Closing Bell: Torque Metals DOMINATES Tuesday

Dominant. Via Getty

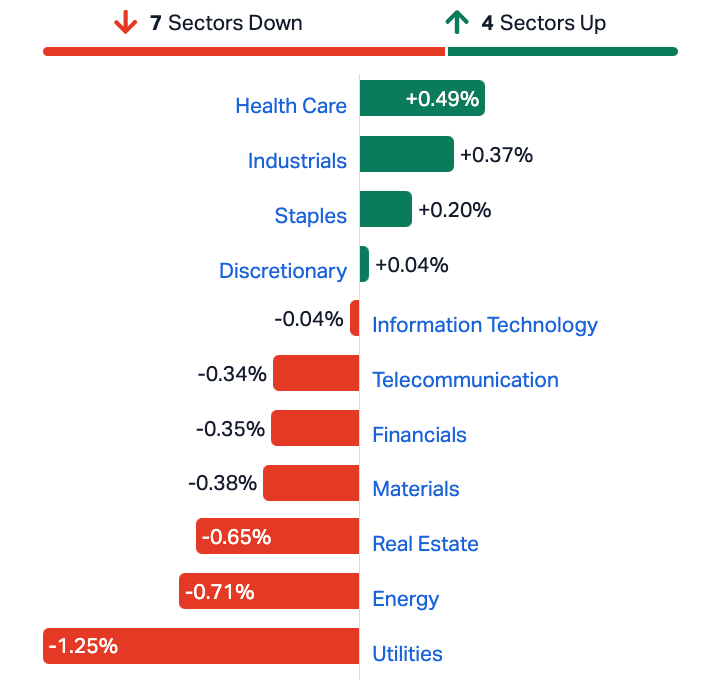

- ASX 200 closes -0.25% lower after RBA holds rates at 4.10%

- Only Consumer Staples, Healthcare and Industrial Sectors find some green

- Small caps dominated by Torque Metals

Aussie home owners have been given another month of grace time from the outgoing Reserve Bank Governor Dr P. Lowe in his final act as top dog, leaving interest rate rises on pause for a third month this arvo as the pace of economic growth eases after the previous 12 rate raises.

And just quickly (this will make more sense after you finish):

Torque: a force that tends to cause rotation

Metals: a solid material which is typically hard, shiny, malleable, fusible, and ductile, with good electrical and thermal conductivity

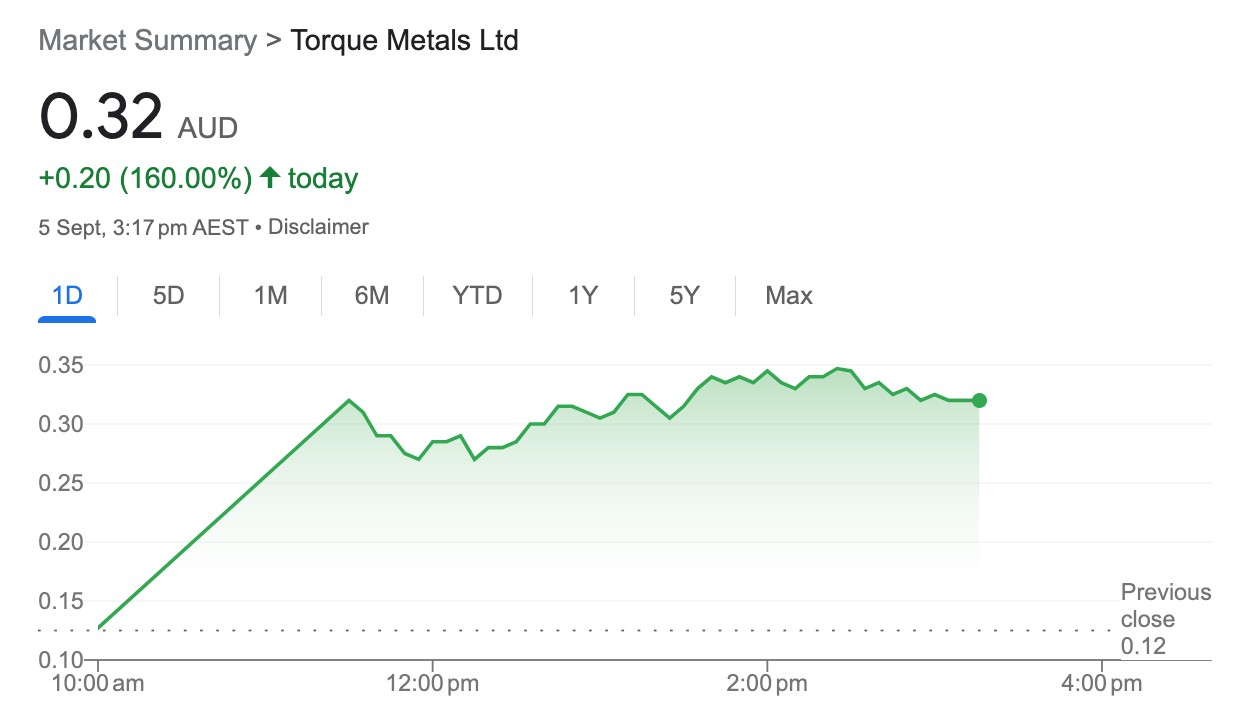

Torque Metals (ASX:TOR)

The Aussie benchmark ended 0.25% lower at the closing bell. It was low from the go. Lower at lunch. Still lower (dammit) after the 2.30pm rates decision, with those resources blue chips weighing.

People seemed a little dull. There was no gilt edge to trade before (low volumes) or after (low self-esteem?).

All sectors were down and pretty out, but for the ASX glamour sectors – the Consumer Staples (supermarkets), Healthcare (X-ray machines) and Industrials (industrial stuff).

Tuesday’s ASX sectors:

The ASX Small Ordinaries Index (XSO) ended -0.8% lower, and the ASX Emerging Companies Index (XEC) lost -0.9%.

This arvo, Qantas chair Richard Goyder said no way to the idea of following Alan Joyce to an early freedom by stepping down at the embattled national carrier.

Mr Goyder told The Australian he for one was important in the chairman’s role especially while Alan Joyce and his $24mn vacate the cabin for new CEO, Vanessa Hudson, who starts tomoz.

Asked if he would leave the airline, Mr Goyder said:

“No, I am fully committed. I will get to work on these things and we’ll do what we need to do. And I think my role in that is pretty important.”

Qantas shares rose at the open, as news of Joycey’s early departure (never had one of those on his watch, ta-da) after 15 years in the captain’s chair.

The stock is finding form, however, as its wonderful/horror month eases into the background. Qantas reported stunning profits, which were swiftly followed by allegations of improper government influence, anti-competitive practices and an attack from the ACCC for apparently flogging tickets for cancelled flights.

Meanwhile, Chalice Mining (ASX:CHN) , has just continued its Tom Petty impersonation on Tuesday.

That’s a miner getting minor as we watch. Culled of more than more 32% last week, short of another 15% today.

CHN disappointed on earnings, today Jeffries downgraded CHN to “underperform.” That might’ve been a bit triggering.

Finally, a stack of stocks have gone ex-divvy. That usually sees the share price take a dive.

Dividends, as you may know, are usually announced to the market a good 5-6 weeks before the ex-divvy date. To receive your divvy, shares in the company must be purchased before the ex-dividend date.

Just don’t want to get your hopes up.

The local bourse lacked direction overnight from EU markets with Wall Street closed over the American Labor Day long weekend.

European trading volumes were whacked, plunging out of perhaps sheer tedium to below their 30-day average. They missed that by almost a full third, according to Bloomers.

RIPPED FROM THE HEADLINES

Yes, EU markets lack inspiration. But we do need to talk about the Danish drugmaker Novo Nordisk.

These chaps make this diet drug Ozempic.

Apparently it’s a big hit, but people still seem pretty heavy to me, so… Anyway, Novo which ate LVMH recently to become Europe’s most valuable company, rose to a new, new record high. People seemed pretty nonplussed. I guess it does that every time it goes higher now though, so…

Anyhoo. Mercedes Benz Group added whole one per cent, after a massively earth-shattering unveiling of a beautiful, ground-breaking new, longer-range electric vehicle. 1%. That’s not much.

China’s Caixin August services PMI just dropped and it is not a good one, and they’ve only been bad lately.

The last manufacturing PMI read was ok. I liked it a lot.

But those good feelings are not going to last while the services sector looks so depressing.

The Caixin China services purchasing managers index fell away again, this time to 51.8 in August, down from 54.1 in July. That’s the worst read in eight months and the other seven haven’t made for joyous inspection.

Finally, shares in Hong Kong went off the happy cliff by 1.7%, swinging madly from a 2.5% jump in the prior session and leaving 3 week highs well behind.

Now with the Caixin PMI scuttling hopes of a sudden economic recovery, Beijing’s slew of measures to save consumers from themselves and a crappy property sector looks weak as water again, pushing investors to move away from riskier assets.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| TOR | Torque Met | 0.325 | 160% | 16,986,721 | $12,042,130 |

| SXG | Southern Cross Gold | 0.77 | 54% | 10,491,539 | $45,027,812 |

| CHK | Cohiba Min Ltd | 0.003 | 50% | 24,348,400 | $4,426,488 |

| RMX | Red Mount Min Ltd | 0.004 | 33% | 764,487 | $7,573,053 |

| VAL | Valor Resources Ltd | 0.004 | 33% | 250,000 | $11,485,004 |

| AHN | Athena Resources | 0.009 | 29% | 1,284,163 | $7,493,273 |

| BCT | Bluechiip Limited | 0.032 | 28% | 1,847,426 | $17,841,762 |

| MRI | Myrewardsinternation | 0.014 | 27% | 1,855,682 | $4,579,829 |

| KNG | Kingsland Minerals | 0.235 | 27% | 2,123,587 | $8,273,163 |

| 88E | 88 Energy Ltd | 0.0075 | 25% | 44,810,169 | $123,965,631 |

| NTM | Nt Minerals Limited | 0.01 | 25% | 175,000 | $6,405,591 |

| LEL | Lithenergy | 0.675 | 24% | 449,617 | $56,140,450 |

| EME | Energy Metals Ltd | 0.16 | 23% | 49,758 | $27,258,831 |

| MLG | Mlgozltd | 0.58 | 21% | 108,514 | $70,461,198 |

| KZR | Kalamazoo Resources | 0.12 | 20% | 276,926 | $16,805,314 |

| SIX | Sprintex Ltd | 0.025 | 19% | 500,000 | $6,483,638 |

| AMM | Armada Metals | 0.026 | 18% | 67,924 | $1,508,497 |

| IMB | Intelligent Monitor | 0.235 | 18% | 50,036 | $48,289,571 |

| WSR | Westar Resources | 0.027 | 17% | 4,402,987 | $4,263,223 |

| IXR | Ionic Rare Earths | 0.021 | 17% | 36,482,144 | $71,029,889 |

| EEL | Enrg Elements Ltd | 0.007 | 17% | 722,932 | $6,059,790 |

| NES | Nelson Resources. | 0.007 | 17% | 1,303,848 | $3,681,566 |

| SER | Strategic Energy | 0.014 | 17% | 3,672,663 | $5,805,782 |

| EMP | Emperor Energy Ltd | 0.015 | 15% | 520,501 | $3,495,212 |

| LSR | Lodestar Minerals | 0.008 | 14% | 1,848,625 | $13,008,781 |

Aptly-named Tuesday Pirate Torque Metals (ASX:TOR) says the deal it’s inked to acquire a collection of gold, nickel and lithium-rich tenements — will be renamed Penzance.

The site is near its Paris gold camp in the Tier-1 Goldfields mining jurisdiction of WA.

This includes New Dawn, an untapped lithium and tantalum occurrence on granted mining leases, 600m along strike of the established Bald Hill lithium-tantalum operation.

The news has lots to get investors excited, but these two reasons help explain the price action:

- The New Dawn lithium project occupies two pre-Native Title, granted Mining Licences, which enable potential discoveries to be pushed quickly into development.

- And early investigations at New Dawn have identified multiple outcropping spodumene-bearing pegmatites with rock samples grading up to 6% Li2O

A Program of Work has now also been approved for due diligence drill holes at New Dawn to test spodumene values and diamond drilling is set to kick off this month.

Torque’s managing director, Cristian Moreno:

“The WA Goldfields reigns supreme on the global stage for minerals exploration and Torque is ecstatic to strengthen its presence in this renowned jurisdiction.Our footprint now spans over 500km², bolstered by 12 mining, 4 prospecting and 12 exploration licences.

“In the wake of remarkable and solid gold discoveries at the Paris gold systems, Torque is strategically expanding its presence in the region, whilst also venturing into the critical minerals domain with the acquisition of New Dawn pre-Native Title mining licenses adjacent to the Bald Hill which hosts a 26.5 Mt @ 1% Li2O spodumene mine.”

The legend who is my lunchtime, Robert Badman noted earlier today of some fast-moving stock prices over at Kingsland Minerals (ASX:KNG).

The Aussie gold hunter wants more – uranium, base metals and non-metals – and Rob says it’s honed in on the latter with a big hit at its Leliyn Graphite Project in the NT.

The explorer has also announced intersections of scale and grade significance this morning, hitting total graphitic carbon at Leliyn with a “bonanza” intersection of 206m at 10% graphite, which it says “confirms Leliyn’s world-class potential”.

Rob, speaking a little to himself and a little to us, (the readers):

‘You know what industry graphitic carbon plays perfectly into, right? It’s an important material used in lithium batteries, specifically for the negative electrode in the lithium cells.’

Now we know.

“Holes LEDD_04 and LEDD_05 were drilled at the north-western extremity of the current drilling area and show that these massive widths and grades are open along strike to the north,” reports Kingsland.

Mineralisation has been outlined over a 5km strike length and remains open along strike and at depth, and the strike sits with a 20km-long graphitic schist host rock, which the company says highlights the scope for huge upside beyond the initial 5km identified strike.

Also on the winners list is gold explorer Southern Cross Gold (ASX:SXG) which announced the best hole drilled to date at its 100%-owned Sunday Creek project in Victoria including a wide and high grade intersection of gold-antimony mineralisation.

SXG says SDDSC077B drilled at the Rising Sun Prospect intersected 404.4m @ 5.6g/t AuEq (5.1g/t Au, 0.3 %Sb) from 374.0m (uncut), and traverses 13 individual high grade vein sets.

Furthermore, seven intervals have>100g/t Au (up to 2,670g/t Au), 20 intervals have >15g/t Au and 20 intervals have >5% Sb (up to 55.8% Sb).

Yes, you read that right – up to 2,670g/t.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MEB | Medibio Limited | 0.001 | -50% | 900,000 | $12,201,488 |

| MOB | Mobilicom Ltd | 0.006 | -45% | 10,605,336 | $14,593,444 |

| AVW | Avira Resources Ltd | 0.001 | -33% | 1 | $3,200,685 |

| OM1 | Omnia Metals Group | 0.095 | -27% | 3,292,326 | $5,924,220 |

| KEY | KEY Petroleum | 0.0015 | -25% | 2,472,222 | $3,935,856 |

| TZL | TZ Limited | 0.015 | -25% | 199,934 | $5,135,162 |

| TIE | Tietto Minerals | 0.37 | -20% | 20,172,124 | $505,700,283 |

| ICN | Icon Energy Limited | 0.004 | -20% | 639,713 | $3,840,068 |

| MXC | Mgc Pharmaceuticals | 0.002 | -20% | 429,702 | $10,637,420 |

| MOM | Moab Minerals Ltd | 0.009 | -18% | 537,035 | $7,501,598 |

| BSN | Basinenergylimited | 0.1 | -17% | 326,082 | $7,203,600 |

| RNO | Rhinomed Ltd | 0.06 | -17% | 37,321 | $20,571,818 |

| AMD | Arrow Minerals | 0.0025 | -17% | 330,905 | $9,071,295 |

| CCO | The Calmer Co Int | 0.005 | -17% | 2,031,667 | $4,902,716 |

| CYQ | Cycliq Group Ltd | 0.005 | -17% | 2,512,351 | $2,145,100 |

| PUA | Peak Minerals Ltd | 0.0025 | -17% | 1,400,669 | $3,124,130 |

| BPH | BPH Energy Ltd | 0.021 | -16% | 9,012,951 | $23,255,887 |

| MBK | Metal Bank Ltd | 0.038 | -16% | 747,986 | $12,441,848 |

| JAY | Jayride Group | 0.11 | -15% | 39,728 | $26,472,914 |

| ID8 | Identitii Limited | 0.011 | -15% | 4,967,470 | $2,766,380 |

| TGH | Terragen | 0.022 | -15% | 10,000 | $6,306,008 |

| 4DS | 4Ds Memory Limited | 0.1325 | -15% | 45,082,535 | $262,181,378 |

| KOR | Korab Resources | 0.018 | -14% | 82,667 | $7,708,050 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 2,450,237 | $15,135,146 |

| ME1 | Melodiol Glb Health | 0.006 | -14% | 30,123,476 | $20,256,243 |

TRADING HALTS

Prominence Energy (ASX:PRM) – capital raising

TG Metals (ASX:TG6) – pending the release of an announcement regarding aircore drilling assay results for the Lake Johnston nickel, lithium and gold project in WA

Live Verdure (ASX:LV1) – capital raising

Buxton Resources (ASX:BUX) – pending an announcement of results from the second diamond drillhole at its Copper Wolf Project

Encounter Resources (ASX:ENR) – pending the release of an announcement regarding material exploration results from diamond drilling at its Aileron Project in the West Arunta.

Bathurst Resources (ASX:BRL) – Pending an announcement regarding a project acquisition

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.