Sheriff of Nottinghike 2: Who let the central banks out?

Put 'em up! Central banks want lower inflation, dead or alive. Via Getty

Seeing as most economists have been unable to predict with any accuracy WTH the Reserve Bank of Australia (RBA) is up to, we sent Stockhead’s Deputy Christian Edwards to hand in his badge and speak instead with the head markets analyst ’round these parts (APAC & Canada) for CMC Markets, Azeem Sheriff.

Like some kind of very brave pale writer Deputy Christian rode into (ahem) Glebe ready to ask all the really tough questions Australia’s best financial journalists have been either too frightened or too well paid to ask.

This is an excerpt of the transcript of the movie of that conversation:

Deputy E: (A handsome and lithe man enters a cafe. He speaks directly into an imaginary camera, making many people uncomfortable) June! Wow. What a month! A world riven. Washington rudderless. China stumbling out of lockdown. New Zealand… who cares. Russia squeezing the life out of its neighbour. The EU kinda squeezing Russia with indecisive and mildly irritating sanctions… And then there’s Mr Inflation – roaming the high plains like some agent of chaos, thumbing his nose at impotent authorities and daring those central banks to come out and play…

Sheriff A: Are you talking to me mate? You know I’ve been here an hour.

Deputy E: That’s just fine. Let’s do this thing. So Azeem, tell me: who let the Central Banks out?

Sheriff A: (instantly warms to this good looking and obviously incisive young man) Well. You’ve done your homework I see. That’s a great question Deputy Edwards! You’re either very brave or grossly underpaid. Please. Sit.

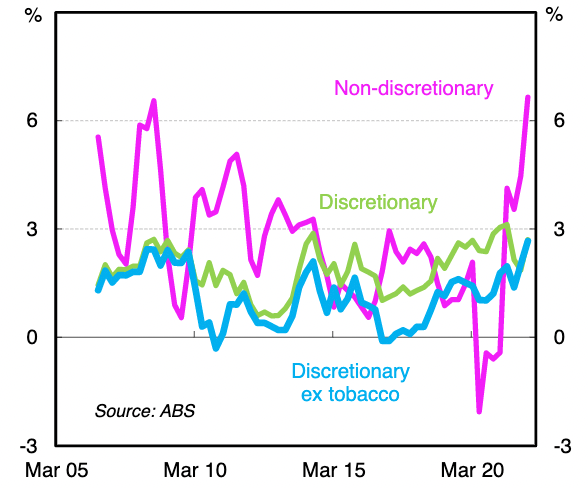

Inflation (annual % change)

Deputy E: Touche.

Sheriff A: And you speak German!

Deputy E: (poor German accent) Off kourse.

Sheriff A: (genuinely impressed) Impressive. Where was I, ah yes, they (central banks) really flexed their muscles and dominated the scene with their very aggressive and unexpected rate hikes which have continued to mess up investors ands stimulate fears of a global recession.

The US Fed cranked it up a notch to 75bps, those hotheads The Swiss came up with a very unexpected 50bps and of course, our local sweetheart the RBA surprised the whole market with the first of many potential hooks of 50bps (market consensus was 25bps) in an attempt to catch the madly accelerating inflation train and get “ahead of the curve”.

Deputy E: Azeem, when you say ‘our local sweetheart the RBA,’ are you in fact referring to the sweethearts at the Oesterreichische Nationalbank – the Reserve Bank of Austria…? Or is it Angola, perhaps, who have a global reputation for being nice?

Sheriff A: We also saw Governor Lowe in an address to AmCham a few weeks back dropping mad little easter eggs about his take on sneaky Mr Inflation, the economic outlook and monetary policy. These are a few key notes I took out of the meeting (hands over beer coasters covered in kids writing in what looks like a brown lipstick)

-

Board expects to discuss 25bps or 50bps at today’s July meeting, similar to June meeting.

-

Board agreed there was a material risk of inflation if they maintained around 25bps.

-

Board felt 50bps was the ideal option, given that the cash rate was still historically low.

-

Coffee was burned. That waiter is ignoring me.

-

Governor didn’t expect the rate increase to affect most of the market as consumers have saved in excess of $250b in personal savings, especially for mortgages.

-

Not expecting a recession in AUS, fundamentals are still very strong including record employment numbers and a 48-year low unemployment rate of 3.9%.

-

The Board expect inflation to be within the 2-3% target range over the next couple of years.

-

Market pricing of 4% cash rate EOY is a bit unreasonable and unlikely.

-

Did I turn the oven off?

Deputy E: And did you?

Sheriff A: Alas, I did not. (uncomfortable silence)

Deputy E: (changing the subject) Pigeon!

Sheriff A: Damn, (hits table) I missed it. Anyway. The Governor also forecast inflation would peak around the 7% mark. Currently, our headline inflation number is 5.1% with a trimmed-mean CPI of 3.7%. We’re seeing that in the US Mr Inflation has been creeping up to 8.6%, and in the EU, banking head Christine La Garde…

Deputy E: Gosh she’s good.

Sheriff A: Just terrific. And such a nice person.

Deputy E: Wow. I knew it. I just… She seems nice. I’ll put a picture of her in the story.

Sheriff A: That’s a lovely idea. Try to find one of her having an exasperated out of body experience after some ECB Governing Council meeting.

Deputy E: Come on man. I think I know my game.

Sheriff A: Anyway, the Europeans came out with that more recent release of the same figure and in the UK we’re topping off the list with a record 9.1% annual inflation…

Deputy E: Hopeless!

Sheriff A: I know, right? They bank like they play rugby (they laugh)

Sheriff A: (nine minutes later…) So, therefore, we could potentially expect a similar pattern with AUS inflation to creep up a bit more before the rate hikes start to kick in and cool inflation.

Deputy E: Can you explain for our audience at home, what key indicators will the RBA use to shoot down inflation and can you find a way to reference the 1990 smash hit sequel to Young Guns, Young Guns II (released in New Zealand as Older Guns 1)

Sheriff A: Well that’s easy. The next two CPI prints are scheduled to be released on 27th July and 26th October 2022 for Q2 and Q3 respectively and therefore will significantly dictate whether the following months will carry a 25bps or 50bps hike. I don’t believe there is sufficient justification to allow a 75bps hike unless inflation just skyrockets. We need to be mindful, that the RBA has two primary roles, a) to keep unemployment low and b) to tackle inflation. All other factors are secondary. “Woah, we’re halfway there” as Bon Jovi said.

Deputy E: (narrows eyes)…

Sheriff A: … since we’ve tackled the unemployment aspect.

Deputy E: I get it. Keep going…

Sheriff A: So. Starting today at 2.30pm Sydenham time. How will the RBA hike, taking into account the CPI releases and the current rising inflation problem…

Deputy E: (dismayed) wait on one goddamned second. Are you saying there’s an inflation problem?!?

Sheriff A: This is the money shot. I want to say this one into the camera.

(Deputy E is still recovering from the inflation news, waves vaguely at an empty seat, Sheriff, entirely unperturbed, turns directly to it) So. I am of the view that the RBA will seek to conduct a rate rise bonanza per the following in July, August, and September, obviously pausing in October for beers, then November and December meetings to bring the cash rate to 2.35% for this cycle – just below the 2.5% mark Governor Lowe expects. Here take these (hands over more beer coasters) you could put them in a list, or dot points when you write up the story. Everyone likes dot points.

Deputy E: (instantly perking right up) OMG. I love dot points too! You have no idea.

CMC Markets RBA rate hike forecast 2022

- July +50bps

- August +25bps

- September +25bps

- October Hold

- November +25bps

- December +25bps

Sheriff A: Hmm. They look a bit like a list… anyway. Of course, the RBA will take a well-deserved break from hiking in January (where there is no meeting because they all go to Vegas apparently) and will monitor the progress/impacts from the first cycle during Q1 ’23, eagerly anticipating the next CPI figures release in Apr ‘23 for Q1.

Deputy E: If you can look into the seeds of time, and say which grain will grow and which will not, speak then to me, who neither fear nor beg your favour.

Sheriff A: The RBA will react again in May ‘23 meeting for another potential 25bps. Potentially one more in Q3 to bring the terminal cash rate to 2.75%. Aggressive tightening of more than 25bps could severely contract the economy giving rise to fears of an AUS recession.. so the RBA will need to slowly release the hikes to allow the economy to digest and absorb.

Deputy E: It’s also key to remember that the RBA does meet monthly – as opposed to other central banks like the Fed which meet every six weeks because why strain yourself, right? Therefore the RBA has the advantage to digest and react sooner, giving more of a reason to increase by 25bps after front loading.

Sheriff A: That’s exactly what I was going to say! Once we get a better picture of the July 22 CPI print, we will be able to reassess the situation. However, the risk is to the upside, where the RBA will most likely throw in a special surprise and catch us most off guard.

Deputy E: A surprise? Like, what are you thinking, more Dine and Discover?

Sheriff A: Exactly. Dine and Discover. ‘The Reserve Your Seat of Australia.’ I believe that’s how they’ll sell it to the country. It’s a ScoMo concept.

Deputy E: Fascinating Azeem. I can picture it so clearly I can actually taste the rising bile. Now, as something of an outlier myself – a sort of hobby contrarian economist if you will – I am more and more bullish that the board at the September meet – perhaps depending on the consistency of jobless numbers and the participation rate – will design and hand out free t-shirts with “I heart the RBA” on the front and then “Take a hike” on the back.

Sheriff A: We think that too. So does Westpac. NAB says it will be “Take a bike” not take a hike.

Deputy E: Really? Take a bike? But that doesn’t make sense. (shakes head) What is going on at NAB these days?

Sheriff A: Totally. Still, better than CommBank.

Together: “I heart the CBA!” (general laughter)

The Big 4 POV: July decision on monetary policy

Westpac’s (ASX:WBC) RBA whisperer Bill Evans, is saying the bank will lift the cash rate by 50bps, with more rate hikes to come in the future.

In a revised note following the June hike, National Australia Bank’s (ASX:NAB) Alan Oster says the cash rate will hit 2.10% by Christmas. NAB expects two x 50bps hikes in both July and in August, followed by another 25bps in November.

ANZ Bank (ASX:ANZ) Research led by head of Aussie economics david Plank is now indicating the bank will hike by 50bps, and will likely signal more rate to come.

Commonwealth Bank (ASX:CBA) head of Australian economics Gareth Aird, has had a lot to say on this but appears to be settling with a 50bps rate hike, expecting the RBA to show a little consistency and not just “chop and change” between a series of 25 or 50 or 75bps hikes over the coming months.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.