Closing Bell: WiseTech drags again; 29Metals sinks 20pc on copper output

29Metals plunges after cash reserve drop and production decline.Picture via Getty Images

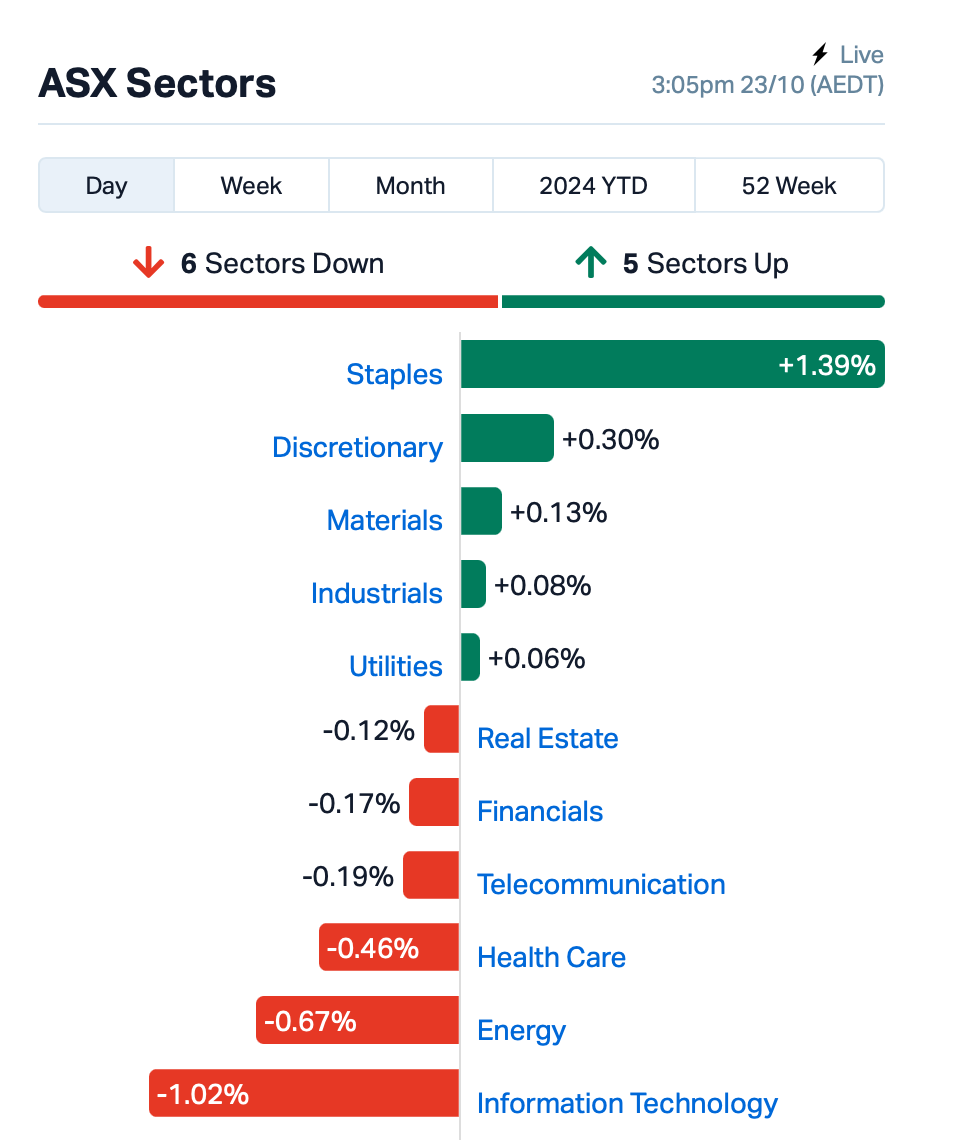

- ASX edges slightly up by 0.12pc as traders rethink rate cuts

- Consumer staples shine while gold miners gain amid global tensions

- 29Metals plunges after cash reserve drop and production decline

The ASX ticked up higher by 0.1% on Wednesday after a quiet session on Wall Street overnight.

Traders took a breather as they rethink rate cut expectations from the Fed following hawkish remarks from some Fed officials.

Consumer staples led the way today, driven by Coles Group (ASX:COL) and Woolworths (ASX:WOW) , both rising around 1%.

Gold miners also some gains as prices stabilise near record highs, with Bellevue Gold (ASX:BGL) and Genesis Minerals (ASX:GMD) up about 2%.

Investors have been flocking to gold as a safe bet amid ongoing tensions in the Middle East and worries about the upcoming US presidential election.

Still in the large caps space, WiseTech Global (ASX:WTC) is dragging down tech stocks, down 1.25% following a 15% drop over the last five sessions amid revelations about founder Richard White’s personal life.

Mineral Resources (ASX:MIN) shares keep tumbling, down another 3% today as ASIC investigates allegations against CEO Chris Ellison regarding a decade-long tax evasion scheme.

QBE Insurance (ASX:QBE) dropped as it faces civil penalty proceedings initiated by the ASIC related to pricing inconsistencies in policies issued between July 2017 and September 2022.

Domain Holdings Australia (ASX:DHG) dropped 3% after announcing CEO Jason Pellegrino will step down after six years, with a leadership transition process set to begin. Pellegrino will remain in the role for three to six months to support the succession.

And, 29Metals (ASX:29M) plunged 21% after reporting a significant drop in cash reserves. Also, copper production at its Golden Grove fell significantly to 4.4kt, while C1 costs surged to US$2.52 per pound, compared to US$1.14 previously.

Across the region, Asian shares were mostly flat with declines in Japan and slight gains in South Korea.

Oil prices dipped slightly this afternoon due to rising crude inventories, and gold fell modestly after reaching a record high.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AAU | Antilles Gold Ltd | 0.005 | 50% | 93,387,247 | $5,567,228 |

| IVX | Invion Ltd | 0.003 | 50% | 2,969,017 | $13,533,183 |

| SI6 | SI6 Metals Limited | 0.002 | 50% | 1,002,028 | $2,368,859 |

| PLG | Pearlgullironlimited | 0.018 | 38% | 747,380 | $2,659,043 |

| NNL | Nordicnickellimited | 0.130 | 37% | 320,516 | $13,865,774 |

| ERA | Energy Resources | 0.004 | 33% | 25,131,992 | $66,444,898 |

| BDG | Black Dragon Gold | 0.033 | 27% | 2,715,596 | $6,955,460 |

| VMC | Venus Metals Cor Ltd | 0.063 | 26% | 27,666 | $9,806,434 |

| FME | Future Metals NL | 0.025 | 25% | 3,251,151 | $11,500,810 |

| AMD | Arrow Minerals | 0.003 | 25% | 32,353,378 | $26,047,256 |

| AVE | Avecho Biotech Ltd | 0.003 | 25% | 2,099,999 | $6,338,594 |

| GTR | Gti Energy Ltd | 0.005 | 25% | 600,000 | $11,841,799 |

| SLZ | Sultan Resources Ltd | 0.011 | 22% | 5,944,132 | $1,778,278 |

| SMX | Strata Minerals | 0.033 | 22% | 487,848 | $5,152,010 |

| LRV | Larvottoresources | 0.600 | 21% | 8,194,768 | $157,441,986 |

| WC1 | Westcobarmetals | 0.023 | 21% | 205,942 | $2,897,506 |

| POL | Polymetals Resources | 0.555 | 21% | 985,103 | $89,589,906 |

| NVA | Nova Minerals Ltd | 0.240 | 20% | 1,779,060 | $54,387,376 |

| PRM | Prominence Energy | 0.006 | 20% | 85,000 | $1,945,882 |

| FXG | Felix Gold Limited | 0.098 | 20% | 973,881 | $26,949,777 |

| EMS | Eastern Metals | 0.025 | 19% | 23,766,574 | $2,387,201 |

| AKG | Academies Aus Grp | 0.135 | 17% | 64,876 | $15,250,664 |

| JBY | James Bay Minerals | 0.575 | 17% | 544,034 | $16,386,825 |

Eastern Metals (ASX:EMS) was up on news that reconnaissance drilling completed at two new targets, Kelpie Hill and Windmill Dam, and at the advanced Evergreen prospect within the 100%-owned Cobar Project in NSW. Initial assays have come back with results such as 7m @ 4.3g/t Au, 2.7g/t Ag, 0.3% Pb from 50m and 1m @ 4.17g/t Au, 2.7g/t Ag from 82m, with the second and third holes returning 3.05m @ 3.9% Zn, 2% Pb, 29.5g/t Ag from 298.5 and 0.5m @ 7.2% Zn, 2.4% Pb from 299m.

Energy Resources of Australia (ASX:ERA) was up after letters went out to shareholders about the previously announced, Rio-backed pro-rata renounceable entitlement offer of new ERA ordinary shares to raise up to approximately $880 million.

Arrow Minerals (ASX:AMD) has taken a significant step forward in developing its projects by signing a Memorandum of Understanding (MoU) with Baosteel for potential sales of iron ore from its Simandou North Iron Project. This partnership will allow Arrow to access key infrastructure, including the Simandou port and rail.

The company has also started the next phase of metallurgical testwork to analyze different iron ore samples. These results will help outline the processing methods and estimate costs for building and operating a processing plant. Arrow’s project is located next to Baosteel’s large iron ore development, which further supports its growth potential.

Adisyn (ASX:AI1) was up on news that it has entered into formal negotiations to acquire 100% of semiconductor IP business 2D Generation, with the goal of leveraging 2D Generation’s “innovative semiconductor solution” to generate opportunities in AI1’s target markets including defence applications, data centres and cybersecurity.

Resource Base (ASX:RBX) was up on the heels of a quarterly this morning, which outlined the company’s recent work in Canada’s James Bay, where completion of the 2024 summer field program following up anomalous targets at the Wali Project resulted in multiple lithium and gold anomalies, with a peak lithium value of 20ppm and peak gold value of 436ppb with associated pathfinder elements.

Nordic Nickel (ASX:NNL) has reported excellent metallurgical results from its Hotinvaara nickel-cobalt deposit in Finland. A composite sample produced a clean concentrate of 18.4% nickel and 0.66% cobalt, with a nickel recovery of 62% using a straightforward grinding and flotation process. This indicates that the lower-grade nickel sulphides at Hotinvaara can be processed effectively to create a high-grade concentrate. The current resource estimate at Hotinvaara is 418 million tonnes at 0.21% nickel and 0.01% cobalt. The deposit has significant potential for growth, NNL said, as it covers just a small part of a much larger mineralised area.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ADA | Adacel Technologies | 0.305 | -35% | 1,061,526 | $35,872,745 |

| DTR | Dateline Resources | 0.004 | -33% | 48,276,791 | $15,097,563 |

| MTB | Mount Burgess Mining | 0.001 | -33% | 498 | $1,947,220 |

| WML | Woomera Mining Ltd | 0.002 | -33% | 4 | $6,165,223 |

| KKO | Kinetiko Energy Ltd | 0.066 | -33% | 1,841,818 | $140,388,440 |

| PLY | Playside Studios | 0.510 | -29% | 7,562,757 | $292,593,827 |

| RNE | Renu Energy Ltd | 0.002 | -25% | 14,821,570 | $1,690,490 |

| IRX | Inhalerx Limited | 0.026 | -24% | 1,075,342 | $6,569,201 |

| 29M | 29Metalslimited | 0.445 | -21% | 6,332,973 | $396,671,824 |

| AKN | Auking Mining Ltd | 0.004 | -20% | 275 | $1,835,323 |

| LPD | Lepidico Ltd | 0.002 | -20% | 105,166 | $21,472,812 |

| OKJ | Oakajee Corp Ltd | 0.008 | -20% | 300,000 | $914,460 |

| TMK | TMK Energy Limited | 0.002 | -20% | 700,545 | $18,979,030 |

| BRU | Buru Energy | 0.049 | -20% | 6,805,716 | $47,234,067 |

| CR9 | Corellares | 0.009 | -18% | 379,493 | $5,116,017 |

| HTG | Harvest Tech Grp Ltd | 0.014 | -18% | 248,834 | $13,884,625 |

| A11 | Atlantic Lithium | 0.265 | -17% | 314,337 | $207,894,097 |

| AZI | Altamin Limited | 0.030 | -17% | 296,618 | $15,798,565 |

| NVU | Nanoveu Limited | 0.055 | -17% | 19,812,522 | $33,324,898 |

| LTP | Ltr Pharma Limited | 1.300 | -16% | 2,412,353 | $131,423,028 |

| ARI | Arika Resources | 0.033 | -15% | 23,383,768 | $24,124,796 |

IN CASE YOU MISSED IT

Arika Resources’ (ASX:ARI) maiden drilling program at the Pennyweight Point prospect has returned a top assay of 14m at 15.48g/t gold from 46m, confirming an extensive zone of shallow, oxide/supergene mineralisation above high-grade primary mineralisation.

An oversubscribed $8m placement supported by existing major shareholder Denala and new significant shareholder Ziwan Trading has ensured that Belararox (ASX:BRX) is fully funded for drilling of the Tambo South and Malambo targets at its TMT copper project in Argentina.

Hillgrove Resources (ASX:HGO) has secured a $10m debt facility with Freepoint Metals and Concentrates to provide financial flexibility as it delivered improvements to all operational metrics at its Kanmanto copper mine.

Zeotech (ASX:ZEO) has secured a Japanese patent for impurity-free zeolite processing technology, expanding the emerging mineral processing technology company’s commercial opportunity in the Japanese molecular sieve market.

AdAlta (ASX:1AD) has appointed Kevin Lynch as the consultant chief medical officer (CMO) for AdCella while a yet unnamed consultant CMO with more than 30 years’ experience in respiratory and orphan drug development has been appointed to AdSolis. Earlier this month, the company formed a clinical advisory board and appointed an additional adviser to advance its lead asset AD-214, which is domiciled under AdSolis. 1AD said the collective expertise and global reach of the healthcare professionals on the CAB would be crucial in guiding AD-214’s Phase 2 clinical trial preparations and ensuring its success.

Astral Resources (ASX:AAR) has reported a significant gold intercept at Kamperman, revealing 3 metres at 177g/t Au from drill hole FRC378.

The first 20 holes of a 31-hole drilling program have shown promising results, including 12 metres at 7.26g/t Au and 25 metres at 24.3g/t Au. Encouraging findings have prompted plans for diamond drilling to further explore the high-grade zone. Meanwhile, drilling at Mandilla is assessing dewatering needs for the Pre-Feasibility Study, with infill drilling ongoing at the Iris and Eos Deposits and an updated Mineral Resources Estimate expected in March 2025.

Brazilian Critical Minerals (ASX:BCM) has announced key logistics milestones for its Ema Rare Earths Project in Brazil. The company reports that “substantial progress” has been made in its efforts to deliver the final product of Mixed Rare Earth Carbonate to ports in Brazil.

BCM notes that inspections and discussions have confirmed the suitability of the Port of Prainha, 130kms by road from the Ema Project, then barging to the Port of Chibatão, with capacity to handle Panamax sized vessels. Alternative routes to port have also been identified. A Scoping Study is meanwhile on course for final report in mid-December.

Medical data and technology company HeraMED (ASX:HMD) has announced it has received firm commitments for a two-tranche private placement of $3.1m to sophisticated and professional investors. HMD, which is focused on digital transformation of maternity care, said placement proceeds would support commercial deployments, pilots and integration of HeraCARE into large health systems, private clinics and various platforms in the US, Australia, and Europe.

Prodigy Gold (ASX:PRX) has received firm bids for the remaining shortfall from its recent Entitlement Offer to raise a further ~$1,677,532 (before expenses) at the issue price of $0.002 per share.

This will bring the total capital raised under the Rights Issue to about $2,106,894 (again, before expenses). This comes on the back of the goldie junior delivering some exceptional gold results from drilling at its Hyperion deposit, part of the Tanami North project in the NT. A headline strike of 10m @ 15.9g/t gold ought to build excitement ahead of a planned resource upgrade.

Suvo Strategic Minerals (ASX:SUV), an Australian hydrous kaolin producer and exploration company, has received firm commitments for $2 million (before costs) under an oversubscribed placement at $0.048 per share.

Cornerstone investment (15% of total placement) comes from PERMAcast, which is Western Australia’s leading supplier of precast and prestressed concrete products. SUV notes that funds will support the development and commercialisation of the company’s low carbon cement (green cement) intellectual property.

White Cliff Minerals (ASX:WCN) says it has acquired additional licence area on the northern, adjacent boundary of its Rae Copper-Silver Project in Nunavut, Northern Canada, where the company says preliminary geophysical results have confirmed prospectivity for district scale sediment-hosted copper potential.

The acquisition grows White Cliff’s licence area by 20% to 1,198 km2, with the licence now covering more than 72km strike length of the prospective Rae Group Sediments, and with recent fundraising completed, the company is now fully funded for Q1 2025 drilling at Rae after it receives results from its recent airborne MobileMT geophysics campaign.

TRADING HALTS

Podium Minerals (ASX:POD) – pending the release of an announcement regarding a proposed capital raising.

Pure Hydrogen Corporation (ASX:PH2) – pending the disclosure of counter parties for transactions disclosed in a different announcement.

Poseidon Nickel (ASX:POS) – pending an announcement regarding a potential change of control transaction.

Horizon Minerals (ASX:HRZ) – pending an announcement in relation to a proposed material acquisition.

Javelin Minerals (ASX:JAV) – pending an announcement on the acquisition of a material asset and a capital raising.

At Stockhead we tell it like it is. While Adalta, Arika Resources, Astral Resources, Belararox, Brazilian Critical Minerals, HeraMED, Hillgrove Resources, Prodigy Gold, Suvo Strategic Minerals, White Cliff Minerals and Zeotech are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.