Closing Bell: Relaxed ASX successfully humps Wednesday

Via Getty

Local investors have successfully humped Wednesday after the ASX earlier bumped hips with a 10-month high.

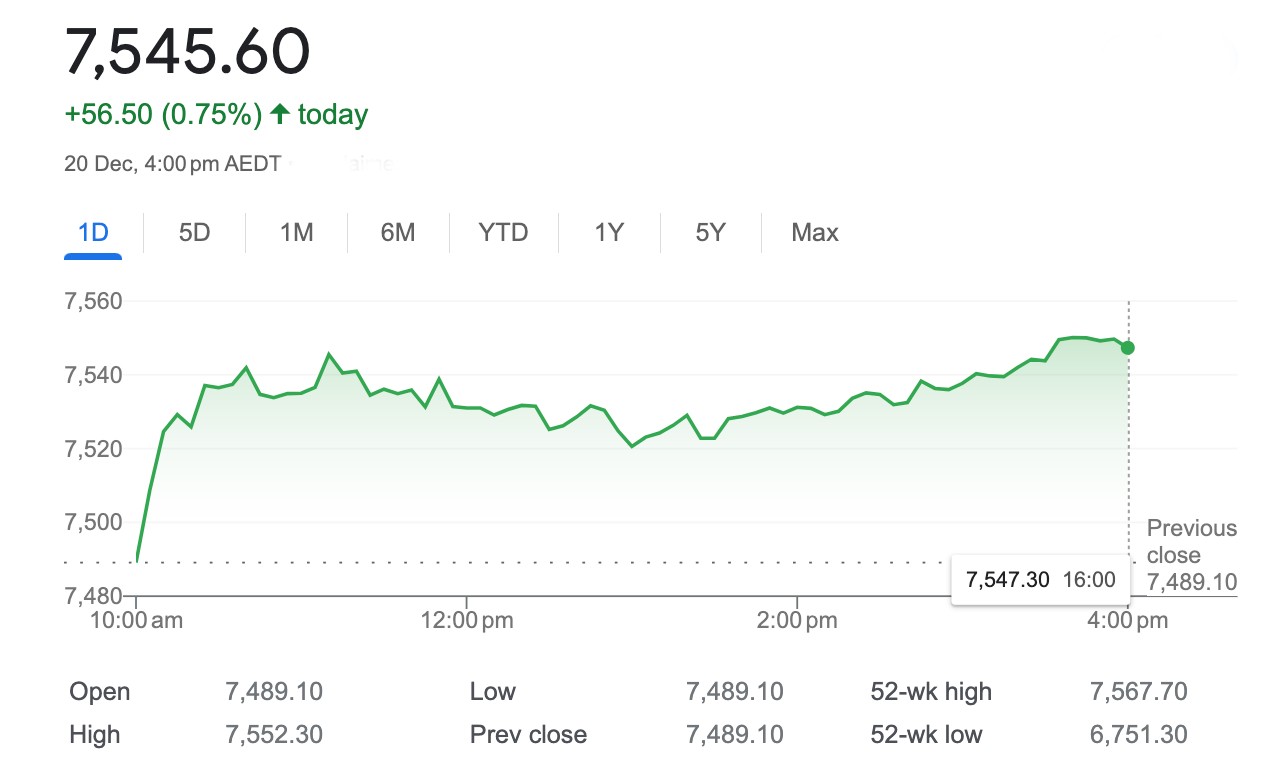

The ASX200 also tracked gains on Wall Street overnight as investors piled on bets that the US Federal Reserve will start unwinding all those rates sometime soon.

At 4pm on Wednesday December 20, the S&P/ASX200 was up 56.5 points, or +0.75 per cent, to 7545.60

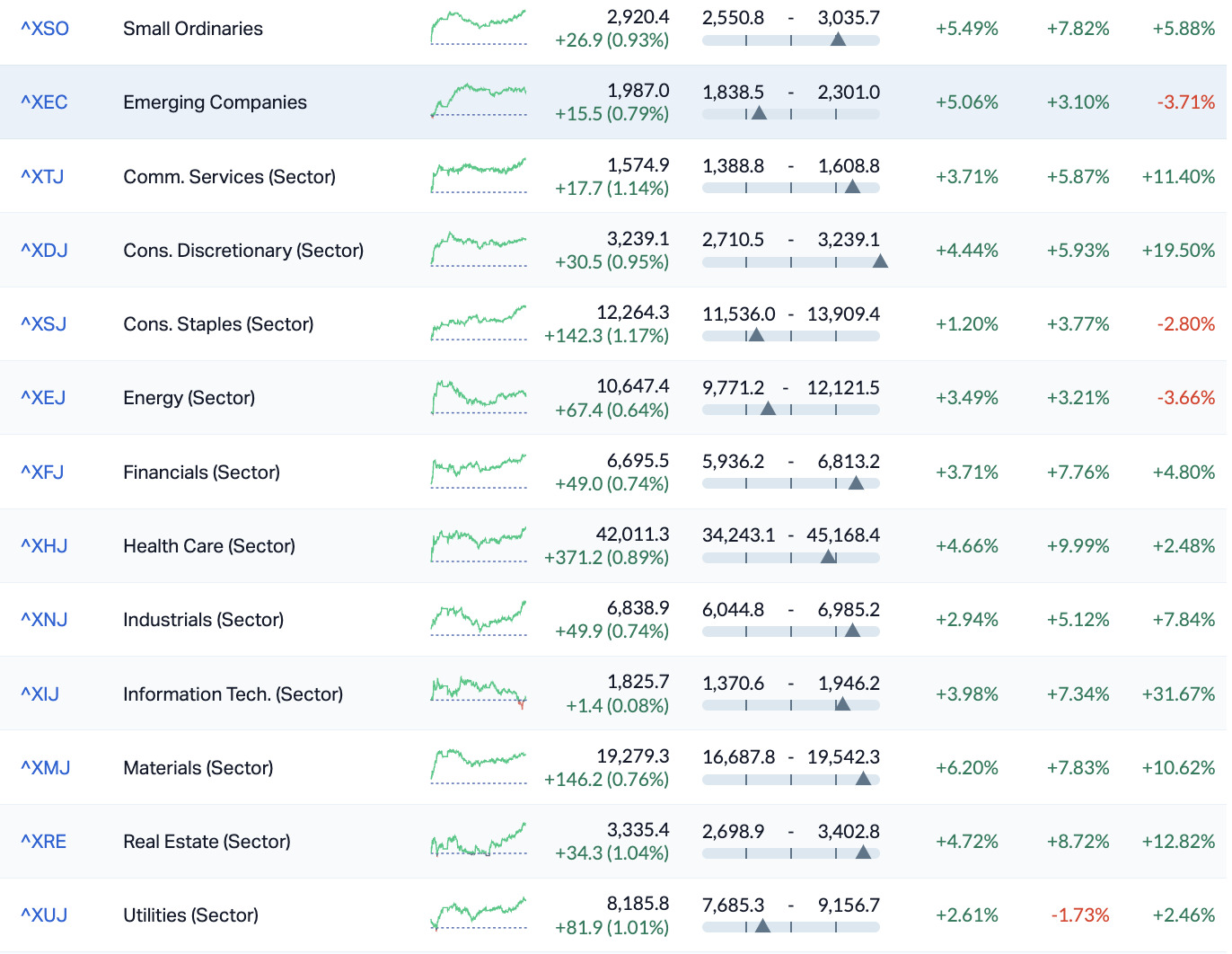

All 11 local sectors closed higher* with the general theme of ‘here comes cheaper money’ winning the day, despite some weak numbers and equally weak policy reminding everyone how much China has not been like China this year.

*Ed: Looks like IT Sector may’ve inched into the red after 4pm.

ASX Sectors on Wednesday

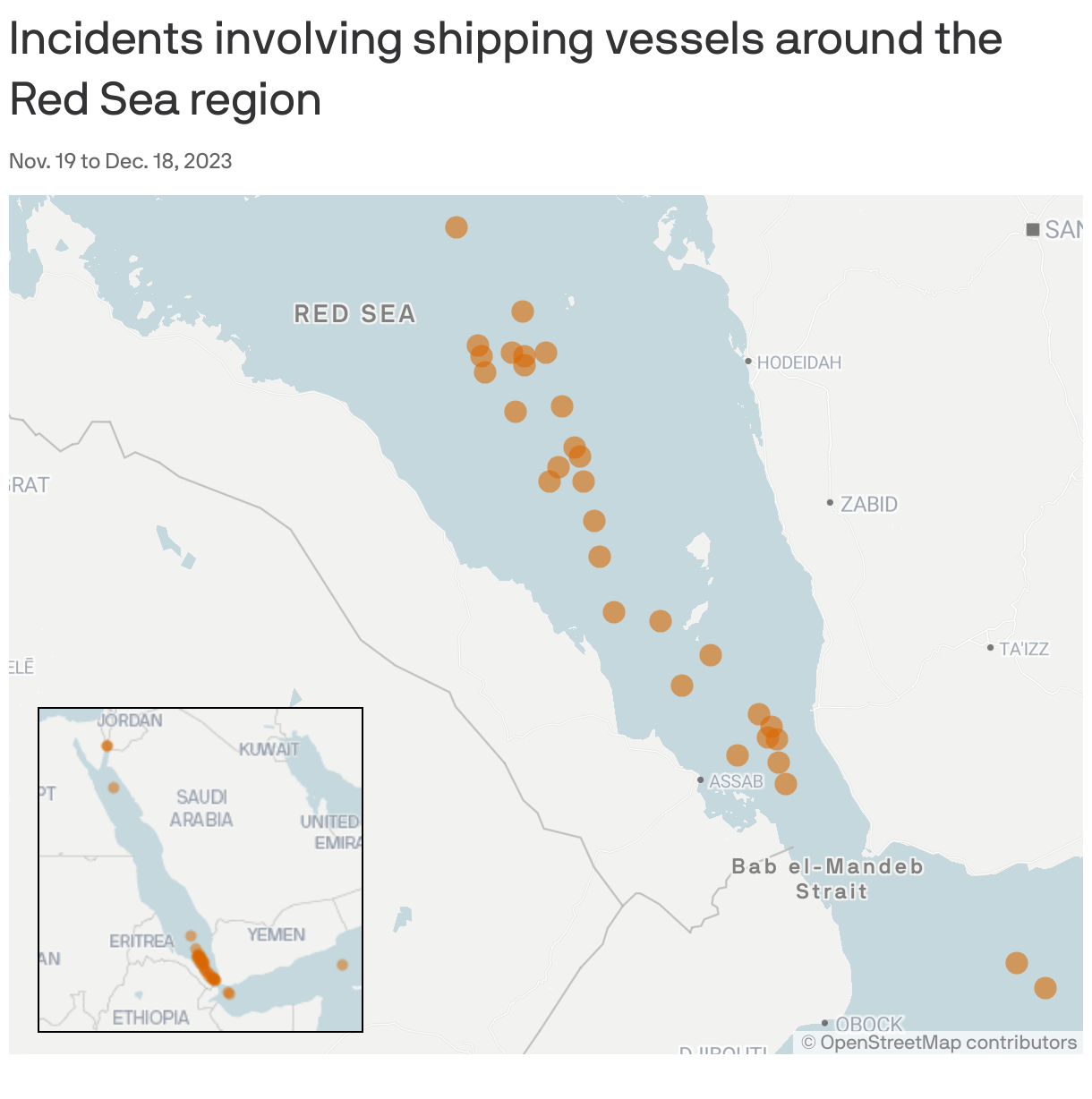

Overnight, Brent crude collected almost +1.6%, to be nudging $US80 a barrel.

Just in time for Christmas, too.

One wonders why it didn’t happen earlier. Just check out how busy Yemeni Houthi rebels have been in the Red Sea shipping lanes from November 19 until this week:

Meanwhile, Energy Sector majors Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) were in the money, while Meridian (ASX:MEZ), after leaping on Tuesday, was sinking on Wednesday.

Elsewhere, shares in Pexa (ASX:PXA) fell more than -10% on an unsatisfying fiscal update and market uncertainties around its locked-in acquisition of UK conveyancing company Smoove.

PEXA flagged weaker-than-expected FY24 revenue to come in between $315 to $325mn, and said the Smoove takeover had been legally OK’d last week.

At the tiny end of town, takeover target Whispir (ASX:WSP) was up almost 10%, after both its bidders lobbed fresh offers in a matter of hours.

And finally, small cap commercial-stage biopharma Neuren Pharmaceuticals (ASX:NEU) is having a Christmas to remember.

Focused on developing ‘novel therapies for orphan neurodevelopmental disorders, NEU’s flagship asset is Daybue (trofinetide).

Earlier this year, the US FDA approved Daybue for the treatment of Rett syndrome in adult and paediatric patients, and the US launch took place in April.

NEU’s been double-bumped by upbeat brokers this week following positive Phase 2 clinical trial results for a drug which treats Phelan-McDermid syndrome – a cognitive disorder in children.

Brokers at both Bell Potter and Wilsons have materially raised their respective 12-month price targets for NEU, calling the new trial data ‘transformative’.

Wilsons says NNZ-2591 will now be a driver of NEU value creation and not just something to speculate on.

Neuren stock jumped circa +28% On Monday and added circa +8% on Tuesday.

Meanwhile, in China…

The People’s Bank of China (PBoC) kept its lending rates steady on Friday, despite pressure to ease monetary policy as China’s economic recovery doesn’t.

That was bad news for mainland stocks. The Shanghai Composite was down -0.5% while the Shenzhen Component is now wallowing around 12 month lows.

The one-year loan prime rate (LPR), pretty much China medium-term lending facility, was held unchanged at a record low of 3.45% for the fourth consecutive month; and the five-year rate, a reference for mortgages, was left at 4.2% for the sixth straight month.

Wednesday’s decision came after the central bank ramped up liquidity injection through medium-term policy last week while keeping the interest rate unchanged.

The PBoC has also pumped about 800 billion Yuan of fresh funds into the local banking system, the biggest monthly injection on record.

Meanwhile, in more of the genuinely crappy Sino-data, we return to the Chinese property sector which remains at the very best, fetid.

According to the numbers, new home prices crashed again in November, the worst fall in eight months and this despite Beijing’s series of soft-measures aimed at boosting demand, but which have just highlighted weakness therein.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| FL1 | First Lithium Ltd | 0.61 | 53% | 12,192,535 | $28,020,667 |

| EMU | EMU NL | 0.0015 | 50% | 13,425,000 | $2,024,771 |

| ME1 | Melodiol Glb Health | 0.0015 | 50% | 14,420,112 | $4,728,824 |

| ETR | Entyr Limited | 0.013 | 44% | 36,419,048 | $17,847,935 |

| AAP | Australian Agri Ltd | 0.021 | 40% | 37 | $4,576,492 |

| WZR | Wisr Ltd | 0.032 | 39% | 99,859,040 | $31,386,135 |

| AUK | Aumake Limited | 0.004 | 33% | 5,000,000 | $5,743,220 |

| DCX | Discovex Res Ltd | 0.002 | 33% | 6,749,792 | $4,953,852 |

| LSR | Lodestar Minerals | 0.004 | 33% | 3,235,000 | $6,070,192 |

| PXX | Polarx Limited | 0.008 | 33% | 2,134,325 | $9,837,701 |

| SCT | Scout Security Ltd | 0.02 | 33% | 101,963 | $3,486,411 |

| CZN | Corazon Ltd | 0.017 | 31% | 255,600 | $8,002,773 |

| ENV | Enova Mining Limited | 0.013 | 30% | 36,017,502 | $6,409,293 |

| VML | Vital Metals Limited | 0.0065 | 30% | 33,929,965 | $29,475,335 |

| GRL | Godolphin Resources | 0.05 | 28% | 791,432 | $6,600,439 |

| MTC | Metalstech Ltd | 0.19 | 27% | 1,446,180 | $28,343,189 |

| ADS | Adslot Ltd. | 0.0025 | 25% | 250,000 | $6,448,991 |

| ASP | Aspermont Limited | 0.01 | 25% | 626,749 | $19,510,110 |

| BFC | Beston Global Ltd | 0.01 | 25% | 9,012,516 | $15,976,375 |

| SOP | Synertec Corporation | 0.18 | 24% | 987,442 | $62,566,911 |

| RVT | Richmond Vanadium | 0.335 | 24% | 5,864 | $23,276,108 |

| POS | Poseidon Nick Ltd | 0.011 | 22% | 25,544,729 | $33,421,813 |

| MXO | Motio Ltd | 0.033 | 22% | 660,000 | $7,241,355 |

| AZY | Antipa Minerals Ltd | 0.017 | 21% | 17,386,224 | $57,887,311 |

| BMO | Bastion Minerals | 0.017 | 21% | 5,865,164 | $2,928,174 |

Rising without reason on Wednesday is Wisr (ASX:WZR). Well, there’s a reason, but I am none the wiser despite looking into it very briefly.

If you know the secret sauce or would just like to troll me for bad writing this year, please email me at [email protected]. I’m pretty damn thick-skinned, too – so should you have anything you’d like to get off your chest, anything at all, then just let it out. I can take it.

Let’s run the ruler over this lot:

Not one for bad grammar, First Lithium (ASX:FL1) this morning told the ASX of a “significant discovery confirmed!”

The exclamation mark is this time appropriate.

The first three holes at Blakala, part of the Gouna project in Mali, include an outstanding 111m intersection at 1.57% Li2O, including a 10m chunk grading 3.39% Li2O from 33m depth.

More lithium for Bastion Minerals (ASX:BMO), which says it’ll buy a few more lithium projects in the Gascoyne and Mt Ida regions, hot spots after Delta Lithium’s (ASX:DLI) recent drilling success.

And fans of many metals will be pleased Godolphin (ASX:GRL) is flogging its non-core Lewis Ponds and Mt Bulga projects in NSW for $11m.

Lewis Ponds contains a 6.2Mt at 2.g/t gold, 80g/t silver, 2.7% zinc, 1.6% lead and 0.2% copper resource. The Mt Bulga mine to the north was reported to have a copper grade of 6.5% and also has a historical resource from 1970.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| RGS | Regeneus Ltd | 0.003 | -40% | 113,000 | $1,532,185 |

| JAV | Javelin Minerals Ltd | 0.002 | -33% | 471,531 | $3,264,347 |

| MCT | Metalicity Limited | 0.0015 | -25% | 253,364 | $8,970,108 |

| TMK | TMK Energy Limited | 0.007 | -22% | 6,285,713 | $55,103,214 |

| LRD | Lordresourceslimited | 0.05 | -21% | 287,944 | $2,339,324 |

| GBZ | GBM Rsources Ltd | 0.009 | -18% | 1,794,979 | $6,823,540 |

| ADG | Adelong Gold Limited | 0.005 | -17% | 206,666 | $4,077,934 |

| LBT | LBT Innovations | 0.01 | -17% | 596,791 | $15,116,124 |

| M2R | Miramar | 0.02 | -17% | 500,000 | $3,572,869 |

| MTB | Mount Burgess Mining | 0.0025 | -17% | 1,062,483 | $3,134,440 |

| SRN | Surefire Rescs NL | 0.008 | -16% | 5,462,894 | $18,649,999 |

| LYK | Lykosmetalslimited | 0.038 | -16% | 137,258 | $2,808,000 |

| AHN | Athena Resources | 0.003 | -14% | 220,000 | $3,746,636 |

| DVL | Dorsavi Ltd | 0.012 | -14% | 222,884 | $8,353,263 |

| MSG | Mcs Services Limited | 0.012 | -14% | 98,594 | $2,773,395 |

| PRX | Prodigy Gold NL | 0.006 | -14% | 2,968,127 | $12,257,755 |

| NFL | Norfolkmetalslimited | 0.215 | -14% | 238,285 | $8,831,249 |

| ADD | Adavale Resource Ltd | 0.007 | -13% | 539,208 | $5,972,709 |

| AVE | Avecho Biotech Ltd | 0.0035 | -13% | 250,069 | $12,677,188 |

| HLX | Helix Resources | 0.0035 | -13% | 835,370 | $9,292,583 |

| ODE | Odessa Minerals Ltd | 0.007 | -13% | 159,000 | $7,576,895 |

| RNX | Renegade Exploration | 0.007 | -13% | 428,571 | $7,997,790 |

| CXU | Cauldron Energy Ltd | 0.022 | -12% | 3,305,636 | $28,308,425 |

| SW1 | Swift Networks Group | 0.015 | -12% | 100,107 | $10,991,765 |

| PXA | Pexagroup | 10.93 | -12% | 2,512,436 | $2,195,825,732 |

TRADING HALTS

Godolphin Resources (ASX:GRL) – For the purpose of ‘considering and lodging a further announcement to the announcement made 20 December 2023 titled “Godolphin to Sell Lewis Ponds and Mt Bulga for $11

Million”’

Indiana Resources (ASX:IDA) – Pending an announcement to the market in relation to a decision from the ICSID ad hoc Committee concerning the stay of enforcement of the Award against the United Republic of Tanzania

Hydrocarbon Dynamics (ASX:HCD) – Pending the release of a capital raising announcement

Savannah Goldfields (ASX:SVG) – Pending the release of a capital raising announcement

Riedel Resources (ASX:RIE) – Pending the release of a capital raising announcement

Live Verdure (ASX:LV1) – Pending the release of a capital raising announcement

Botala Energy (ASX:BTE) – Pending the release of a capital raising announcement

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.