Closing Bell: Staples go stupid as ASX200 proves it’s no Dow Jones, but it can be average

News

News

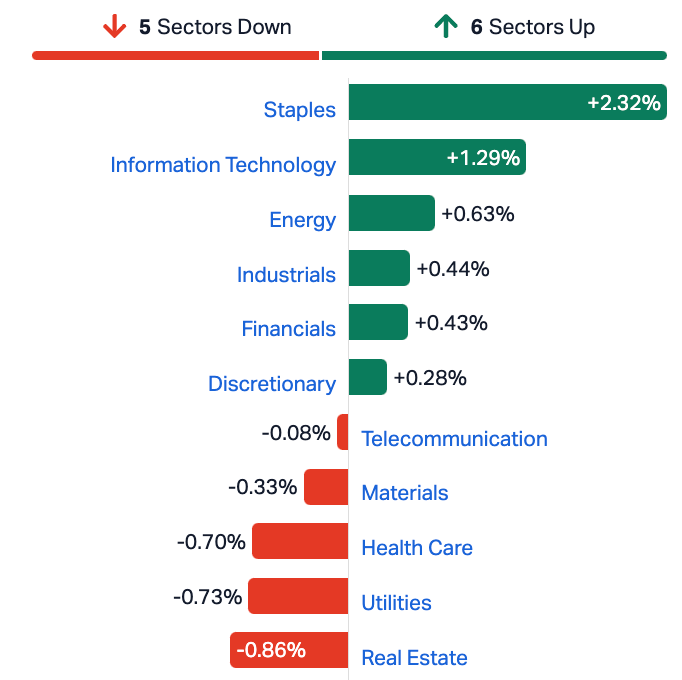

The indignation of Coles has led Consumer Staples to a 2.3% gain on Tuesday, the supermarket literally dragging the benchmark’s corpse into the green light of day.

Everyone over here at Stockhead likes a comeback story. This was not that kind of comeback.

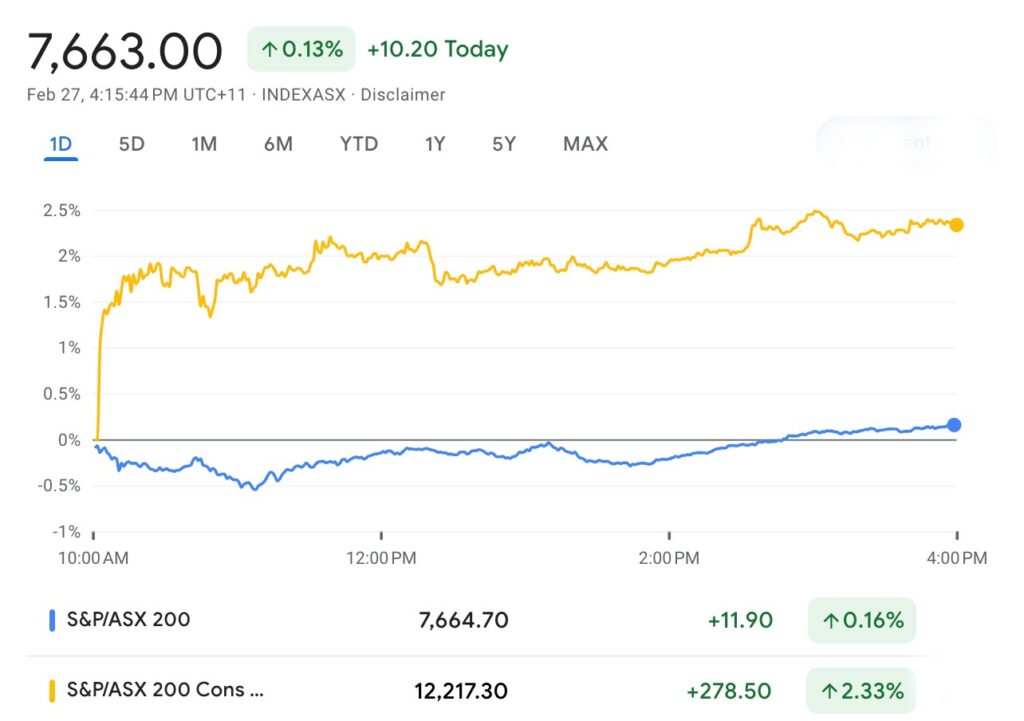

At 4.15pm on Tuesday February 26, the S&P/ASX200 closed up 10 points or 0.13% higher to 7,663.

After a dull lead from the states and iron ore losses across the planet, the ASX found itself behind the eight ball this morning and peppered with corporate earnings of all stripes throughout a wobbly old Tuesday.

While the benchmark did end higher, there’s a fair bit of angst on the trading floor because as the monthly shadow of new inflation data for January looms large on Wednesday.

This month Tony Sycamore from IG markets says the monthly CPI indicator is expected to increase to 3.5% YoY, largely due to base effects.

“Nonetheless, the trend of softer inflation and a cooling labour market will likely enable the RBA to remove its tightening bias in the coming months before cutting rates by 25 rate cuts in August and delivering a second 25 bp cut in November.”

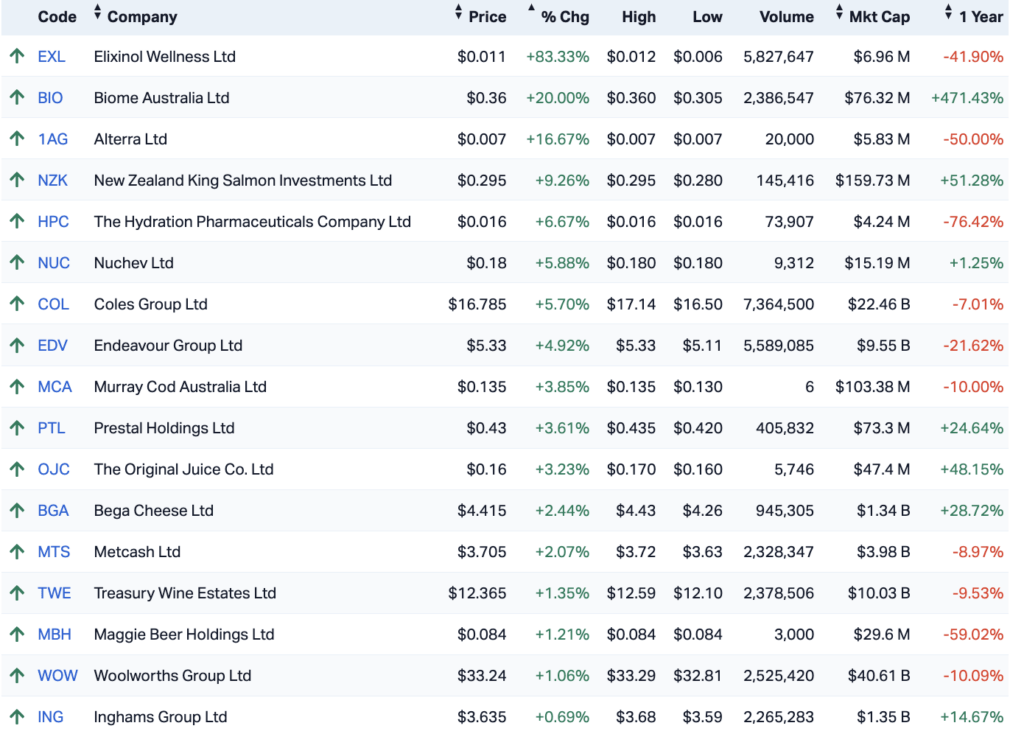

Today the standout run for Consumer Staples came on the back of a defiant session for Coles Group (ASX:COL) which delivered better-than-expected results and an up yours to critics of the supermarket giant which has been accused of price gouging.

Coles enjoyed its best session since all the money it made during the pandemic.

The success dragged the entire sector higher, with Endeavour Group (ASX:EDV) not far behind.

Coles surged after its underlying EBITDA increased 4.1% to $1,900mn and opened up a fully franked interim dividend of 36 cents per share.

The market’s reaction to Coles throws what happened last week at Woolies into starker relief – WOW’s share price fell 8.9% after missing expectations and CEO Brad Banducci stormed off into his shock retirement.

Elsewhere, Adbri (ASX:ABC) says the $2.1bn, $3.20 a pop takeover offer from Ireland-based CRH is a go-go. The plan is that with the support of major shareholder (42.7%) Barro Group, CRH would acquire all of the shares Barro doesn’t.

Full year underlying EBITDA at Adbri was up 31% to $311m, after a 13.1% revenue lift to $1.92bn.

Statutory NPAT fell 9.5% to $92.9m, after last year’s property profits land sales at Moorebank and Rosehill. The company says price increases and strong demand delivered the decent underlying result.

The company has kept dividend payments on hold to reduce debt and to pay for upgrades to its Western Australian cement facility at Kwinana.

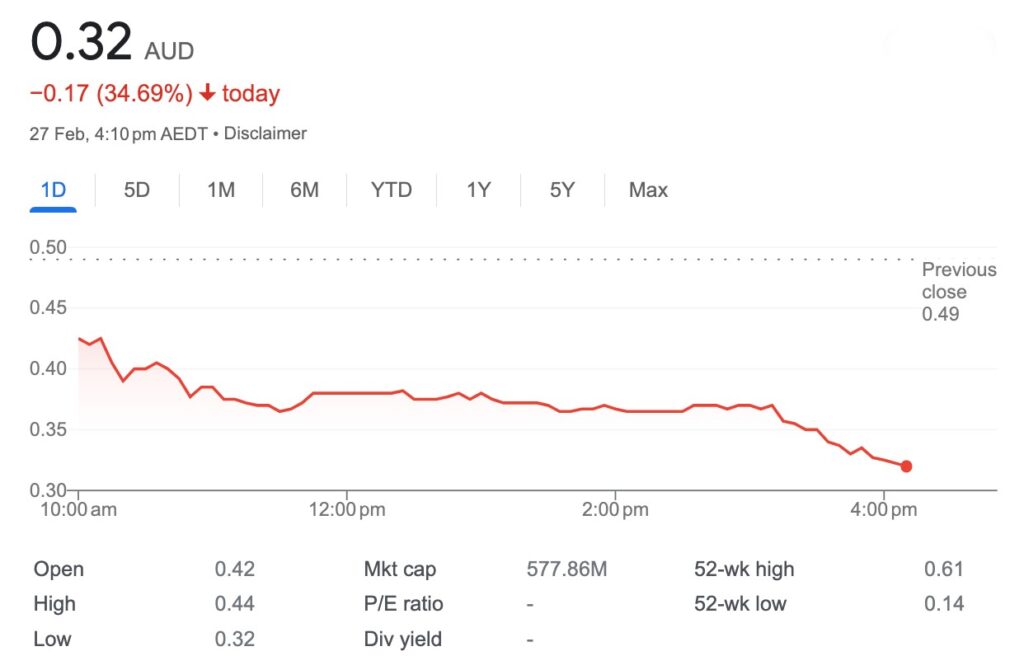

Tech stocks slumped after the Nasdaq fell overnight. The major drags included Block Inc (ASX:SQ2) (-5.3%) and BrainChip Holdings (ASX:BRN) which has had some kind of aneurism.

Down 35%.

Energy was the other winner after oil prices regained some upward momentum last night.

These ASX300 companies dropped earnings today…

Abacus Group (ASX:ABG)

Adbri (ASX:ABC)

Altium (ASX:ALU)

Alumina (ASX:AWC)

Appen (ASX:APX)

Articore Group Ltd. (ASX:ATG)

Austin Engineering (ASX:ANG)

City Chic Collective (ASX:CCX)

Coles Group (ASX:COL)

Woodside Energy Group (ASX:WDS)

Helia Group (ASX:HLI)

Johns Lyng Group (ASX:JLG)

Reece (ASX:REH)

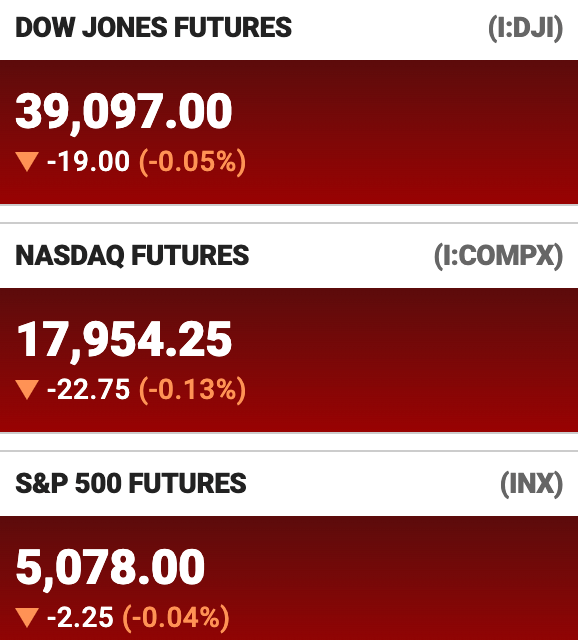

US Markets…

On Monday night in New York the S&P500 ended 0.4% lower with most sectors negative.

Consumer Discretionary and Energy the outperformers. Comms services and Utilities struggled the most.

US Small caps reversed higher, with the Russell 2000 rising 0.6%.

One problem was the lift in US Treasury yields.

The 10-year Treasury note rose 2 basis points to 4.28% while the 30-year also inched up 2 basis points to 4.4%. The 5-year yield popped 3 basis points to 4.31% while the 2-year rose 4 basis points to 4.73%.

Next door, the Dow Jones Industrial Average snapped a 3-day winning streak as it fell 62 points, or nearly 0.2%.

Salesforce (CRM) probably stood out the most as it gained 2.6%.

Berkshire Hathaway lost almost 1.9% following its ho-hum earnings report over the weekend. Hey. It’s still trading near all-time highs. And those highs really are high.

But some names a re looking heavily pumped and Berkshire fits the bill. Analysts have said recent price action suggests the stock is peaking, at least in the short term.

Chief Executive and Friend of the Show, Warren Buffett took time in his annual letter to shareholders to explain how difficult it is for the firm to find good takeover candidates in an era of plentiful capital.

“Size did us in, though increased competition for purchases was also a factor,” he said.

In the past, Berkshire was able to make transformative deals such as purchasing insurance giant Geico and BNSF Railway. Buffett also said Berkshire has “no possibility of eye-popping performance.”

Nevertheless, Berkshire Hathaway earnings rose 28% on an operating basis vs. a year earlier to $8.48 billion,

The so-called Magnificent 7 stocks had a mixed start to the week, with Tesla (TSLA) doing the best as it rallied almost 4%. That said, it was Chinese competitor Li Auto (LI) which ended near 19% higher as the EV stock delivered a punchy Q4 with earnings per ADS at 60 cents, which was a handy 1,400% increase on the 4 cents per ADS of a year earlier.

Revenue soared 130% to $5.88 billion. It was also well clear of Wall Street which expected earnings per ADS of 44 cents on revenue of $5.5 billion.

Nvidia (NVDA) also ended in positive territory, rising 0.4%.

Google-daddy Alphabet (GOOGL) struggled most as it fell 4.4% in above-average volume. Shares fell amid criticism of its “Gemini” artificial intelligence system which GOOGL had to pull the plug amid a media backlash over inaccurate racial depictions of historical figures.

Apple (APPL) fell 0.8%, Microsoft (MSFT) shed 0.7%. Meta Platforms (META) and e-commerce giant Amazon.com (AMZN) flirted with positive territory but Meta fell 0.5% while Amazon dipped 0.2%.

This means Amazon was back where it began – despite the fireworks of joining the Dow Jones Industrial Average, which it did on Monday.

Here’s where US Futures are pointed..

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BP8 | Bph Global Ltd | 0.002 | 100% | 274,588 | $1,954,116 |

| AUA | Audeara | 0.065 | 97% | 1,969,631 | $4,772,055 |

| EXL | Elixinol Wellness | 0.009 | 50% | 6,028,632 | $3,797,230 |

| MTB | Mount Burgess Mining | 0.003 | 50% | 2,000,000 | $2,089,627 |

| HIQ | Hitiq Limited | 0.026 | 30% | 94,000 | $7,036,899 |

| OEQ | Orion Equities | 0.22 | 29% | 14,603 | $2,660,369 |

| 5EA | 5Eadvanced | 0.225 | 29% | 1,895,487 | $54,804,972 |

| NAG | Nagambie Resources | 0.029 | 26% | 545,061 | $18,322,621 |

| AMD | Arrow Minerals | 0.005 | 25% | 35,480,683 | $26,735,060 |

| IVX | Invion Ltd | 0.005 | 25% | 956,423 | $25,698,129 |

| TMK | TMK Energy Limited | 0.005 | 25% | 8,346,247 | $24,490,317 |

| SRK | Strike Resources | 0.049 | 23% | 494,482 | $11,350,000 |

| ARN | Aldoro Resources | 0.105 | 22% | 253,677 | $11,577,642 |

| EQS | Equitystorygroupltd | 0.036 | 20% | 275,000 | $1,278,444 |

| BIO | Biome Australia Ltd | 0.36 | 20% | 2,432,625 | $63,603,194 |

| INP | Incentiapay Ltd | 0.006 | 20% | 1,043,578 | $6,219,650 |

| SIT | Site Group Int Ltd | 0.003 | 20% | 914,000 | $6,506,226 |

| YAR | Yari Minerals Ltd | 0.006 | 20% | 83,160 | $2,411,789 |

| REH | Reece Limited | 28.72 | 19% | 846,371 | $15,561,758,920 |

| TRI | Trivarx Ltd | 0.038 | 19% | 3,609,112 | $10,824,918 |

| LEL | Lithenergy | 0.54 | 19% | 247,429 | $46,869,550 |

| AJL | AJ Lucas Group | 0.013 | 18% | 560,912 | $15,133,026 |

| AME | Alto Metals Limited | 0.027 | 17% | 236,000 | $16,595,033 |

| AMX | Aerometrex Limited | 0.31 | 17% | 232,831 | $25,172,519 |

| TBN | Tamboran | 0.2275 | 17% | 3,074,588 | $401,756,004 |

Up circa 90% is the Aussie “global hearing health leader specialising in innovative listening solutions for people with hearing challenges”, – (that’ll be you Mr Audeara (ASX:AUA)) has made a groundbreaking, milestone-making maiden sale – to mass manufacture AUA audio tech for Avedis Zildjian.

The maiden third party purchase order of $2.1m is also the largest single order Audeara has received since inception.

AUA co-founder and CTO Alex Afflick says the purchase is “expected to have a significant positive impact on the Company’s cashflow and its push toward breakeven and profitability.”

First announced early last year, the project AUA says, is nearing mass production, ahead of a commercial launch anticipated in H1 FY25.

OD6 Metals (ASX:OD6) says it’s just pumped about the quality of the metallurgical recoveries from samples tested at the Australian Nuclear Science Organisation (ANSTO), including – apparently – up to 90% of Magnet Rare Earth Elements (MagREE) in multiple Prospect areas, across 60 new samples.

Lots and lots happening out of these samples from Splinter Rock with OD6 claiming that recoveries for all MagREO are inclusive of Nd, Pr, Dy, Tb similar.

This is the key to overall project economics for any clay hosted rare earth project.

MD Brett Hazelden says the metrics align closely with the essential value drivers we believe are crucial for the economic viability of clay-hosted rare earth projects.

“The outstanding results from our metallurgical leaching studies continue to affirm the Splinter Rock project as Australia’s premier clay-hosted rare earth deposit. With consistent recoveries averaging over 60% across multiple prospects, and notably high recoveries observed for each of the fifteen rare earth elements, our confidence in the project’s potential remains high.”

Meanwhile, battery metals stocks have been crunched lately, but one brave US-based ASX battery metals player is taking care of Tuesday with a startlingly comprehensive update on progress at the 5E Boron Americas Complex in California.

Word is: it remains on track to kickstart commercial operations at the new boron and lithium mine in California in the second quarter of this year.

5E Advanced Materials (ASX:5EA) is planning to open what will be only the second major boric acid operation in America. The other is a non-core asset owned and operated by Rio Tinto (ASX:RIO) which has been in business since 1927.

5EA CEO Susan Brennan says the company remains on track to start commercial ops in CY Q2 2024, with all mining operations and related activities on track as it moves closer to initial boron and lithium production.

Just how big a deal is it, Ms Brennan?

“I cannot emphasize enough the importance 5E will represent in the US in the coming months as a new and secure producer of critical materials needed for clean energy economies.”

That’s how much.

And new sources of the ‘supermaterial’ — used alongside rare earths metals in permanent magnets, fire retardants, ceramics, fertiliser, detergent and more — are essential given the concentrated nature of the market.

5EA began mining at its Boron Americas Complex at Fort Cady last month, where it plans to produce 2000tpa of boric acid and 100tpa of lithium carbonate from a starter plant in 2024 before ramping up in a US$389m expansion to 90,000tpa and 1100tpa in 2026.

Finally, a shout out to Elixinol Wellness (ASX:EXL), which is up about 88%. It could be the Germans. or it could be that this is just a stunner of a prospects…

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| DGL | DGL Group Limited | 0.61 | -41% | 11,372,619 | $293,711,155 |

| BRN | Brainchip Ltd | 0.325 | -34% | 53,089,583 | $884,849,196 |

| ACE | Acusensus Limited | 0.76 | -33% | 2,841,047 | $144,095,972 |

| ICL | Iceni Gold | 0.018 | -33% | 1,771,022 | $6,657,148 |

| AVW | Avira Resources Ltd | 0.001 | -33% | 1,285,000 | $3,200,685 |

| PPG | Pro-Pac Packaging | 0.2 | -30% | 10,000 | $51,780,998 |

| ATG | Articore Group Ltd | 0.57 | -29% | 3,511,312 | $226,226,630 |

| DCX | Discovex Res Ltd | 0.0015 | -25% | 1,500,322 | $6,605,136 |

| ASH | Ashley Services Grp | 0.26 | -25% | 1,473,816 | $49,671,687 |

| ASP | Aspermont Limited | 0.007 | -22% | 104,503 | $22,100,712 |

| T3D | 333D Limited | 0.007 | -22% | 5,393 | $1,075,004 |

| BUX | Buxton Resources Ltd | 0.105 | -22% | 327,285 | $23,388,330 |

| MPK | Many Peaks Minerals | 0.094 | -22% | 29,000 | $4,370,476 |

| ENV | Enova Mining Limited | 0.04 | -22% | 85,018,301 | $32,687,396 |

| MEG | Megado Minerals Ltd | 0.011 | -21% | 729,287 | $3,562,378 |

| CCZ | Castillo Copper Ltd | 0.004 | -20% | 1,270 | $6,497,527 |

| NRZ | Neurizer Ltd | 0.004 | -20% | 27,071,129 | $7,319,554 |

| SI6 | SI6 Metals Limited | 0.004 | -20% | 781,561 | $9,969,297 |

| TRJ | Trajan Group Holding | 1.055 | -19% | 3,148,872 | $197,880,911 |

| BIT | Biotron Limited | 0.069 | -19% | 8,166,017 | $76,693,418 |

| OXT | Orexploretechnologie | 0.022 | -19% | 464,545 | $5,276,222 |

| NOX | Noxopharm Limited | 0.06 | -18% | 142,840 | $21,333,370 |

| ARR | American Rare Earths | 0.24 | -17% | 8,493,296 | $130,042,757 |

| ME1 | Melodiol Glb Health | 0.0075 | -17% | 12,528,338 | $2,536,828 |

| RNT | Rent.Com.Au Limited | 0.025 | -17% | 337,322 | $18,889,487 |

ICYMI Closing Bell 27022024

Impact Minerals (ASX:IPT) has identified a new proprietary metallurgical process that could make it cheaper to produce high purity alumina (HPA) from its Lake Hope project in Western Australia. Following months of laboratory test work, the company confirmed successful production of the desired 4N HPA via a low-temperature leach (LTL) and acid digestion methodology.

Near-term gold developer Brightstar Resources (ASX:BTR) has another reason to be smiling with priority assays from two metallurgical diamond holes at the unmined Cork Tree Well deposit returning significant intersections with visible gold, including a standout hit of 27.6m @ 17.77g/t gold from 51m.

BPM Minerals (ASX:BPM) is 60% of the way through a 10,000m drill program at its 134km2 Claw gold project, just 500m from the 3.24Moz Mt Gibson gold mine being developed by Capricorn Metals (ASX:CMM).

More success for TG Metals (ASX:TG6) at Burmeister with initial assays returning more high-grade lithium intersections of up to 23.5m @ 1.52% Li2O from the recent drilling over one of the key prospects at its Lake Johnston project.

With Pond 1 earthworks and liner installation now complete at its Hombre Muerto West Phase 1 lithium brine project in Argentina, Galan Lithium (ASX:GLN) is well on track to achieve its stated goal of producing first chloride during the first half of 2025.

Also in Argentina, Belararox (ASX:BRX) has begun field work at Tambo South – the fifth of 12 such targets within its TMT project – located just north of the Filo Del Sol mine operated by Filo Mining, which recently welcomed an investment of $113.16 million for a 5% stake in the $3.1 billion-capped company.

Ionic Rare Earths (ASX:IXR) has increased the exploration target over its Makuutu heavy rare earths project by a whopping 40% to 285-766Mt @ 400-700ppm total rare earth oxides (TREO). This will be used to plan future drill programs and is additional to the current MRE for the Ugandan project.

And Pure Hydrogen (ASX:PH2) has received a binding purchase order from Wilba Transport – on behalf of the NSW Government – for the delivery of one of its +$700,000 battery electric vehicle EV70 Mini Buses for the regional Bourke jurisdiction.

Dubber Corp (ASX:DUB) ) – Dubber is investigating accounting issues that have come to light in connection with the audit review of the Company’s 31 December 2023 half-year account.

Frontier Energy (ASX:FHE) – pending an announcement regarding the results of a Definitive Feasibility Study.

New Age Exploration (ASX:NAE) – pending an announcement to be made by the Company to the market in connection with the execution of a Mineral Rights and Tenement Acquisition Agreement.

WhiteHawk (ASX:WHK) – pending an announcement concerning a capital raising.

Xstate Resources (ASX:XST) – pending an announcement to the market regarding a material asset divestment.