Closing Bell: Noxopharm ignores screams as unsuspecting local markets ambushed by hellish bank-tech-comms beastie

Not good. Via Getty

- Benchmark index falls to 11-month lows

- Utilities only sector in green

- Small caps led by Noxopharm

Local markets have extended unexpected October losses on Wednesday as tech stocks, and the Financial Sector led losses on another bond-yield-led rout on Wall Street overnight.

At 4.15pm in Sydney, the ASX200 was down almost 0.8% to 6,890.20.

Over the past five days, the benchmark has lost -2% and is now down -2.85% over the past 12 months.

Wall Street was gripped by a sell-off overnight as stronger-than-expected US jobs data sent Treasury yields back up to the ionosphere. The benchmark YS 10-year US yield surged above 4.8% for the first time since 2007.

Regional equity markets also extended losses on Wednesday, as shares in Japan, South Korea and Hong Kong all fell sharply, many to multi-month lows.

Markets in China remain shut for a week-long holiday.

The ASX Small Ords lost 0.8% and the ASX Emerging Co’s (XEC) index lost 2.2%.

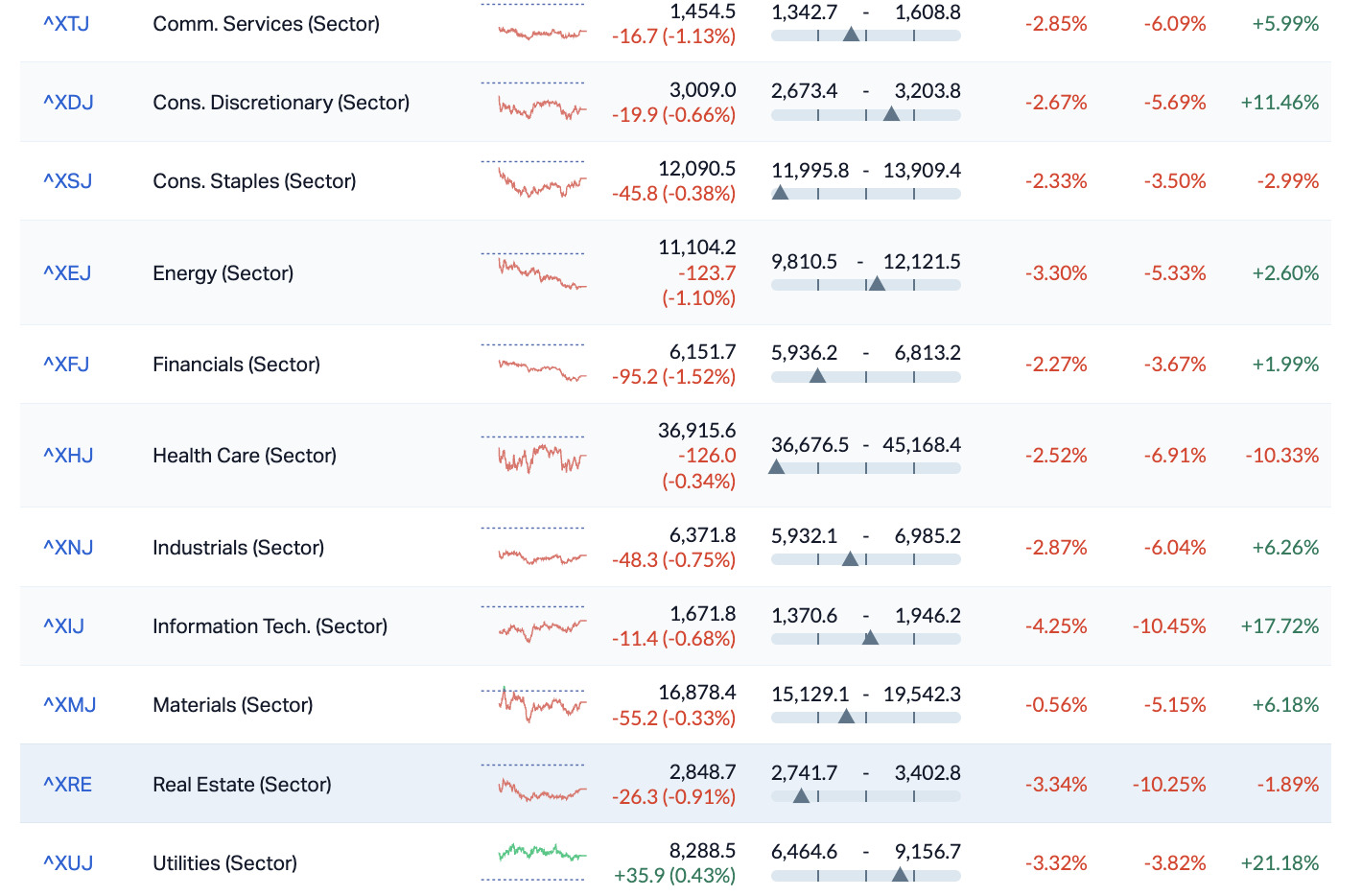

ASX by Sectors on today — Intraday — 52 Week Range — Week – Month – Year

Ripped from the headlines

Japan

In Japan, the yen has steadied near 149 per USD on Wednesday arvo, after an unexpected surge late Tuesday raised fears that someone might need to go and intervene again in the local currency markets.

The currency jumped as much as 1.7% to 147.3, before giving back most of the gains as stronger-than-expected US jobs data bolstered the view that the Federal Reserve will keep interest rates at restrictive levels for longer. Japan’s currency is like an old smoker’s heart and not good with shocks.

South China Sea

Philippines President Ferdinand Marcos Junior says investigations are ongoing around the deaths of three Filipino fishermen, in a ramming incident that sank their boat in the hotly contested waters of the South China Sea. Tensions between China and local Filipino fisherman have been ramping over months.

The ‘maritime incident’ occurred just as 1,800 soldiers, sailors and participants from the US – the Philippines’ former treaty ally – as well as strategic partners including Australia, Japan, Britain and Canada began to take part in ‘Samasama’ drills, which are set to last two weeks and include anti-submarine warfare, search and rescue operations, air defence drills and land phases.

“We assure the victims, their families, and everyone that we will exert every effort to hold accountable those who are responsible for this unfortunate maritime incident,” Ferdinand Marcos Junior said on the X social media platform.

Hong Kong

Stocks in Hong Kong were down over 1% in afternoon trade, sliding quickly for a second session while moving closer to their lowest level in over 11 months.

Hang Seng investors are on the coalface of China’s weak economic recovery and Beijing’s property market paralysis.

New data suggests China’s 100 biggest developers were still struggling to recover from deteriorating demand, with China Evergrande Group shares back amid double-digit losses on fears that the bankrupt giant could face liquidation while its founder and Chairman remains in detention.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.002 | 100% | 547,211 | $15,642,574 |

| NOX | Noxopharm Limited | 0.105 | 69% | 22,213,354 | $18,118,753 |

| BP8 | Bph Global Ltd | 0.002 | 33% | 1,753,117 | $2,002,095 |

| NZS | New Zealand Coastal | 0.002 | 33% | 6,038,171 | $2,500,515 |

| SIH | Sihayo Gold Limited | 0.002 | 33% | 245,250 | $18,306,384 |

| YPB | YPB Group Ltd | 0.004 | 33% | 205,415 | $2,230,384 |

| ADA | Adacel Technologies | 0.735 | 30% | 363,704 | $43,067,119 |

| ICR | Intelicare Holdings | 0.015 | 25% | 196,000 | $2,506,985 |

| TI1 | Tombador Iron | 0.015 | 25% | 3,259,806 | $25,901,788 |

| ERL | Empire Resources | 0.005 | 25% | 1,465,113 | $4,451,740 |

| BNR | Bulletin Res Ltd | 0.098 | 24% | 4,940,429 | $23,193,697 |

| JPR | Jupiter Energy | 0.022 | 22% | 19,000 | $22,865,945 |

| NIM | Nimyresourceslimited | 0.265 | 20% | 700,943 | $17,042,884 |

| SCT | Scout Security Ltd | 0.018 | 20% | 742,500 | $3,460,020 |

| ROO | Roots Sustainable | 0.006 | 20% | 31,285,152 | $693,611 |

| VTI | Vision Tech Inc | 0.365 | 20% | 156,258 | $9,673,752 |

| ICE | Icetana Limited | 0.039 | 18% | 440,879 | $8,156,181 |

| TSL | Titanium Sands Ltd | 0.007 | 17% | 2,204,193 | $10,630,828 |

| TGM | Theta Gold Mines Ltd | 0.145 | 16% | 16,455 | $88,134,376 |

| MKG | Mako Gold | 0.015 | 15% | 103,397 | $7,488,106 |

| AZI | Altamin Limited | 0.069 | 15% | 732,233 | $23,503,005 |

| AL8 | Alderan Resource Ltd | 0.016 | 14% | 17,343,515 | $8,633,725 |

| ETR | Entyr Limited | 0.008 | 14% | 2,565,673 | $13,881,727 |

| OAU | Ora Gold Limited | 0.008 | 14% | 182,115 | $33,469,980 |

| ABE | Ausbondexchange | 0.13 | 13% | 15,137 | $4,456,607 |

Noxopharm (ASX:NOX) is almost 70% higher at the close on Wednesday.

That’s not bad, after being caught speeding the session previous by the ASX police.

The Aussie biotech has today shared the news that the US Food and Drug Administration has granted Orphan Drug Designation (ODD) status to Noxopharm’s CRO-67 preclinical drug candidate, for the treatment of pancreatic cancer.

The FDA grants ODDs for drugs designed to prevent, diagnose or treat rare diseases or conditions, and the designation comes with various benefits that include:

– Tax credits for qualified clinical trials

– Exemption from user fees (e.g. FDA application fees)

– Potential seven years of market exclusivity after approval

So far this year only x2 other Aussie companies have received an ODD from the FDA, from a total of 260 issued.

Another standout on Wednesday is the Aussie global space safety firm Adacel Technologies (ASX:ADA), which just won a new contact from the US Federal Aviation Administration (FAA) contract.

ADA says it’s a bit of an industry leader in ‘advanced air traffic management solutions and simulation and training systems, is looking at a terrific. US$59 million deal over five years, in a deal which covers services connected with ADA’s existing installed network of Tower Simulation Systems (TSS), ‘including the maintenance and support of the TSS hardware and a full-scale technical refresh for all major components within the TSS large and small systems and TSS Mobile Units.’

Daniel Verret, Adacel’s CEO says that Adacel brings ‘unique knowledge and unparalleled experience’ with the FAA TSS software systems.

We are steadfastly committed to making robust, consistent training a daily reality at the FAA,” Mr. Verret added.

Lithium-junior Bulletin Resources (ASX:BNR) is up more than 25% today on news that it’s all but got its EPA approvals to begin drilling at its Ravensthorpe lithium project in WA’s Great Southern region.

And Redstone Resources (ASX:RDS) has revealed it’s partnering with Galan Lithium (ASX:GLN) ‘to further solidify its exposure to the highly sought after, Tier‐1 mining jurisdiction, that is the James Bay Lithium district in Québec, Canada.’

Earlier today my mentor in rocks, Reuben Adams said AZI is hoping to follow in the footsteps of much bigger brother Vulcan Energy (ASX:VUL) by producing both lithium and geothermal energy from deep brines.

“AZI – which has been focused on getting its Gorno zinc project up and running – picked up a couple of geothermal energy-lithium brines applications in Lazio, Italy, June last year.

“The stock has now expanded its tenure by 500% after an independent consultant said there was def potential for both power production and lithium extraction at Lazio,” Reubs added.

“Preliminary discussions are being held with potential strategic partners, European funds and financial institutions to explore options to advance the Lazio project,” AZI says.

“Altamin is also considering the possibility of a future ‘spin off’ of the assets into a new lithium focused company once key project milestones have been achieved.”

The $30m capped company had $1m in the bank at the end of June.

High grade iron ore producer Tomador Iron (TI1) has recovered slightly from yesterday’s precipitous fall, but the news still ain’t good.

A previously announced “geotechnical event” at its namesake mine in Brazil is a bit worse than originally thought, with work to make the mine safe leading to constrained production in the September quarter of ~112,000 wet metric tonnes.

TI1 expects production constraints – and subsequent higher costs – to continue during the December 2023 quarter as it awaits “further geotechnical advice”.

The silver lining is that sales levels have exceeded production in the quarter by utilising stockpiled product.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| TKM | Trek Metals Ltd | 0.034 | -36% | 14,749,866 | $26,188,364 |

| GTG | Genetic Technologies | 0.002 | -33% | 2,182,691 | $34,624,974 |

| MTL | Mantle Minerals Ltd | 0.002 | -33% | 111,041 | $18,442,338 |

| RBR | RBR Group Ltd | 0.002 | -33% | 1,300,062 | $4,855,214 |

| ERG | Eneco Refresh Ltd | 0.016 | -27% | 165,010 | $5,991,884 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | 1,052,334 | $15,569,766 |

| AGD | Austral Gold | 0.022 | -24% | 6,555 | $17,757,029 |

| STA | Strandline Res Ltd | 0.085 | -23% | 23,495,877 | $160,882,066 |

| FFF | Forbidden Foods | 0.014 | -22% | 1,717,038 | $3,363,490 |

| RAS | Ragusa Minerals Ltd | 0.03 | -21% | 690,178 | $5,418,754 |

| CUF | Cufe Ltd | 0.012 | -20% | 3,231,123 | $17,191,685 |

| CYQ | Cycliq Group Ltd | 0.004 | -20% | 141,250 | $1,787,583 |

| SI6 | SI6 Metals Limited | 0.0065 | -19% | 19,660,629 | $15,950,875 |

| DY6 | Dy6Metalsltd | 0.11 | -19% | 70,636 | $5,205,936 |

| TAL | Talius Group Limited | 0.009 | -18% | 1,145,087 | $25,147,533 |

| WNR | Wingara Ag Ltd | 0.028 | -18% | 32,003 | $5,968,445 |

| KCC | Kincora Copper | 0.03 | -17% | 100,000 | $5,773,646 |

| EDE | Eden Inv Ltd | 0.0025 | -17% | 403,109 | $10,090,911 |

| ROG | Red Sky Energy. | 0.005 | -17% | 1,181,119 | $31,813,363 |

| MGA | Metalsgrovemining | 0.105 | -16% | 5,171 | $4,650,063 |

| BIT | Biotron Limited | 0.076 | -16% | 16,645,768 | $81,175,041 |

| FTC | Fintech Chain Ltd | 0.011 | -15% | 18,000 | $8,460,005 |

| LPM | Lithium Plus | 0.475 | -15% | 1,935,628 | $36,953,392 |

| EME | Energy Metals Ltd | 0.17 | -15% | 61,517 | $41,936,662 |

| C1X | Cosmosexploration | 0.285 | -15% | 327,631 | $14,899,125 |

TRADING HALTS

Accelerate Resources (ASX:AX8) – Pending an announcement in regarding a potential material acquisition and associated capital raising

Cauldron Energy (ASX:CXU) – Pending an announcement by the Company regarding a material capital raising

Neurotech (ASX:NTI) – Pending the release of the results of the Company’s Phase I/II clinical trial in paediatric patients with PANDAS/PANS

Dimerix (ASX:DXB) – Pending the release of an announcement regarding a licensing agreement.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.