Closing Bell: We have a wonderful new record on the ASX200

Via Getty

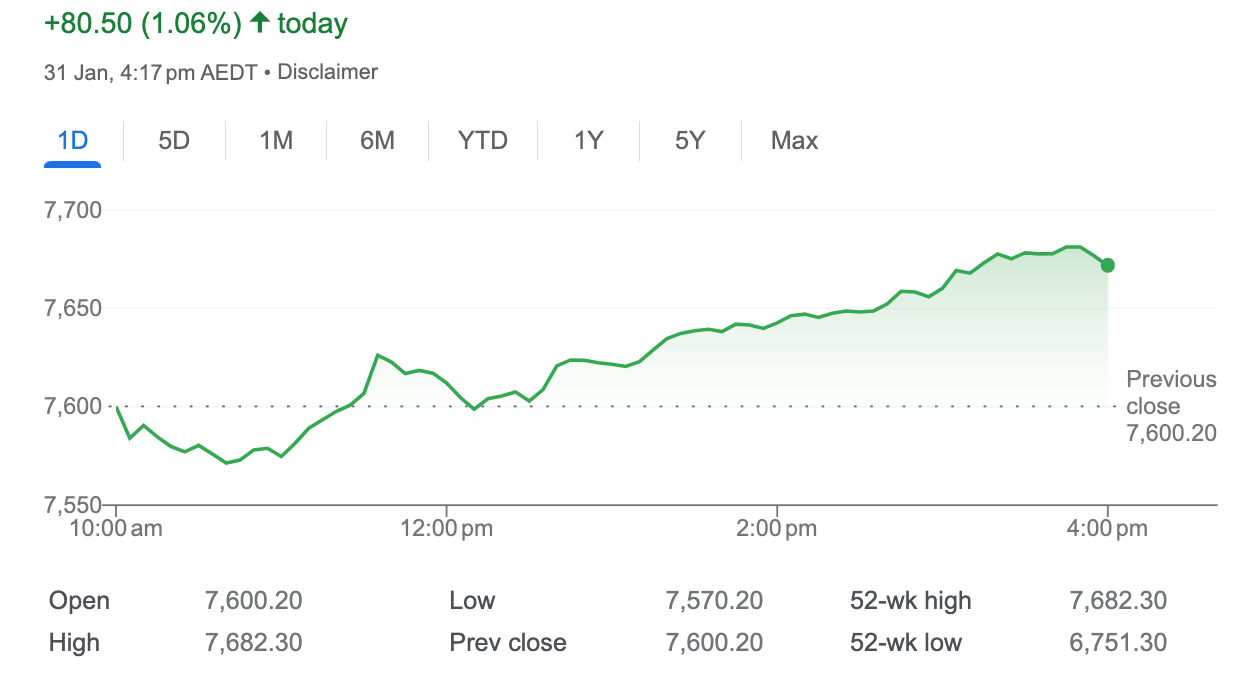

- ASX gains 1pc, ends at new record high

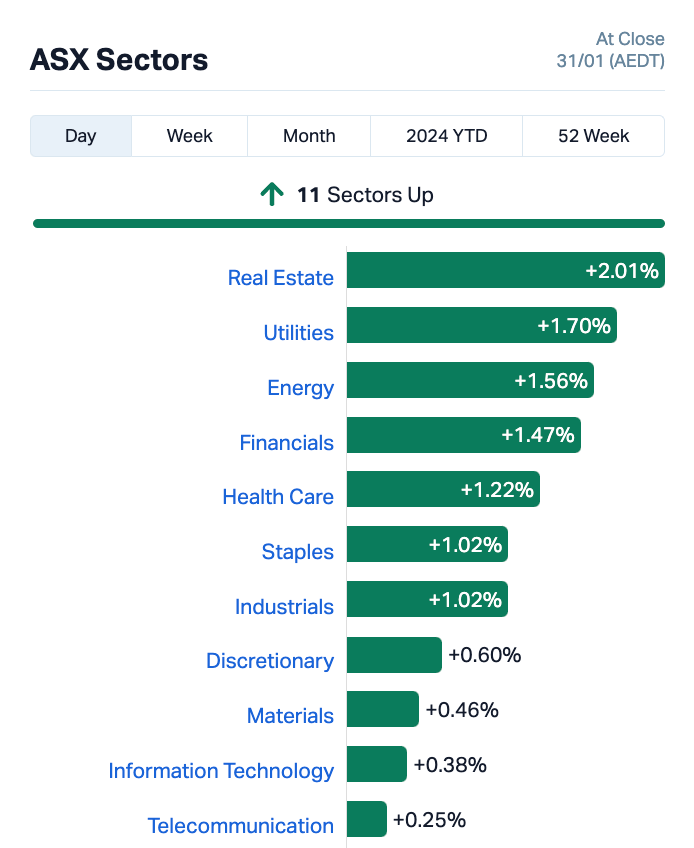

- All sectors in the green

- Mako Gold leads out the small caps

Local markets have risen on Wednesday with some aplomb. It’s the eighth straight daily gain for the Aussie stock market with a new record to take home.

At 4.15pm on 31 Jan, the S&P/ASX200 was ahead 88.50 points or 1.06% to a new record high of 7,680.70.

By lunchtime in Sydney, the benchmark hit a new all-time high of 7682.30 points after the CPI data dropped, before ending at a record close.

Over the past four weeks, the XJO has gained about 0.1%, and in the last year, it’s up 1.5%.

All 11 sectors were higher.

The McAussie consumer price index rose 4.1% year-on-year in the fourth quarter, slower than the 5.4% recorded last time and coming in under the 4.3% forecast.

The bureau of stats’ monthly CPI read also eased off to 3.4% in December from 4.3% in November, missing market expectations of 3.7%.

The Reserve Bank of Australia is widely expected to hold rates steady at next week’s first meet of 2024, with local markets pricing in a 70% chance of a rate cut in June and are fully priced in for a cutty-cut move in August.

HSBC chief economist Paul Bloxham says the CPI will make the RBA comfy with an economy “moving in the right direction”.

“Today’s numbers also provided even more evidence that further rate hikes are not on the cards – consistent with the view we have held for some time now.

“However, rate cuts may still be quite some time away.”

In the States…

Overnight, the Dow rose 0.35% to clock a new record high, while the S&P 500 and Nasdaq Composite lost 0.06% and 0.76%, respectively.

Microsoft beat Wall Street estimates for Q2 revenue on Tuesday, as new AI features helped attract customers to its cloud and Windows services.

Meanwhile, Microsoft shares were little changed even as the firm reported better-than-expected earnings and revenue. Microsoft beat Wall Street estimates for Q2 revenue on Tuesday, as new AI features helped attract customers to its cloud and Windows services.

In after market action, Google-daddy Alphabet’s Q4 revenue best expectations on Tuesday, as advertising spending rose and demand for cloud services grew from companies attracted by its artificial intelligence tools. Alphabet tumbled 5.5% as the Google-parent’s ad revenue came in short of analysts’ expectations. AMD also plunged 6% after issuing a weak revenue forecast for the current quarter.

Revenue for the quarter stood at US$86.31 billion, stealing past estimates of $85.33bn.

Shares in Supermicro (SMCI) – one of the best-performing US stocks over the last 12 months – have spiked overnight, being a less headline yet quiet beneficiary of the AI boom.

SMCI makes high-density servers and storage equipment and its training AI models excel at fast response times and handling large volumes of data.

Supermicro said revenue jumped 103% in the quarter to $3.66 billion, well ahead of analyst consensus at $3.06 billion and beating original guidance of US$2.7 to $2.9 billion.

We’re watching Elon..

The Tesla CEO Elon Musk’s US$56bn remuneration package just got binned by a judge in Delaware, prompting Elon to go the full Donald on Delaware – ‘Never incorporate your company in the state of Delaware’ – he X’d in anger.

Tesla’s agreement with Musk is by far the largest compensation ever provided to an executive and is a major factor in making him one of the world’s wealthiest individuals. It allows Musk to buy Tesla stock at heavily discounted prices as escalating financial and operational goals are met – though it requires him to hold the acquired stock for five years.

Musk qualified for all 12 tranches, or performance targets, in the compensation plan and wasn’t guaranteed any salary.

The multi-hatted CEO billionaire also says the first human to get his company Neuralink’s cybernetic implant is recovering well from going cyborg.

After an open recruitment for the first-in-human clinical trial of its wireless brain-computer interface (BCI), Neuralink says the Precise Robotically Implanted Brain-Computer Interface (PRIME) study would evaluate the safety of the company’s implant (N1) and surgical robot (R1), while assessing whether the device can help paralysed people control external devices with their thoughts. Which I can already do, BTW.

On Sunday, the first implant was placed in a human.

“The first human received an implant from @Neuralink yesterday and is recovering well,” Musk X’d the other day. “Initial results show promising neuron spike detection.”

US Futures were mixed in Sydney at 4pm on Tuesday.

Meanwhile in China…

Equities in Hong Kong have been dashed for a second session with all sectors were lower at 3pm in Sydney.

Needless to say, sentiment is all but spent after the January official manufacturing PMIs in China dropped. Okay. They’re less bad, but still bad – and still in contraction anyway.

That’s now 4 straight month of contraction in factory activity, with new orders, foreign sales, and employment all falling.

Concerns over the lack of stupendous shaped stimulus out of Beijing suggests to traders of the state’s reluctance to just get in there and boost confidence and capital markets with a hefty kick of fiscal spending .

Meantime, worries about the property blackhole across China remain front of mind – who knows how the liquidation of property giant China Evergrande Group will play out. I do not.

Around the hood…

Asian-Pacific markets were mostly lower in the arvo on Wednesday – everyone has their own key economic data to swallow – while also keeping an eye on the US Federal Reserve tonight.

The Nikkei 225 Index dropped 0.8% to below 35,800 on Wednesday, snapping a two-day advance, as Japanese tech tracked their US peers lower, under pressure amid one or two unsettling quarterly reports out of Mega tech land in the US.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| VPR | Volt Power Group | 0.002 | 100% | 1,756,583 | $10,716,208 |

| CT1 | Constellation Tech | 0.003 | 50% | 544,110 | $2,949,467 |

| RBR | RBR Group Ltd | 0.003 | 50% | 334 | $3,236,809 |

| CTN | Catalina Resources | 0.004 | 33% | 1,374,626 | $3,715,461 |

| CYQ | Cycliq Group Ltd | 0.004 | 33% | 500,478 | $1,072,550 |

| AUA | Audeara | 0.037 | 32% | 218,928 | $4,049,016 |

| DEL | Delorean Corporation | 0.039 | 30% | 2,077,308 | $6,471,627 |

| IR1 | Irismetals | 0.7 | 27% | 258,091 | $71,216,740 |

| OAU | Ora Gold Limited | 0.0075 | 25% | 11,527,505 | $34,146,005 |

| COV | Cleo Diagnostics | 0.175 | 25% | 361,880 | $10,374,000 |

| AOA | Ausmon Resorces | 0.0025 | 25% | 500,000 | $2,117,999 |

| ATV | Activeportgroupltd | 0.082 | 24% | 383,165 | $20,931,760 |

| GTE | Great Western Exp. | 0.031 | 24% | 677,631 | $8,700,265 |

| PLY | Playside Studios | 0.74 | 23% | 2,740,694 | $244,822,747 |

| LML | Lincoln Minerals | 0.006 | 20% | 3,081,857 | $8,520,226 |

| MTL | Mantle Minerals Ltd | 0.003 | 20% | 3,077,945 | $15,493,615 |

| NVQ | Noviqtech Limited | 0.003 | 20% | 151,250 | $3,273,613 |

| OAR | OAR Resources Ltd | 0.003 | 20% | 3,166,666 | $6,609,319 |

| AQN | Aquirianlimited | 0.215 | 19% | 76,619 | $14,521,315 |

| AUG | Augustus Minerals | 0.07 | 19% | 510,890 | $4,963,080 |

| MKG | Mako Gold | 0.013 | 18% | 18,182,916 | $7,286,503 |

| SHV | Select Harvests | 3.75 | 18% | 815,270 | $384,966,552 |

| CXU | Cauldron Energy Ltd | 0.041 | 17% | 7,093,144 | $40,366,275 |

| MHC | Manhattan Corp Ltd | 0.0035 | 17% | 308,651 | $8,810,939 |

| MTB | Mount Burgess Mining | 0.0035 | 17% | 50,000 | $3,134,440 |

The Small Caps winners list today had Mako Gold (ASX:MKG) at the top of the ladder, after posting an activities report and balance sheets to the market today that investors decided was all really good news.

The short version is that things are progressing well for the company, particularly at its flagship Napié Gold Project in Côte d’Ivoire, where low-cost exploration work is continuing.

Meanwhile, the company has progressed its due diligence ahead of a proposed accretive transaction with Goldridge, that would see Mako consolidate its holdings and create a district scale gold play in the area.

There were, as always it seems, a couple of small caps making big moves for mysterious reasons – and today, that included both Iris Metals (ASX:IR1) (+22.7%) and Cleo Diagnostics (ASX:COV) (+21.4%), and neither of them having fresh news to pin it on.

Delorean (ASX:DEL) made headway this morning after the company handed in its report card for the quarter, with news that its focus on project delivery is enabling it to “return to growth and profitability” – plus, it’s got close to $5 million smackers in the bank, and investors like that kind of thing a lot.

And last but not least, game makers PlaySide Studios (ASX:PLY) has reported record quarterly revenue of $20.7 million, a 106% jump on PCP, and well ahead of the prior quarterly total of $15.5 million.

The company also reported a record Original IP revenue of $11.1 million, +245% against the same period last year, and a 41% jump to another record, this time in Work for Hire revenue totalling $9.6 million.

Investors were mashing their controllers as fast as their crusty old thumbs could manage, and Playside was up 20% before lunch.

ActivePort Group (ASX:ATV) rose on the back of a solid quarterly, which reported the company had managed to boost revenue from operations by 7% to $3.73 million from Q1, and is boasting positive operating cashflow up $1.30 million, after the company accepted its R&D refund for FY23, taking net cash and equivalents up in the quarter from $1.66 million at the end of Q1 to $2.58 million at the end of Q2.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.002 | -33% | 18,697,169 | $14,817,722 |

| RR1 | Reach Resources Ltd | 0.002 | -33% | 2,651,538 | $9,630,891 |

| CUF | Cufe Ltd | 0.016 | -27% | 7,087,329 | $25,214,472 |

| ATH | Alterity Therap Ltd | 0.0045 | -25% | 14,850,432 | $22,867,957 |

| SOV | Sovereign Cloud Hldg | 0.05 | -24% | 589,468 | $22,400,444 |

| ENV | Enova Mining Limited | 0.016 | -24% | 21,754,827 | $13,459,516 |

| MCL | Mighty Craft Ltd | 0.014 | -22% | 1,926,300 | $6,572,379 |

| BMO | Bastion Minerals | 0.012 | -20% | 4,630,287 | $4,671,661 |

| A8G | Australasian Metals | 0.1 | -20% | 26,088 | $6,515,062 |

| TAS | Tasman Resources Ltd | 0.004 | -20% | 20,069 | $3,563,346 |

| MRC | Mineral Commodities | 0.021 | -19% | 677,061 | $25,596,288 |

| 29M | 29Metalslimited | 0.3425 | -18% | 9,943,304 | $294,552,439 |

| YAR | Yari Minerals Ltd | 0.009 | -18% | 914,684 | $5,305,936 |

| GLN | Galan Lithium Ltd | 0.445 | -18% | 2,967,081 | $190,875,031 |

| PAR | Paradigm Bio. | 0.31 | -17% | 4,008,098 | $131,470,941 |

| CI1 | Credit Intelligence | 0.1 | -17% | 166,183 | $10,565,425 |

| ASR | Asra Minerals Ltd | 0.005 | -17% | 6,397,517 | $9,818,974 |

| AYT | Austin Metals Ltd | 0.005 | -17% | 19,800 | $7,711,148 |

| CHK | Cohiba Min Ltd | 0.0025 | -17% | 1,593,001 | $7,590,691 |

| KNM | Kneomedia Limited | 0.0025 | -17% | 1,099,253 | $4,599,814 |

| PUR | Pursuit Minerals | 0.005 | -17% | 7,039,993 | $17,663,828 |

| TIG | Tigers Realm Coal | 0.005 | -17% | 215,000 | $78,400,214 |

| IPD | Impedimed Limited | 0.11 | -15% | 4,552,103 | $263,030,030 |

| BXN | Bioxyne Ltd | 0.011 | -15% | 776,649 | $24,721,390 |

| DCL | Domacom Limited | 0.011 | -15% | 333,000 | $5,661,523 |

In Case You Missed It

Spartan Resources has dug deep – really deep – to confirm that mineralisation at its Never Never deposit maintains good widths and grades at depth, reporting its deepest assay to date: 16.65m @ 10.29g/t gold from a downhole depth of 625.83m, driving further belief that the once-mothballed Dalgaranga Project is actually a viable concern.

Galan Lithium plans to undertake a non-underwritten share purchase plan offer of $1.5m to existing shareholders for ongoing development costs and resource work, supplementing the recently completed $18 million raise for Phase 1 construction activities at the Hombre Muerto West lithium brine project in Argentina.

Latin Resources has made a third major spodumene discovery along the highly prospective Salinas lithium corridor in Brazil, boosting the already fabulous Salinas project beyond its most recent upgrade which saw Latin’s resource grow by 56% in early December last year.

Meanwhile, Haranga Resources keeps on improving its inventory of uranium anomalies at the Saraya project in Senegal, as the company keeps going with its unusual exploration method that involves sampling termite mounds to find evidence of yellowcake or other minerals carried to the surface by the critters.

Remaining assay results from Phase 3 drilling at Prospect Resources’ (ASX:PSC) Step Aside lithium project in Zimbabwe have extended the depth and strike continuity of mineralisation at the WinBin discovery, adding weight to the theory that Step Aside could be within the same mineralised system as the 72.7Mt Arcadia project, which it sold to Huayou Cobalt in mid-2022 for about US$422m in cash.

TRADING HALTS

Imricor Medical Systems (ASX:IMR) – pending an announcement in relation to a proposed capital raising.

Conrad Asia Energy (ASX:CRD) – pending an announcement to the market in relation to a capital raising.

Vertex Minerals (ASX:VTX) – pending release of an announcement by the Company in relation to a proposed capital raising.

Singular Health Group (ASX:SHG) – pending an announcement in respect of a material purchase order received.

Centrex Metals (ASX:CXM) – ending the release of an announcement regarding a capital raising.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.