Closing Bell: Sunshine Metals and then Broad Daylight as we Give Thanks for this Winner of a Week

Reuben Adams on Friday. Pic: Getty

- The ASX benchmark has closed slightly higher for Friday and the week

- Sector gains led by Utilities +1.55%

- Small caps led by Sunshine Metals

Well it’s been quite the week on local markets, ending on a note which looks like a B flat, sounds like a C minus. Or a slightly burned cat.

A lack of Wall Street leads and light volumes has been the song of Friday here in Sydney.

Surprisingly the ASX hasn’t given away the entirety of it’s morning gains after an encouraging session in Europe marked by signs of falling inflation and equity gains.

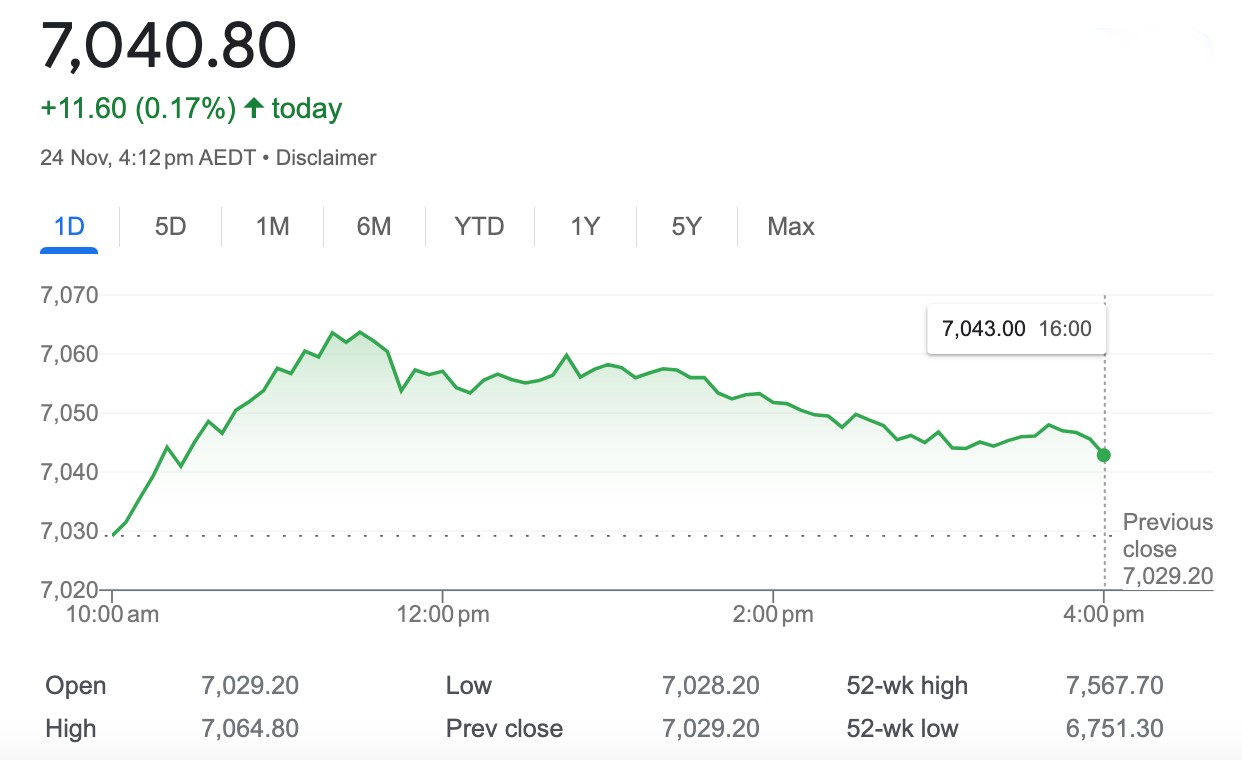

At match-out on Friday November 24, the S&P/ASX 200 (XJO) index was up 11.6 points, or +0.17% at 7,041:

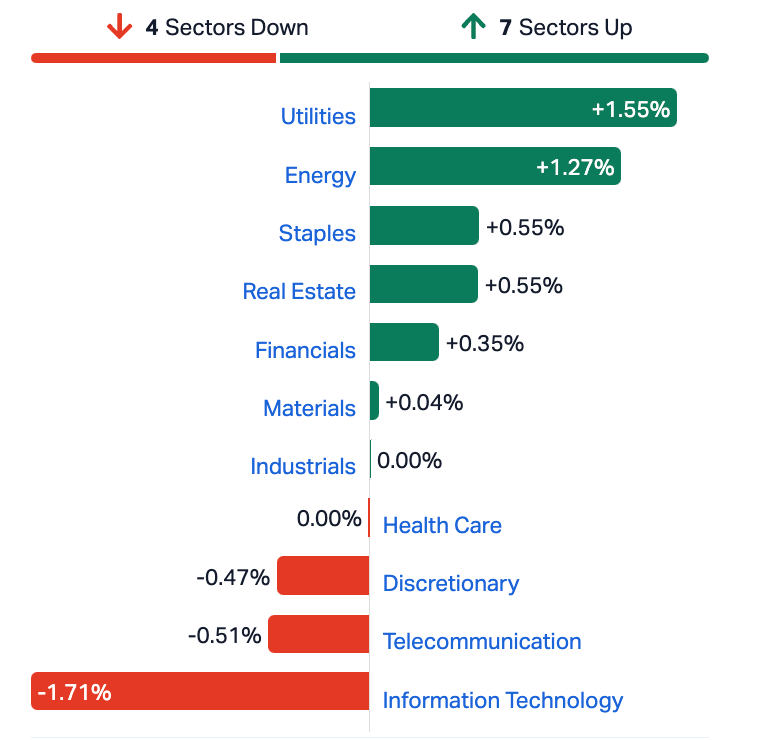

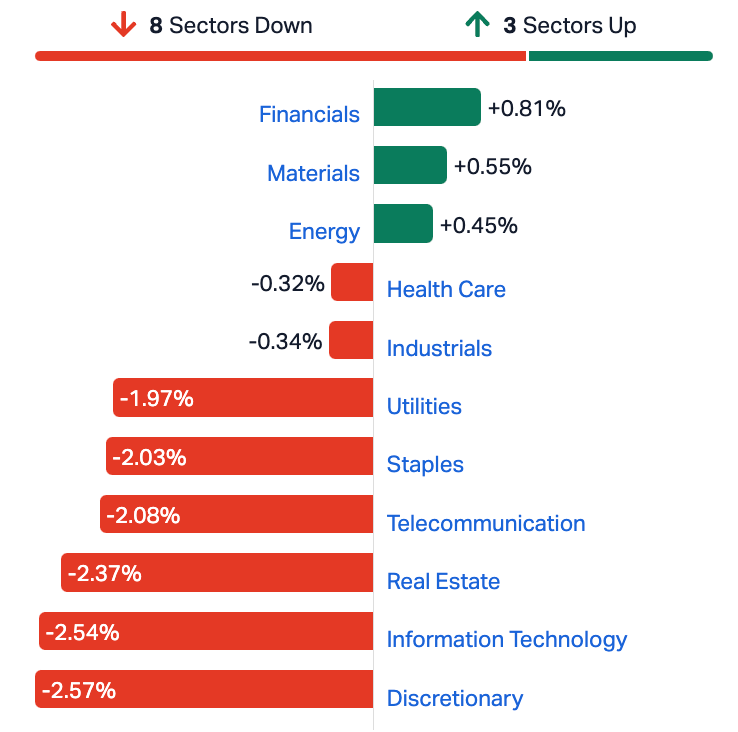

More gains in the energy, utilities, property, consumer staples and financial sectors outweigh falls in tech, consumer discretionary and communications sectors.

ASX Sectors On Friday

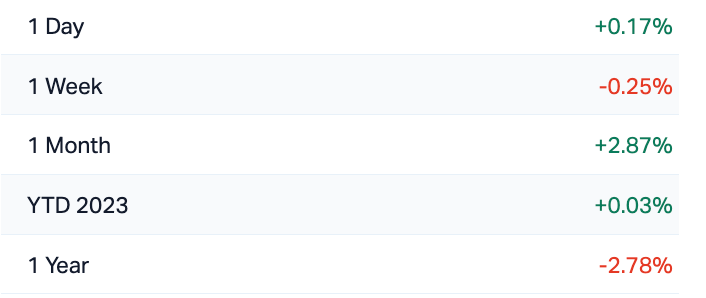

One week on the ASX

Around our neck of the woods, Asian-Pacific markets were all mixed up on Friday – thrown well off kilter by Japan’s accelerating headline inflation rate which clocked 3.3% in October from 3% in September – the highest reading since July.

Preliminary figures also showed that business activity in Japan slowed to an 11-month low in November amid persistent weakness in the manufacturing sector. Because it’s the Nikkei, shares in Japan advanced.

Markets in South Korea, Hong Kong and mainland China are lower.

US markets were closed, by God, for Thanksgiving hols on Thursday in New York, but they all have to come back for a half day of trading on Friday.

And yes, most don’t.

Nevertheless, Futures for the 3 key US indices – the Dow Jones Industrial Average, the S&P 500 and the Nasdaq Composite were marginally higher ahead of the abbreviated session on Friday:

THE WEEK AHEAD

We’ve got a fair bit happening next week – so look up and look ahead team.

At home we cop the monthly consumer price index (CPI) which AMP reckons will likely be up 5.2%y-o-y but down from last month’s 5.6% which would imply a marginal increase in prices over the month.

October retail sales are expected to fall by 0.2%.

Some of the September quarter GDP components are also due to be released.

Building approvals drop which are expected to bounce back by 5% after a fall last month. There’s private sector credit and CoreLogic home prices.

The feisty RBA Governor M. Bullock is set to terrify a panel next week at the HKMA-BIS High-Level Conference in Hong Kong.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| SHN | Sunshine Metals Ltd | 0.021 | 91% | 143,839,744 | $13,464,093 |

| BP8 | BPH Global Ltd | 0.0015 | 50% | 2,469,341 | $1,615,563 |

| PHO | Phosco Ltd | 0.073 | 46% | 480,182 | $13,720,668 |

| RGL | Riversgold | 0.015 | 36% | 50,607,653 | $10,463,876 |

| AVM | Advance Metals Ltd | 0.004 | 33% | 1,590,000 | $2,167,040 |

| CC9 | Chariot Corporation | 0.955 | 32% | 1,892,875 | $53,165,387 |

| UBI | Universal Biosensors | 0.25 | 32% | 263,955 | $40,350,193 |

| TG1 | Techgen Metals Ltd | 0.105 | 27% | 4,966,522 | $6,404,967 |

| WYX | Western Yilgarn NL | 0.125 | 25% | 117,856 | $4,965,750 |

| ATH | Alterity Therapeutics | 0.005 | 25% | 1,233,482 | $9,759,590 |

| EPM | Eclipse Metals | 0.01 | 25% | 1,632,244 | $16,350,434 |

| FGL | Frugl Group Limited | 0.01 | 25% | 1,536,667 | $7,688,496 |

| GTG | Genetic Technologies | 0.0025 | 25% | 205,268 | $23,083,316 |

| ME1 | Melodiol Global Health | 0.0025 | 25% | 5,546,409 | $8,436,084 |

| BTH | Bigtincan Holdings | 0.18 | 24% | 2,940,318 | $88,051,698 |

| AUN | Aurumin | 0.026 | 24% | 989,960 | $6,687,305 |

| NFL | Norfolk Metals | 0.315 | 24% | 2,605,188 | $7,732,874 |

| RNE | Renu Energy Ltd | 0.016 | 23% | 686,700 | $5,817,358 |

| HIQ | Hitiq Limited | 0.023 | 21% | 29,206 | $5,587,207 |

| NAG | Nagambie Resources | 0.03 | 20% | 705,994 | $14,543,158 |

| SFG | Seafarms Group Ltd | 0.006 | 20% | 1,924,461 | $24,182,996 |

| SKN | Skin Elements Ltd | 0.006 | 20% | 300,000 | $2,947,430 |

| AGH | Althea Group | 0.039 | 18% | 750,204 | $13,069,450 |

| GIB | Gibb River Diamonds | 0.039 | 18% | 2,564 | $6,979,812 |

| 4DX | 4Dmedical Limited | 0.92 | 18% | 3,386,333 | $270,244,018 |

17m at 22.14g/t from 67m…

That’s the headline from drilling at Sunshine Metals’ Ravenswood Consolidated Project in North Queensland, where the heavily diluted $24 million micro cap may have struck paydirt in a gold and copper rich feeder zone to its 2.3Mt zinc, gold, copper, lead and silver VMS resource at the Liontown deposit.

It’s a bit of a game changer and why the stock price just doubled today.

“The stunning intercepts at Liontown are a great reward for the solid geological work completed by the team,” MD Damien Keys said.

“The decision was made to target the gold-copper rich footwall and feeder zones to the Liontown Resource with a high impact, shallow RC program. The feeder zones have not been recognised by past explorers and are often difficult to target.”

Another 11 holes have already been drilled to target these feeder zones and footwall lodes, with assays due in December this year.

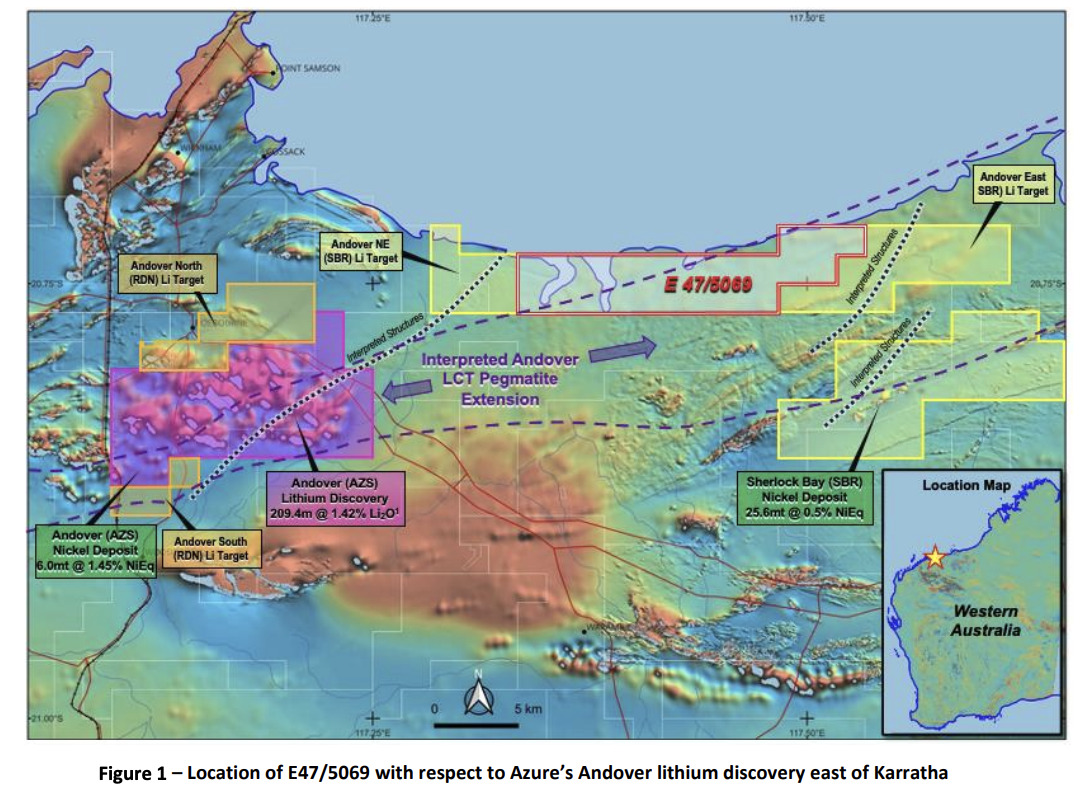

Meanwhile, Riversgold (ASX:RGL) has acquired ‘a key 74 square kilometre tenement application directly along strike – just 8km northeast of the major Andover lithium (spodumene) pegmatite discovery of Azure Minerals (ASX:AZS).’

Nice.

That’s the spot in the lithium-famous Andover Corridor where AZS struck spodumene glory with drilling intersections of up to 209.4m at 1.42% Li2O.

Consultants will be commencing exploration efforts ‘in earnest within the week.’

Aurumin (ASX:AUN) says it has executed a deal with Polaris Metals, a subsidiary of Mineral Resources (ASX:MIN), for the sale of the iron ore rights on four of its Mt Dimer exploration tenements in WA.

The Mt Dimer exploration tenements are proximal to MinRes’ Carina iron ore mine.

Key terms of the sale include $250k payable to AUN on satisfaction of the conditions precedent, plus progress payments of ~1.25 million and $1/t royalty on iron ore exported.

Techgen Metals (ASX:TG1) is on the run again, having risen well over +200% over the past month on either a case of terrific mistaken identity… or the distant whiff of lithium

TG1’s ticker code, as my esteemed colleague Josh Chiat has pointed out, is ‘mighty close’ to one of the real market darlings of the moment — TG6 orTG Metals (ASX:TG6), the leader of the Lake Johnston lithium rush (which Josh adds has even seen Rio Tinto (ASX:RIO) partake in the form of a farm-in with Charger Metals (ASX:CHR)).

But Techgen has had plenty of lithium to make the fan club curious:

“It’s got pegmatite mapping going on at its Ida Valley lithium project, 50km north along strike from Delta Lithium’s (ASX:DLI) popular Mt Ida project (14.6Mt at 1.2% Li2O).

“Sampling there has returned peak soil grade of 144.5ppm lithium and 49.8ppm caesium, with pegmatites identified in all three of the target areas among 41 rock chop samples, 29 of them in the northwest where a large pegmatite field on a 800m by 400m area remains open in all directions,” Josh says.

Ark Mines (ASX:AHK) has announced first pass water-based beneficiation test work at its 100%-owned Sandy Mitchell project in North Queensland has produced a high commercial grade rare earth concentrate with “excellent recoveries.”

According to AHK, the test work has shown the greatest upgrade is by simple gravity separation, confirming the material is amenable to straightforward beneficiation by water-only, low-cost gravity processing.

The final concentrate assays returned:

• 51.9% TREO (519,000ppm), and contained mostly La, Ce, Pr and Nd, plus Heavy Rare Earths Dy and Tb, which collectively represents a very high value saleable product

• Direct cerium oxide (CeO2) recovery from gravity feed to REM concentrate is estimated to be 71.7%, however testwork calculated that in a normal recirculating gravity plant, overall recovery of 83.8% may be achieved

• In cerium oxide recovery, the CeO2 content is used as a tracer for the rare-earth bearing mineral monazite which was subsequently upgraded from 0.04% in the as-received feed, to 23.6% in the cleanest product

• Similar upgrade trends are observed for zirconium dioxide (ZrO2)

The independent board at packaging company Pact Group (ASX:PGH), have again urged shareholders to reject the latest (68c) takeover offer made by Bennamon Industries.

Pact is sending a letter today to shareholders explaining their decision, however the bid looks much along the lines of the ‘opportunistic’ $234 million bid first made by the Geminder family-owned investment company Kin Group back in September.

That bid would’ve allowed Kin Group to take control of the remaining 50% of PGH it doesn’t own.

The company was co-founded by Kin Group chairman Ruffy Geminder and his wife Fiona – the daughter of late cardboard king Richard Pratt – in 2002.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CSS | Clean Seas Ltd | 0.265 | -25% | 1,836,682 | $58,748,777 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | 521,001 | $15,569,766 |

| BUB | Bubs Aust Ltd | 0.13 | -21% | 10,015,791 | $124,265,466 |

| YOJ | Yojee Limited | 0.004 | -20% | 51,300 | $6,527,426 |

| AKM | Aspire Mining Ltd | 0.061 | -19% | 43,647 | $38,072,774 |

| ADVDB | Ardiden Ltd | 0.195 | -18% | 96,863 | $14,785,844 |

| C1X | Cosmos Exploration | 0.12 | -17% | 413,284 | $6,883,875 |

| GHY | Gold Hydrogen | 0.8 | -17% | 2,151,259 | $54,646,102 |

| PAB | Patrys Limited | 0.0075 | -17% | 7,526,404 | $18,517,026 |

| CT1 | Constellation Tech | 0.0025 | -17% | 11,200 | $4,413,601 |

| NGY | Nuenergy Gas Ltd | 0.02 | -17% | 656,413 | $35,542,932 |

| NRX | Noronex Limited | 0.011 | -15% | 540,182 | $4,917,923 |

| SHO | Sportshero Ltd | 0.017 | -15% | 13,501 | $11,500,022 |

| HYD | Hydrix Limited | 0.018 | -14% | 218,077 | $5,338,596 |

| CTN | Catalina Resources | 0.003 | -14% | 366,566 | $4,334,704 |

| ETR | Entyr Limited | 0.006 | -14% | 1,058,385 | $13,881,727 |

| HCD | Hydrocarbon Dynamic | 0.006 | -14% | 680,003 | $4,547,661 |

| AR3 | Austrare | 0.16 | -14% | 598,258 | $28,520,703 |

| AMM | Armada Metals | 0.052 | -13% | 700,518 | $10,354,084 |

| PRM | Prominence Energy | 0.013 | -13% | 324,116 | $2,308,146 |

| CYG | Coventry Group | 1.175 | -13% | 9,101 | $128,235,684 |

| ZEU | Zeus Resources Ltd | 0.011 | -12% | 842,841 | $5,741,013 |

| MHK | Metalhawk | 0.2 | -11% | 326,123 | $18,050,750 |

| DDT | DataDot Technology | 0.004 | -11% | 1,413,647 | $5,449,288 |

| KP2 | Kore Potash PLC | 0.008 | -11% | 58,941 | $6,021,518 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.