Closing Bell: Stupid ASX loses confidence, ends flat… but 25pc of Redbubble’s back

Via Getty

- Benchmark ASX index finishes ever so slightly up

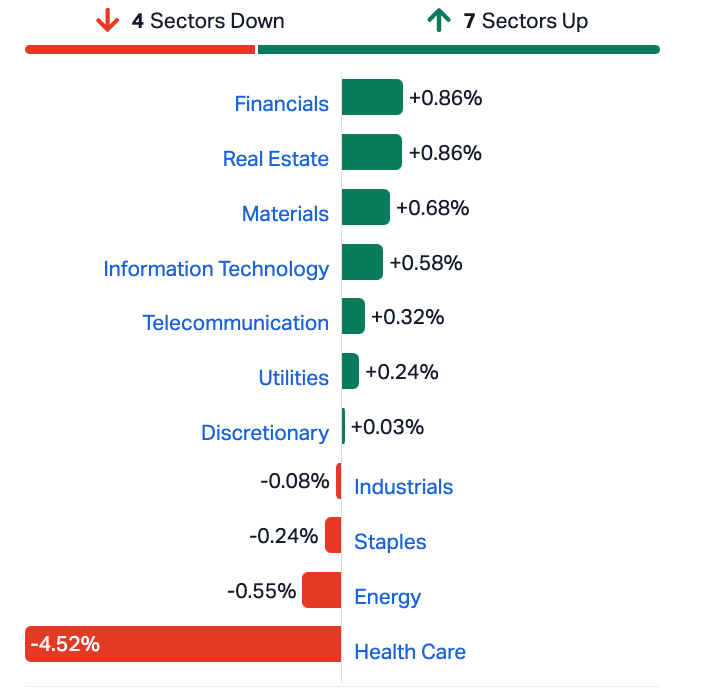

- ASX Sectors led by Financial, IT, Property and Materials

- Small cap gainers: RBL, PIL, and LPI

Here’s how we ended on Thursday. Local markets largely did okay, and then wilted when we got to the business end of business. The pic below covers it nicely, although it does appear flattering to the All Tech (ATX), which is as flighty as a pub full of birds.

The ASX200 timidly tracked Wall Street’s late gains overnight, after the release of the latest FOMC minutes suggest that the now slightly dovish US Federal Reserve looks like holding interest rates steady at the next decision on November 1.

Whatevs, really – the Fedspeakers will scour the incoming indicators, before making a call and US rates will stay elevated for “some time” until inflation is heading back to 2%. So: High for Long, but maybe not Higher for Longer.

At home, Healthcare had the stuffing knocked out as CSL shares drop further after Wednesday’s unseemly AGM.

The third largest company on the ASX by market cap has shed 6 enormous % and looks like closing at a near four-year low, or what could be its largest intraday fall of the year.

Since offering a profit warning on June 14, CSL shares are down near 25%.

Banks, property, materials and IT stocks did the best.

ASX Sectors on Thursday

In regional equity markets news, Mainland Chinese stocks traced the US and EU gains, amid growing expectations of The Fed being nicer (as above) and is done with raising interest rates.

Financial stocks led the advance, however, as the Shanghai Composite lifted above 0.5% after one of Beijing’s top state funds increased its stake in China’s own Big Four (state) banks – a clear signal to traders that investment and confidence will be supported.

Likewise the Hang Seng in Hong Kong jumped to a four-week high, financials leading the broader index to a near 3% gain after lunch.

The Nikkei 225 Index jumped 2.2% to above 31,600 while the broader Topix Index climbed 1.9% to 2,307 in post-holiday trade on Tuesday, recouping some losses from last week and tracking gains on Wall Street overnight.

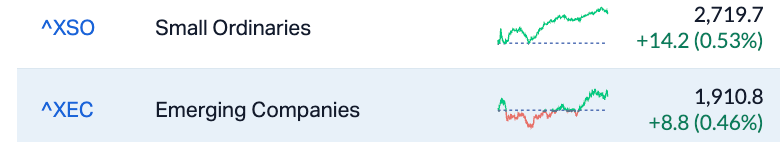

Check out the volatility on the XEC:

Still… the ASX Small Ords (XSO) added +0.5% and the ASX Emerging Co’s (XEC) index eventually ended up +0.45%.

SMALL CAP WRAP

Liontown Resources (ASX:LTR) has extended Albemarle’s exclusive due diligence period by a week as the headline $6.6 billion buyout runs into Australia’s richest person Gina Rinehart.

Rinehart’s Hancock Prospecting has now snapped up enough LTR stock to trigger her own takeover bid as per Aussie law.

More likley, Rinehart will force the US-based lithium giant into some kind of corporate ménage à trois.

The world’s biggest lithium chemical maker has wanted Liontown for itself and revised a third and final offer to $3 share about a month ago. But during the four weeks of DD offered by LTR, to enable Albemarle to put forward a binding offer, Ms Rinehart has played them both like a violin at the annual saps convention.

Sierra Rutile (ASX:SRX) says it’s taking notes of media reports (and the potential for additional speculation through online channels) in Sierra Leone relating to ‘discussions with the Government of Sierra Leone (GoSL) on the renegotiation of the terms of the Area 1 fiscal regime as set out in the Third Amendment Agreement.’ News, I confess to not having been across.

“We refer to the previous disclosure in relation to these matters on page 6 of the SRX Investor Presentation entitled “2023 Half Year Results August 2023”, the company suggested.

“Sierra Rutile confirms that discussions with GoSL are ongoing and it will make further announcements in due course in accordance with its continuous disclosure obligations.”

Xtek (ASX:XTE) ’ says its combat armour business – HighCom Armor Solutions Inc – just made a multi-million dollar sale to supply ‘many thousands of its high-end ballistic body armour products from existing inventory to an undisclosed international customer’.

HighCom’s apparently kept inventory levels right topped up just in case the world kept blowing up and this foresight finds XTE ‘perfectly positioned to support expected periodic large government orders as well as to be ready to surge support for any unforeseen escalations occurring around the world’.

Scott Basham, XTEK Group CEO:

“This new international order, valued at A$2.2m, received from an undisclosed international customer, will see many thousands of our advanced high-performance body armour products rapidly dispatched from inventory to meet this customer’s urgent delivery priorities.

“In parallel with this order, we are also negotiating multiple similarly sized orders, and some even bigger contracts, which if received, could potentially see our entire finished goods inventory of body armour and helmets completely consumed, and then see us potentially needing to ramp up our production lines back to similar levels as we did to supply our advanced lifesaving, high-performance ballistics protection products to Europe previously.

“Our policy of maintaining levels of resilience in our raw and finished goods inventories were put in place for this exact situation, and consequently we believe we are very well placed to support the significant immediate, and any sustained ongoing demand for equipment that may be required over the coming days, weeks, and months.”

In other XTE news, after two years of making XTE’s “unique and patented XTclaveTM system” in its Adelaide Manufacturing Centre, the XTEK Board has made the decision to close the operation and to relocate under one roof at our HighCom Armor production facility in Columbus, Ohio.

As part of the relocation process, key XTclave engineering staff will be offered an opportunity to continue their employment and relocate to the US.

XTE says the main reason for the relocation is that manufacturing here in peaceful Australia ‘is affecting our ability to penetrate the US market’.

RIPPED FROM THE HEADLINES

WTI crude futures fell toward $83 per barrel on Thursday after industry data showed that US crude inventories increased by a huge 12.94 million barrels last week, exceeding forecasts for a 1.3 million barrel build and reversing from a 4.21 million barrel decline in the preceding week. Official data from the Energy Information Administration will be released later on Wednesday.

The US oil benchmark also dropped nearly -3% overnight in the US, nixing almost all the gains made earlier in the week after Israel and Hamas started getting into it.

Still, the broader chatter is that downward pressure on oil prices may be limited – now that geopolitics is running the show.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MXC | Mgc Pharmaceuticals | 0.002 | 100% | 272,407 | $4,427,968 |

| FAU | First Au Ltd | 0.003 | 50% | 1,686,674 | $2,903,987 |

| MTH | Mithril Resources | 0.002 | 33% | 1,699,999 | $5,053,207 |

| NET | Netlinkz Limited | 0.008 | 33% | 1,715,141 | $21,363,170 |

| SIH | Sihayo Gold Limited | 0.002 | 33% | 18,190 | $18,306,384 |

| AMD | Arrow Minerals | 0.0025 | 25% | 500,000 | $6,047,530 |

| MCT | Metalicity Limited | 0.0025 | 25% | 627,000 | $7,472,172 |

| MRQ | Mrg Metals Limited | 0.0025 | 25% | 70,000 | $4,411,837 |

| RBL | Redbubble Limited | 0.57 | 24% | 1,443,253 | $130,051,303 |

| ADV | Ardiden Ltd | 0.006 | 20% | 252,990 | $13,441,677 |

| EEL | Enrg Elements Ltd | 0.006 | 20% | 602,593 | $5,049,825 |

| LVT | Livetiles Limited | 0.006 | 20% | 4,212,468 | $5,885,553 |

| TKL | Traka Resources | 0.006 | 20% | 149,268 | $4,356,646 |

| LPI | Lithium Pwr Int Ltd | 0.415 | 19% | 2,381,467 | $220,233,146 |

| M2M | Mtmalcolmminesnl | 0.032 | 19% | 220,000 | $2,763,275 |

| REC | Rechargemetals | 0.17 | 17% | 152,802 | $15,309,749 |

| BEX | Bikeexchange Ltd | 0.007 | 17% | 2,500,015 | $8,595,779 |

| FGH | Foresta Group | 0.014 | 17% | 1,384,132 | $24,785,562 |

| PIL | Peppermint Inv Ltd | 0.014 | 17% | 30,304,005 | $24,454,282 |

| ROO | Roots Sustainable | 0.007 | 17% | 186,452 | $919,875 |

| TAS | Tasman Resources Ltd | 0.007 | 17% | 177,041 | $4,276,016 |

| VAL | Valor Resources Ltd | 0.0035 | 17% | 732,316 | $11,620,004 |

| VN8 | Vonex Limited. | 0.022 | 16% | 93,846 | $6,874,744 |

| DTC | Damstra Holdings | 0.115 | 15% | 17,842 | $25,788,209 |

| MIO | Macarthur Minerals | 0.195 | 15% | 2,380 | $28,229,093 |

Peppermint Innovation (ASX:PIL) is up so fast this arvo the All Seeing ASX Eye nabbed them for speeding.

This is the slightly self-flattering reply from PIL, to which I say well done, having thought it was worth the slight bump in share price the stock managed at the time:

PIL is of the view there has been a lag in the market with respect to understanding the information presented in our last announcements.

On 15 September 2023 Peppermint announced it had entered into a strategic partnership agreement to provide MASS-SPECC’s Pinoy Coop Mobile App the full value of Peppermint’s mobile banking application and eWallet services. MASS-SPECC is the oldest and largest regional co operative federation in the Philippines, represented by 343 member co-ops with approximately 1.6 million individual members, many of whom reside in far-flung or remote areas.

This was significant as the announcement noted MASS-SPECC has processed cash withdrawals, bills payment and fund transfer transactions of Php 14.4 billion (circa $390 million) in value up to August for year 2023 and Peppermint was to work together with MASS-SPECC on a fee per transaction basis in the digital transformation of its co-operative members; the Pinoy Coop Mobile App was expected to be deployed

in December 2023.Further on 27 September 2023 Peppermint announced it had been issued with two vitally important Certifications by the Central Bank of the Philippines (Bangko Sentral ng Pilipinas – “BSP”). Peppermint had been working on the Certifications for some time and they marked an important milestone in Peppermint’s strategy to fully leverage our Electronic Money Issuer (“EMI”) licence and use it to drive revenue growth via increased transactions across the bizmoto platform.

In the announcement our Managing Director noted the Certification facilitated bizmoto’s complete and direct interoperability across the Philippines payment landscape, as well as emphasising the potential value of our EMI licenced platform. He also noted a comparison between a Philippines mobile-App based platform with an EMI licence called Coins.ph which was sold in early 2021 for US200 million, while Peppermint had a commercially proven, deployed and growing mobile-App based ecosystem in the Philippines underpinned by a Finance Company Licence and an EMI licence to be then valued at circa AUD$13M on the ASX.

In short sir, that is why we’re ahead on a random day in October by circa 18%.

Meanwhile taking the Thursday meat tray home is Redbubble (ASX:RBL) – the online marketplace connecting independent artists with customers that we don’t often hear from, but which dropped news of a remarkable turnaround this morning and jumped +25%.

According to RBL, it’s turned to a positive underlying cash flow of $0.7 million, up $16.9 million on prior corresponding period (pcp) and up $5.5 million on the fourth quarter of FY23.

That’s allowed the company to build its cash balance to $39.9m, up $4.2m from 30 June 2023, which the company has attributed to “a number of recently-implemented initiatives, including the introduction of artist account tiers on the Redbubble and TeePublic marketplaces and a dynamic order routing system for the Redbubble marketplace in the US, as well as further optimisation of paid marketing spend”.

Lithium Power International (ASX:LPI) has also been climbing this morning, up 18.5% in very short order on no news – which was enough to have the ASX push it into a trading pause just minutes after the market opened, and then into a complete halt.

BUT… Rob Badman might have sniffed out something takeover related. You should read it.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| DCL | Domacom Limited | 0.015 | -32% | 606,238 | $9,581,039 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 4,903,753 | $31,285,147 |

| CLE | Cyclone Metals | 0.0015 | -25% | 60,610,000 | $20,529,010 |

| RHY | Rhythm Biosciences | 0.21 | -21% | 2,718,505 | $58,602,786 |

| GTN | GTN Limited | 0.33 | -20% | 71,581 | $84,279,347 |

| EMU | EMU NL | 0.002 | -20% | 27,804,412 | $3,625,053 |

| MXO | Motio Ltd | 0.026 | -19% | 287,292 | $8,365,909 |

| EDE | Eden Inv Ltd | 0.0025 | -17% | 1,117,456 | $10,090,911 |

| MTL | Mantle Minerals Ltd | 0.0025 | -17% | 2,978,688 | $18,442,338 |

| RML | Resolution Minerals | 0.005 | -17% | 410,127 | $7,543,751 |

| SFG | Seafarms Group Ltd | 0.005 | -17% | 1,441,209 | $29,019,595 |

| AHF | Aust Dairy Limited | 0.018 | -14% | 1,489,884 | $13,773,203 |

| AHX | Apiam Animal Health | 0.3 | -14% | 1,177,490 | $63,001,906 |

| CRB | Carbine Resources | 0.006 | -14% | 100,000 | $3,862,164 |

| GCR | Golden Cross | 0.003 | -14% | 1,779,999 | $3,840,396 |

| GGE | Grand Gulf Energy | 0.006 | -14% | 2,058,860 | $13,067,502 |

| TOY | Toys R Us | 0.012 | -14% | 65,418 | $12,920,853 |

| NKL | Nickelxltd | 0.062 | -14% | 602,445 | $6,223,340 |

| ODA | Orcoda Limited | 0.28 | -14% | 42,109 | $54,976,047 |

| BEZ | Besragoldinc | 0.1425 | -14% | 3,617,775 | $68,986,649 |

| AJL | AJ Lucas Group | 0.014 | -13% | 45,271 | $22,011,674 |

| KCC | Kincora Copper | 0.029 | -12% | 41,793 | $5,287,493 |

| MRC | Mineral Commodities | 0.033 | -12% | 55,825 | $25,929,598 |

| PPY | Papyrus Australia | 0.022 | -12% | 404,021 | $12,314,190 |

| ADD | Adavale Resource Ltd | 0.0115 | -12% | 900,165 | $9,494,801 |

TRADING HALTS

Lithium Power International (ASX:LPI) – Pending the release of an announcement in response to the recent Bloomberg article published on 11 October 2023 involving the company and Chilean copper giant Codelco.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.