Closing Bell: RBA pause positivity short lived as ASX 200 has worst day in four weeks

Getty Images

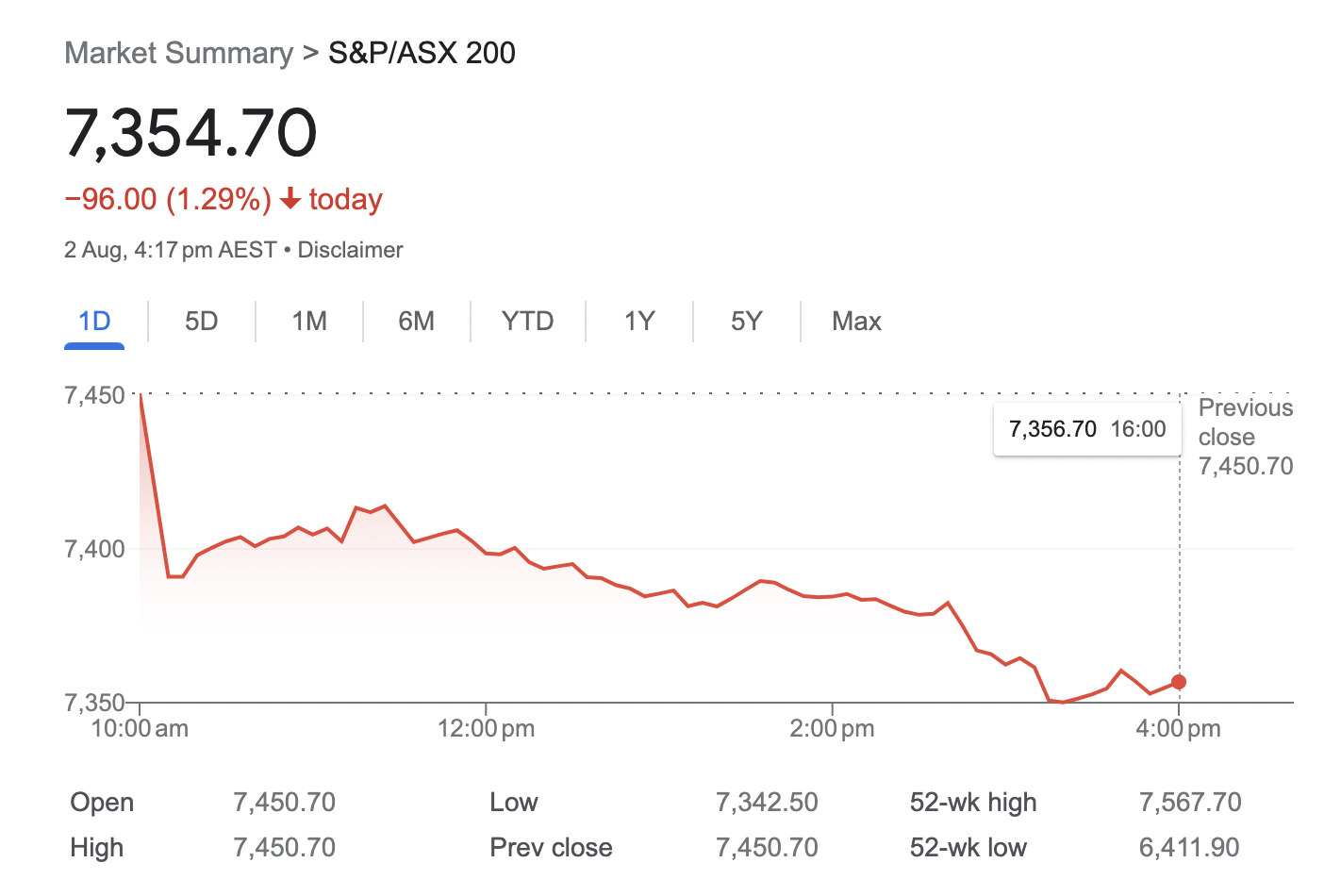

- The ASX 200 has had its worst day in roughly a month with a 1.29 percentage dip

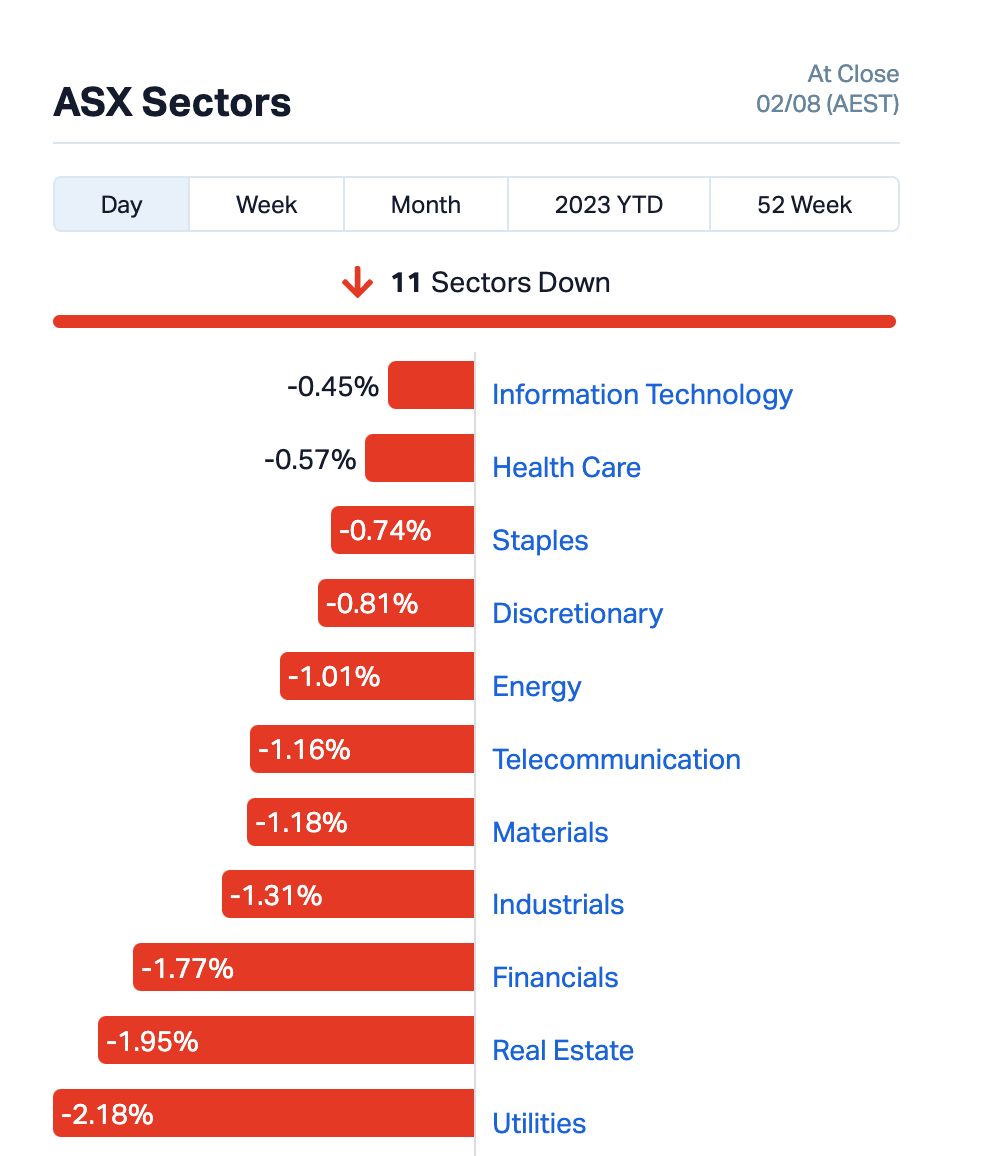

- The sectors were a shade of spilt claret, with Utilities and Real Estate leading losses

- Standout small caps: BCAL Diagnostics and American West Metals

Local trading couldn’t go back to back after yesterday’s bright day, unfortunately, with the ASX 200 registering its crappest day in about four weeks.

And it’s not great news for the Aussie dollar, which slid below 66 US cents, after data showed manufacturing activity in the US slowed more than expected in July.

Yesterday’s RBA pause partying is well and truly over now, with empties and ciggie butts everywhere and a semi-naked drunk bloke who probably isn’t the departing Philip Lowe in stained Y-fronts in the corner.

On closer inspection, it might be Stiffler, who doesn’t know what the ASX, the RBA, or Australia is. But he was down for it anyway.

Sean William Scott, aka Stiffler in “American Pie,” revealed that his salary for the original 1999 film was only $8,000. The film went on to gross more than $235 million at the box office and spur multiple sequels. https://t.co/64BP88o0Ho

— IndieWire (@IndieWire) August 1, 2023

Why the sudden turnaround? Because it’s the ASX, and as you well know, it’s frequently one big fickle tease. But there’s a clearer reason than that.

And it has to do with the bourse copy trading Wall Street once again. As Gregor mentioned at lunch, “the United States has had its credit rating downgraded from ‘AAA’ to ‘a bit crap’ by Fitch Ratings.”

Fitch cuts USA credit rating. 🚨🚨🚨

$33 trillion in debt and growing $2 trillion per year.

$1 trillion annual debt service to pay interest and rising.

18% of tax revenue. Probably $100 trillion in unfunded liabilities.I am surprised the credit rating isn't even lower. pic.twitter.com/U03FMvZmID

— Wall Street Mav (@WallStreetMav) August 1, 2023

Fitch, who we think might’ve gone to high school with Stiffler (or was that Finch?), said in a note: “The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.”

Meanwhile, US treasury Secretary Janet Yellen has described the Fitch downgrade as “arbitrary” and “outdated”. Words that some might suggest could also apply to h… no, nothing.

YELLEN CALLS FITCH DOWNGRADE 'ARBITRARY' AND 'OUTDATED'

— *Walter Bloomberg (@DeItaone) August 1, 2023

https://t.co/Bwy5OK4gWe pic.twitter.com/QwboZCaw46

— Sven Henrich (@NorthmanTrader) August 1, 2023

TO MARKETS

Our advanced technical analysis learnings allow us to ascertain that the ASX 200 formed a perfect “Land Just Before Green, Bounce Off Rock and Careen Disappointingly into Water Trap” formation on the charts.

Zooming into the sectors… and it’s a red, tomatoey, soupy mush with nothing much to write home about at all if you’re a fan of generalising.

What can we say? Utilities had a shocker, with Real Estate, Financials and Industrials not faring much better. IT and Health Care did their level best to find any semblance of speck of silver lining.

Now for a few specific standouts in the mid-larger end of Bourse City, before we take you to ASX Small Caps Funky Town, further below…

Winning:

• FINEOS (ASX:FCL): +11.6% on no fresh news for the insurance-tech play.

• Deep Yellow (ASX:DYL): +6.4% on nothing much to report regarding the energy stock.

Not Winning:

• MAAS Group Holdings (ASX:MGH): -7.5% after a notification today of a securities buy-back (about 2.172m today).

• Weebit Nano (ASX:WBT): -5.7% on no fresh news today for the tech stock. Yesterday, though, as reported by Eddy:

“The chips maker fell despite saying that its Resistive Random-Access Memory (ReRAM) can stand heat up to 125 degrees Celsius.

“This is the temperature specified for automotive grade 1 Non-Volatile Memories (NVMs).

“The achievement demonstrates the suitability of Weebit ReRAM for use in microcontrollers and other automotive components, as well as high-temperature industrial and IoT applications.”

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| DXN | DXN Limited | 0.0015 | 50% | 4,057,419 | $1,721,315 |

| MEB | Medibio Limited | 0.0015 | 50% | 932,329 | $5,150,594 |

| BDX | Bcaldiagnostics | 0.115 | 44% | 6,543,048 | $10,887,577 |

| AHN | Athena Resources | 0.008 | 33% | 4,614,715 | $6,422,805 |

| YPB | YPB Group Ltd | 0.004 | 33% | 660,090 | $2,230,384 |

| AW1 | Americanwestmetals | 0.25 | 25% | 46,326,070 | $69,069,676 |

| AJQ | Armour Energy Ltd | 0.0025 | 25% | 8,056 | $9,842,684 |

| THR | Thor Energy PLC | 0.005 | 25% | 200,000 | $5,837,166 |

| NYR | Nyrada Inc. | 0.041 | 24% | 134,641 | $5,148,287 |

| DCN | Dacian Gold Ltd | 0.115 | 22% | 611,839 | $114,379,288 |

| VKA | Viking Mines Ltd | 0.011 | 22% | 6,780 | $9,227,326 |

| NME | Nex Metals Explorat | 0.017 | 21% | 32,000 | $4,935,455 |

| DC2 | Dctwo | 0.023 | 21% | 150,000 | $2,483,606 |

| ODY | Odyssey Gold Ltd | 0.03 | 20% | 455,439 | $19,138,445 |

| BNO | Bionomics Limited | 0.012 | 20% | 6,309,909 | $14,687,354 |

| CYQ | Cycliq Group Ltd | 0.006 | 20% | 5,987 | $1,737,583 |

| HLX | Helix Resources | 0.006 | 20% | 18,922,067 | $11,615,729 |

| PRX | Prodigy Gold NL | 0.006 | 20% | 536,751 | $8,755,539 |

| TIG | Tigers Realm Coal | 0.006 | 20% | 1,577,857 | $65,333,512 |

| TMX | Terrain Minerals | 0.006 | 20% | 610,000 | $5,415,997 |

| E33 | East 33 Limited. | 0.033 | 18% | 63,090 | $14,534,484 |

| SYM | Symbio Holdings Ltd | 2.74 | 17% | 847,584 | $199,505,791 |

| GBZ | GBM Rsources Ltd | 0.021 | 17% | 334,642 | $11,087,301 |

| SQX | SQX Resources Ltd | 0.14 | 17% | 613,053 | $3,000,000 |

| INP | Incentiapay Ltd | 0.007 | 17% | 1 | $7,590,382 |

• Health-tech stock BCAL Diagnostics (ASX:BDX) started and finished well today. We’ve been talking about it all day, in fact, but here’s the choicest summary, from our very own non-fungible Eddy Sunarto:

“BCAL Diagnostics has announced breakthrough results and major steps towards commercialisation of its breast cancer diagnostic test.

“A clinical study the company sponsored with Precion Inc. in North Carolina has achieved an impressive sensitivity of 90% and a specificity of 85.5%.

“What this means is that the BCAL breast cancer test should readily be capable of being replicated not only in BCAL’s dedicated laboratory in Australia but, more importantly, will enable blood samples to be analysed (using the BCAL test) in commercial laboratories throughout the world.”

• American West Metals (ASX:AW1) is another one we can’t stay away from today.

The $92m-capped copper hunter has revealed a “major discovery” at the Storm project in Canada.

Diamond drilling of a large gravity target has intersected thick intervals of copper sulphides, reports the company.

The two diamond drill holes were punched in 680m apart — the continuity of the mineralised horizon and the size of the gravity anomaly,>5km long and up to 1km wide, suggests that drilling has potentially identified a very large copper deposit, it says.

Assays are pending, and you can read more about it here, in this special report.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| EEL | Enrg Elements Ltd | 0.003 | -40% | 15,993,270 | $5,046,171 |

| VTM | Victory Metals Ltd | 0.245 | -38% | 2,189,343 | $31,522,301 |

| XTC | Xantippe Res Ltd | 0.001 | -33% | 3,256,420 | $17,220,150 |

| AIS | Aeris Resources Ltd | 0.27 | -29% | 4,819,630 | $262,559,326 |

| AXP | AXP Energy Ltd | 0.0015 | -25% | 71,724 | $11,649,361 |

| MTL | Mantle Minerals Ltd | 0.0015 | -25% | 2,356,792 | $12,294,892 |

| TMB | Tambourahmetals | 0.2625 | -23% | 1,382,510 | $14,371,530 |

| ACW | Actinogen Medical | 0.029 | -22% | 6,702,414 | $67,201,330 |

| NNG | Nexion Group | 0.011 | -21% | 1,422,185 | $2,832,310 |

| KCC | Kincora Copper | 0.053 | -21% | 1,523,825 | $8,060,252 |

| DDT | DataDot Technology | 0.004 | -20% | 190,005 | $6,054,764 |

| ICN | Icon Energy Limited | 0.004 | -20% | 2,000,189 | $3,840,068 |

| PKO | Peako Limited | 0.008 | -20% | 455,232 | $4,707,315 |

| SHP | South Harz Potash | 0.031 | -18% | 1,949,002 | $22,800,472 |

| GLE | GLG Corp Ltd | 0.165 | -18% | 14,089 | $14,820,000 |

| GFN | Gefen Int | 0.005 | -17% | 82,980 | $769,679 |

| MXC | Mgc Pharmaceuticals | 0.0025 | -17% | 6,821,820 | $11,677,079 |

| SRI | Sipa Resources Ltd | 0.021 | -16% | 3,274 | $5,703,953 |

| ICG | Inca Minerals Ltd | 0.029 | -15% | 432,378 | $16,490,339 |

| NOX | Noxopharm Limited | 0.036 | -14% | 379,682 | $12,273,994 |

| AUR | Auris Minerals Ltd | 0.012 | -14% | 53,348 | $6,672,763 |

| AVM | Advance Metals Ltd | 0.006 | -14% | 267,433 | $4,119,911 |

| CPT | Cipherpoint Limited | 0.006 | -14% | 14,800 | $8,114,692 |

| LML | Lincoln Minerals | 0.006 | -14% | 6,304,332 | $9,944,983 |

| M2M | Mtmalcolmminesnl | 0.024 | -14% | 60,001 | $2,233,490 |

Aeris Resources (ASX:AIS) is down a good (well, bad) 29% today on some FY24 guidance announcing.

The copper-gold producer and explorer has, according to its Exec Chairman Andre Labuschagne (yep, Marnus’s old man), “made the tough but appropriate decision to place the Jaguar Operation onto care and maintenance, with operations ceasing in September.”

Straight batting it further, Labuschagne added:

“Between the operational challenges, lower zinc price and cost inflation it became obvious that the best value for our shareholders was to pause production at Jaguar.

“We firmly believe this decision provides the greatest opportunity for shareholders to realise value from Jaguar over the medium term.”

Meanwhile, a reprise here from this morning’s 10 at 10. But it still applies…

Victory Metals (ASX:VTM) released a maiden resource of 250Mt at a grade of 520 parts per million (ppm) rare earths – for 130,000t contained rare earths – at the North Stanmore project in WA.

Biotech Actinogen Medical (ASX:ACW) is down today, despite the company announcing a non-renounceable rights issue offer to raise roughly $10 million from eligible shareholders.

It will raise $10m at 2.5c per share – a substantial discount to the last closing price.

Lastly, lithium explorer Tambourah Metals (ASX:TMB) will raise $3.7m at 23.5c per share – a 30.9% discount to the last closing price of TMB shares and a 13.8% discount to 10-day VWAP.

LAST ORDERS

• Anax Metals (ASX:ANX), has announced today it’s received “firm commitments” to raise $1.1 million via a placement to institutional, professional and sophisticated investors.

And that’s to support the exploration and development at the Whim Creek Copper-Zinc JV project in the Pilbara, which Anax plans to make a first mover base metals producer.

You can read yesterday’s special report on that for a fair bit more.

• Global X, a major ETF (exchange traded fund) provider (eg. Global X Battery Tech and Lithium ETF (ASX:ACDC)) is expanding its Australian team with the appointment of Nicholas Vedelago as Senior Business Development Manager in Queensland.

Vedelago will be responsible for building relationships and positive outcomes for clients.

What dose that mean in slightly less marketing speak? It means he’ll aim to get across the benefits of Global X’s various ETFs that focus on a range of sectors, including commodities, income/finance, core, and digital assets. (We did say slightly less.)

Vedelago joins a distribution team that has more than doubled in the last 12 months, according to the company.

Among other things, Global X Chief Executive Officer for Australia, Evan Metcalf, had this to say:

“We’re confident that Nicholas’ deep industry knowledge and experience will prove instrumental in helping us to continue to deliver exceptional service for stakeholders as we expand our brand footprint across Australia.”

Vedelago brings over a decade of experience in the wealth management and banking industry, including at Colonial First State.

Global X also recently appointed Nathan Lui as Regional Manager – Southern in the company’s Melbourne office. He joined the business from Betashares.

TRADING HALTS

Mesoblast (ASX:MSB): Pending an announcement regarding a US Food and Drug Administration’s review of the company’s Biologics License Application resubmission for remestemcel-L in the treatment of children with steroid-refractory acute graft versus host disease.

ChemX Materials (ASX:CMX) A pause in trading that allows ChemX to “manage its continuous disclosure obligations pending the release of an announcement regarding a strategic funding package and management change”.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.