Closing Bell: WiseTech leaps 17pc on profit jump; Dundas doubles on gold discovery

WiseTech Global surged 16pc on strong earnings. Picture Getty

- ASX extended its eight-day winning streak

- WiseTech Global surged 16pc on strong earnings, while Santos fell 5pc

- Lithium and gold stocks rose despite concerns over oversupply

Aussie shares kept their winning streak alive in the final minutes of trading, as investors processed around 40 corporate results on a busy day for the ASX.

The benchmark ASX200 index ended up closing 0.05% higher, despite spending most of the day in the red.

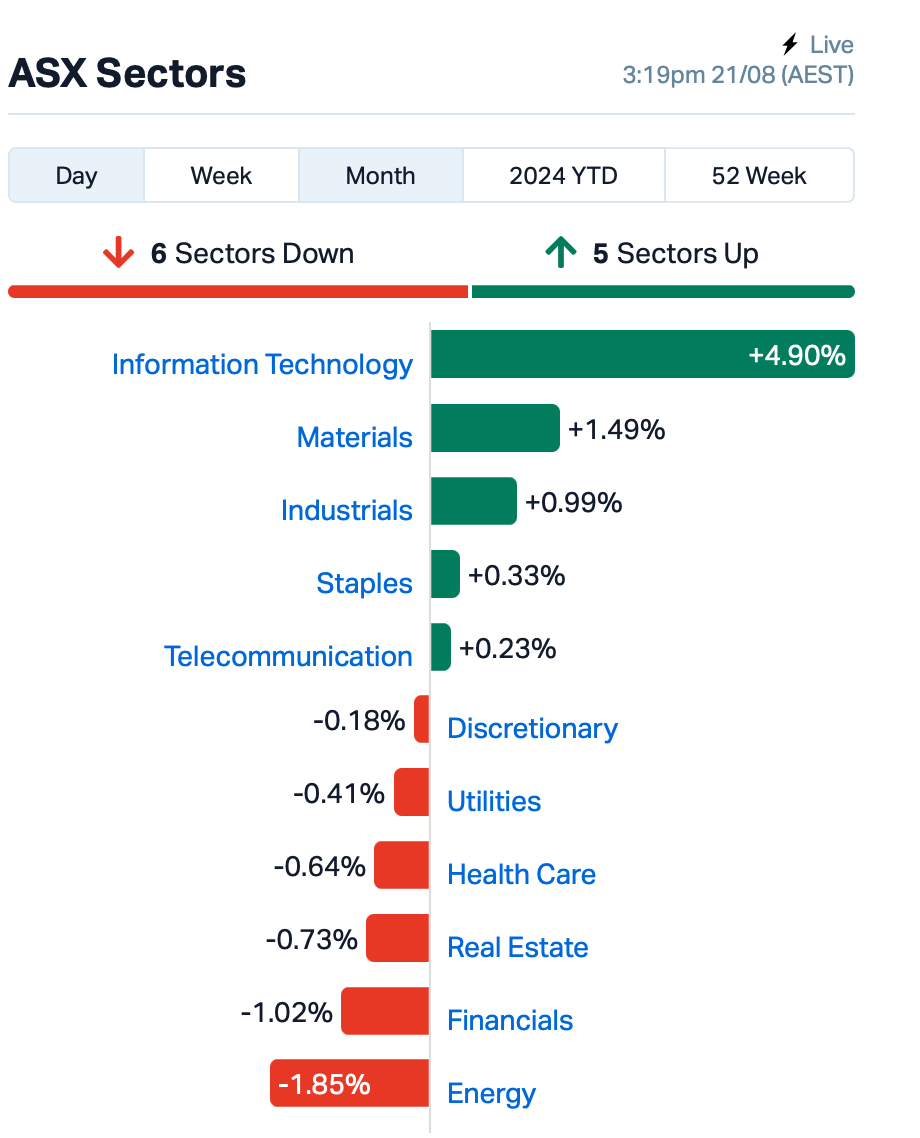

Of the 11 ASX sectors, 5 rose and 6 declined.

Tech was by far best performer, driven by a 17% increase in WiseTech (ASX:WTC) after a significant profit jump – more on that below.

Energy meanwhile was weighed down by Santos (ASX:STO)’s uninspiring result.

Lithium related stocks caught bids despite widespread concerns from major brokers about an oversupply issue. Research showed that producers from Australia, China, South America, and Africa are ramping up production even as demand from the electric vehicle sector slows.

Gold stocks meanwhile keep rising after bullion futures briefly touched an all time high of US$$2,570.40, marking the fourth consecutive occasion since April 2023 that gold prices have surpassed their previous record highs.

Today’s earnings season highlights

WiseTech Global (ASX:WTC) jumped 16% after reporting strong FY24 results.

The company’s CargoWise software, used by major logistics providers, helped drive a 28% increase in revenue to $1.04 billion and a 28% rise in EBITDA to $495.6 million.

WTC’s net profit grew by 15% to $283.5 million, while free cash flow was up 14% to $333 million. Final dividend per share was up 10% to $0.092.

Pallet maker Brambles (ASX:BXB) rose 8% after its profit and cash flow results for FY24 exceeded forecasts.

Sales revenue grew 7%, while underlying profit and earnings per share increased by 17% as cost increases were offset by pricing and efficiency gains. Looking ahead, Brambles says it expects steady growth.

Property fund manager, Charter Hall(ASX:CHC) skyrocketed 15% after reporting operating earnings of $358.7 million.

Despite a statutory loss of $222.1 million, the fund maintained distributions at 45.1 cents per security.

Domino’s Pizza (ASX:DMP) fell slightly despite reported strong financial results.

The company achieved network sales of $4.19 billion, up 4.6%, and online sales rising by 7.5% to $3.37 billion. Earnings before interest and taxes (EBIT) grew by 3% to $207.7 million.

Santos (ASX:STO) slipped 5% following its half-year results.

The company reported a 9% decline in sales revenue to $2.7 billion, and a 5% drop in free cash flow to $1.1 billion.

Production fell by 2% to 44 million barrels of oil equivalent, and earnings before interest, tax, and other expenses decreased by 13% to $1.85 billion.

And, Corporate Travel Management (ASX:CTD) skidded by 4% after the company missed its full-year earnings forecast and signalled a challenging first half ahead.

What else happened today?

Across the region, Asian stock markets ended their three-day winning streak as concerns about Chinese tech stocks and a pause in Wall Street’s rally weighed on the region.

In Hong Kong, Chinese tech index fell by up to 2% on concerns about China’s consumption outlook.

Shares in Tokyo also fell despite better export data, as worries about earnings grew with the yen’s recent rise.

Looking ahead to tonight’s session on Wall Street, eyes will be on the Fed Reserve’s meeting minutes.

Several US companies are set to report earnings or trading updates, including Macy’s, Snowflake, Target, and Zoom Video Communications.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| DUN | Dundas Minerals | 0.058 | 142% | 23,418,487 | $2,031,073 |

| MTM | MTM Critical Metals | 0.060 | 62% | 15,905,196 | $10,400,953 |

| RGT | Argent Biopharma Ltd | 0.390 | 53% | 61,171 | $12,343,429 |

| RR1 | Reach Resources Ltd | 0.017 | 42% | 5,477,710 | $10,493,176 |

| EDE | Eden Inv Ltd | 0.002 | 33% | 77,539 | $6,162,314 |

| HLX | Helix Resources | 0.004 | 33% | 55,888,650 | $9,792,581 |

| MEL | Metgasco Ltd | 0.004 | 33% | 130,000 | $4,342,760 |

| TYX | Tyranna Res Ltd | 0.004 | 33% | 150,174 | $9,863,776 |

| HUM | Humm Group Limited | 0.680 | 31% | 7,588,205 | $255,513,099 |

| AAU | Antilles Gold Ltd | 0.005 | 29% | 31,876,397 | $5,114,997 |

| IMI | Infinitymining | 0.019 | 27% | 49,229 | $1,781,301 |

| LRV | Larvottoresources | 0.335 | 26% | 19,698,808 | $81,607,932 |

| UNT | Unith Ltd | 0.024 | 26% | 7,702,604 | $23,324,478 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 198,456,432 | $57,867,624 |

| CZN | Corazon Ltd | 0.005 | 25% | 350,000 | $2,671,622 |

| PKO | Peako Limited | 0.005 | 25% | 1,221,860 | $2,736,476 |

| PUR | Pursuit Minerals | 0.003 | 25% | 110,000 | $7,270,800 |

| TAS | Tasman Resources Ltd | 0.005 | 25% | 479,839 | $3,220,998 |

| AAM | Aumegametals | 0.055 | 25% | 1,918,623 | $23,147,069 |

| M2R | Miramar | 0.011 | 22% | 22,693,399 | $3,553,016 |

| HCT | Holista CollTech Ltd | 0.017 | 21% | 1,319,244 | $3,903,201 |

| KME | Kip McGrath Edu.Cntr | 0.405 | 21% | 270,543 | $19,042,243 |

| CTQ | Careteq Limited | 0.018 | 20% | 146,666 | $3,556,781 |

| AGC | AGC Ltd | 0.360 | 20% | 1,034,537 | $76,979,167 |

| CL8 | Carly Holdings Ltd | 0.012 | 20% | 293,906 | $2,683,704 |

Dundas Minerals (ASX:DUN) went flying on news that it has drilled into high grade gold while exploring at the Windanya and Baden-Powell projects, located adjacent the Goldfields Highway ~60km north of Kalgoorlie, Western Australia, with the highlight being an assay of 9.5 g/t Au between 146m and 147m, with drilling to be extended to further test the depth of mineralisation.

Argent Biopharma (ASX:RGT) was up on news that the company has sealed a strategic collaboration with SINTEF, one of Europe’s largest independent research organisations, to address the critical and unmet clinical challenge of chronic wound management, through nano-formulations as part of the Company’s ongoing expansion into new therapeutic areas.

Metgasco (ASX:MEL) was up on news that work at its 25% owned Odin and Vali gas field is set to recommence after bad weather in July hampered progress. The company says that two wells, Odin-1 and Vali-1 continue to perform steadily, averaging production rates of 1.4 MMscf/d and 1.1 MMscf/d respectively, and work is underway to bring Odin-2 to productivity.

Kip McGrath Education Centres (ASX:KME) was up on the heels of the company’s earnings report, which delivered happy-ish news to shareholders. The company says revenue was up 21.0% to $32.4 million, delivering an EBITDA of $6.5 million (down 2.7%) and an NPAT of $1.3 million, down 31.5% on pcp.

MTM Critical Metals (ASX:MTM) was moving higher on news that the company has achieved a significant breakthrough in the development of its Flash Joule Heating (FJH) technology, through which it was able to convert SC6 spodumene concentrate directly to lithium chloride (LiCl) in a single, acid-free unit operation.

Reach Resources (ASX:RR1) was up on news that the company has completed a heritage survey at its 100% owned Wabli Creek Project, in the Gascoyne region of WA with the Wajarri people and the Burringurrah Aboriginal Corporation, which has provided clearance for ground disturbing activities including a drilling program over the main target areas of the project.

Humm (ASX:HUM) released its results for FY24, and investors were happy. The company reported statutory net profit (after tax) of $7.1 million was up 145%, with the second half statutory net profit (after tax) of $13.1 million representing a turnaround of $19.1 million from the first half loss of $6.0 million. The company says it’s in good shape, with $125.1 million in unrestricted cash and $0.7 billion of warehouse headroom.

Comms Group (ASX:CCG) was up on news that the company’s revenue guidance exceeded for the year with total revenue of $55.5 million, an increase of 7% year-on-year. Importantly, the company says, that growth in revenue is all organic and over 90% of revenue is recurring. As a result, Comms Group has announced its inaugural dividend, declaring $0.0025 per share, fully franked.

Bioxyne (ASX:BXN) was flying high on news that the company has produced its first commercial run of edible cannabis products, namely THC gummies to fulfil an order that the company had taken a deposit for. The company says it is now scaling up its gummy manufacturing capabilities from 2 million single doses per month to 6 million to meet anticipated market demand.

Larvotto Resources (ASX:LRV) has been on a tear since last week on the back of China deciding to restrict exports of highly sought-after antimony – of which it currently dominates production. A 5250m RC drilling program is about to kick off at the Clarks Gully deposit at the explorer’s Hillgrove gold-antimony project in NSW to increase confidence in the current 266,000t antimony (Sb) and 2g/t gold (10.6g/t AuEq) resource.

Infill drilling at Antilles Gold (ASX:AAU)’s Cuban operation (that’s right, an ASX junior in Cuba) has revealed multiple 20m intercepts with 1.2-1.7% copper at its Nueva Sabana gold-copper deposit at the El Pilar gold project – a 50:50 JV with the Cuban government. Best hits for shallow gold mineralisation showed 2m @ 25.26g/t gold from 38.5m, including 1m @ 45.39g/t; and 25m @ 1.76% copper from 52m, including 4m @ 5.56%.

Silver Mines (ASX:SVL) says despite the NSW courts upholding the appeal by Bingman Catchment Landcare against the company that challenged an administrative process against the impacts of a power line for its Bowdens project, it’s progressing a new development application. Bowdens is a 396Moz silver equivalent deposit with exploration upside and SVL is proposing the development of an open cut mine feeding a new 2Mtpa plant that will produce 66Moz silver, 130,000t zinc and 95,000t of lead across a 16.5-year mine life.

And, Amplia Therapeutics (ASX:ATX) jumped as hight as 11% this morning after the company provided an update on its ACCENT trial for advanced pancreatic cancer. The trial, which tests a drug called narmafotinib combined with standard chemotherapy, has just hit a major milestone. Recently, a fifth patient in the trial showed a confirmed partial response, meaning their tumour size decreased by at least 30% and remained stable over two months, with no new tumours appearing. The trial started with 26 patients, and the goal was to see at least six of them achieve this level of tumour reduction before expanding to a second group of 24 patients. With five patients now meeting this target, only one more confirmed response is needed to proceed with the next phase of recruitment.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ECT | Env Clean Tech Ltd. | 0.002 | -33% | 884,421 | $9,515,431 |

| GGE | Grand Gulf Energy | 0.004 | -33% | 2,098,337 | $12,571,482 |

| LSR | Lodestar Minerals | 0.001 | -33% | 500,000 | $3,901,170 |

| ADN | Andromeda Metals Ltd | 0.012 | -25% | 35,015,248 | $49,764,335 |

| YAR | Yari Minerals Ltd | 0.003 | -25% | 1,292,000 | $1,929,431 |

| GBE | Globe Metals &Mining | 0.035 | -22% | 760,177 | $31,115,047 |

| PLG | Pearlgullironlimited | 0.011 | -21% | 12,001 | $2,863,585 |

| MEG | Megado Minerals Ltd | 0.008 | -20% | 300,000 | $2,544,556 |

| MCM | Mc Mining Ltd | 0.057 | -20% | 207,866 | $29,394,948 |

| BPH | BPH Energy Ltd | 0.018 | -18% | 19,678,283 | $26,520,581 |

| PEC | Perpetual Res Ltd | 0.009 | -18% | 3,572,031 | $7,040,335 |

| AQN | Aquirianlimited | 0.175 | -17% | 31,229 | $16,941,534 |

| JPR | Jupiter Energy | 0.025 | -17% | 81,370 | $38,209,566 |

| PSL | Paterson Resources | 0.020 | -17% | 613,306 | $10,944,909 |

| FME | Future Metals NL | 0.017 | -15% | 21,836 | $11,500,810 |

| CDT | Castle Minerals | 0.003 | -14% | 20,000 | $4,647,392 |

| N1H | N1 Holdings Ltd | 0.120 | -14% | 4,170 | $12,327,780 |

| SHN | Sunshine Metals Ltd | 0.012 | -14% | 908,018 | $22,227,027 |

| THB | Thunderbird Resource | 0.025 | -14% | 262,119 | $9,339,595 |

| ADG | Adelong Gold Limited | 0.004 | -13% | 2,098,793 | $4,471,956 |

| AIV | Activex Limited | 0.007 | -13% | 15 | $1,724,021 |

| BLZ | Blaze Minerals Ltd | 0.004 | -13% | 794 | $2,514,233 |

| LCL | LCL Resources Ltd | 0.007 | -13% | 400,000 | $7,719,024 |

IN CASE YOU MISSED IT

Arizona Lithium (ASX:AZL) has completed the collection of a 100t bulk sample from three holes as part of its work to validate an exploration target and expand resources at its Big Sandy lithium project in Arizona.

Everest Metals Corporation (ASX:EMC) has delivered a world-class, maiden rubidium resource of 3.6Mt at 0.22% rubidium and 0.07% Li2O at its Mt Edon project in WA’s Mid-West region. This includes a high-grade zone of 1.3Mt at 0.33% rubidium and 0.07% Li2O.

Killi Resources (ASX:KLI) has started a maiden drill program of up to 10 holes at the Kaa gold-copper prospect within its Mt Rawdon West project in Queensland. This will focus on Kaa’s identified 1.8km mineralised trend and beneath the 238g/t gold rock chip sample it picked up.

Perpetual Resources (ASX:PEC) has extended the high-grade rare earths discovery at its Raptor project in Brazil after assays from a further seven drill holes returned up to 6,327ppm TREO. Besides confirming the continuity of mineralisation at the Portão Verde prospect, drilling has also identified a new mineralisation frontier at the Pina Colada prospect.

Renascor Resources’ (ASX:RNU) downstream equipment trials for its planned purified spherical graphite manufacturing facility in South Australia has successfully produced lithium-ion battery-anode-grade graphite across all targeted product specifications.

Toubani Resources (ASX:TRE) has received firm commitments for a $10m capital raising from several Australian specialist resources fund managers as well as existing and new institutional and retail investors. Proceeds will be used to progress its Kobada gold project in southern Mali towards shovel-ready status.

AuMake International (ASX:AUK) has formalised its three-year strategic co-operation framework agreement with China’s Yangtze River New Silk Road International Logistics, which will purchase at least $100m worth of Australian goods from the company per year.

TRADING HALTS

Zimi (ASX: ZMM) – pending an announcement by Zimi in connection with an accelerated renounceable entitlement offer.

At Stockhead, we tell it like it is. While Arizona Lithium, Aumake, Everest Metals Corporation, Killi Resources, Perpetual Resources, Renascor Resources and Toubani Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.