Closing Bell: REZ, WA1 and AOA outperform on a green day for the ASX

Getty Images

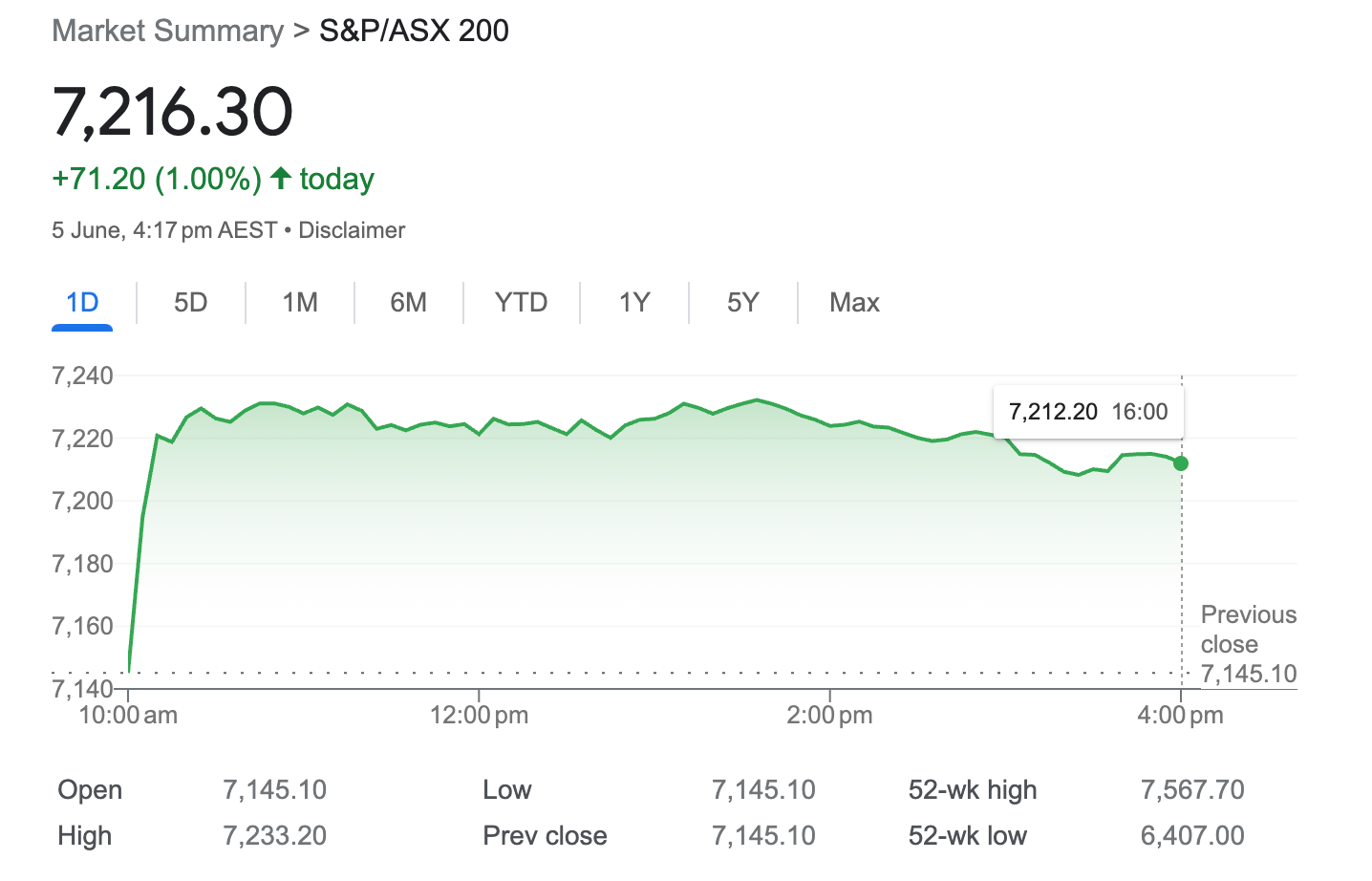

- S&P/ASX 200 closes up 1% – its best performance in about a week

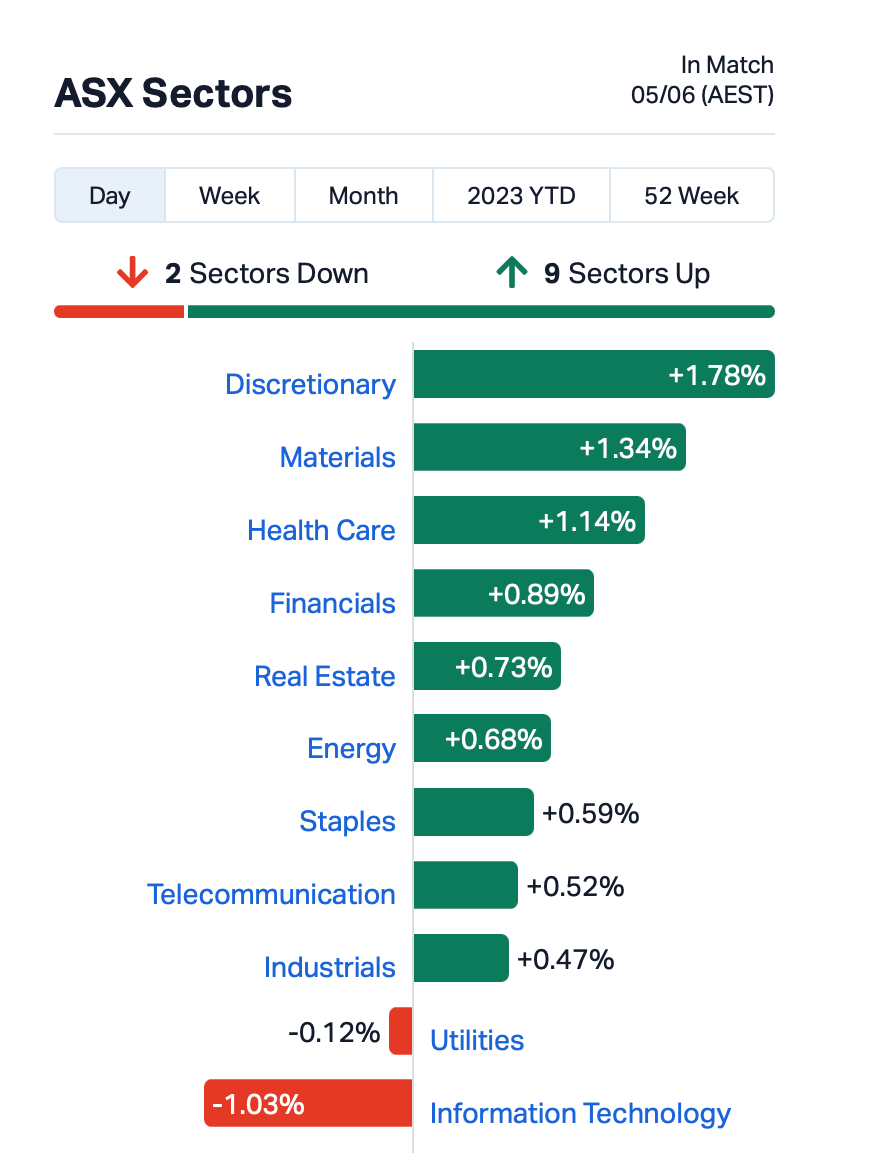

- All sectors bar IT and Utilities had green days, with Discretionary and Utilities outperforming

- Resources & Energy Group had a +183% stonker of a day on its you-beaut nickel sulphide find

The Aussie bourse trended sideways in a classic (coined 10 seconds ago), “windsock” technical analysis pattern this afternoon, after running one up the flagpole first thing.

The ASX 200 shut up shop with a decent 1% gain at 4pm on the dot – its best performance in about five days or so. Which might be something of a surprise to some, considering the odds of a twelfth consecutive RBA interest-rate hike is reasonably high.

Although, to be fair, that’s still swinging about like a Michael Neser delivery in a cyclone.

That came back a mile!

Big swing from Michael Neser before the rain in Leicester yesterday #LVCountyChamp pic.twitter.com/ncGtJZSans

— Rothesay County Championship (@CountyChamp) April 28, 2023

But Stockhead‘s Eddy Sunarto told us all before we were even at our desks this morn that he reckoned the ASX would rise about 1 per cent today. And he was bloody well right.

It’s been largely a green scene sectors-wise this arvo and not much has changed in that regard since our wrap that came out piping hot from the microwave, just in time for the very end of your lunch break a bit earlier.

But let’s go over it again for good measure and see where it’s all at…

Essentially, IT and Utilities are the only sectors letting the XI down somewhat today, otherwise it’s been a real team performance.

What happened in Asian markets? Let’s see…

After a reasonable start, the Shanghai Composite had a bit of a dip, actually, and is currently down 0.04%.

Hong Kong’s Hang Seng is still in the green, though up 0.54%, while Japan’s Nikkei is having a bonza(i) day, with a 2.17% pump.

Hmm, why? It seems the Nikkei has responded well to the Wall Street rally on Friday, along with a bumper, better-than-expected US jobs report.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| REZ | Resourc & En Grp Ltd | 0.034 | 183% | 136,961,399 | $5,997,669 |

| AOA | Ausmon Resorces | 0.005 | 67% | 2,206,195 | $2,907,868 |

| MRD | Mount Ridley Mines | 0.003 | 50% | 2,325,660 | $15,569,766 |

| SLM | Solismineralsltd | 0.6 | 41% | 3,674,992 | $19,785,862 |

| SIX | Sprintex Ltd | 0.038 | 36% | 793,457 | $7,121,921 |

| TD1 | Tali Digital Limited | 0.002 | 33% | 315,992 | $4,942,733 |

| RR1 | Reach Resources Ltd | 0.0105 | 31% | 67,410,714 | $22,040,405 |

| FTL | Firetail Resources | 0.115 | 28% | 51,506 | $6,930,000 |

| WA1 | Wa1Resourcesltd | 5.99 | 28% | 2,799,332 | $183,963,843 |

| ODE | Odessa Minerals Ltd | 0.014 | 27% | 10,308,717 | $8,266,056 |

| AVE | Avecho Biotech Ltd | 0.005 | 25% | 570,898 | $8,648,637 |

| ERL | Empire Resources | 0.005 | 25% | 1,094,373 | $4,451,740 |

| ICN | Icon Energy Limited | 0.005 | 25% | 3,094,000 | $3,072,055 |

| LNU | Linius Tech Limited | 0.005 | 25% | 22,948,860 | $14,356,099 |

| GCX | GCX Metals Limited | 0.031 | 24% | 75,350 | $4,644,467 |

| SRJ | SRJ Technologies | 0.11 | 24% | 98,151 | $8,438,629 |

| DDB | Dynamic Group | 0.32 | 23% | 2,532 | $34,983,768 |

| M3M | M3Mininglimited | 0.135 | 23% | 154,499 | $4,510,157 |

| BOT | Botanix Pharma Ltd | 0.11 | 22% | 5,638,633 | $118,015,616 |

| M2R | Miramar | 0.055 | 22% | 248,252 | $3,617,178 |

| NMR | Native Mineral Res | 0.033 | 22% | 189,016 | $3,243,746 |

| VTI | Vision Tech Inc | 0.285 | 21% | 40,735 | $7,453,546 |

| PGO | Pacgold | 0.4 | 21% | 150,904 | $18,137,399 |

| IMB | Intelligent Monitor | 0.12 | 20% | 6,996 | $13,070,030 |

| SGQ | St George Min Ltd | 0.051 | 19% | 3,068,449 | $36,141,954 |

The story of the day in the small caps is very clearly Resources & Energy Group’s monster, nickel-based gain, as well as WA1’s eye-catching niobium win.

• Resources and Energy Group (ASX:REZ) : +183% on the news, as reported by Reubs earlier today, that the firm’s opening drilling campaign has confirmed “large and shallow open pittable nickel sulphide deposit at Springfield, part of its East Menzies project in WA”.

• WA1 Resources (ASX:WA1): +26% on positive “Luni assay and mineralogy diamond-drilling assay results at the West Arunta project in Western Australia. Shallow, high-grade niobium mineralisation is now evident over a 1km extent,” reports the firm. Reuben also has more here.

Some others catching the eye today:

• Ausmon Resources (ASX:AOA) : +67% on no fresh news today for the minerals explorer. It did register some promising soil-sampling results a few days ago in Broken Hill, though…

• Solis Minerals (ASX:SLM) : +41% on no particularly compelling news that’s fresh today. But here’s what we know, regarding SLM’s continued good form:

“SLM is now up ~270% since announcing the purchase of the Jaguar lithium project in Brazil last week. At Jaguar – located in Bahia state — the company says there are rock chips grading up to 4.95% Li2O along a 1km long, 50m wide spodumene-rich pegmatite body,” wrote Reubs earlier today.

• Reach Resources (ASX:RR1) : +31% on nothing new that we’re noticing today.

TODAY’S ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| IDT | IDT Australia Ltd | 0.068 | -29% | 1,921,788 | $23,400,453 |

| WWG | Wisewaygroupltd | 0.052 | -28% | 37,352 | $12,045,159 |

| AYM | Australia United Min | 0.003 | -25% | 5,000 | $7,370,310 |

| DXN | DXN Limited | 0.0015 | -25% | 1,220,000 | $3,442,630 |

| EMU | EMU NL | 0.002 | -20% | 1,372,857 | $3,625,053 |

| RML | Resolution Minerals | 0.004 | -20% | 934,000 | $6,286,459 |

| CF1 | Complii Fintech Ltd | 0.03 | -19% | 118,796 | $20,331,225 |

| 1ST | 1St Group Ltd | 0.005 | -17% | 1,868,768 | $8,501,947 |

| GNM | Great Northern | 0.0025 | -17% | 2,000,000 | $6,408,941 |

| THR | Thor Energy PLC | 0.005 | -17% | 174,195 | $8,841,677 |

| LCT | Living Cell Tech. | 0.011 | -15% | 1,148,929 | $20,281,884 |

| NHE | Nobleheliumlimited | 0.205 | -15% | 2,339,002 | $29,611,068 |

| SKS | SKS Tech Group Ltd | 0.15 | -14% | 11,960 | $19,141,877 |

| BAT | Battery Minerals Ltd | 0.003 | -14% | 1,396,533 | $12,455,055 |

| CPT | Cipherpoint Limited | 0.006 | -14% | 777,848 | $8,114,692 |

| VBS | Vectus Biosystems | 0.43 | -14% | 45,000 | $26,594,760 |

| CCA | Change Financial Ltd | 0.044 | -14% | 49,929 | $32,010,731 |

| OXT | Orexploretechnologie | 0.052 | -13% | 98,772 | $6,219,852 |

| LYK | Lykosmetalslimited | 0.048 | -13% | 40,000 | $3,432,000 |

| AUK | Aumake Limited | 0.0035 | -13% | 100,000 | $5,949,038 |

| GMN | Gold Mountain Ltd | 0.0035 | -13% | 7,050,000 | $7,879,730 |

| INP | Incentiapay Ltd | 0.014 | -13% | 1,086,417 | $20,241,018 |

| PVS | Pivotal Systems | 0.007 | -13% | 1,300,587 | $4,276,950 |

| TMX | Terrain Minerals | 0.007 | -13% | 3,014,375 | $8,665,594 |

| WFL | Wellfully Limited | 0.007 | -13% | 10,000 | $3,943,553 |

LAST ORDERS

Courtesy of Stockhead‘s very own Nadine “QUEENSLANDER!” McGrath…

“Data centre provider NextDC (ASX:NXT) has announced it has raised $202 million through the retail component of its fully underwritten 1 for 8 pro-rata accelerated non renounceable entitlement offer of new fully paid ordinary shares in the company.

“The retail entitlement offer closed at the end of May and raised with an offer price of $10.80/new share.

“NXT said the retail entitlement offer achieved strong support from eligible retail shareholders, with valid applications of ~$133 million, representing a take up rate of ~66%.

“Eligible retail shareholders were also offered chance to apply for additional new shares up to a maximum of 100% more than their entitlement, at the offer price (top up facility).

“When combined with the top up facility, valid applications from eligible retail shareholders were ~$176 million.

“Entitlements of ineligible retail shareholders and entitlements not taken up by eligible retail shareholders represented ~2.4 million New Shares or ~A$26 million, which will be allotted to sub-underwriters.”

TRADING HALTS

Forbidden Foods (ASX:FFF) – Capital raise

Pacific Edge (ASX:PEB) – Taken directly from the firm’s notice: “The company has become aware that Novitas, the Medicare Administrative Contractor with jurisdiction for the company’s US laboratory, finalised the proposed Local Coverage Determination (LCD) (L39365) covering reimbursement of Cxbladder by Medicare.”

Arovella Therapeutics (ASX:ALA) – Capital raise

Midas Minerals (ASX:MM1) – Capital raise

Nuheara (ASX:NUH) – Capital raise

Global Oil and Gas (ASX:GLV) – Pending the outcome of an offshore petroleum application

Adavale Resources (ASX:ADD) – Pending an announcement in relation to nickel sulphide drilling at Kabanga Jirani Nickel Project.

Sacgasco (ASX:SGC) – Pending an announcement regarding a material transaction in the Philippines.

PharmAust (ASX:PAA) – Pending interim analysis results from Motor Neurone Disease Phase 1/2 clinical trial.

HeraMED (ASX:HMD) – Pending clarity around June 1 announcement of “Strategic partnership signed – US employee rewards program”.

Alvo Minerals (ASX:ALV) – Pending announcement regarding a material acquisition.

M3 Mining (ASX:M3M) – Regarding exploration results.

Annnnd, that’s it. More halts than a game of Castle Wolfenstein to round out your afternoon news.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.