CoreLogic says home prices are falling faster; CBA says the economy is next

A fallen wombat by Getty

CoreLogic says the slump in Australian property values has probably gone airborne. And you can pop your masks back on if you want – but it’s still spreading across the country.

CBA says the economy will get it and the RBA vaccine is entirely untested.

In other words the good news is house price falls are spreading and accelerating while the bad news is our sliding economy will follow.

The highest rates of infection are in the most densely populated cities of Sydney and Melbourne, although CoreLogic warns that the spread is on and conditions are weakening elsewhere.

Released on Thursday, CoreLogic’s June national Home Value Index recorded a second consecutive month of falls in value, down 0.6%, to be 0.2% lower over the quarter.

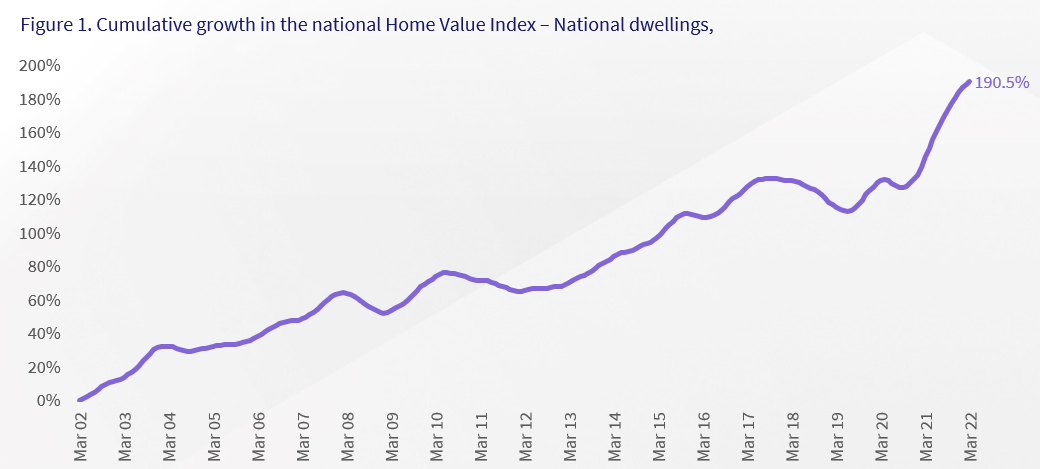

It’s not the end of the world, nor even the end of Hobart. We’re really only just recovering from the same data crunchers at CoreLogic telling us the cost of our Australian property dream climbed about 191% over the two decades to March 2022, largely spurred ahead by the 210% jump in value of standalone homes.

And regional values are up about 41% since March 2020, for the love of Batemans Bay.

That makes the continued falls in Sydney (-1.6% month and -2.8% quarter) and the Other City (-1.1% month and -1.8% quarter) fairly mundane and nothing to antagonise your evening with.

In the past 20 years the stoic, if easily aroused Australian housing market has found itself in six full-on periods of really pulse-driving price rises, punctuated by five periods of old school comedowns.

These pretty obvious comedowns largely happen when credit conditions change – like we’re seeing now – usually related to macro-prudential tightening rising interest rates and/or alongside arse-quivering economic shocks like the GFC, Covid-19 and whatever we’re calling this one.

In the past 20 years these housing market depressions – or momentary funks – have lasted on average, about 25 months.

CoreLogic says their average peak-to-trough declines are about -5.0% in value.

So Sydney and Melbourne were the main spreading events for June’s steeper drop, but housing values were also down in Hobart (-0.2% month and -0.1% quarter) as well as regional Victoria (-0.1% month and +1.2% quarter).

House and home

CBA’s head of Australian economics Gareth Aird says there’s no question home prices have begun their descent.

His team expected today’s national home prices to drop by ~0.9% for June led by falls in Sydney which they undershot by 0.1% over the month.

A few weeks ago Aird freaked a lot of people out when he predicted an 11% fall in Sydney house prices this year, followed by a further 7% slide next year.

And remember the cost of a home ‘can’t be divorced from the broader economy’ and changes in home prices influence the economic outlook, Aird said.

“Indeed they are a forward-looking indicator (changes in home prices impact wealth, consumer confidence, spending decisions and employment).”

Lawless says every capital city is now well past their peak rate of growth with trend rates clearly taking their cues across the remaining markets.

Rolling three month change in dwelling values for state capitals

Worth noting as well, even Australia’s third largest city, the fun-living person-magnet BrisVegas, has now also seen prices flatten out to a mere 0.1% during June, while obstinate Adelaide is the only capital holdout still delivering a monthly growth rate higher than 1% (1.3%). Growth in Perth’s housing values, which wafted higher on the updraft of reopening, are now wilting too, with values up a weary 0.4%.

CoreLogic research director, Tim Lawless, pins the sharper slowdown as coincidental with the May cash rate hike, as surging inflation and broader economic fears nibbled at the nails of consumer sentiment.

“Considering inflation is likely to remain stubbornly high for some time, and interest rates are expected to rise substantially in response, it’s likely the rate of decline in housing values will continue to gather steam and become more widespread.”

Lawless said a rise in advertised supply across some markets is mostly due to a slowdown in the rate of absorption.

“Estimated transactions in Sydney throughout the June quarter were -36.7% lower than a year ago while Melbourne is down -18.3%.

CoreLogic reckons national home sales through the June quarter were almost 16% lower than June last year, but are still happily 13% above the five-year average.

Tougher selling conditions come through in the crapness of weekly auction stats, where the combined capitals clearance rate has now held below 60% since the last week of May; crazy low compared to the last few years. There’s longer selling times too which is probably why the same sellers are now more obviously offering discounts at private treaty sales.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.