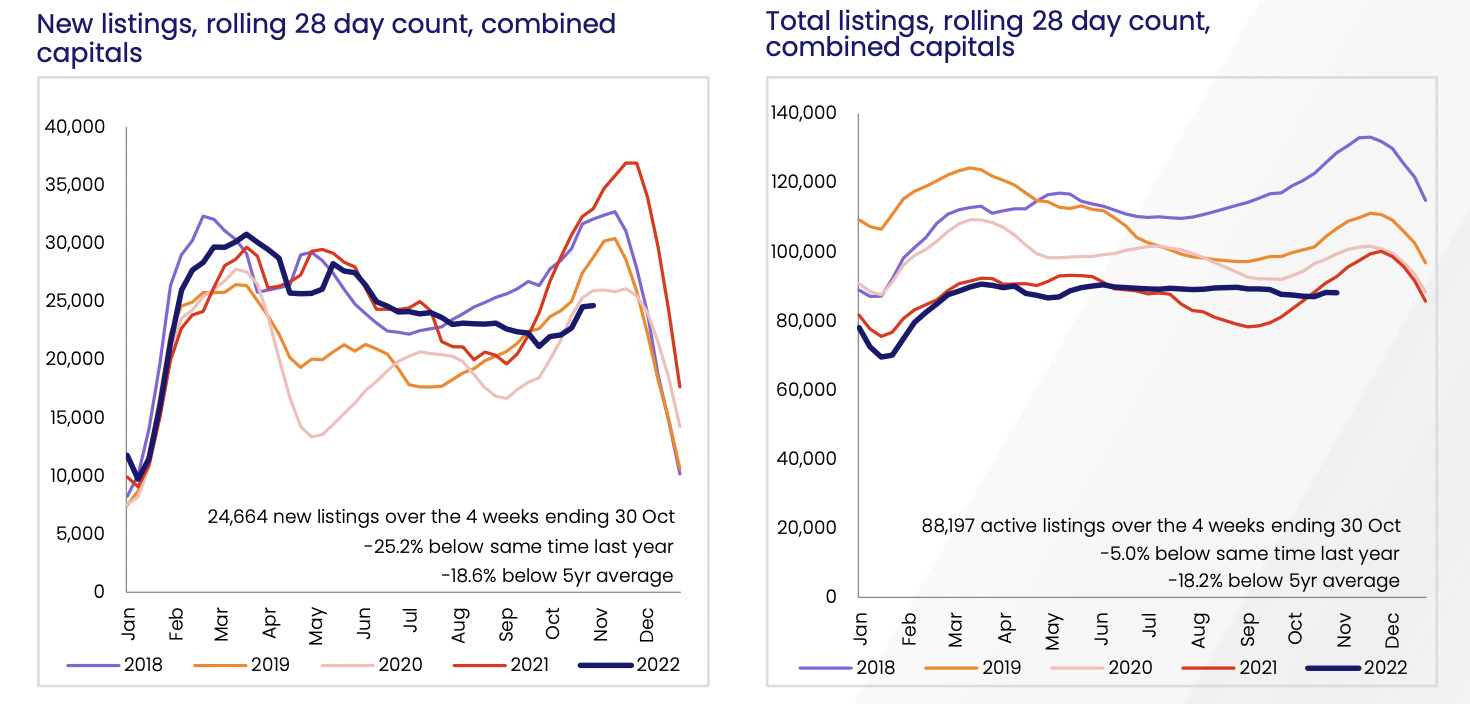

On the supply side CoreLogic notes the flow of new listings picked up last month, but the traditional spring selling season remains untraditionally below levels seen at the same time last year and relative to the previous five-year average.

Over the four weeks, the number of newly listed capital city dwellings was more than 25% below last year and some 19% below the previous five-year average.

On the demand side, CoreLogic calculate that modelled sales over the three months to October across the 8 x capital cities were 16.6% lower than a year ago.

Lawless said it is probably still too early to claim the worst of the decline phase is over.

“Despite the easing in the pace of decline, with Australian borrowers facing the double whammy of further interest rate hikes along with persistently high and rising inflation, there is a genuine risk we could see the rate of decline re-accelerate as interest rates rise further and household balance sheets become more thinly stretched,” he said.

“To-date, the housing downturn has remained orderly, at least in the context of the significant upswing in values. This is supported by a below-average flow of new listings that is keeping overall inventory levels contained.

“There’s also tight labour market conditions, an accrual of borrower savings and a larger than normal cohort of fixed interest rate borrowers, who have so far been insulated from the rapid rise in interest rates.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.