Closing Bell: Most ASX sectors flash green on another record day; Mithril strikes gold in Mexico

ASX-listed Mithril strikes gold in Mexico. Pic via Getty Images

- ASX hits record high as Wall Street rallies

- Mining and tech sectors lead gains while banks also climb

- Myer shares drop 4pc after sales decline, Harvey Norman facing second class action

The ASX touched a record high just minutes into trading on Friday, mirroring a strong session on Wall Street. At the close of the day, the benchmark ASX200 index retreated slightly from its record, finishing the day up 0.21%.

Overnight, the S&P 500 jumped by 1.7% to a new record, while the Nasdaq surged 2.5%.

Traders globally are generally optimistic that the Fed’s 50bp rate cut might pave the way for a soft landing in the US economy.

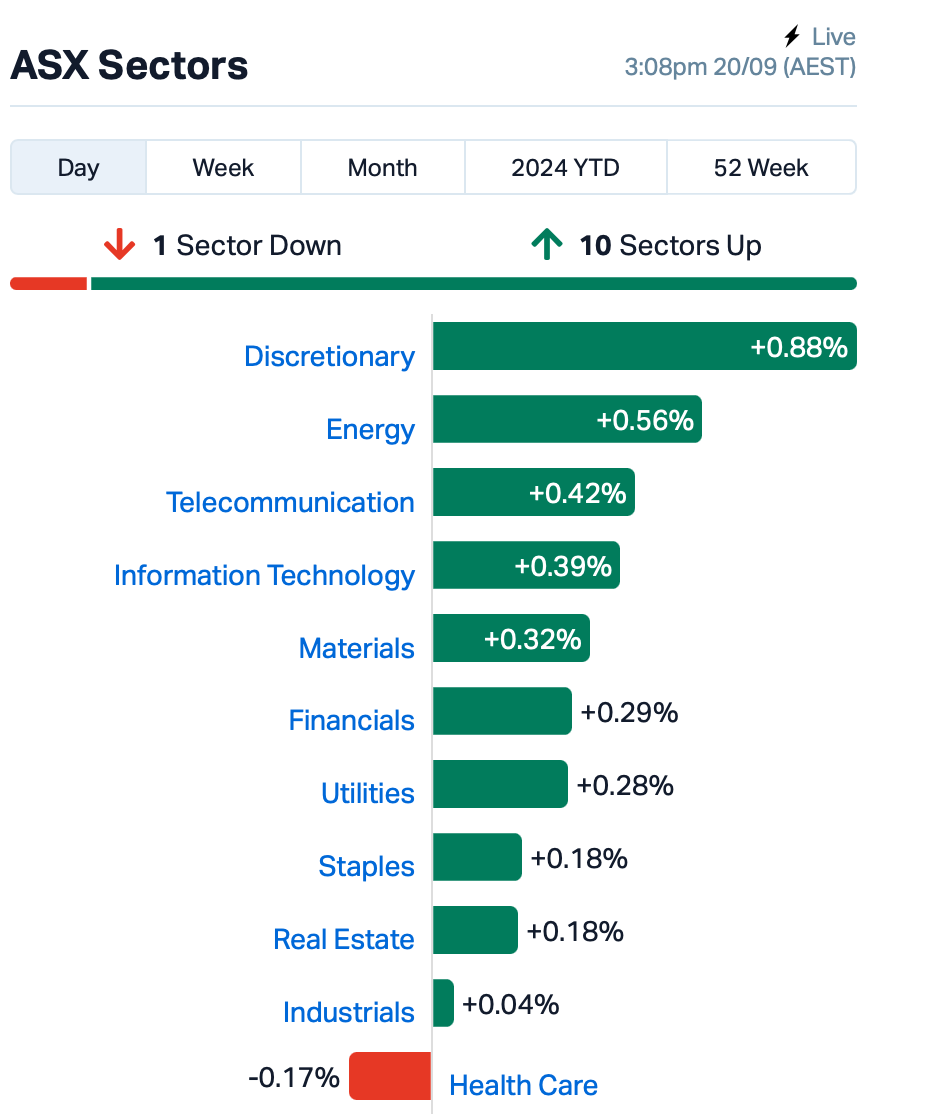

Every sector on the ASX, except for Healthcare, was flashing green today, with Discretionary and Energy leading the charge.

The big banks, along with iron ore stocks BHP (ASX:BHP) and Rio Tinto (ASX:RIO), also climbed.

Retail chain Myer Holdings (ASX:MYR), however, took a hit of 4% after reporting a 2.9% decline in total sales in FY24, largely caused by store closures and challenging economic conditions.

The retailer reported a sharp decrease in NPAT, from $71.1 million the previous year to $52.6 million.

Still in the large caps space, Macquarie Group (ASX:MQG)’s US arm, Macquarie Investment Management, has been fined nearly US$80 million by the SEC for apparently inflating the value of 4,900 mortgage-backed securities between 2017 and 2021. MQG was up slightly.

Retailer Harvey Norman (ASX:HVN) rose over 1% as investors overlooked a second class action claiming “misleading and deceptive” practices related to extended warranty sales.

Maurice Blackburn Lawyers filed the class action against Harvey Norman, the retailer’s second one in a week, claiming that Harvey Norman sold extended warranties, called ‘Product Care’, that provided no real value to customers.

The action argues that these warranties misled consumers, as they already have protections under Australian Consumer Law, and alleges that Harvey Norman lacked the necessary licence to sell financial products.

What else is happening today?

The Bank of Japan held interest rates steady at 0.25% today, but suggested it might hike rates soon. The Yen slightly strengthened after the announcement.

In a surprising move, China opted to keep its benchmark lending rates unchanged today, leaving markets reeling after the US’s 50bp cut. A recent Reuters survey revealed that 69% of market participants had anticipated cuts.

With disappointing economic indicators from August, pressure is now mounting for Beijing to act decisively to stabilise the world’s second-largest economy.

Meanwhile, shareholders are worried about ASX companies becoming more conservative with their payouts levels.

Recent data shows that the average dividend ratio for S&P/ASX 200 companies has dropped from 62% to 53%.

Reece Birtles, chief investment officer at Martin Currie, said this retention of earnings could hurt shareholder value, especially as market conditions change.

He said the resource sector is particularly an area of concern for income investors.

“While the sector delivered strong dividends relative to expectations over the past year, the outlook is now much more challenging, with most future dividends downgraded in this sector.”

“Woodside, in particular, is a concern due to its M&A decision to invest in two new US projects, which is putting pressure on its ability to maintain strong dividend payouts.”

The banking sector remains stable but shows stagnant growth, which could also lead to lower future yields for dividend stocks, says Birtles.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MTH | Mithril Silver Gold | 0.328 | 60% | 13,835,305 | $21,130,626 |

| SMS | Starmineralslimited | 0.049 | 48% | 1,671,463 | $3,125,852 |

| BGE | Bridgesaaslimited | 0.014 | 40% | 250,000 | $1,227,304 |

| MEL | Metgasco Ltd | 0.004 | 33% | 250,491 | $4,342,760 |

| RFA | Rare Foods Australia | 0.016 | 33% | 1,275,975 | $3,263,799 |

| SIS | Simble Solutions | 0.004 | 33% | 4,388,051 | $2,260,352 |

| ESR | Estrella Res Ltd | 0.009 | 29% | 1,720,027 | $12,723,936 |

| PIM | Pinnacleminerals | 0.055 | 28% | 237,072 | $1,954,923 |

| ATX | Amplia Therapeutics | 0.125 | 26% | 708,198 | $27,205,033 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 3,519,701 | $57,867,624 |

| AMD | Arrow Minerals | 0.003 | 25% | 8,895,016 | $25,378,730 |

| EEL | Enrg Elements Ltd | 0.003 | 25% | 1,592,003 | $2,090,032 |

| PUR | Pursuit Minerals | 0.003 | 25% | 3,616 | $7,270,800 |

| BDG | Black Dragon Gold | 0.017 | 21% | 371,921 | $3,745,247 |

| AD1 | AD1 Holdings Limited | 0.006 | 20% | 255,657 | $5,486,742 |

| GCM | Green Critical Min | 0.003 | 20% | 95,000 | $3,671,357 |

| TMG | Trigg Minerals Ltd | 0.024 | 20% | 33,041,196 | $9,360,026 |

| TZL | TZ Limited | 0.024 | 20% | 95,000 | $5,131,662 |

| SUH | Southern Hem Min | 0.019 | 19% | 838,208 | $11,779,841 |

| ALY | Alchemy Resource Ltd | 0.007 | 17% | 2,302,947 | $7,068,458 |

| AOK | Australian Oil. | 0.004 | 17% | 523,188 | $2,833,920 |

| CDT | Castle Minerals | 0.004 | 17% | 3,741,667 | $4,118,442 |

| POS | Poseidon Nick Ltd | 0.004 | 17% | 3,946,555 | $12,611,626 |

Mithril Silver Gold (ASX:MTH) announced impressive drilling results from its Copalquin District project in Mexico, with hole CDH-159 yielding a remarkable intercept of 33.00 metres at 31.8 g/t gold and 274 g/t silver, including a standout 7.00 metres at 144 g/t gold and 1,162 g/t silver.

This finding represents the highest-grade intercept to date in the area and suggests significant potential for resource expansion, with plans to double the existing resource of 529,000 ounces at El Refugio by Q1 2025.

The Copalquin District, rich in mining history with 100 underground gold-silver mines, boasts a maiden JORC resource and ongoing exploration that highlights its potential as a major gold-silver district in Mexico’s Sierra Madre Trend. With multiple target areas and promising geological conditions, Mithril says it aims to capitalise on the district’s substantial mineralisation and further enhance its exploration success.

In spite of weak lithium prices, US-focused ioneer (ASX:INR) has set its sights on a potential 2028 start date for commercial production and December 2024 date for FID on its Rhyolite Ridge lithium and boron mine in the USA.

The company published its final environmental impact statement today for the project, which has the potential to quadruple domestic production of lithium in the United States, where carmakers are finding it tough to find material that complies with rules to garner tax incentives in the Inflation Reduction Act.

Currently the only commercial source of lithium domestically in the USA is Albemarle’s Silver Peak brine operation. At 5000t LCE, that’s a fraction of the output of the giant hard rock lithium mines in Australia.

Importantly, the release of the final EIS includes an opinion from the US Fish and Wildlife Service that it won’t jeopardise the future existence of the Tiehm’s Buckwheat, a flowering plant in the Silver Peak region of Esmeralda County, Nevada.

Trigg Minerals (ASX:TMG) was also one of the best-performing small caps today.

Reborn after originally listing in WA’s short-lived wave of potash proponents, Trigg has two major exploration fronts at hand now after securing a project where the company says some of Australia’s highest grade antimony has been found.

It started drilling earlier this week at the Drummond project in Queensland, where the explorer is searching for an analogue of the 3.6Moz Pajingo mine.

But the company has today acquired the Taylors Arm and Spartan assets in the New England Orogen of New South Wales.

The latter is next to Hillgrove, Australia’s largest known deposit of the critical mineral, which has doubled in value this year and surged in investor interest since China initiated export controls in August.

Taylors Arm, though, has the historic antimony chops. Its 71 historic workings include Testers, where grades from massive stibnite veins clocked 63% Sb, regarded by TMG as the highest in Oz.

Also in the package, the Swallows Nest mine started during World War 2 and delivered a 40% Sb concentrate from 1940-1955 along with a 30% product when it reopened in 1972, with recent rock samples showing the grade could still be there (29.8% Sb and 31.4% Sb)

Amplia Therapeutics (ASX:ATX) has received Fast Track Designation from the US FDA for its drug narmafotinib, a treatment for advanced pancreatic cancer.

This designation helps speed up the development of the promising drug, and will also mean Amplia can have more frequent communications with the FDA, which could lead to accelerated approval in the future.

Meanwhile, the company’s ongoing ACCENT trial for narmafotinib is taking place in Australia and South Korea, and the company is also planning a trial in the US after receiving clearance for its application earlier this year.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OVT | Ovanti Limited | 0.003 | -25% | 23,419,786 | $6,225,393 |

| RBR | RBR Group Ltd | 0.002 | -25% | 8,250,000 | $3,268,809 |

| SI6 | SI6 Metals Limited | 0.002 | -25% | 328,987 | $4,737,719 |

| FSG | Field Solu Hldgs Ltd | 0.015 | -25% | 992,770 | $15,468,891 |

| PNT | Panthermetalsltd | 0.018 | -25% | 2,640,858 | $2,091,988 |

| BLG | Bluglass Limited | 0.023 | -21% | 5,630,473 | $53,262,660 |

| EXL | Elixinol Wellness | 0.004 | -20% | 27,908 | $6,605,912 |

| GTI | Gratifii | 0.004 | -20% | 3,013,784 | $10,745,981 |

| GTR | Gti Energy Ltd | 0.004 | -20% | 6,885,116 | $12,749,735 |

| ODE | Odessa Minerals Ltd | 0.002 | -20% | 41,833 | $2,608,206 |

| RIL | Redivium Limited | 0.004 | -20% | 160,000 | $13,734,274 |

| WML | Woomera Mining Ltd | 0.002 | -20% | 1,941,896 | $3,795,347 |

| TOR | Torque Met | 0.082 | -18% | 130,964 | $18,843,893 |

| GMN | Gold Mountain Ltd | 0.003 | -17% | 1,060,008 | $11,722,420 |

| BIM | Bindimetalslimited | 0.088 | -16% | 315,706 | $3,386,250 |

| EQX | Equatorial Res Ltd | 0.105 | -16% | 22,185 | $16,430,669 |

| OCN | Oceanalithiumlimited | 0.033 | -15% | 50,755 | $3,217,422 |

| DOU | Douugh Limited | 0.003 | -14% | 187,500 | $3,787,241 |

| M24 | Mamba Exploration | 0.012 | -14% | 141,772 | $2,633,152 |

| NRZ | Neurizer Ltd | 0.003 | -14% | 24,000,522 | $7,633,918 |

| PLG | Pearlgullironlimited | 0.012 | -14% | 51,102 | $2,863,585 |

| SS1 | Sun Silver Limited | 0.760 | -13% | 2,355,541 | $60,969,125 |

IN CASE YOU MISSED IT

Deep diamond drilling at American West Metals’ (ASX:AW1) Storm project in Canada has discovered Cyclone style copper mineralisation at depth and confirmed prospectivity of the Central Graben area. The project in the Nunavut region could host large-scale stratigraphic hosted copper deposits.

Anson Resources (ASX:ASN) has raised $5m through a placement of shares priced at 8c each to accelerate its Green River lithium development in Utah. The company will seek to raise a further $2m through a share purchase plan to eligible shareholders.

Lumos Diagnostics (ASX:LDX) has reached the first milestone in the second phase of its development agreement to create a new foetal fibronectin (fFN) test to help indicate a pregnant woman’s risk of delivering prematurely for Nasdaq-listed Hologic.

Metalicity’s (ASX:MCT) first hole at the Pennyweight Point prospect within its Yundamindra gold project has returned an exceptional 30m intersection grading 3.86g/t gold. Assays from a further 31 holes are pending.

Mithril Silver and Gold (ASX:MTH) has made an intercept of 7m grading 144g/t gold and 1162g/t silver at its Copalquin project in Mexico, the best intersection seen to date. It comes as the company moves to increase existing resources.

Renegade Exploration (ASX:RNX) is set to drill into new Greater Mongoose targets in mid-October in its search for the next large iron-oxide copper-gold discovery in Queensland at its Cloncurry project.

The explorer, which shares the broader Carpentaria JV with Glencore, is chasing an iron-oxide copper-gold discovery in the vein of Evolution Mining’s (ASX:EVN) 50,000tpa copper, 80,000ozpa gold Ernest Henry mine.

“The new drone data will be incorporated with our magnetic remnants data, and Mongoose Deeps drill hole data to provide a higher confidence 3D model for drill targeting but is already offering an impressive picture of widespread mineralisation and robust new targets,” RNX MD Rob Kirtlan said.

Trigg Minerals (ASX:TMG) has picked up a string of historic antimony mines that include some of the highest grades of the critical mineral ever recorded in Australia.

The Taylors Arm portfolio and Spartan antimony project have history on their side in the form of previous production and proximity to Australia’s largest antimony resource.

Taylors Arm contains no less than 71 historical mines on granted exploration licence areas, including the Testers mine which featured massive stibnite veins grading up to 63% Sb, the highest recorded in Oz.

Notably, Spartan is next to Larvotto Resources (ASX:LRV) and its mothballed Hillgrove mine on the same rocks.

Raiden Resources (ASX:RDN) has secured two diamond drill rigs from Western Australian drilling contractor, Topdrill, and earthmoving contractor JB Contracting, for its upcoming maiden diamond drilling program at the Andover South lithium project.

“Both have extensive experience working within the Andover Complex, including at Azure’s Andover lithium project,” MD Dusko Ljubojevic said.

“Along with the expertise of our technical team, this positions Raiden for a smooth and successful campaign, maximising the potential for discovery success for our shareholders.”

The 5,000m drilling program (up to 10,000m if RDN elects to extend) is expected to commence next week with a single diamond drill rig, as soon as initial access has been completed, with a second rig mobilising shortly after.

At Stockhead, we tell it like it is. While American West Metals, Anson Resources, Lumos Diagnostics, Metalicity, Mithril Silver and Gold, Renegade Exploration, Trigg Minerals and Raiden Resources are all Stockhead advertisers, they did not sponsor this article

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.