Closing Bell: Resources swing the ASX higher as gold, iron ore rise

The resources sector came out swinging today, surging on rising commodity prices and dragging the rest of the market with it. Pic: Getty Images

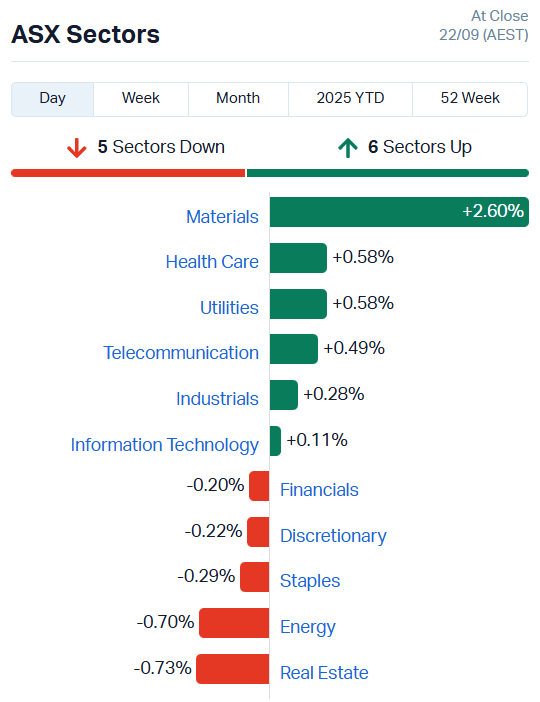

- ASX lifts 0.43pc, now 2.69pc below 52-week high

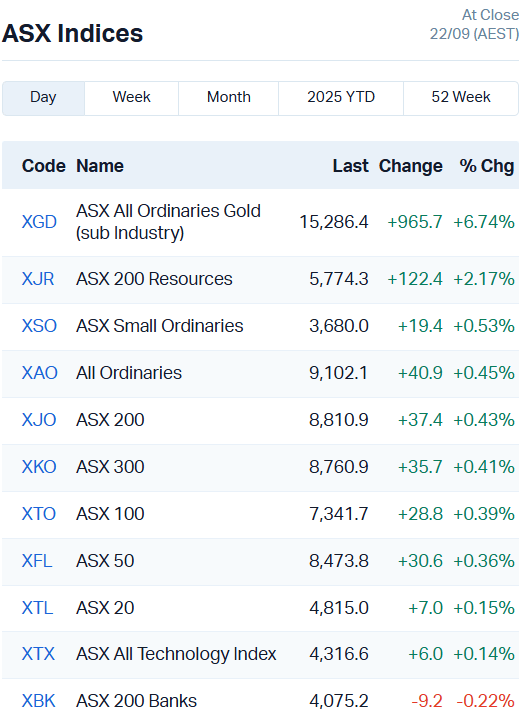

- Materials leads gains, up 2.6pc as XGD rises 6.7pc

- Gains in iron ore and gold prices push resource stocks higher

ASX miners surge on gold and iron ore gains

The ASX 200 rose 0.43% today, paring back from earlier gains of 0.8% but still putting in a solid performance.

Almost all of that strength came from the materials, and more specifically, the resources sector, which is having a ripper of a day.

Gold futures are still hanging out near all time highs, currently sitting at US$3735 an ounce.

Between that and some tailwinds for iron ore, our miners were sitting pretty.

Standout gold stocks included Genesis Minerals (ASX:GMD) which jumped 13%, Greatland Resources (ASX:GGP) ticking up 11.6%, Alkane Resources (ASX:ALK) 8.68% and Perseus Mining (ASX:PRU) 8.4%.

At the big end of town, Newmont Corp (ASX:NEM) added 4.8%, Evolution Mining (ASX:EVN) climbed 6% and Northern Star Resources (ASX:NST) 7.8%.

The greater ASX All Ords Gold index surged a full 6.7%, dragging the ASX200 Resources index more than 2% higher.

Iron ore shows signs of recovery

Iron ore futures lifted 0.2% on Friday, settling at US$106 per tonne today.

Demand from Chinese steel manufacturers is on the up, despite efforts by the China Mineral Resources Group to curb rising prices.

The CMRG slapped BHP (ASX:BHP) with a boycott of one of its iron ore products, Jindlebar fines, after negotiations between the two entities broke down a few days ago.

It’s not the first time the CMRG has thrown its weight around when negotiations break down – in January last year Fortescue (ASX:FMG) was faced with an unusually long customs delay when its own negotiations with the CMRG hit troubled waters.

FMG’s cargo was subjected to inspections for solid waste, which Reuters’ sources considered highly unusual, delaying the shipment beyond the usual 1-3 days.

This most recent move seems to have backfired for the CMRG, driving iron prices higher at a time when the Group is attempting to negotiate better prices with iron ore giants.

Fortescue jumped 2.9%, Rio Tinto (ASX:RIO) added 2.4% and even BHP itself gained 1% by the end of trade.

A little further down the pecking order, Fenix Resources (ASX:FEX) surged 15.6% while Champion Iron (ASX:CIA) gained 4% and Mount Gibson Iron (ASX:MGX) 5.6%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CNJ | Conico Ltd | 0.007 | 75% | 5747125 | $1,088,583 |

| SPL | Starpharma Holdings | 0.225 | 73% | 20583274 | $54,369,222 |

| YRL | Yandal Resources | 0.255 | 59% | 4406500 | $49,477,597 |

| RLG | Roolife Group Ltd | 0.0075 | 50% | 1.18E+08 | $9,392,478 |

| MOM | Moab Minerals Ltd | 0.0015 | 50% | 3000000 | $1,874,666 |

| AHN | Athena Resources | 0.007 | 40% | 5061156 | $11,329,785 |

| IXC | Invex Ther | 0.145 | 38% | 229405 | $7,891,154 |

| AYT | Austin Metals Ltd | 0.004 | 33% | 500000 | $4,752,574 |

| CT1 | Constellation Tech | 0.002 | 33% | 500000 | $2,212,101 |

| LNU | Linius Tech Limited | 0.002 | 33% | 940813 | $9,884,271 |

| VR1 | Vection Technologies | 0.072 | 33% | 1.42E+08 | $97,993,980 |

| ALM | Alma Metals Ltd | 0.006 | 33% | 4994818 | $8,357,567 |

| POD | Podium Minerals | 0.056 | 33% | 8592920 | $33,571,210 |

| TM1 | Terra Metals Limited | 0.15 | 30% | 6773019 | $71,923,389 |

| WGR | Westerngoldresources | 0.16 | 28% | 1152250 | $28,750,789 |

| THB | Thunderbird Resource | 0.019 | 27% | 15868338 | $5,846,121 |

| GAL | Galileo Mining Ltd | 0.215 | 26% | 769532 | $33,596,238 |

| BLZ | Blaze Minerals Ltd | 0.0025 | 25% | 10261650 | $5,750,000 |

| DTM | Dart Mining NL | 0.0025 | 25% | 2051603 | $2,749,052 |

| MGU | Magnum Mining & Exp | 0.01 | 25% | 9786177 | $18,544,297 |

| RFT | Rectifier Technolog | 0.005 | 25% | 1028859 | $5,527,936 |

| 1MC | Morella Corporation | 0.0185 | 23% | 2759542 | $5,526,435 |

| AVE | Avecho Biotech Ltd | 0.008 | 23% | 5182121 | $20,627,514 |

| DAL | Dalaroometalsltd | 0.057 | 21% | 2946480 | $13,947,340 |

| FME | Future Metals NL | 0.023 | 21% | 14011604 | $18,209,616 |

In the news…

Drug delivery technology company Starpharma (ASX:SPL) has inked a major collaborative and license agreement with Genentech to develop innovative cancer therapies using the proprietary DEP delivery platform.

The deal includes tiered royalties on sales, up to US$564 million in milestone payments and an upfront cash injection of US$5.5m. Genentech will take exclusive rights to commercialise products developed from the collaboration, building off SPL’s research.

Yandal Resources (ASX:YRL) has hit gold in the first RC drilling at a new target near the Ironstone Well-Barwidgee project’s Arrakis prospect. The drill bit produced 54m at 1.2g/t from 108m with a higher-grade component of 8m at 4.7g/t from 154m.

YRL says the new gold hits expand Arrakis’ strike to more than 2.2km, with results from five drill holes still pending. The company intends to follow up with more RC and diamond drilling to test along strike both to the north and south.

RooLife Group (ASX:RLG) is expanding its market share within China, inking a two-year supply deal with local distributor Zhongshan Runlian to the tune of RMB 300m (A$64m).

The deal will see RLG coffee, food and machines gain greater visibility through livestreams, influencer campaigns and subscription bundles.

Vection Technologies (ASX:VR1) has locked-in a $22m defence deal with a NATO-approved partner for its extended reality (XR) interfaces.

The framework agreement was executed with a company active across the European defence ecosystem, with current extension limit set for up to $29.5m.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PFM | Platformo Ltd | 0.034 | -36% | 4063 | $5,030,140 |

| IXRR | Ionic Rare Earths - Rights | 0.002 | -33% | 5443588 | $1,138,891 |

| 14D | 1414 Degrees Limited | 0.057 | -30% | 8398314 | $23,915,894 |

| REG | Regis Healthcare Ltd | 6.73 | -27% | 4789784 | $2,777,519,007 |

| BMO | Bastion Minerals | 0.0015 | -25% | 1075000 | $4,409,906 |

| PAB | Patrys Limited | 0.0015 | -25% | 2183334 | $9,167,513 |

| SFG | Seafarms Group Ltd | 0.0015 | -25% | 196478 | $9,673,198 |

| OB1DD | Orbminco Limited | 0.024 | -20% | 458008 | $5,103,852 |

| XGL | Xamble Group Limited | 0.02 | -20% | 1057012 | $11,300,474 |

| AN1 | Anagenics Limited | 0.004 | -20% | 6461449 | $2,481,602 |

| PIL | Peppermint Inv Ltd | 0.0025 | -17% | 3130365 | $7,415,472 |

| PRX | Prodigy Gold NL | 0.0025 | -17% | 5903595 | $20,225,588 |

| TEG | Triangle Energy Ltd | 0.0025 | -17% | 100000 | $6,567,702 |

| TMK | TMK Energy Limited | 0.0025 | -17% | 41776996 | $30,667,149 |

| SP3 | Specturltd | 0.026 | -16% | 507978 | $9,823,904 |

| 8CO | 8Common Limited | 0.039 | -15% | 395335 | $10,308,366 |

| NIM | Nimyresourceslimited | 0.062 | -15% | 1974635 | $19,650,441 |

| C29 | C29Metalslimited | 0.023 | -15% | 531096 | $4,703,082 |

| OSL | Oncosil Medical | 1.7 | -14% | 43871 | $37,372,024 |

| 1TT | Thrive Tribe Tech | 0.003 | -14% | 6134 | $1,443,718 |

| AUK | Aumake Limited | 0.003 | -14% | 3000000 | $10,581,756 |

| AYM | Australia United Min | 0.003 | -14% | 439888 | $6,449,021 |

| CDR | Codrus Minerals Ltd | 0.024 | -14% | 992229 | $5,788,563 |

| CYQ | Cycliq Group Ltd | 0.006 | -14% | 68282 | $3,223,617 |

| SHE | Stonehorse Energy Lt | 0.006 | -14% | 1006415 | $4,791,046 |

In Case You Missed It

Victory Metals (ASX:VTM) is positioning its flagship North Stanmore heavy rare earth project in WA to produce a scandium by-product after identifying a potential revenue stream.

ReNerve (ASX:RNV) has launched new Empliq product range in US tapping into lucrative dermal and amniotic tissue market.

Locksley Resources’ (ASX:LKY/OTCQB:LKYRF) test work on ore from the Mojave project has returned high antimony recoveries as the company targets a slice of the US domestic supply chain.

Peregrine Gold (ASX:PGD) is back in the field with a 3500m second phase drilling campaign underway at the Newman gold and iron ore project.

DY6 Metals (ASX:DY6) has expanded a soil sampling program to include an extra 2,888km2 ahead of drilling at the Central rutile project in Cameroon.

Tech-focused fund Bailador Technology Investments’ (ASX:BTI) large investment into SiteMinder (ASX:SDR), which delivered particularly strong annual results, has proven to be a canny allocation.

Kingsland Minerals’ (ASX:KNG) scoping study for the Leliyn project in the NT has highlighted its potential to be a globally competitive graphite producer.

Core Energy Minerals (ASX:CR3) has promoted executive director Anthony Greenaway to the role of managing director.

Private members’ clubs are back in vogue and investors are betting big on curated communities.

Last Orders

Red Metal (ASX:RDM) has kicked off a drilling program over two separate magnetic targets within the northeastern portion of the Hemi Structural corridor at the Pardoo project in Western Australia’s Pilbara region.

Omega Oil and Gas (ASX:OMA) has raised $46 million to fund development of the Canyon project and expand its footprint in oil and gas-prone areas of the Taroom Trough.

OMA recently inked an Area of Mutual Interest (AMI) agreement with Tri-Star and Beach Energy (ASX:BPT) to jointly pursue new acreage.

Trading halts

Altamin (ASX:AZI) – cap raise

Gateway Mining (ASX:GML) – cap raise

Green Critical Minerals (ASX:GCM) – underwriting of options

Indiana Resources (ASX:IDA) – exploration results & ASX query

Kula Gold (ASX:KGD) – divestment & cap raise

Metal Bank (ASX:MBK) – cap raise

RareX (ASX:REE) – funding arrangements

RooLife Group (ASX:RLG) – response to ASX queries

Swift Networks (ASX:SW1) – cap raise

Trigg Minerals (ASX:TMG) – acquisition and placement

At Stockhead, we tell it like it is. While Northern Star Resources, Red Metal and Omega Oil and Gas are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.