Closing Bell: Thursday and the ASX200 is flat and porous. I am unhappy… But at least Bega made a lot of cheese

Via Getty

- Local markets end flat like an old can of coke on the coffee table

- Sectors are mixed up. I’m mixed up after all that

- Small Caps led by Way2VAT again, as well as some cracking local medtechs

It is 4pm on Thursday February 22, and the S&P/ASX200 is perfectly flat.

There is, of course, nothing perfect about being flat, especially after a day of mixed up earnings, weirdly incohrent leads and generally confused and volatile trade.

Here it is again. 4pm in Sydney. match out in 15 mins, but let’s stick with this:

Flat and unwilling is my take.

As discussed at lunchtime – the connection between what excites Wall Street (Nvidia) and anything for sale down here is tenuous at best.

Tony Sycamore, analyst at IG markets says the contrast right now between the ASX200 and its large concentration of dowdy yet “reliable” financial and resource stocks, and the new world of AI and tech stocks has been laid bare.

“The local bourse mostly sidelined in trading, despite AI chip maker Nvidia’s lights-out earnings report, which will likely provide the basis for the next chapter of the AI frenzy that has driven Wall Street to new highs in 2024.

“Nvidia’s share price initially fell over 3% after the report before rebounding to be trading over 9% higher at $735.94 in after-hours trading,” Tony says.

Unfortunately, as the Man from IG observed earlier, there was to be no Lazarus-like rebound for many of the ASX-listed blue chips which dropped earnings nunbers today.

Tabcorp (down -16%) after EBITDA fell 14% to $170mn.

Reject Shop (down 14%) after net profit fell 11% to $14.5mn.

Super Retail Group, (down 5.7%).

Qantas (down 2.35)% to $5.46 as its underlying profit fell 12.8% to $1,245 million on rising customer costs and as airfares continue to normalise. Mining heavyweight Rio Tinto fell -0.95% to $124.60 despite reporting a full-year profit of $US10.1B and a larger dividend than expected.

Now that ugliness is behind us, you’ll be wanting to know where the cheese is on the ASX on Thursday.

Bega has lots of it.

Up 14% after an extra tasty 1H earnings beat.

In 1H FY2024 Bega’s EBITDA (earnings before interest, tax, depreciation and amortisation ) of $86.1mn was a 20% improvement on the previous !h.

Branded segment was the standout – EBITDA up a satanic $66.6 million or 153%. The Group also maintained solid FY24 guidance too, which looks achievable at $160-170mn.

Also in the surprisingly cheesy corner, funkster fashion retailer Universal Store, where the shares are as upbeat as the fashion brands – which in this case is about 16% after delivering a first half beat on analyst expectations.

Net profit surprised at $20.7mn over 1H, up 16.7% beating market estimates despite the “difficult and subdued consumer spending environment”.

Like-for-like sales in the first few months of the year are up over 10% for its Perfect Stranger business.

Elsewhere, happy days for Twiggy Forrest and family, after they banked a massive payout on Fortescue (ASX:FMG), 41% profit boost.

The $85 billion iron ore giant – which briefly hit an all time high share price of nearly $30 at the end of January – has parked an extra US$3.337bn in the kitty on the back of surging iron ore prices and smaller discounts for its low grade product.

Josh reports that the 1H divvy payout was up 44% with investors looking forward to the circa $3.3 billion pay day.

Across the wider bourse, losses across Property and Consumer Discretionary weighed heavily, while the big banks were a total drag.

Both the small ords and the emerging companies indi ces were higher.

ASX Sectors on Thursday

On Wall Street…

Overnight, the benchmark US S&P 500 and the Dow Industrial added 0.1 3%.

Softness across the technology sector weighed on the Nasdaq, which ended 0.33% in the bad books.

We’vwe gone over Nvidia, but how about that Palo Alto Networks?

What a loser of a network security company (about 29%) on weak forecasts.

US Futures at 4pm in Sydney…

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| IEC | Intra Energy Corp | 0.003 | 50% | 5,145,714 | $3,381,563 |

| TRI | Trivarx Ltd | 0.031 | 41% | 5,079,485 | $7,442,131 |

| MSI | Multistack International | 0.007 | 40% | 160,611 | $681,520 |

| SRZ | Stellar Resources | 0.009 | 29% | 3,706,595 | $8,043,185 |

| EE1 | Earths Energy Ltd | 0.019 | 27% | 15,356,821 | $7,949,463 |

| BRN | Brainchip Ltd | 0.43 | 26% | 42,513,174 | $613,976,993 |

| PAA | PharmAust Limited | 0.3 | 25% | 3,216,435 | $92,756,771 |

| ADG | Adelong Gold Limited | 0.005 | 25% | 1,896,302 | $2,798,623 |

| CCO | The Calmer Co Int | 0.005 | 25% | 1,563,328 | $4,302,342 |

| CTN | Catalina Resources | 0.005 | 25% | 536,088 | $4,953,948 |

| PUR | Pursuit Minerals | 0.005 | 25% | 301,743 | $11,775,886 |

| RMX | Red Mount Min Ltd | 0.0025 | 25% | 3,962,000 | $5,347,152 |

| WML | Woomera Mining Ltd | 0.005 | 25% | 1,298,114 | $4,872,556 |

| IIQ | Inoviq Ltd | 0.82 | 24% | 847,739 | $60,732,343 |

| LBT | LBT Innovations | 0.016 | 23% | 5,821,607 | $16,390,609 |

| FBR | FBR Ltd | 0.027 | 23% | 11,417,948 | $97,708,599 |

| 4DS | 4Ds Memory Limited | 0.12 | 22% | 24,688,955 | $172,757,822 |

| RKT | Rocketdna Ltd. | 0.011 | 22% | 31,473,908 | $5,905,034 |

| OEC | Orbital Corp Limited | 0.105 | 22% | 671,424 | $12,539,379 |

| FOS | FOS Capital Ltd | 0.23 | 21% | 137,690 | $10,223,166 |

| MAG | Magmatic Resrce Ltd | 0.03 | 20% | 178,288 | $7,642,320 |

| 88E | 88 Energy Ltd | 0.006 | 20% | 118,431,568 | $123,627,103 |

| DOU | Douugh Limited | 0.006 | 20% | 326,941 | $5,410,345 |

| FFF | Forbidden Foods | 0.012 | 20% | 114,129 | $2,018,605 |

It’s medtech talk here on the small end of the ASX on Thursday. First up we have a strong surge for PharmAust (ASX:PAA) which says it has engaged “globally renowned experts” in MND/ALS and rare neurodegenerative diseases to form a scientific advisory board (SAB) for the next stage of development of monepantel (MPL).

Monepantel is PAA’s lead candidate for the treatment of Motor Neurone Disease (MND) / Amyotrophic Lateral Sclerosis (ALS) and pipeline expansion activities in additional neurodegenerative diseases.

Still doing well is the other local medtech LBT Innovations (ASX:LBT) with the microbiology lab services and tech provider delivered its first homemade environmental monitoring tech ( an APAS Independence instrument with APAS PharmaQC software) to a Thermo Fisher facility.

It’s the maiden recognised sale of the technology, according to CEO & managing director Brent Barnes, who says the delivery is six months ahead of schedule and LBT is primed to cash in on “the positive market interest” from pharmaceutical customers following initial market development activities completed 2H23.

Barnes says LBT has now established a “pipeline of potential early adopters” who’ve shown interest in the LBT tech which aims “to provide efficiencies and improve traceability within environmental monitoring workflows.”

The stock has jumped.

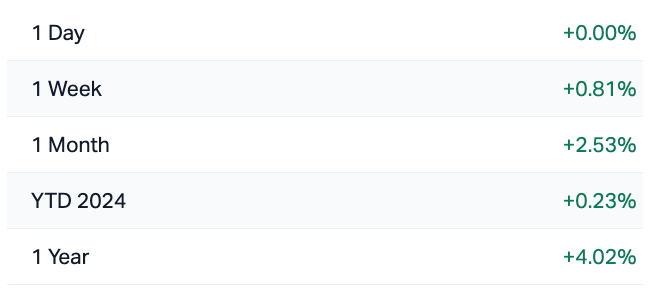

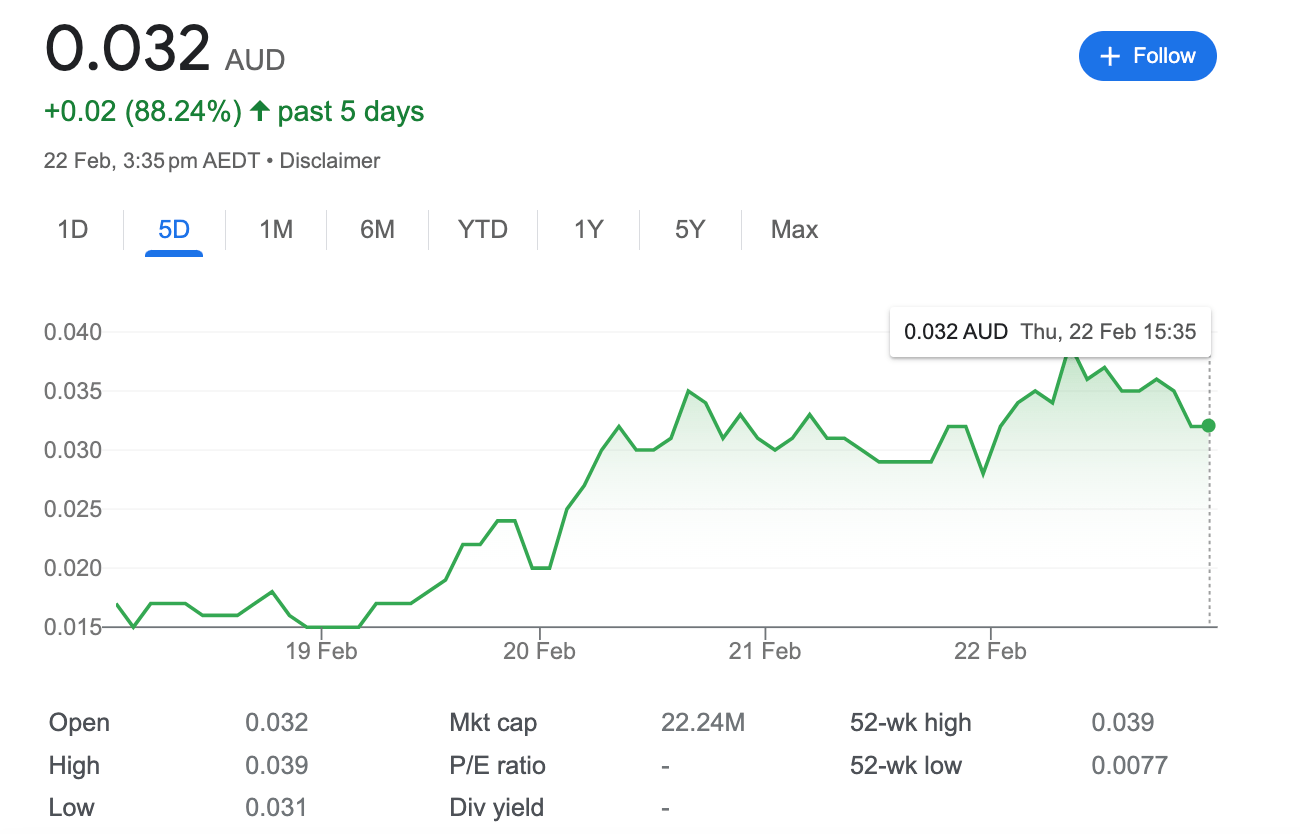

Meanwhile, Way2VAT (ASX:W2V), is still sticking it to the man.

It’s up double digits again.

That’s made for a good five days on the bourse:

The riches began pouring in after last Friday’s launch of a new AI-driven automatic auditing system.

Other early movers with news out include 88 Energy (ASX:88E) which says its 20% working interest has been successfully transferred to the company as part of stage one of a three-stage farm-in deal for its Namibian petroleum exploration licence.*

As well as Insignia Financial (ASX:IFL) which dropped a 1H statutory (NPAT) loss of $49.9mn, which IFL says is down to strategic initiatives and remediation costs. But shareholders who came for the earnings, stayed for the upgraded outlook.

The wealth manager says in its ASX announcement that FY24 group net revenue margin is expected to be between 45.5-46 bps (previously 44.8-45.8 bps) while EBITA margin has increased as well, while in-year transformation costs and benefits remain on track.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AOA | Ausmon Resorces | 0.002 | -33% | 696,242.00 | $3,176,998 |

| GES | Genesis Resources | 0.004 | -33% | 164,207.00 | $4,697,048 |

| SYA | Sayona Mining Ltd | 0.046 | -28% | 367,922,628.00 | $658,770,945 |

| EXL | Elixinol Wellness | 0.006 | -25% | 3,661,613.00 | $5,062,973 |

| E33 | East 33 Limited | 0.018 | -22% | 289,600.00 | $12,353,040 |

| ICU | Investor Centre Ltd | 0.022 | -21% | 2,147,121.00 | $8,489,545 |

| MAF | MA Financial Group | 4.47 | -20% | 5,295,602.00 | $1,002,224,778 |

| LVE | Love Group Global | 0.1 | -20% | 41,666.00 | $5,066,771 |

| KGD | Kula Gold Limited | 0.008 | -20% | 1,909,730.00 | $4,232,119 |

| NES | Nelson Resources | 0.004 | -20% | 1,000,000.00 | $3,067,972 |

| SIT | Site Group Int Ltd | 0.002 | -20% | 186,525.00 | $6,506,226 |

| TMK | TMK Energy Limited | 0.004 | -20% | 443,787.00 | $30,612,897 |

| IXU | Ixup Limited | 0.028 | -18% | 71,904.00 | $36,976,210 |

| ADD | Adavale Resource Ltd | 0.005 | -17% | 11,661,500.00 | $6,067,033 |

| ASR | Asra Minerals Ltd | 0.005 | -17% | 640,409.00 | $9,918,974 |

| AYT | Austin Metals Ltd | 0.005 | -17% | 288,500.00 | $7,711,148 |

| BNL | Blue Star Helium Ltd | 0.01 | -17% | 7,818,142.00 | $23,307,183 |

| TML | Timah Resources Ltd | 0.042 | -16% | 2,917.00 | $4,437,988 |

| HPC | The Hydration Company | 0.016 | -16% | 371,956.00 | $5,037,694 |

| TRS | The Reject Shop | 4.54 | -16% | 106,476.00 | $206,489,333 |

| MTC | Metalstech Ltd | 0.165 | -15% | 1,014,184.00 | $36,846,145 |

| OCT | Octava Minerals | 0.05 | -15% | 185,000.00 | $2,643,938 |

| SRT | Strata Investment | 0.145 | -15% | 49,229.00 | $28,802,008 |

| AVE | Avecho Biotech Ltd | 0.003 | -14% | 862,645.00 | $11,092,540 |

| MIO | Macarthur Minerals | 0.12 | -14% | 18,712.00 | $23,275,488 |

TRADING HALTS

Hillgrove Resources (ASX:HGO) – pending the announcement by Hillgrove of the outcome of a proposed capital raising.

Lifestyle Communities (ASX:LIC) – pending an announcement in connection with a fully underwritten pro rata accelerated non-renounceable entitlement offer.

Alterity Therapeutics (ASX:ATH) – pending an announcement in relation to a capital raise.

Australian Mines (ASX:AUZ) – pending the release of an announcement concerning a capital raising.

Inoviq (ASX:IIQ) – pending an announcement in relation to the results of its Breast Cancer Monitoring Study.

Island Pharmaceuticals (ASX:ILA) – pending an announcement to ASX regarding a capital raising.

Western Yilgarn (ASX:WYX) – pending an announcement in connection with a proposed capital raising.

Siren Gold (ASX:SNG) – pending an announcement in connection with a proposed capital raising.

Minbos Resources (ASX:MNB) – pending the release of an announcement in relation to a capital raising.

HeraMED (ASX:HMD) – pending an announcement to the market regarding a material new contract.

FirstWave Cloud Tech (ASX:FCT) – pending an announcement of a proposed material financing transaction that is under the final stages of review.

ICYMI – PM Edition

Battery metal and uranium-focused Summit Minerals (ASX:SUM) has added another exploration licence to expand its Stallion uranium project tenure – increasing the total area from 196km2 to 361km2 in the highly prospective Ponton Creek uranium district, east of Kalgoorlie

PharmAust (ASX:PAA) has engaged globally renowned experts in MND/ALS and rare neurodegenerative diseases to form a scientific advisory board (SAB) for the next stage of development of monepantel, its lead candidate for the treatment of Motor Neurone Disease.

ECS Botanics (ASX:ECS) the Aussie medicinal cannabis cultivator and manufacturer, has secured a new $9.3 million offtake agreement to supply medicinal cannabis dried flower over three years to Rokshaw. The contract is another significant milestone, involving a new international customer and the second customer based in the United Kingdom. Rokshaw are part of New York headquartered and Canadian listed Curaleaf International, the biggest cannabis company in the world.

Laboratory analysis has proven that lithium is indeed present within the large outcropping pegmatites which played a key role in Uvre’s (ASX:UVA) move to secure the South Pass project in Wyoming, which hasn’t had any historical exploration done to date.

Belararox (ASX:BRX) has announced that its Environmental Impact Assessment for the TMT Project’s Malambo Target has been approved, permitting advanced exploration activities, including surface sampling and mapping exploration, to commence at the TMT Project’s Toro Camp.

Classic Minerals (ASX:CLZ) has scored a coup after signing a deal with AuResources for US$60 million ($91.8 million) in funding via a forward sales facility to progress development of its gold projects.

QEM’s (ASX:QEM) quest to become a major vanadium supplier has received a significant boost after it successfully produced high-purity vanadium from an industrial waste stream in Australia, following a successful recycling study carried out on its behalf by The University of Queensland (UQ).

Geochemical sampling at the Boomerang prospect, part of Kula Gold’s (ASX:KGD) new Marvel Loch project, which is nestled between several known major gold mines – including north of the historical +600,000oz Nevoria mine and east of Minjar Gold’s 3Moz Marvel Loch mine.

High-grade results up to 1.75% Li2O have been returned in eight diamond holes on First Lithium’s (ASX:FL1) Faraba licence, which is fast becoming a primary prospect at the Gouna project in Mali.

Green Technology Metals (ASX:GT1) has released a business update, revealing that the company is zeroed in on work to become the first lithium concentrates and chemicals business in Ontario, with Drilling activities scheduled to commence in the second half of 2024 at its Syemour lithium project.

Anson Resources (ASX:ASN) has started drilling aimed at defining a maiden resources at its potentially extensive Green River lithium brine project in Utah’s Paradox Basin, where the company says it’s chasing an exploration target of between 2Bt and 2.6Bt of brines grading 100ppm to 150ppm lithium and 2,000ppm to 3,000ppm bromine.

Miramar Resources (ASX:M2R) been super busy digging about in its massive 100%-owned Bangemall Project in the prospective Gascoyne region of WA, where geophysical contractors completed a reconnaissance moving loop electromagnetic (MLEM) survey over the 3km historic late-time SkyTEM anomaly at the recently granted Trouble Bore Target.

Stellar Resources (ASX:SRZ) has received firm commitments to raise $3,200,000 via a Placement including the participation of a cornerstone investor Nero Resource Fund who has participated to the amount of approximately $2.4 million.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.