Closing Bell: Stocks, USD soar and Bitcoin hits record as Trump closes in

News

News

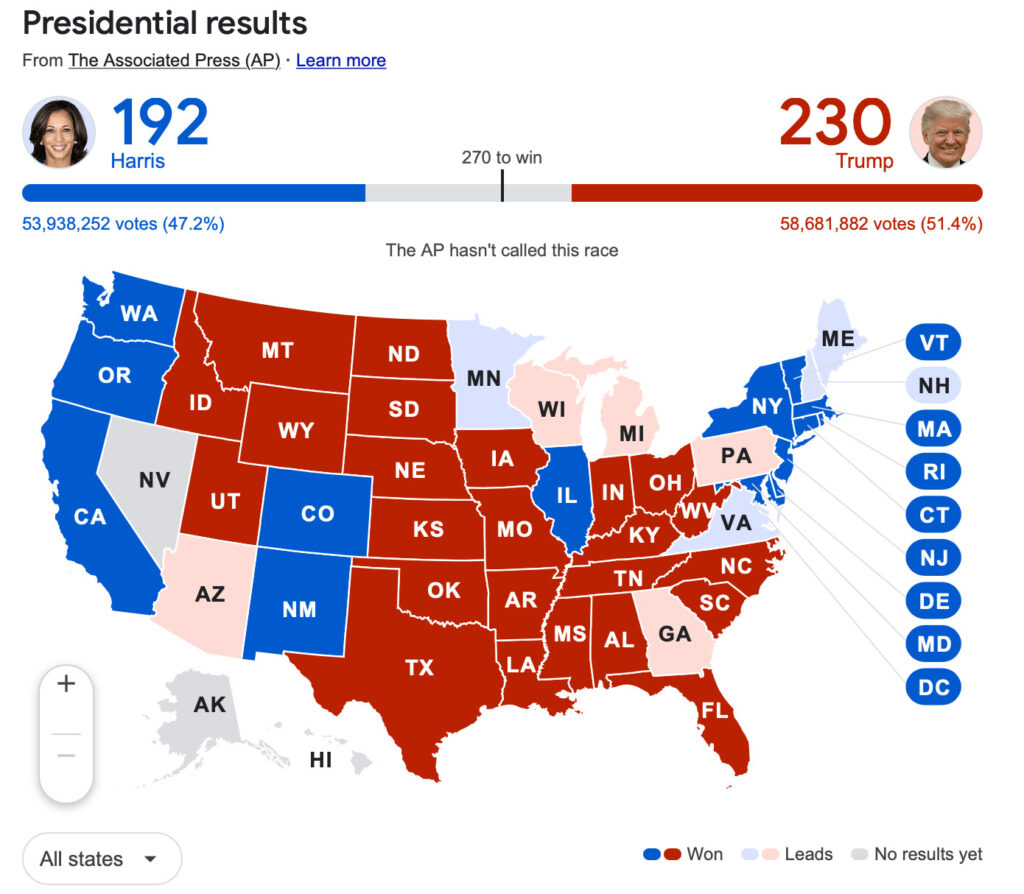

Stocks surged, Treasury yields soared, and the US dollar looked set for its biggest gain since March 2020 as early returns from the US election sparked a wave of market movements tied to a potential Trump victory.

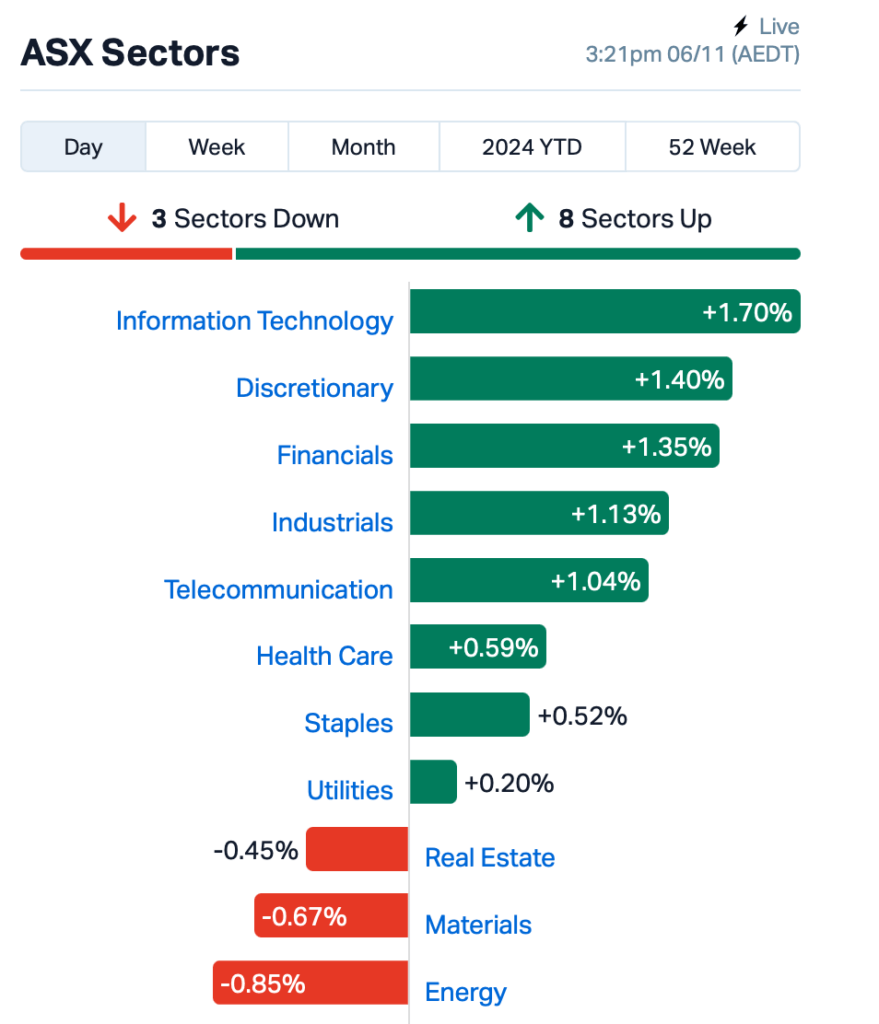

The ASX jumped 0.9% on Wednesday as the tight race in the US election continues.

The US dollar reached its highest point since July, spurred by early results from the election showing Donald Trump in a lead in key battleground states. At the time of writing, the AUD/USD was down 1.5% to trade at US65.41 cents.

Bitcoin, a so-called Trump trade, also surged to a record high, trading now at US$74,000. It climbed as high as $75,000 at one point.

“Regardless of who wins, markets generally experience a relief rally,” said Jeff Schulze at ClearBridge Investments.

Meanwhile, Tech led the ASX today, while Energy dragged.

In the consumer discretionary sector, JB HiFi (ASX:JBH) led the charge with a 2.5% gain, despite no news, while tech stock BrainChip Holdings (ASX:BRN) surged 9%, also without any specific updates.

Mining stocks gained momentum as iron ore prices rose by 2%, fuelled by expectations of new stimulus measures from Beijing to support China’s economy.

Goodman Group (ASX:GMG) , a real estate play, added 0.5% after forecasting a 9% increase in FY25 operating earnings per share and confirming a 30¢ full-year dividend.

Westpac (ASX:WBC) saw a 1% rise after the resignation of two directors following just one term, despite its status as one of Australia’s premier boards.

Meanwhile, Domain Holdings, Domino’s Pizza, Fortescue, and IGO are holding their annual general meetings today.

Overnight, The Russell 2000 Index surged 2.5%, as small-cap stocks – often seen as more insulated from global trade tensions – appeared to gain from expectations of a Trump win.

Trump Media & Technology stock saw a sharp rise of 10% after hours.

In Asia today, equities in Japan and Australia rose, while Hong Kong stocks slipped.

As early results roll in, betting odds are moving in Trump’s favour, with markets responding by lifting Trump-linked assets such as small-cap stocks, cryptocurrencies, and bond yields.

However, it’s still a waiting game, and the night could see plenty of twists.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AKN | Auking Mining Ltd | 0.005 | 67% | 6,416,062 | $1,174,051 |

| SI6 | SI6 Metals Limited | 0.002 | 50% | 128,700 | $2,767,292 |

| TMK | TMK Energy Limited | 0.003 | 50% | 3,086,666 | $16,784,811 |

| WEL | Winchester Energy | 0.003 | 50% | 600,000 | $2,726,038 |

| LNU | Linius Tech Limited | 0.002 | 33% | 1,524,000 | $9,226,824 |

| RML | Resolution Minerals | 0.002 | 33% | 50,000 | $2,415,033 |

| CDX | Cardiex Limited | 0.125 | 30% | 861,962 | $28,240,759 |

| NME | Nex Metals Explorat | 0.036 | 29% | 124,742 | $7,623,783 |

| EVG | Evion Group NL | 0.037 | 28% | 1,145,377 | $10,061,932 |

| AVE | Avecho Biotech Ltd | 0.003 | 25% | 252,862 | $6,338,594 |

| BCM | Brazilian Critical | 0.010 | 25% | 50,200 | $6,953,531 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 81,270,660 | $6,192,443 |

| IG6 | Internationalgraphit | 0.064 | 23% | 97,416 | $10,065,033 |

| CCO | The Calmer Co Int | 0.011 | 22% | 44,771,518 | $19,812,478 |

| NVU | Nanoveu Limited | 0.045 | 22% | 12,698,600 | $18,682,140 |

| WEC | White Energy Company | 0.060 | 20% | 8,908 | $9,949,214 |

| PUR | Pursuit Minerals | 0.003 | 20% | 60,000 | $9,088,500 |

| KCC | Kincora Copper | 0.043 | 18% | 174,132 | $7,844,199 |

| ASH | Ashley Services Grp | 0.230 | 18% | 201,081 | $28,075,301 |

| MTC | Metalstech Ltd | 0.170 | 17% | 275,702 | $28,566,216 |

| BP8 | Bph Global Ltd | 0.004 | 17% | 125,000 | $1,189,924 |

| GTI | Gratifii | 0.004 | 17% | 262,338 | $12,008,879 |

| JAV | Javelin Minerals Ltd | 0.004 | 17% | 466,667 | $15,568,189 |

Auking Mining (ASX:AKN), in partnership with local Saudi company Barg Alsaman Mining Company (BSMC), has won the bid for the Shaib Marqan gold exploration licence in Saudi Arabia.

The project is located in a promising gold-mineralised area within the Arabian-Nubian Shield, close to established gold deposits like the Al Amar mine, which produced nearly 30,000oz of gold in 2022.

The area is under-explored, with at least 22 ancient workings and gold-rich quartz veins averaging 5.8g/t, reaching up to 40g/t in some samples. The company will now work with the Saudi Ministry and BSMC to finalise the exploration licence in the coming weeks.

Si6 Metals (ASX:SI6) said it will begin a drill program in November 2024 at the Fred’s Well prospect, located within its Monument Gold Project in Western Australia’s Laverton Gold District.

The program will include 1,700 metres of drilling with 25 aircore and 2 reverse circulation holes, targeting an area along a 30km structural trend with promising gold mineralisation.

Fred’s Well is close to Monument’s 154,000oz gold resource, with previous drilling intercepts showing significant gold, including 24m at 3.24g/t Au. The drilling will aim to expand the resource by testing the depth and strike of known mineralised areas, potentially upgrading the project’s resource calculation.

Red Mountain Mining (ASX:RMX) has received promising gold results from 91 rock chip samples collected from its Flicka Lake prospect in Ontario, Canada.

The best results came from the Flicka Zone, with Vein #2 returning values of 24.2g/t Au and 19.4g/t Au, and Vein #3 showing a peak of 9.35g/t Au.

These results confirm high-grade gold mineralisation at Flicka Lake, similar to historical data, and highlight the potential for strike extension of the mineralisation along the shear. Additional soil assay results are expected by the end of November.

Lord Resources (ASX:LRD) has secured an earn-in agreement to acquire up to 80% of the Ilgarari Copper Project in Western Australia, which hosts high-grade copper mineralisation over a 4 km strike.

Historic drilling has returned impressive results, such as 17m at 1.27% Cu and 3m at 3.26% Cu, with mineralisation continuing into fresh sulphide ore at depth.

The project is located near Newman, and further exploration will focus on extending known mineralisation and identifying the source, with additional tenement applications submitted to cover regional structures. CEO Andrew Taylor highlighted the acquisition as a low-cost entry into a highly prospective copper project.

Evion Group’s (ASX:EVG) joint venture (JV) near Pune, India, has completed production testing and secured its first sales contract for expandable graphite, with 386 tonnes to be sold to European buyers for over A$2 million at prices above US$3,000 per tonne.

The JV expects to produce around 400 tonnes over the next 10 weeks, with further sales contracts likely to follow, as global demand for expandable graphite grows, especially in industries like electric vehicles, energy storage and aerospace.

Arika Resources (ASX:ARI) has reported strong new gold intercepts from its recently completed drilling program at the Landed at Last prospect, part of its Yundamindra Gold Project in Western Australia. Notable results include thick, high-grade zones such as 30m at 2.26g/t gold and 40m at 1.22g/t gold, confirming the scale and potential of the deposit. These results build on previous high-grade intersections from May’s maiden drilling program and extend the mineralisation both at surface and at depth.The Landed at Last prospect is part of a 2.5km gold mineralised corridor, with many of the structures still untested.

Prodigy Gold (ASX:PRX) has received final results from its September 2024 drilling program at Tregony North, with several promising gold intercepts. Highlights include 21m at 4.4g/t gold, with a 1m section returning 24.7g/t gold, and 13m at 2.7g/t gold, with 2m at 9.7g/t gold. These results add to the previously reported strong findings from the Hyperion area and will be incorporated into an updated Tregony Mineral Resource in the coming months.

Nanoveu (ASX:NVU) is set to begin the next phase of benchmarking for the ECS-DOT System-on-a-Chip (SoC) technology developed by Embedded A.I Systems (EMASS). Starting 7th November, the testing will focus on key AI applications, Anomaly Detection and Keyword Spotting, using the industry-standard MLPerf Tiny AI suite. The ECS-DOT’s performance will be measured against current semiconductor leaders, STMicroelectronics and Syntiant, with results expected within a week.

The Calmer Co International (ASX:CCO) has posted a record-breaking revenue of over $860,000 in October, equating to an annualised rate of more than $10 million. This marks a threefold increase compared to October 2023.

The impressive result was driven by strong sales across both the Amazon USA channel and the Australian Shopify eCommerce platform, with eCommerce sales reaching $670,000, or more than $21,500 per day. The company has also launched new products such as its Taki Mai flavoured dietary shots and kava stick packs.

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| FCG | Freedom Care | 0.070 | -46% | 1,019,754 | $3,104,908 |

| ADD | Adavale Resource Ltd | 0.002 | -20% | 92,592 | $3,059,413 |

| LPD | Lepidico Ltd | 0.002 | -20% | 10,659 | $21,472,812 |

| MRQ | Mrg Metals Limited | 0.004 | -20% | 3,087,161 | $13,632,593 |

| RIL | Redivium Limited | 0.004 | -20% | 653,121 | $13,734,274 |

| WML | Woomera Mining Ltd | 0.002 | -20% | 254,194 | $5,416,475 |

| CLU | Cluey Ltd | 0.037 | -18% | 7,148 | $15,877,068 |

| CUL | Cullen Resources | 0.005 | -17% | 152,977 | $4,160,411 |

| GES | Genesis Resources | 0.005 | -17% | 50,000 | $4,697,048 |

| M2R | Miramar | 0.005 | -17% | 1,815,333 | $2,380,940 |

| PRM | Prominence Energy | 0.005 | -17% | 7,463 | $2,335,058 |

| RHK | Red Hawk Mining Ltd | 0.695 | -16% | 21,530 | $164,844,470 |

| ILT | Iltani Resources Lim | 0.190 | -16% | 342,843 | $9,902,364 |

| ALM | Alma Metals Ltd | 0.006 | -14% | 2,502,314 | $10,798,617 |

| MOH | Moho Resources | 0.006 | -14% | 65,999 | $3,774,247 |

| WNR | Wingara Ag Ltd | 0.006 | -14% | 167,272 | $1,228,798 |

| JBY | James Bay Minerals | 0.485 | -14% | 706,395 | $18,895,013 |

| S66 | Star Combo | 0.130 | -13% | 150,000 | $20,262,447 |

| QHL | Quickstep Holdings | 0.195 | -13% | 81,841 | $16,138,398 |

| B4P | Beforepay Group | 1.130 | -13% | 112,362 | $62,632,138 |

| FRB | Firebird Metals | 0.100 | -13% | 135,474 | $16,371,561 |

ADX Energy (ASX:ADX) has mobilised a workover rig and testing equipment to prepare its Welchau-1 discovery well in Upper Austria for production testing. This will confirm if the hydrocarbons present are indeed light oil with associated gas as well as the well’s ability to flow.

Drilling at Arika Resources’ (ASX:ARI) Yundamindra project in WA has continued to return exceptional shallow gold results including a 30m thick hit grading 2.26g/t at the Landed at Last prospect. The results point to a significant shallow gold orebody extending >2.5km.

Ark Mines (ASX:AHK) has upgraded the monazite equivalent grade range of the conceptual exploration target for its Sandy Mitchell rare earths project to between 1286 parts per million (ppm) to 1903ppm monazite equivalent.

While the tonnage range remains unchanged at between 1.3 billion tonnes (Bt) to 1.5Bt, the grade range is up from the previous 1250ppm to 1490ppm monazite equivalent, further emphasising its potential as one of the world’s largest surface-expressed, sand-based placer rare earth deposits.

“We are excited to move forward with development for what is a very large deposit within a simple mineralised structure, which can be extracted with an extremely low environmental impact,” executive director Ben Emery said.

“The increase in MzEq grades as part of this updated exploration target will be incorporated into a forthcoming scoping study for Sandy Mitchell, and we look forward to providing further updates on project development once the results of the scoping study are announced.”

The first phase of Earths Energy’s (ASX:EE1) Techno-Economic Feasibility Study (TEFS) has found that its Paralana project in South Australia is suitable for enhanced geothermal system development due to favourable permeability and the right horizontal well drilling stress environment.

Argent Minerals (ASX:ARD) has completed 50 reverse circulation drill holes totalling 2943m across its wholly-owned Kempfield polymetallic gold-silver-lead-zinc project in New South Wales.

These holes targeted a 200m by 40m mineralised zone, which was delineated during the July-August 2024 fieldwork program, that extends the Kempfield NW zone to over 2km by and average width of 100m.

A further 12 holes totalling 1300m will be drilled to test the mineralised silver-base-metal lithology extension proximal to the Lode 300 Mineralised Zone that was discovered by the August 2024 rock chip reconnaissance program.

D3 Energy (ASX:D3E) has completed production testing at RBD01 – a repurposed gold exploration hole, which flowed gas at an average rate of 93,000 standard cubic feet per day during a 15-day period.

Importantly, world-class concentrations of 6.2% helium were measured after 12 days of sustained production, the highest recorded to date across its wells.

Managing director David Casey said it was pleasing to flow and measure gas from a legacy gold exploration hole drilled in 1982 and that the sustained gas rate was encouraging given the lack of any decline and potential downhole obstructions identified in RBD01. RBD01 has been shut-in to allow reservoir pressures to build and the company will now move to test the recently drilled RBD12 well.

Shares of D3E have also started trading on the OTCQB Venture Market in the US under the symbol DNRGF, providing the company with access to a broader network of US-based investors, enhancing market visibility and increasing liquidity for shareholders.

Dimerix (ASX:DXB) is hosting a webinar dedicated to reviewing key initial findings from Project PARASOL, a collaborative international initiative for clinical endpoints in focal segmental glomerulosclerosis (FSGS).

Project PARASOL is focused on defining quantitative relationships between short-term changes in key biomarkers—proteinuria and glomerular filtration rate (GFR)—and long-term outcomes in FSGS.

It seeks to establish alternative proteinuria-based endpoints to support both accelerated and traditional approval pathways for FSGS treatments.

Regener8 Resources (ASX:R8R) has wrapped up maiden drilling testing the Hatlifter nickel-cobalt and Grasshopper rare earths-niobium targets at its East Ponton project in WA.

Samples from the drilling have been sent to ALS for assay.

“Regener8 has safely completed the maiden drilling program at East Ponton. We are proud of the team overcoming challenging subsurface drilling conditions and look forward to receiving assay results in the coming months,” managing director Stephen Foley said.

At Stockhead, we tell it like it is. While ADX Energy, Argent Minerals, Arika Resources, Ark Mines, D3 Energy, Earths Energy, Dimerix and Regener8 Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.