ASX Small Caps Lunch Wrap: Who’s got it in for cupcake-guzzling bears and farting cows?

"A 'wild' bear chases down an innocent young woman in a dark forest," reckons Getty Images.

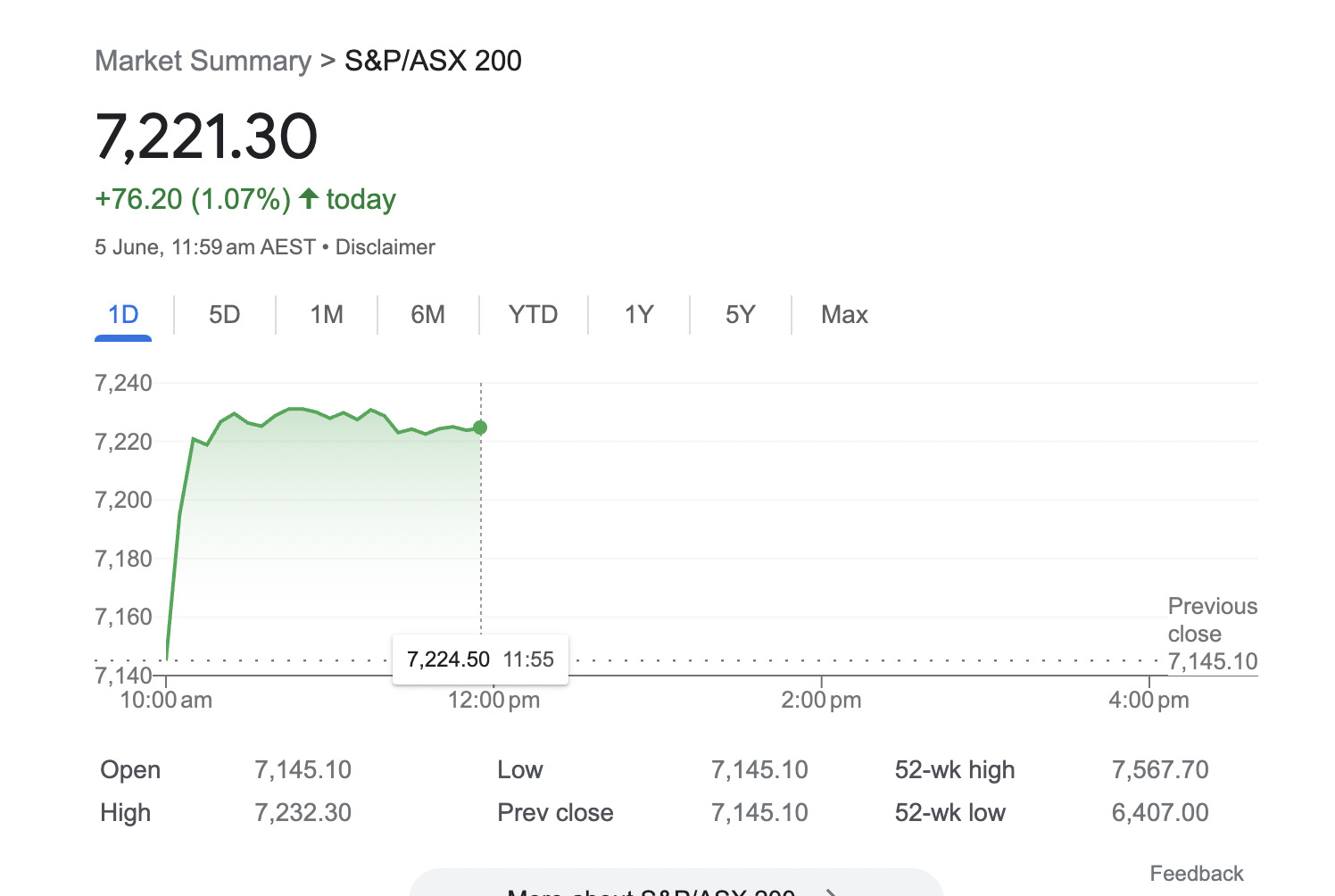

Much like Friday, the ASX 200 has woken up with another “surprising gain” this morning. I’d like to say what did it was a weird, kinky dream about the Fed pivoting to the sounds of Lionel Richie dancing on the debt ceiling. And so I will.

In any case, we’ll explore what’s doing with its 1.13% spurt out of the gates a little further below.

We haven’t completely read Eddy’s Market Highlights yet, but we’re betting our most bottomest dollar that it has something to do with developments among lawmaking, official types in the US leading into the weekend.

Speaking of which, some other eye-opening lawmaking seems to be causing a stir there and elsewhere over the past 48 hours or so.

We’ll start with the Connecticut lawmakers, who have, according to this Insider report, voted to approve legislation that will allow the use of deadly force against the rising population of bears in the state. This comes after several recent disturbing incidents, including the following:

A black bear “attack” on a bakery just a week ago resulted in the horrific mauling and consumption of 60 cupcakes. And it’s an incident that is clearly the straw that broke the camel’s back within the terrified community.

Here’s the footage… Warning: the level of calorie-intake on display could cause distress to some viewers. Stockhead’s editor, for instance, who’s currently on a diet of corn thins and water, might want to look away.

CUPCAKE THIEF🧁: A hungry black bear barged into the garage of a Connecticut bakery, scared several employees and helped itself to 60 cupcakes before ambling away. https://t.co/tua7y3tk9l pic.twitter.com/FsajqiUC8L

— ABC News (@ABC) May 28, 2023

If only someone on Twitter could now be bothered to waste their time by splicing the Nintendo Wii-style music in the clip above over the bear-DiCaprio-ravage scene from The Revenant. That’d be something.

The iconic scene from THE REVENANT where DiCaprio's Hugh Glass is mauled by the bear. pic.twitter.com/2fH2Gw3peE

— All The Right Movies' Podcast (@ATRMPodcast) December 2, 2020

Over in the Republic of Ireland, it’s been reported that lawmakers there are planning to slaughter 200,000 farting cows in order to, supposedly, help tackle climate change and reach their global-warming, net-zero-like goals.

Many a Tweet-triggered voice will very likely be in a strop about this (just quickly checking our “feed”… yep) before ploughing into a double beef pattie burger with cheese in, oh about 5 mins time…

Ireland about to slaughter 200,000 cows for the crime of farting. pic.twitter.com/9B1KbOgZYz

— Sunny Glasgow (@Pitchforks4Sale) June 3, 2023

TO MARKETS

How’s the ASX looking since we began that human-vs-beast diversion? It cleaned itself off and has flattened out again. Here’s a chart that summarises the situation better than we can describe it in words. If we were paid by the word, we’d go into it further in lengthy, boring detail for you, naturally.

Drilling down into some sector specifics, meanwhile, let’s make use of another handy chart that we hope is still largely relevant by the time you read this. This one comes from Market Index, and it’s a real beaut if you dig the colour green.

Discretionary, Real Estate, Financials, Materials… you’re dominating out there on court at the moment. Great zone defence, and good use of the wings on the counter attack.

IT, what’s up, bud? Feeling a bit wheezy? No probs, look, you sit this one out but tell us when you’re ready to go back on. You do know there’s an Apple mixed reality headset being unveiled to the tech sector this week, don’t you? Don’t give a rat’s? Okay, fair enough. But lift your body language at least, okay?

Some of the standout plays of the day so far from some of the biggish guns:

• WA1 Resources (ASX:WA1): +26% on positive “Luni assay and mineralogy diamond-drilling assay results at the West Arunta project in Western Australia. Shallow, high-grade niobium mineralisation is now evident over a 1km extent,” reports the firm.

• Immutep (ASX:IMM): +15% on positive final data developments regarding the treatment of head and neck cancer – revealed at the ASCO 2023 annual meeting.

• Meteoric Resources (ASX:MEI): +8% on no fresh news.

• Lovisa Holdings (ASX:LOV): +5% on no fresh news.

• NRW Holdings (ASX:NWH): +6% on no fresh news.

And some who might want to lift their game…

• Neuren Pharmaceuticals (ASX:NEU): -12% on no fresh news.

• Weebit Nano (ASX:WBT): -6% on a notification of cessation of securities.

• Capricorn Metals (ASX:CMM): -4.6% on no fresh news.

NOT THE ASX

Right, we’ve read all of Eddy’s Market Highlights now, and we can tell you the following…

Eddie “The Doctor” Sunarto is indeed some sort of Time Lord, having correctly predicted the ASX 200 was to rise at least 1pc.

And it can indeed be put down to the form of US stonks and whatnot, which had a beaut Friday close on the back of the US debt ceiling bipartisan bill being approved in the Senate.

Also, Eddy reports, “the crucial US non-farm payroll data shows that US employers added 339,000 jobs in May, well above the consensus estimate of 195,000”.

What does this mean for a Fed pause, though? Well, it’s mixed, to be honest, but there is still a strong thought that the US central bank could be looking to take a break in its rate-hiking exploits in order to ascertain a clearer assessment about where the US economy lies and what impact the inflation-combatting bonanza has actually had over the past year.

A quick scan of the CME FedWatch tool tells us there is currently about a 74% probability of a pause, with the remaining 26% expecting another 25bps hike at the June 14 FOMC meeting.

Bears looking at charts this weekend pic.twitter.com/jNHnilKWk2

— Sven Henrich (@NorthmanTrader) June 4, 2023

Over in Asia today, at the time of writing, things are still looking up for the moment…

Shanghai: +0.22%

Hang Seng: +0.60%

Nikkei: + 1.76%

Meanwhile, in the land of magic internet money, Bitcoin has dipped below US$27k again since this morning’s Mooners and Shakers roundup. Metaverse-related tokens, however, are trying to convince themselves there’s an Apple-headset narrative they can APE off for a few green wicks here and there.

Apple, the world's most valuable company, is entering the metaverse.

Here's what you need to know: pic.twitter.com/k835jJug9P

— Milk Road (@MilkRoadDaily) June 5, 2023

The whole crypto sector is currently looking more shaky than moony so far this week, but we’ll see if it can catch some momentum in the wake of positive stock market performances. It usually does, but has been a little slow on the uptake with it all this time around.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for June 5 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Today Volume Market Cap REZ Resources & Energy Group 0.03 150% 95,066,857 $5,997,669 MRD Mount Ridley Mines 0.003 50% 2,125,660 $15,569,766 AOA Ausmon Resorces 0.004 33% 2,106,195 $2,907,868 MTL Mantle Minerals Ltd 0.002 33% 2,751,800 $9,221,169 SRJ SRJ Technologies 0.115 29% 86,943 $8,438,629 WA1 WA1 Resources 5.95 27% 1,853,984 $183,963,843 AVE Avecho Biotech Ltd 0.005 25% 506,267 $8,648,637 RR1 Reach Resources Ltd 0.01 25% 33,606,193 $22,040,405 M3M M3Mining 0.135 23% 154,499 $4,510,157 SLM Solis Minerals 0.515 21% 1,642,216 $19,785,862 CMX ChemX Materials 0.12 20% 181,815 $5,066,113 GTG Genetic Technologies 0.003 20% 625,000 $28,854,145 ODE Odessa Minerals Ltd 0.013 18% 3,998,166 $8,266,056 SIX Sprintex Ltd 0.033 18% 251,851 $7,121,921 MXC Mgc Pharmaceuticals 0.007 17% 5,122,346 $20,098,158 SCU Stemcell United Ltd 0.0035 17% 521,167 $3,854,189 IMM Immutep Ltd 0.3025 16% 4,330,501 $228,616,863 AVM Advance Metals Ltd 0.008 14% 373,131 $4,119,911 DLT Delta Drone Intl Ltd 0.016 14% 7,459,027 $7,240,853 MOB Mobilicom Ltd 0.008 14% 75,320 $9,286,737 BME Black Mountain Energy 0.024 14% 31,559 $3,847,708 PPG Pro-Pac Packaging 0.26 13% 900 $41,788,174 HGV Hygrovest Limited 0.054 13% 7,000 $11,037,791 AYT Austin Metals Ltd 0.0045 13% 110,000 $4,063,499 BYH Bryah Resources Ltd 0.018 13% 85,664 $5,465,991

An absolute standout:

• Resources and Energy Group (ASX:REZ): +150% on news, as reported by Reuben “There’s Nothing Shallow About Me… Apart From That” Adams that the firm has reported a large and shallow nickel find “with prospects for open-cut development”. Big. News. Reubs has more on that here.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for January 17 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AMD Arrow Minerals 0.003 -25% 10,000 $12,095,060 AYM Australia United Min 0.003 -25% 5,000 $7,370,310 GMN Gold Mountain Ltd 0.003 -25% 5,550,000 $7,879,730 MCT Metalicity Limited 0.0015 -25% 59,224 $7,472,172 NHE Noble Helium 0.19 -21% 1,602,086 $29,611,068 IDT IDT Australia Ltd 0.076 -21% 453,115 $23,400,453 AUH Austchina Holdings 0.004 -20% 9,989,946 $10,389,418 EMU EMU NL 0.002 -20% 1,372,857 $3,625,053 RML Resolution Minerals 0.004 -20% 934,000 $6,286,459 ODM Odin Metals Limited 0.013 -19% 416,000 $11,985,954 GNM Great Northern 0.0025 -17% 2,000,000 $6,408,941 THR Thor Energy PLC 0.005 -17% 174,195 $8,841,677 VBS Vectus Biosystems 0.42 -16% 30,000 $26,594,760 SKS SKS Tech Group Ltd 0.15 -14% 11,960 $19,141,877 ATH Alterity Therap Ltd 0.006 -14% 151,714 $17,079,283 CPT Cipherpoint Limited 0.006 -14% 171,950 $8,114,692 OAR OAR Resources Ltd 0.003 -14% 862,499 $8,438,633 OXT Orexplore Technologies 0.052 -13% 98,581 $6,219,852 AUK Aumake Limited 0.0035 -13% 100,000 $5,949,038 SIT Site Group Int Ltd 0.0035 -13% 1,853,105 $9,871,648 RLF RLF Agtech 0.155 -11% 3,302 $15,904,562 NEU Neuren Pharmaceuticals 12.02 -11% 763,147 $1,712,433,596 SMN Structural Monitor 0.56 -11% 83,210 $84,533,164 EEL ENRG Elements 0.016 -11% 100,000 $18,166,216 RLG Roolife Group Ltd 0.008 -11% 238,600 $6,476,023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.