Closing Bell: Surging bond yields slam ASX, down more than 150 points

It was a sea of tears with very little relief in sight on the ASX today, as investors demand ever higher yields to take on government debt. Pic: Getty Images.

- ASX plunges in worst performance since April

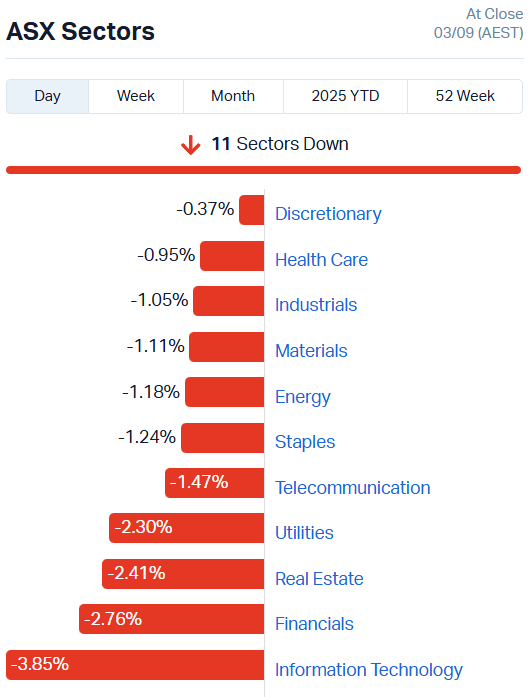

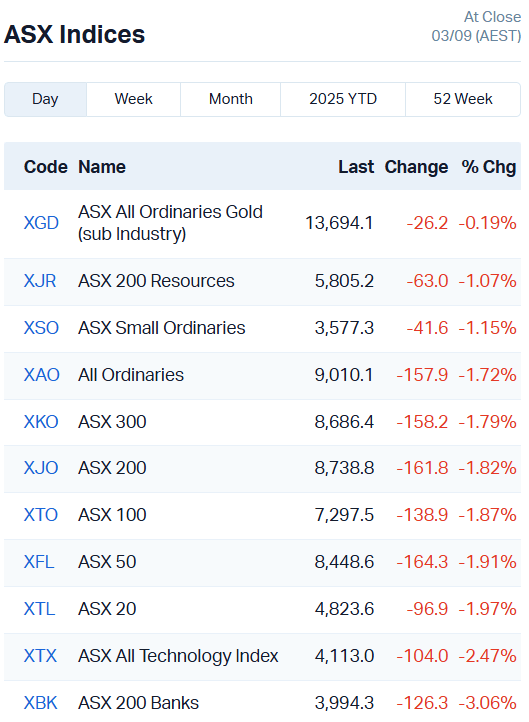

- All 11 sectors and every index lower

- Rising bond yields a core driver of market weakness

A sea of red

The ASX 200 has had its worst trading day since April’s Liberation Day, plunging a full 161.8 points or 1.82%.

There were no resistance points whatsoever through trade, just a steady fall back down below 8800 points.

Info tech – severely hampered by tech losses on Wall Street – and financials – hammered by rising bond yields – led losses.

Every single sector and index fell, with nary a single point of light amongst the sea of bloodletting.

The biggest fall by market value was in Commonwealth Bank (ASX:CBA), down 3.4%, joined by Westpac (ASX:WBC), which fell 3.6%.

Rounding out the major banking losses, Macquarie (ASX:MQG), National Australia Bank (ASX:NAB) and ANZ (ASX:ANZ) all slid just over 2%.

BHP (ASX:BHP) dragged materials lower with a 1.3% haircut, while CSL (ASX:CSL) continued its brutal fall from grace, shedding 0.84%.

Bond yields soar globally

Bond yields have been rising across the globe as investor fears around ballooning government debt grow.

As investors become less confident that a government’s debt will continue to hold its value, they begin to demand higher returns for taking the risk of buying in.

French 30-year bonds have hit their highest level in more than 16 years at 4.5%, according to Reuters, and UK 30-year yields have touched their highest point since 1998 at 5.69%.

Germany is moving in a similar direction as 30-year bond yields hit 14-year highs at 3.4%.

US 30-year yields rose 5.1 basis points to 4.96%, while 10-year Treasury yields rose 4.5bps to 4.27%.

“Bond markets simply aren’t playing nice right now,” Westpac head of financial markets strategy Martin Whetton told the ABC.

“Sovereigns are facing large financing requirements at a time that the markets are struggling to see value in yields.

“The UK is ground zero: as fiscal challenges and the future funding requirements and spending needs simply don’t add up to the growth and tax revenues expected.

“Global yields are all moving higher as a result.”

Governments keep asking for more money but it’s looking like there simply isn’t enough demand for the debt bonds required to fund them.

As for Australia, our debt is among the lowest in the world as a percentage of GDP at 35%, and our bonds still enjoy a Triple A rating, unlike our cousins across the pond.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ABX | ABX Group Limited | 0.073 | 78% | 35086724 | $10,327,142 |

| KCCDA | Kincora Copper | 1.04 | 55% | 96366 | $15,777,099 |

| 4DX | 4Dmedical Limited | 1.17 | 52% | 24823801 | $358,509,371 |

| AFA | ASF Group Limited | 0.006 | 50% | 1 | $3,169,590 |

| CTO | Citigold Corp Ltd | 0.006 | 50% | 14304214 | $12,000,000 |

| SRN | Surefire Rescs NL | 0.0015 | 50% | 532500 | $3,906,859 |

| SNS | Sensen Networks Ltd | 0.064 | 39% | 5277529 | $36,479,724 |

| CTN | Catalina Resources | 0.004 | 33% | 2386265 | $7,278,057 |

| CVB | Curvebeam Ai Limited | 0.14 | 27% | 306031 | $43,519,908 |

| 8CO | 8Common Limited | 0.038 | 27% | 586759 | $6,722,847 |

| ERA | Energy Resources | 0.0025 | 25% | 144318 | $810,792,482 |

| MEL | Metgasco Ltd | 0.0025 | 25% | 3646564 | $3,674,173 |

| PLC | Premier1 Lithium Ltd | 0.01 | 25% | 2239069 | $2,944,485 |

| GIB | Gibb River Diamonds | 0.058 | 23% | 854682 | $10,081,944 |

| EQS | Equitystorygroupltd | 0.022 | 22% | 27461 | $3,183,262 |

| FLG | Flagship Min Ltd | 0.077 | 20% | 2367043 | $16,048,465 |

| ERL | Empire Resources | 0.006 | 20% | 1120000 | $7,419,566 |

| M2R | Miramar | 0.003 | 20% | 1691662 | $2,987,308 |

| MQR | Marquee Resource Ltd | 0.012 | 20% | 8411383 | $7,333,990 |

| EXT | Excite Technology | 0.0095 | 19% | 5699521 | $16,581,135 |

| PGM | Platina Resources | 0.026 | 18% | 10288764 | $13,709,967 |

| SHN | Sunshine Metals Ltd | 0.02 | 18% | 32623345 | $35,489,962 |

| TAS | Tasman Resources Ltd | 0.02 | 18% | 21147 | $4,748,997 |

| BRE | Brazilian Rare Earth | 2.88 | 18% | 770801 | $276,156,603 |

| BUS | Bubalusresources | 0.135 | 17% | 5983888 | $6,599,621 |

In the news…

ABx Group (ASX:ABX) is flying after ANSTO leach tests extracted more than 70% of valuable heavy rare earths dysprosium and terbium from 100kg Deep Leads project samples.

The metallurgical testing also revealed Deep Leads rare earths can be extracted at higher pHs than first thought, lowering impurities and reagent costs while also reducing environmental impact.

Management says ABX is on track to deliver a mixed rare earth carbonate sample by the fourth quarter of this year.

4D Medical’s (ASX:4DX) US offering is looking a lot more attractive after the company secured US Medicare reimbursement for its CT:VQ software. Alongside the usual chest CT fee, CMS will pay US$650.50 per scan.

4DX can now deploy its tech without the need for additional administrative infrastructure, offering a cheaper, cleaner lung function assessment tool.

Flagship Minerals (ASX:FLG) has also kicked off a data review, looking to turn a 1.05Moz gold foreign estimate (NI 43-101 Canadian code) into a JORC estimate for the Pantanillo gold project in Chile.

FLG obtained a sizeable 700-file, 10,000-document data set for Pantanillo from Anglo American Norte, revealing very shallow, surprisingly broad gold intercepts of up to 193m at 1.01 g/t from 28m and 293m at 0.53 g/t gold from 9m.

Gibb River Diamonds (ASX:GIB) has officially started mining at the Edjudina gold project, with all resulting gold to be sold on the very hot spot gold market.

Contractor BML Ventures will be handling the nitty gritty of the mining effort, as well as delivering the ore to nearby gold processing plants. The net surplus cash will be split 50/50 between GIB and BML.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AGN | Argenica | 0.28 | -57% | 9835053 | $82,854,579 |

| OILR | Optiscan Imaging | 0.001 | -50% | 900000 | $417,670 |

| LML | Lincoln Minerals | 0.006 | -33% | 39282646 | $19,148,128 |

| RLC | Reedy Lagoon Corp. | 0.002 | -33% | 2362995 | $2,330,120 |

| SFG | Seafarms Group Ltd | 0.001 | -33% | 16717812 | $7,254,899 |

| COY | Coppermoly Limited | 0.01 | -29% | 297400 | $12,357,204 |

| 1AD | Adalta Limited | 0.003 | -25% | 8553500 | $5,285,266 |

| AUK | Aumake Limited | 0.003 | -25% | 37473 | $12,093,435 |

| AYT | Austin Metals Ltd | 0.003 | -25% | 3867662 | $6,336,765 |

| AX8 | Accelerate Resources | 0.007 | -22% | 5033138 | $7,354,698 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 407495 | $11,584,182 |

| ASP | Aspermont Limited | 0.008 | -20% | 4602021 | $25,131,768 |

| VEN | Vintage Energy | 0.004 | -20% | 41546 | $10,434,568 |

| SMM | Somerset Minerals | 0.013 | -19% | 17286495 | $12,901,610 |

| COD | Coda Minerals Ltd | 0.14 | -18% | 1110902 | $42,492,343 |

| NTM | Nt Minerals Limited | 0.0025 | -17% | 13281 | $3,632,709 |

| RLG | Roolife Group Ltd | 0.005 | -17% | 2339682 | $11,270,973 |

| TMK | TMK Energy Limited | 0.0025 | -17% | 15115354 | $30,667,149 |

| VBS | Vectus Biosystems | 0.073 | -16% | 11348 | $4,640,000 |

| EQR | Eq Resources Limited | 0.035 | -15% | 17962302 | $126,753,289 |

| PVW | PVW Res Ltd | 0.018 | -14% | 5269 | $4,177,000 |

| AKN | Auking Mining Ltd | 0.006 | -14% | 962017 | $5,627,975 |

| MRD | Mount Ridley Mines | 0.003 | -14% | 78690 | $3,133,418 |

| MSG | Mcs Services Limited | 0.006 | -14% | 920847 | $1,386,698 |

| ROG | Red Sky Energy. | 0.003 | -14% | 163 | $18,977,795 |

In Case You Missed It

Green Critical Minerals’ (ASX:GCM) VHD graphite exhibits significantly better thermal expansion performance than copper and aluminium.

Indiana Resources’ (ASX:IDA) upcoming aircore drilling at Minos will follow up excellent gold-in-calcrete results from recently completed regional sampling.

Austin Metals (ASX:AYT) has returned a batch of high-grade gold hits from a now strike-expanded Austin gold project in Western Australia.

Australian Mines (ASX:AUZ)prepare to drill in New South Wales and Brazil, with a 1000 metre campaign at Flemington, and a jam packed gold program at Boa Vista.

Arika Resources’ (ASX:ARI) drilling delivers standout results at F1 prospect growing the Landed at Last system.

St George Mining (ASX:SGQ) has reported more high-grade results from drilling at its REE project in Brazil ahead of a planned resource update.

Trading halts

Argent Minerals (ASX:ARD) – cap raise

Cavalier Resources (ASX:CVR) – cap raise

Jindalee Lithium (ASX:JDL) – potential merger transaction

Lotus Resources (ASX:LOT) – cap raise

Pearl Gull Iron (ASX:PLG) – disposal of material asset

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.