Closing Bell: Up, up… share price is up for Coles, but ASX slumps on earnings reports

Hold onto your grocery bags, the ASX took a beating on full-year reports but managed a late recovery on Coles' results. Pic: Getty Images

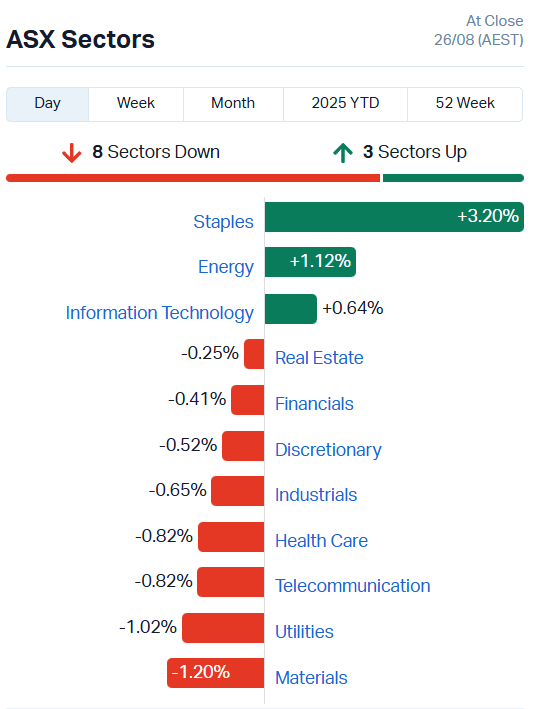

- ASX slides 0.41pc as full year results disappoint

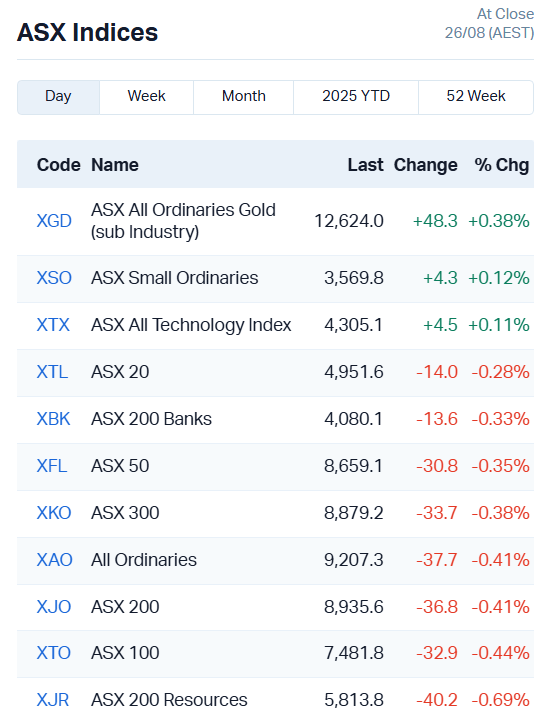

- Gold, Small Ords, Tech index enjoy late interest-rate-related rally

- Consumer staples and Coles soften blow

Coles results plus late gold rally soothes market

The ASX spent the vast majority of the day firmly in the red, trading 0.41% lower on some – let’s be honest – rubbish earnings reports.

Fortescue, Tyro Payments, Web Travel, G8 Education and Viva Energy gave the market bears a good hard poke with their disappointing results, pushing us into a bit of a slump.

Lucky for us, growing consensus the US Fed will cut rates in September has given gold a tidy kick late in the day, with futures rising about 0.17% to US$3423 an ounce.

While that doesn’t sound like much – a measly 6 US bucks an ounce increase – it’s reversed the fortunes of our gold index for the day, swinging out of the negative and up 0.38%.

Small Caps, ever exposed to the price of finance, also enjoyed a little 0.12% lift in the final hour of trade, joined by the All Tech, up 0.11%.

Our other hero of the day is Coles (ASX:COL), which pumped up 8.5% to $22.5 a share by end of trade on some solid yearly results.

The supermarket giant – second only to Woolworths in Australia – reported $44.5b in full-year sales, with supermarket sales up 4.3% to $40b.

COL just barely missed net profit expectations, topping out at $1.08 billion vs forecasts of $1.11 billion, but managed a tasty 24.4% surge of growth in its ecommerce offering.

The grocery giant is also teeing up for a solid beginning to FY26, with sales revenue hiking 4.9% in the first eight weeks of the new financial year to outpace analyst assumptions.

Coles’ success gave the rest of the consumer staples sector a nice little nudge, with Woolworths (ASX:WOW) adding 2.8% and A2 Milk (ASX:A2M) 2.4%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| T3D | 333D Limited | 0.05 | 233% | 6948065 | $2,832,807 |

| GML | Gateway Mining | 0.045 | 61% | 31752199 | $11,446,968 |

| ENT | Enterprise Metals | 0.008 | 60% | 13750389 | $6,856,586 |

| AIV | Activex Limited | 0.02 | 54% | 881271 | $2,801,534 |

| EEL | Enrg Elements Ltd | 0.0015 | 50% | 700000 | $3,253,779 |

| QXR | Qx Resources Limited | 0.006 | 50% | 12663630 | $5,241,315 |

| RLC | Reedy Lagoon Corp. | 0.003 | 50% | 19181 | $1,553,413 |

| SRN | Surefire Rescs NL | 0.0015 | 50% | 1808180 | $3,906,859 |

| AQI | Alicanto Min Ltd | 0.038 | 36% | 1944872 | $23,748,003 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 1063604 | $7,254,899 |

| NPM | Newpeak Metals | 0.018 | 29% | 766676 | $4,608,007 |

| AHK | Ark Mines Limited | 0.455 | 28% | 3399562 | $23,487,048 |

| VML | Vital Metals Limited | 0.165 | 27% | 557200 | $15,326,905 |

| ERA | Energy Resources | 0.0025 | 25% | 714289 | $810,792,482 |

| FIN | FIN Resources Ltd | 0.005 | 25% | 950000 | $2,779,554 |

| WEL | Winchester Energy | 0.0025 | 25% | 100 | $2,726,038 |

| BCM | Brazilian Critical | 0.023 | 21% | 21358644 | $29,696,213 |

| FL1 | First Lithium Ltd | 0.12 | 20% | 484190 | $7,965,360 |

| CYQ | Cycliq Group Ltd | 0.006 | 20% | 1047 | $2,302,583 |

| WHK | Whitehawk Limited | 0.012 | 20% | 5379830 | $8,769,850 |

| S66 | Star Combo | 0.195 | 18% | 153592 | $22,288,692 |

| KLS | Kelsian Group Ltd | 4.76 | 18% | 2946769 | $1,094,317,702 |

| PAT | Patriot Resourcesltd | 0.04 | 18% | 175682 | $5,610,763 |

| MPP | Metro Perf.Glass Ltd | 0.041 | 17% | 22974 | $6,488,233 |

| NXL | Nuix Limited | 2.41 | 17% | 2993356 | $689,393,807 |

In the news…

Digital asset management play 333D (ASX:T3D) has planted its flag in the Bitcoin space, adopting a BTC treasury strategy.

The company intends to channel all excess cash into Bitcoin as a strategic reserve asset, with the first step already taken. T3D converted A$370,500 to 2.018 BTC.

The pivot aligns 333D with a growing number of global companies that see Bitcoin not as speculation, but as a long-term store of value. Very few ASX-listed companies have adopted a formal Bitcoin treasury strategy. Over in the States, though, it’s so far worked spectacularly well for Michael Saylor’s Microstrategy software company.

Gold explorer Gateway Mining (ASX:GML) has unearthed a new shear gold zone at the Yandal gold project in WA, with gravity and aeromagnetic surveys sketching out a massive 90-kilometre-long strike.

GML reckons this shear zone is a major secondary splay associated with the primary 75km Celia Shear Zone, with virtually zero exploration work completed on it to date.

Gateway has already got boots on the ground to take a closer look, kicking off rock chip sampling, soil sampling, lag sampling and mapping programs to vector-in on any economical gold systems that might sit along the shear.

QX Resources (ASX:QXR) is looking to get its hands on full ownership rights to the Madaba uranium project in Tanzania, a premier uranium region, in return for $800k in cash.

The project already holds a resource estimate of 125Mlbs at 300 parts per million uranium. QX reckons there’s over a dozen more targets to drill test on the tenure. Historical results have graded up to 1.2% uranium.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RGL | Riversgold | 0.003 | -40% | 10518745 | $8,418,563 |

| KLR | Kaili Resources Ltd | 0.54 | -34% | 6831230 | $120,868,298 |

| M2R | Miramar | 0.002 | -33% | 7002532 | $3,029,566 |

| RDS | Redstone Resources | 0.004 | -33% | 12812289 | $6,205,604 |

| AOA | Ausmon Resorces | 0.003 | -25% | 5100957 | $5,244,854 |

| MEM | Memphasys Ltd | 0.003 | -25% | 1498225 | $7,934,392 |

| LEG | Legend Mining | 0.007 | -22% | 4625144 | $26,230,295 |

| CVB | Curvebeam Ai Limited | 0.14 | -20% | 387459 | $69,194,383 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 31681431 | $11,584,182 |

| CAV | Carnavale Resources | 0.004 | -20% | 1010400 | $20,451,092 |

| DTM | Dart Mining NL | 0.002 | -20% | 300000 | $2,995,139 |

| FBR | FBR Ltd | 0.004 | -20% | 27499637 | $29,581,288 |

| IMI | Infinitymining | 0.008 | -20% | 726035 | $4,230,158 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 14873 | $16,854,657 |

| TKL | Traka Resources | 0.002 | -20% | 10920300 | $6,055,348 |

| TRM | Truscott Mining Corp | 0.042 | -19% | 213935 | $10,175,805 |

| BLG | Bluglass Limited | 0.012 | -17% | 4676419 | $37,358,175 |

| GBE | Globe Metals &Mining | 0.06 | -17% | 53906 | $50,015,017 |

| PFT | Pure Foods Tas Ltd | 0.025 | -17% | 9466 | $4,212,769 |

| 8IH | 8I Holdings Ltd | 0.01 | -17% | 29269 | $4,177,930 |

| JAV | Javelin Minerals Ltd | 0.0025 | -17% | 4553048 | $18,756,675 |

| XGL | Xamble Group Limited | 0.02 | -17% | 1670342 | $8,136,342 |

| ATV | Activeportgroupltd | 0.016 | -16% | 9311896 | $13,052,565 |

| LU7 | Lithium Universe Ltd | 0.011 | -15% | 19817244 | $18,667,735 |

| AHL | Adrad Hldings | 0.7 | -15% | 31238 | $66,668,553 |

In Case You Missed It

Mammoth Minerals (ASX:M79) has kickstarted a second phase of field exploration aimed at guiding the design of drilling at its Blue Dick mine, part of its broader Excelsior gold-silver project in Nevada.

Bayan Mining and Minerals (ASX:BMM) has appointed a former US official as its newest strategic adviser to help progress the Desert Star rare earths projects in the United States.

Zenith Minerals (ASX:ZNC) has received the all clear to begin a large-scale second phase drill campaign over the Forrestania Greenstone Belt.

Ausgold (ASX:AUC) is garnering local support for its +100,000ozpa Katanning gold project, opening the door to improve the already attractive project further.

Victory Metals (ASX:VTM) has secured $11.5m in an institutional placement to support targeted drilling of heavy rare earth zones at the North Stanmore project in WA.

A partnership with Washington DC-based GreenMet has offered Locksley Resources (ASX:LKY) an opportunity to position the Mojave project within key US government critical mineral initiatives.

EMVision Medical Devices’ (ASX:EMV) final site activation in a pivotal validation trial for its first commercial device – the emu brain scanner for stroke diagnosis – is due in early September.

Western Gold Resources (ASX:WGR) is about to kick-off 35,300m of grade control and infill drilling ahead of production at the Gold Duke project in WA.

Peregrine Gold (ASX:PGD) has expanded the Tin Can gold prospect’s strike to 850m with aircore drilling at the Newman project.

Caprice Resources (ASX:CRS) has started an aeromagnetic survey as the first step in its search for mineral riches at the West Arunta project.

Ballard Mining (ASX:BM1) has returned up to 4m at 32g/t gold in infill drilling at Mt Ida as well as 14m at 11.3g/t in resource extension drilling.

Omega Oil and Gas’ (ASX:OMA) Canyon Sandstone reservoir in the Taroom Trough has been found to compare favourably to the highly productive Eagle Ford in the US.

Anson Resources (ASX:ASN) has initiated a test work program designed to determine flow rate and upgrade the resource at the Green River lithium project.

Rhythm Biosciences (ASX:RHY) has completed the final validation of ColoSTAT and submitted data to authorities to add the blood test for colon cancer to its laboratory accreditation.

Ora Banda Mining’s (ASX:OBM) has delivered a 575% increase in FY2025 net profit to $186.1 million on the back of high gold prices and the quality of its underground operations.

Trading Halts

archTIS (ASX:AR9) – acquisition & cap raise

Cyprium Metals (ASX:CYM) – cap raise

Gladiator Resources (ASX:GLA) – cap raise

Godolphin Resources (ASX:GRL) – cap raise

Hartshead Resources (ASX:HHR) – well-carry deal

Invictus Energy (ASX:IVZ) – cap raise

Lachlan Star (ASX:LSA) – cap raise

PolarX (ASX:PXX) – earn-in transaction

Terra Metals (ASX:TM1) – cap raise

Vulcan Steel (ASX:VSL) – cap raise

At Stockhead, we tell it like it is. While 333D is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.