Closing Bell: Tech drags; but goldie Evolution hits 12-month high and Nyrada jumps 36pc

Gold prices near record highs with Evolution Mining rising. Picture via Getty Images

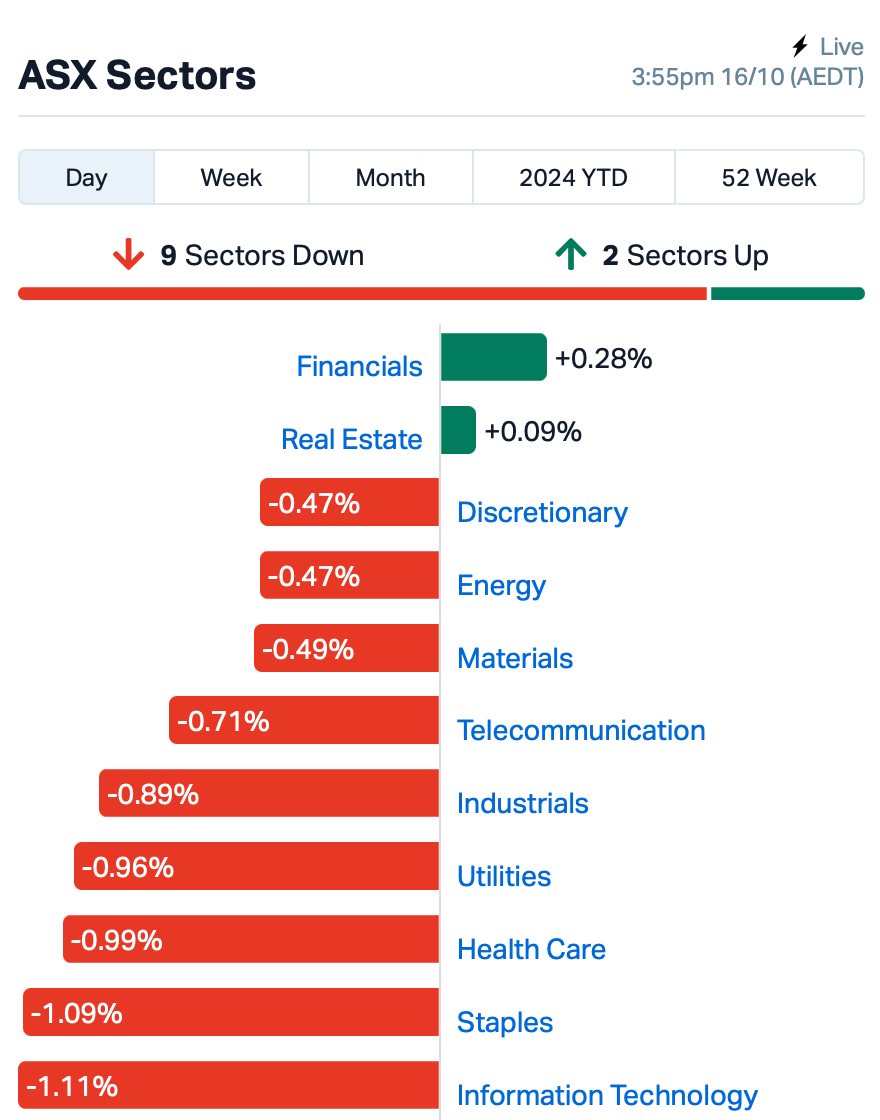

- ASX falls as tech sector drops on Euro chipmaker ASML’s report

- Gold prices near record highs with Evolution Mining rising

- Trump defends tariffs and Fed influence in recent interview

The ASX fell 0.41%, led by declines in the Tech sector following a surprising report from Dutch chipmaker ASML overnight that raised global concerns about the AI boom.

In its release, ASML warned of a slower recovery in the semiconductor market and cut its guidance for next year, and its CEO pointed out that customers outside the AI sector are being cautious, adding that the company also anticipates its sales to China will decline from nearly 50% of its revenue to around 20% next year.

The Energy sector also had losses after oil prices fell by 4% overnight. Beach Energy (ASX:BPT) and Santos (ASX:STO) dropped by over 2%.

However, Woodside Energy Group (ASX:WDS) rose by 1% after the company upgraded its full-year production forecasts.

Elsewhere, the uranium sector struggled, while coal miners New Hope Corp (ASX:NHC) and Whitehaven Coal (ASX:WHC) fell by more than 3% each.

Miners were also facing pressure today. Lithium miners were hit hard, with Pilbara Minerals (ASX:PLS) down 4%.

Gold prices are trading near record highs, with Evolution Mining (ASX:EVN) rising 6% and hitting a 52-week high. EVN reported production of 193,554 ounces of gold and 19,059 tonnes of copper during the quarter, maintaining an All-in Sustaining Cost (AISC) of $1,569 per ounce, which it says is one of the lowest in the industry.

Rio Tinto (ASX:RIO) fell almost 1% after its main iron ore division reported shipments below analysts’ expectations during the quarter. Rio reported only a slight increase in iron ore production in Pilbara, producing 84.1 million tonnes of iron ore in Q3, a slight increase of 1% compared to the pcp. Copper production also faced challenges, particularly at the Kennecott mine, where geological issues impacted access to ore.

Now read Josh Chiat’s Rio and Evolution kick off large cap reporting season

Still in large caps, medical device firm ProMedicus (ASX:PME) fell 2% despite securing a 5-year contract extension worth at least $32 million with a major Australian Radiology Network. This extension involves the company’s Visage RIS product and comes with an increased fee compared to the previous agreement.

Trump doubles down on tariffs and Fed Reserve

Across the region today, Asian stocks fell, with fluctuations in Chinese shares ahead of a press briefing expected to announce support measures for the struggling property sector.

The MSCI Asia Pacific Index dropped for a third session, and stocks in Tokyo and Seoul declined, along with our own local market.

Meanwhile, in an interview that concluded just a couple of hours ago at the Economic Club of Chicago, presidential candidate Donald Trump defended his plans to boost the US economy through higher tariffs, as well as more influence over the Federal Reserve.

His remarks were well-received by attendees, who supported his stance on protecting American companies through tariffs, despite concerns from economists that tariffs would harm small businesses.

“China thinks we’re a stupid country. A very stupid country. They can’t believe that somebody finally got wise to them,” he said.

Trump also suggested that a president should have the right to advise the Federal Reserve on interest rates, but stopped short of saying he will remove Fed Chairman Jerome Powell if elected.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RML | Resolution Minerals | 0.002 | 100% | $700,000 | $1,610,022 |

| MKG | Mako Gold | 0.016 | 63% | $26,994,459 | $9,372,881 |

| TD1 | Tali Digital Limited | 0.002 | 50% | $504,253 | $3,295,156 |

| POS | Poseidon Nick Ltd | 0.006 | 38% | $33,113,636 | $16,815,502 |

| NYR | Nyrada Inc. | 0.135 | 36% | $6,250,549 | $18,038,661 |

| CTN | Catalina Resources | 0.004 | 33% | $83,204 | $3,715,461 |

| MRQ | Mrg Metals Limited | 0.004 | 33% | $1,054,653 | $8,134,556 |

| RIL | Redivium Limited | 0.004 | 33% | $47,706 | $8,240,564 |

| RLG | Roolife Group Ltd | 0.004 | 33% | $1,350,876 | $3,530,989 |

| TX3 | Trinex Minerals Ltd | 0.002 | 33% | $150,000 | $2,742,978 |

| RFA | Rare Foods Australia | 0.017 | 31% | $51,441 | $3,535,782 |

| 88E | 88 Energy Ltd | 0.003 | 25% | $6,340,211 | $57,867,624 |

| HFY | Hubify Ltd | 0.010 | 25% | $992,649 | $4,089,090 |

| OAR | OAR Resources Ltd | 0.003 | 25% | $2,143,390 | $6,601,669 |

| T3D | 333D Limited | 0.010 | 25% | $47,086 | $955,559 |

| PEC | Perpetual Res Ltd | 0.016 | 23% | $17,527,268 | $9,568,395 |

| PV1 | Provaris Energy Ltd | 0.029 | 21% | $2,183,802 | $15,143,216 |

| CDX | Cardiex Limited | 0.072 | 20% | $865,008 | $17,650,474 |

| TG6 | Tgmetalslimited | 0.180 | 20% | $328,067 | $10,666,131 |

| TGH | Terragen | 0.060 | 20% | $141,664 | $18,454,056 |

| MEL | Metgasco Ltd | 0.006 | 20% | $3,655,833 | $7,287,934 |

| PUR | Pursuit Minerals | 0.003 | 20% | $5,914,253 | $9,088,500 |

| SPX | Spenda Limited | 0.013 | 18% | $10,651,062 | $50,639,555 |

Drug discovery company Nyrada (ASX:NYR) jumped 36% after the company moved closer to starting a phase I human trial for its drug NYR-BI03, aimed at treating strokes and traumatic brain injuries. Nyrada completed safety studies in rats, showing no harm during a 14-day toxicology assessment. The next step is to obtain ethics approval, with the trial expected to begin this quarter. NYR-BI03 works by blocking certain channels that affect heart function and has shown promising preclinical results, including a significant neuroprotective effect in stroke studies. Investors are eagerly awaiting human trial results, as the stroke treatment sector has been a growing area for ASX-listed biotechs.

Now read Tim Boreham’s Rats – and investors – are happy as Nyrada forges ahead with its first human brain injury trial

GTI Energy (ASX:GTR) was up after releasing an investor presentation this morning, focused on its Lo Herma uranium play in Wyoming, which the company says is currently “the only “junior”in Wyoming with compliant ISR uranium resources”, with current drilling underway aimed at a providing a resource upgrade and scoping study. Currently, the company says it has an inferred resource of 7.4 Mlbs so far in Wyoming, and at an $80/lb contract price, that makes Wyoming ISR projects “very attractive”.

TMK Energy (ASX:TMK) was up after announcing a three day extension to the closing date of Entitlement Issue (Offer), which will now close at 5.00pm (AWST) Friday 25 October 2024 to allow additional time for shareholder participation. The company also notes that directors and management have agreed to a 50% reduction in cash fees for the next 6 months, with the company aiming to reduce costs by $250,000 through the initiative, as it moves towards a commercial outcome from its 100% owned Gurvantes XXXV Coal Seam Gas Project in the South Gobi Desert of Mongolia.

Mako Gold (ASX:MKG) was up quite rapidly ton news the company has entered into a Bid Implementation Agreement with Aurum Resources (ASX:AUE), for “an agreed merger pursuant to which Aurum proposes to acquire 100% of the issued shares in Mako and 100% of two classes of unlisted options by way of an off-market takeover bid”.

The deal, as it stands, is for 1 Aurum share for every 25.1 Mako shares, representing an offer price of $0.018 per Mako share, along with 1 Aurum share for every 170 Class A Options, and 1 Aurum share for every 248 Class B Options, with the merger aimed at creating “an emerging exploration and development gold business in West Africa, with cash of over A$20 million1 to advance the flagship Napié and Boundiali Projects in northern Côte d’Ivoire”.

Energy Resources of Australia (ASX:ERA) was up on news that the ASX Takeover Panel had knocked back requests from two ERA shareholders – Zentree Investments and WA stockbroker Willy Packer’s Packer and Co. – which had complained that ERA’s 19.87 for 1 renounceable entitlement offer would enable Rio Tinto (ASX:RIO), which owns 86.3% of ERA, to take its stake beyond 90% and compulsorily acquire the rest of its stock at just 0.2c a pop. The entitlement offer has resumed, with an updated Ex-Date set for Friday, 18 October.

TG Metals (ASX:TG6) said its lithium deposit, Burmeister, has produced excellent lithium concentrate using simple processing methods. The spodumene concentrate achieved a grade of up to 6.31% Li2O. By using ore sorting technology, the company improved the lithium content by 15-39% and significantly reduced iron levels. Initial tests also indicate that it can produce a high-grade, low-impurity concentrate. Ongoing tests will continue to refine the processing methods, aiming for efficient and cost-effective lithium extraction from the Burmeister deposit in Western Australia.

MTM Critical Metals (ASX:MTM) has successfully raised $8 million from investors to speed up the commercialisation of its Flash Joule Heating (FJH) technology. This funding will help develop a demonstration plant capable of processing one tonne per day, which is a key step towards commercial operations. The company plans to use this technology to extract valuable metals like gallium, indium, gold, copper, and lithium from waste materials, making the process more sustainable and efficient. Collaborations with industry partners are already in progress, aimed at boosting the supply of critical minerals.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SIS | Simble Solutions | 0.003 | -25% | 1,301,581 | $3,013,803 |

| DUB | Dubber Corp Ltd | 0.019 | -21% | 7,422,903 | $22,226,157 |

| AHN | Athena Resources | 0.004 | -20% | 3,080 | $5,352,338 |

| AKN | Auking Mining Ltd | 0.004 | -20% | 2,000,000 | $1,762,851 |

| RC1 | Redcastle Resources | 0.008 | -20% | 8,000 | $4,103,258 |

| TMK | TMK Energy Limited | 0.002 | -20% | 10,471,610 | $18,979,030 |

| TON | Triton Min Ltd | 0.010 | -17% | 503,520 | $18,820,665 |

| AL8 | Alderan Resource Ltd | 0.003 | -14% | 54,545 | $5,499,371 |

| AUR | Auris Minerals Ltd | 0.006 | -14% | 50,000 | $3,336,382 |

| EPM | Eclipse Metals | 0.006 | -14% | 1,644,216 | $15,755,989 |

| M2R | Miramar | 0.006 | -14% | 3,634,662 | $2,777,763 |

| NOR | Norwood Systems Ltd. | 0.030 | -14% | 192,640 | $16,665,008 |

| PIL | Peppermint Inv Ltd | 0.006 | -14% | 1,000,000 | $14,849,508 |

| SOM | SomnoMed Limited | 0.320 | -14% | 269,107 | $79,960,054 |

| MM8 | Medallion Metals. | 0.084 | -13% | 766,016 | $39,575,520 |

| 1AE | Auroraenergymetals | 0.039 | -13% | 246,936 | $8,057,868 |

| EQR | Eq Resources Limited | 0.046 | -13% | 2,448,508 | $118,562,482 |

| FTZ | Fertoz Ltd | 0.020 | -13% | 105,136 | $6,818,592 |

| NVU | Nanoveu Limited | 0.040 | -13% | 7,233,575 | $23,226,444 |

| PHO | Phosco Ltd | 0.040 | -13% | 143,718 | $12,868,416 |

| BCB | Bowen Coal Limited | 0.007 | -13% | 1,771,658 | $23,443,918 |

IN CASE YOU MISSED IT

C29 Metals (ASX:C29) is positioned to start drilling at its Ulytau uranium project in Kazakhstan after meeting all regulatory requirements for the issue of a drill permit. The company’s geology team has started pre works ahead of mobilising the drill rig to site.

Greenvale Energy (ASX:GRV) is moving to acquire a controlling stake in the Tobermorey uranium project in the NT, while also divesting its farm-in deal to acquire the EP145 project and returning it to Mosman Oil and Gas.

Legacy Minerals’ (ASX:LGM) Phase 1 drilling has returned an intersection of 120m at 0.3g/t platinum group elements, confirming that magmatic-related PGE-nickel-copper sulphide mineralisation is present at its Fontenoy project in NSW. The company has also formed a joint venture with Earth AI to accelerate exploration of the project.

TG Metals (ASX:TG6) has completed initial metallurgical testing proving that a simple combination of ore sorting technology with heavy liquid separation and dense media separation is enough to generate a high-grade, low impurity spodumene concentrate. This grades up to 6.31%, well above the 6% Li2O benchmark on which the commodity is priced.

TRADING HALTS

Mayur Resources (ASX:MRL) – pending an announcement in relation to a Strategic Alliance arrangement.

Adisyn (ASX:AI1) – pending the release of an announcement in relation to a response to an ASX price query.

Caravel Minerals (ASX:CVV) – for the purpose of planning and executing a capital raising.

Resource Base (ASX:RBX) – pending an announcement by the Company in respect of a capital raising.

C29 Metals (ASX:C29) – to enable the company to finalise and execute an equity raise.

Rimfire Pacific Mining (ASX:RIM) – pending an announcement to the market regarding an injunction hearing relating to the termination of the Fifield Project Earn-in dispute.

Turaco Gold (ASX:TCG) – pending an announcement about a capital raising.

DUG Technology (ASX:DUG) – requested in connection with a proposed capital raising.

Dragon Mountain Gold (ASX:DMG) – pending an announcement by the Company in relation to a capital raise.

Lowell Resources Fund (ASX:LRT) – pending the release of a placement announcement.

Sierra Nevada Gold (ASX:SNX) – pending an announcement to the market in relation to a capital raising.

Percheron Therapeutics (ASX:PER) – pending an announcement in relation to a capital raising.

AnteoTech (ASX:ADO) – pending an announcement concerning the counterparty in its announcement on the 15 October 2024, for the First Commercial Order for Ultranode battery anode.

At Stockhead, we tell it like it is. While C29 Metals, Greenvale Energy, Legacy Minerals and TG Metals are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.