ASX Small Caps Lunch Wrap: Who else wouldn’t be dead for quids today?

Next time, you can go get your own pension money, Trev. Pic via Getty Images.

Local markets are down this morning, following an overly-dramatic 0.8% slump when the ASX doors were flung open for business at 10am.

At 8:00am this morning, the ASX 200 futures index was pointing down by -0.55% but, being the perennial overachiever that it is, the benchmark blew straight past that mark by 10:15am, causing much wailing and gnashing of teeth.

The drop isn’t exactly earth-shatteringly huge, but it’s enough to have a few local investors pondering how they might be able to scrounge up a few bob this morning – which is, coincidentally enough – precisely the train of thought that sent two plucky Irish lads off to their local post office, dragging a dead guy along for the ride.

This story takes place in the town of Carlow, southwest of Dublin, where Declan Haughney fronted up to the local post office clutching his uncle’s out-of-date social welfare card, hoping to collect pension.

When it was explained to him the various reasons why he would be unable to collect his uncle’s €246 payment, Haughney had a massive strop and left the post office shouting that his uncle was “at home, very unwell and that he would have to go and bring him down”.

“Very unwell”, it turns out, might be the understatement of the decade.

Haughney and his mate, Gareth Coakley, were returning to the post office about 10 minutes dragging 66-year-old Peadar Doyle between them in a brazen attempt to Weekend at Bernie’s their way to collecting the cash.

Along the way, they were spotted by witness Claire Knight, who stopped to ask if everything was okay.

“He’s fine, he’s grand,” Haughney replied, before the pair hauled the clearly-deceased man into the post office and up to post office worker Margaret O’Toole’s service window.

“He’s here now to collect,” Haughney told O’Toole, who called Haughney’s attention to the fact that Doyle wasn’t moving.

“He’s dead, he’s dead!” Haughney cried. “She [Ms O’Toole] wouldn’t pay. It was her fault. If you paid me he wouldn’t be here.”

Police were called, while Haughney and Coakley sat Doyle upright on the floor, before lying him down in a well-overdue recovery position.

The pair were jailed, and were sentenced this week to a couple of years in prison for their efforts. Prosecutors were unable to secure a longer sentence, as it was unclear from the autopsy whether the 66-year-old had been alive when he was dragged from his home.

There’s probably an easier way to pick up a lazy €246 – so let’s go take a look at the market news to see who’s very unlikely to be dragging a corpse to the post office this morning.

TO MARKETS

The ASX 200 benchmark fell nearly 1.0% at open this morning, after a lacklustre effort on Wall Street overnight knocked the wind out of local investors’ sails.

The main thrust behind the losses is likely due to investors getting back into their Nervous Nelly groove, despite yesterday’s rate pause, and some unsettling news from the US, which I’ll get to in a minute.

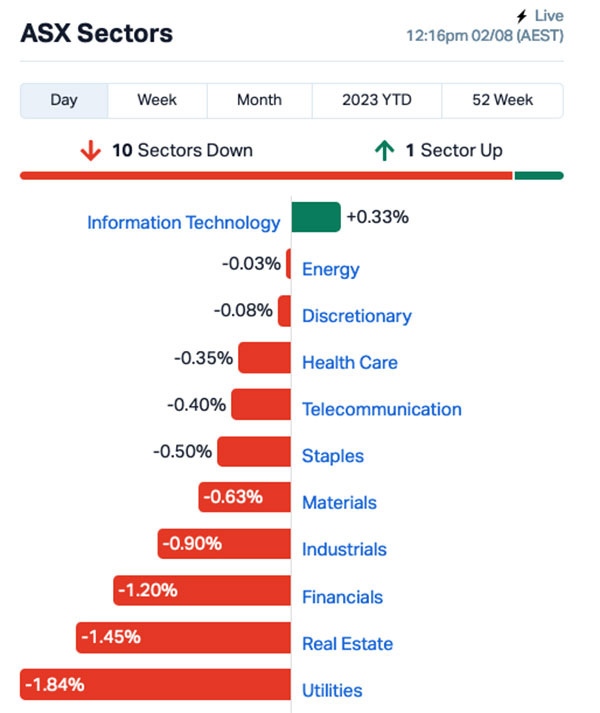

Leading the local losses is the increasingly useless Utilities sector, which has dropped nearly 2.0% so far this morning, with Real Estate down 1.5% and the ultra-bloated heavyweight Financials in third-worse spot, down 1.2% as well.

The only sector not in the red at lunchtime today is InfoTech, but its measly 0.33% pip won’t be nearly enough to turn the ship around.

In the fancy caviar-filled beanbags at the top end of town, Strike Energy (ASX:STX) is the sole billion dollar baby offering any kind of sunshine this morning, up 4.9% after investors digested the news that Strike and Talon Energy (ASX:TPD) had been unable to agree to terms of a takeover bid initiated by STX.

NOT THE ASX

Wall Street dropped a mixed bag of results overnight, which saw the the S&P 500 fall by 0.26%, tech heavy Nasdaq by -0.43%, while blue chips Dow Jones finished 0.20% higher.

Earlybird Eddy reckons the mixed results stem from US investors taking their time to assess earnings results from big pharma against data showing manufacturing activity in the US slowed more than expected in July.

Pfizer fell -1.25% after saying it would launch a cost-cutting program if demand for its COVID-19 products remains muted this quarter.

Uber fell almost 6%, despite reporting its first-ever quarterly operating profit. Total revenue grew 14% to $US9.2 billion during the quarter, but has missed analysts’ forecasts, who rated the performance ✭✭✭✫✫, and complained that Uber “tried to touch them” the whole way home.

Helping to keep the Dow afloat, however, was construction and mining equipment maker Caterpillar, which rose 9% after reporting a rise in Q2 profits.

But the banner headline finance news is undoubtedly the startling report that the United States has had its credit rating downgraded from “AAA” to “a bit crap” by Fitch Ratings.

Fitch said in a note: “The rating downgrade of the United States reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.”

Which is a lot of words for “I’m cutting up your credit card”.

Gold fell -1% to US$1,943.66/oz ahead of US manufacturing and labour market data, crude prices fell by around -0.5%, leaving WTI trading at US$81.37 a barrel, and Iron Ore 62% fe dipped almost -4% to $US108.32/ a tonne.

“Looking ahead to the second half of 2023, an economic contraction could bring additional upside for gold, further reinforcing its safe-haven asset status,” said a report from the World Gold Council.

In Japan, the Nikkei is down 1.71% this morning, as the nation’s moviegoing public continues to wildly overreact to the #Barbenheimer hashtag, which encourages cinema lovers to see the two current blockbusters as an ironic double feature, highlighting the apparent juxtaposition between the two films’ overall thematics and visual aesthetics.

It turns out that Japan – for some obscure reason that I can’t quite put my finger on – isn’t altogether happy that director Christopher Nolan decided to lionise the man who led the development of atomic weapons.

And an attempt by the local arm of Warner Bros to drive ticket sales for Barbie and Oppenheimer has been met with stern disdain, and an opposition hashtag #NoBarbenheimer, which prompted this apology from the Barbie distributor in Japan.

— 映画『バービー』公式 (@BarbieMovie_jp) July 31, 2023

My Japanese is – as always – a little rusty, but the gist of it is essentially “That was a bit of a dick move, and we’re sorry”.

And so they should be, many Japanese citizens feel – life is hard enough without a major motion picture studio blithely encouraging people to sit through such a harrowing cinematic experience, even if it does have Margot Robbie in it.

In China, there’s still no word on what’s happened to former foreign minister Qui-Gon – however, there are growing rumours that he’s been reassigned to the Jedi Council. In the meantime, Shanghai markets are down 0.61%.

And in Hong Kong, the Hang Seng is down 1.71% despite local authorities confirming that work crews have now completed the task of hosing what’s left of French extreme sports guy Remi Lucidi off the terrace of a high rise building.

Lucidi, who was Insta-famous for taking selfies from atop the tallest buildings he could climb around the world, plunged plunged 68 floors to his death – but he died doing what he loved, which was – apparently – stopping very suddenly.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 02 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BDX | BCAL Diagnostics | 0.14 | 75% | 4,540,276 | $10,887,577 |

| DXN | DXN Limited | 0.0015 | 50% | 4,057,419 | $1,721,315 |

| MEB | Medibio Limited | 0.0015 | 50% | 932,329 | $5,150,594 |

| VPR | Volt Power Group | 0.0015 | 50% | 250,024 | $10,716,208 |

| AW1 | American West Metals | 0.27 | 35% | 33,629,782 | $69,069,676 |

| MTH | Mithril Resources | 0.002 | 33% | 500,000 | $5,053,207 |

| YPB | YPB Group Ltd | 0.004 | 33% | 660,090 | $2,230,384 |

| THR | Thor Energy PLC | 0.005 | 25% | 200,000 | $5,837,166 |

| VMM | Viridis Mining | 0.595 | 24% | 1,428,753 | $14,980,319 |

| VKA | Viking Mines Ltd | 0.011 | 22% | 6,780 | $9,227,326 |

| NME | Nex Metals Explorations | 0.017 | 21% | 32,000 | $4,935,455 |

| NYR | Nyrada Inc | 0.04 | 21% | 120,128 | $5,148,287 |

| CYQ | Cycliq Group Ltd | 0.006 | 20% | 5,987 | $1,737,583 |

| HLX | Helix Resources | 0.006 | 20% | 6,910,893 | $11,615,729 |

| PRX | Prodigy Gold NL | 0.006 | 20% | 286,751 | $8,755,539 |

| TIG | Tigers Realm Coal | 0.006 | 20% | 1,577,857 | $65,333,512 |

| TMX | Terrain Minerals | 0.006 | 20% | 610,000 | $5,415,997 |

| SYM | Symbio Holdings Ltd | 2.76 | 18% | 556,754 | $199,505,791 |

| SQX | SQX Resources Ltd | 0.14 | 17% | 506,435 | $3,000,000 |

| AHN | Athena Resources | 0.007 | 17% | 2,877,757 | $6,422,805 |

| INP | Incentiapay Ltd | 0.007 | 17% | 1 | $7,590,382 |

| OAU | Ora Gold Limited | 0.007 | 17% | 169,292 | $26,621,551 |

| T92 | Terra Uranium | 0.15 | 15% | 16,062 | $6,708,671 |

| ME1 | Melodiol Global Health | 0.0115 | 15% | 9,769,384 | $26,885,538 |

| MXO | Motio Ltd | 0.047 | 15% | 270,476 | $10,718,821 |

Leading the Small Caps this morning is Bcal Diagnostics (ASX:BDX), up 87.5% on news that it has achieved some breakthrough results from a clinical study on the company’s BCAL breast cancer diagnostic test.

The company says that the study, which it sponsored with US company Precion in North Carolina, achieved “an impressive sensitivity of 90% and a specificity of 85.5%” – which is a huge step towards commercialisation in the company’s quest for early detection of breast cancer.

In second place, it’s American West Metals (ASX:AW1), up 32.5% so far today after it revealed a “major discovery” at the Storm copper project in Canada.

Diamond drilling of a large gravity target has intersected thick intervals of copper sulphides, after two diamond drillholes were punched in 680m apart to show the continuity of the mineralised horizon and the size of the gravity anomaly is more than 5km long and up to 1km wide.

The results suggest that drilling has potentially identified a very large copper deposit, and full assays are pending, due sometime in the next four weeks.

And in third spot today, it’s Symbio Holdings (ASX:SYM), up 18% off the back of yesterday’s after hours announcement that the company has received a non-binding indicative proposal from Superloop (ASX:SLC).

Under the terms of the Indicative Proposal, Symbio shareholders would receive A$1.425 cash and 2.14 Superloop shares for each Symbio share, valuing Symbio at $2.85 per share – well above yesterday’s closing price of $2.35.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 02 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| XTC | Xantippe Res Ltd | 0.001 | -33% | 2,643,087 | $17,220,149.54 |

| VTM | Victory Metals Ltd | 0.29 | -27% | 1,558,287 | $31,522,301.13 |

| MTL | Mantle Minerals Ltd | 0.0015 | -25% | 2,356,792 | $12,294,891.67 |

| KCC | Kincora Copper | 0.052 | -22% | 1,240,273 | $8,060,251.82 |

| NNG | Nexion Group | 0.011 | -21% | 890,859 | $2,832,309.96 |

| TMB | Tambourah Metals | 0.27 | -21% | 1,335,549 | $14,371,529.70 |

| GLE | GLG Corp Ltd | 0.16 | -20% | 10,000 | $14,820,000.00 |

| DDT | DataDot Technology | 0.004 | -20% | 90,000 | $6,054,763.92 |

| EEL | Energy Elements | 0.004 | -20% | 9,884,721 | $5,046,171.25 |

| ACW | Actinogen Medical | 0.03 | -19% | 4,054,422 | $67,201,329.55 |

| SHP | South Harz Potash | 0.031 | -18% | 1,257,128 | $22,800,472.30 |

| MXC | MGC Pharmaceuticals | 0.0025 | -17% | 2,149,072 | $11,677,078.85 |

| SRI | Sipa Resources Ltd | 0.021 | -16% | 3,274 | $5,703,953.38 |

| PET | Phoslock Environmental Tech | 0.022 | -15% | 807,123 | $16,234,153.23 |

| AUR | Auris Minerals Ltd | 0.012 | -14% | 47,345 | $6,672,763.40 |

| CPT | Cipherpoint Limited | 0.006 | -14% | 14,800 | $8,114,692.12 |

| RCR | Rincon | 0.045 | -13% | 93,585 | $3,726,896.78 |

| E25 | Element 25 Ltd | 0.495 | -13% | 768,938 | $123,992,290.95 |

| SIX | Sprintex Ltd | 0.033 | -13% | 998,822 | $10,956,408.82 |

| HTG | Harvest Tech Grp Ltd | 0.034 | -13% | 441,833 | $26,854,470.75 |

| AUE | Aurum Resources | 0.096 | -13% | 100,009 | $2,750,000.00 |

| ADR | Adherium Ltd | 0.0035 | -13% | 22,000 | $19,997,633.26 |

| GLA | Gladiator Resources | 0.014 | -13% | 2,658 | $9,452,749.23 |

| LVH | Livehire Limited | 0.056 | -13% | 356,632 | $22,425,751.10 |

| RIM | Rimfire Pacific | 0.007 | -13% | 138,737 | $16,041,957.85 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.