Closing Bell: Small caps surge again, up 1.5% with lithium the source of this apparently renewable energy

News

News

Following a Wednesday night of fine, rich gains, local stocks refused to share on Thursday morning before a little bit of small cap momentum inspired a little giving.

The Emerging Companies (XEC) index is heading into the end of business almost 1.5% higher, while the benchmark has surged beyond parity and is abut 0.4% ahead.

The lithium producers are a likely source of this apparently renewable energy – they lifted in concert after Tesla beat profit expectations, regardless of the boss trying to buy Twitter and a whole cavalcade of disruptions hitting its manufacturing plants in China.

The King of EVs forecast sales to climb some 50% over the next few years, with Emma’s Aussie-listed lithium miners of both the hard rock and the briney-brine set to benefit.

How good was her timing on this bible of Aussie lithium.

And for where all the lithium names lined up at the close today – Emma D is all over that as well – what a legend!

Inflation and toothless central banking continues to be front of mind for equity investors everywhere.

This afternoon, Sydney time, The Bank of Japan chose to hold its short-term rate at minus 0.1%, smack on consensus because (just like Texas…) the BoJ does not have a Plan B.

Later today, the European Central Bank (ECB) will also make its interest rates decision.

Overnight UK inflation estimates hit fresh 40-year-highs:

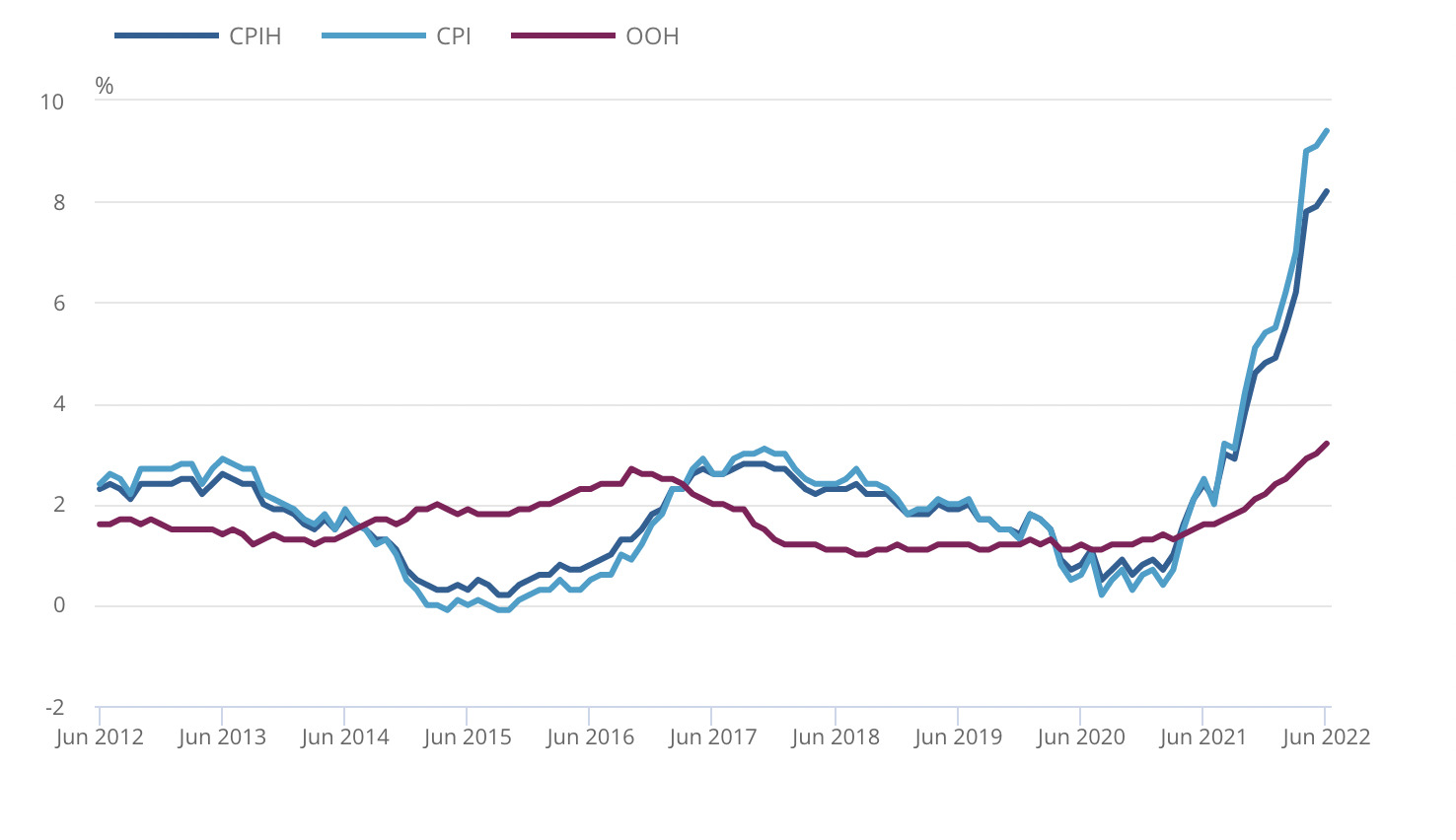

CPI 12-month inflation rates for the last 10 years – June 2012 to June 2022 via the UK Office of National Stats (CPIH is core inflation with housing, BTW)

These are dark times according to the Office for National Statistics (ONS), with the only glimmer of light that inflation somehow still remain short of the 2.5% monthly increase back in April.

Already under intense pressure, the BoE has now gone for five straight 25 basis point (bps) hikes, but the bank’s Guv’nah Andrew Bailey, Tuesday Sydenham time said the BoE’s Monetary Policy Board would be looking hard at a 50 bps hike at its next (August) policy meet.

Nothing is off the table, he said, as central banks worldwide have been rushing to hike rates to meet the challenge of surging inflation.

Gold is having a dreadful run and is hitting some post-pandemic doldrums, a burgeoning USD and rising interest rates chalking up another successful double-team.

Here are the best performing ASX small cap stocks for July 21 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| TOR | Torque Met | 0.215 | 43% | 4,261 |

| DVL | Dorsavi Ltd | 0.014 | 40% | 1,241,202 |

| SBR | Sabre Resources | 0.0055 | 38% | 44,374,822 |

| DOU | Douugh Limited | 0.027 | 35% | 4,900,472 |

| SPT | Splitit | 0.225 | 29% | 4,524,236 |

| ALM | Alma Metals Ltd | 0.014 | 27% | 38,000 |

| AKN | Auking Mining Ltd | 0.125 | 25% | 1,278,336 |

| BDG | Black Dragon Gold | 0.05 | 25% | 85,442 |

| MGG | Mogul Games Grp Ltd | 0.0025 | 25% | 750,000 |

| IOU | Ioupay Limited | 0.081 | 25% | 18,385,508 |

| AWV | Anova Metals Ltd | 0.011 | 22% | 100,000 |

| TLX | Telix Pharmaceutical | 6.77 | 22% | 2,204,441 |

| RXM | Rex Minerals Limited | 0.17 | 21% | 1,548,009 |

| BDM | Burgundy D Mines Ltd | 0.16 | 21% | 617,516 |

| NUH | Nuheara Limited | 0.295 | 20% | 599,813 |

| NSX | NSX Limited | 0.06 | 20% | 365,836 |

| ECG | Ecargo Hldg | 0.012 | 20% | 14,000 |

| SIH | Sihayo Gold Limited | 0.003 | 20% | 196,667 |

| TKL | Traka Resources | 0.006 | 20% | 1,097,454 |

| IHR | intelliHR Limited | 0.073 | 20% | 113,620 |

| WYX | Western Yilgarn NL | 0.155 | 19% | 15,247 |

| S66 | Star Combo | 0.225 | 18% | 4,000 |

| ATV | Activeportgroupltd | 0.092 | 18% | 132,311 |

| IKE | Ikegps Group Ltd | 0.7 | 18% | 195,144 |

| SYA | Sayona Mining Ltd | 0.1875 | 17% | 91,674,369 |

Shares in the Perth-based gold-nickel Torque Metals’ (ASX:TOR) jumping a whole heap very quickly this morning on zero news and only slightly higher volumes.

TOR was last in the news when it began exploration at its Domingo and Melchior nickel prospects within the Paris Project, southeast of Kalgoorlie in the gold-rich Boulder Lefroy Fault Zone.

“We anticipate plenty of news flow from this nickel search, and the Paris gold drilling program in the coming weeks,” CEO Cristian Moreno says.

Sabre Resources (ASX:SBR) is up and rattling after launching what it describes as an ‘AGGRESSIVE’ nickel sulphide drilling and exploration program at both the Nepean South Project in the eastern Goldfields of WA and the Sherlock Bay Project in the Pilbara.

Drill targeting at both projects is being guided by previous nickel and other pathfinder results (including copper) and detailed geophysical surveys – including magnetics, gravity, and electromagnetics.

“These are exciting times for Sabre and we look forward to updating the market on the results from both Nepean South and Sherlock Bay as they come to hand,” SBR CEO Jon Dugdale says.

Copper and gold junior Aeris Resources (ASX:AIS) has been all over its Golden Plateau deposit in southeast Queensland like a rash of late.

Located 1km north from the Cracow mill and AIS says it is a high priority exploration area, one that holds the potential to extend the mine life at Cracow.

More high-grade intersections have been returned, with hits up to 17.9m at 6.3g/t gold including 10.7m at 9.4g/t gold and 1m at 9.2g/t gold.

Executive chairman Andrew Labuschagne calls it an ‘exciting’ story for investors.

The Golden Plateau mine and surrounding deposits historically produced approximately 850,000 ounces of gold, within a prospective corridor extending 1km along strike and up to 270m below surface.

Resource definition drilling program will continue throughout the first quarter of FY23.

Diamond explorer Burgandy Diamond Mines (ASX:BDM) is up over 20% on nothing new, other than it launched a new ‘ultra-luxury’ diamond brand – Maison Mazerea – in Paris earlier this month.

The company says that’s the final stage of a strategy to become what crazy Jess or crazy BDM call a world-leading end-to-end fancy colour diamond business.

Crazed rough diamonds aside, the vertically integrated model of mining and buying rough stones – cutting, and polishing, then selling via Maison Mazerea – will allow Burgundy to capture the full margins from the diamond value chain and seriously differentiates its value proposition.

Galena (ASX:G1A) and HAZER (ASX:HZR) are among the laggards on Thursday, shedding circa 20%.

Here are the best performing ASX small cap stocks for July 21 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Security | Description | Last | % | Volume |

|---|---|---|---|---|

| LER | Leaf Res Ltd | 0.022 | -72% | 23,052,365 |

| MEB | Medibio Limited | 0.001 | -50% | 6,677 |

| ALT | Analytica Limited | 0.001 | -33% | 5 |

| T3D | 333D Limited | 0.001 | -33% | 16,584 |

| VPR | Volt Power Group | 0.0015 | -25% | 298,790 |

| GNM | Great Northern | 0.004 | -20% | 84,367 |

| PRM | Prominence Energy | 0.002 | -20% | 1,854,908 |

| HZR | Hazer Group Limited | 0.695 | -17% | 1,791,465 |

| ROG | Red Sky Energy. | 0.005 | -17% | 932,844 |

| TSC | Twenty Seven Co. Ltd | 0.0025 | -17% | 2,043,922 |

| LRL | Labyrinth Resources | 0.021 | -16% | 548,437 |

| G1A | Galena Mining | 0.14 | -15% | 2,116,177 |

| ELE | Elmore Ltd | 0.03 | -14% | 1,933,313 |

| PRS | Prospech Limited | 0.025 | -14% | 144,558 |

| LGM | Legacy Minerals | 0.13 | -13% | 21,280 |

| SFG | Seafarms Group Ltd | 0.013 | -13% | 792,708 |

| EQS | Equitystorygroupltd | 0.076 | -13% | 40,000 |

| ADX | ADX Energy Ltd | 0.007 | -13% | 2,411,611 |

| CLE | Cyclone Metals | 0.0035 | -13% | 5,208,188 |

| IPT | Impact Minerals | 0.007 | -13% | 4,256,914 |

| CI1 | Credit Intelligence | 0.105 | -13% | 97,184 |

| HAL | Halo Technologies | 0.525 | -13% | 62,020 |

| RBX | Resource B | 0.105 | -13% | 261,083 |

| BEX | Bikeexchange Ltd | 0.022 | -12% | 1,092,994 |

| PLG | Pearl Gull Iron | 0.045 | -12% | 4,502 |

Kaiser Reef (ASX:KAU) says it’s diggers-deep in an encouraging maiden JORC Resource for the Maldon Gold Project, which includes the Nuggety Reef section.

KAU has A Mineral Resource Estimate of 1.2 Mt at 4.4 g/t gold (Inferred) for 186,656 ounces of gold, and an exploration target of 1.75 to 2.7Mt at between 3 g/t gold and 4 g/t gold for 165,000-345,000 ounces of gold, which is absolutely tremendous news for everyone involved.

Meanwhile, G8 Education (ASX:GEM) says that it’s come to an arrangement with current MD and CEO Gary Carroll, to start making room for this replacement.

It’s not a ‘here’s your watch, don’t let the door hit you on the way out’ situation, though. Carroll’s going to stick around as a consultant until the end of the year, while the new kid on the block, Pejman Okhovat, gets his feet under the desk.

Okhovat comes into the GEM gig after just 12 months in the MD’s seat at Woolies, where he took a leaf out of his competitor’s playbook, sending the Fresh Food People’s price Down, Down to the tune of 4.3%.

Montem Resources (ASX: MR1) – pending a material announcement

Morella Corporation (ASX:1MC) – pending capital raise

Tombola Gold (ASX:TBA) – pending the release of an announcement regarding a material capital raising transaction