Closing Bell: It’s official – the ASX is completely out of New Year cheer

Determined to see the New Year in with a bang, Robyn was devastated when her Tinder finished faster than the countdown to the fireworks. Pic via Getty Images.

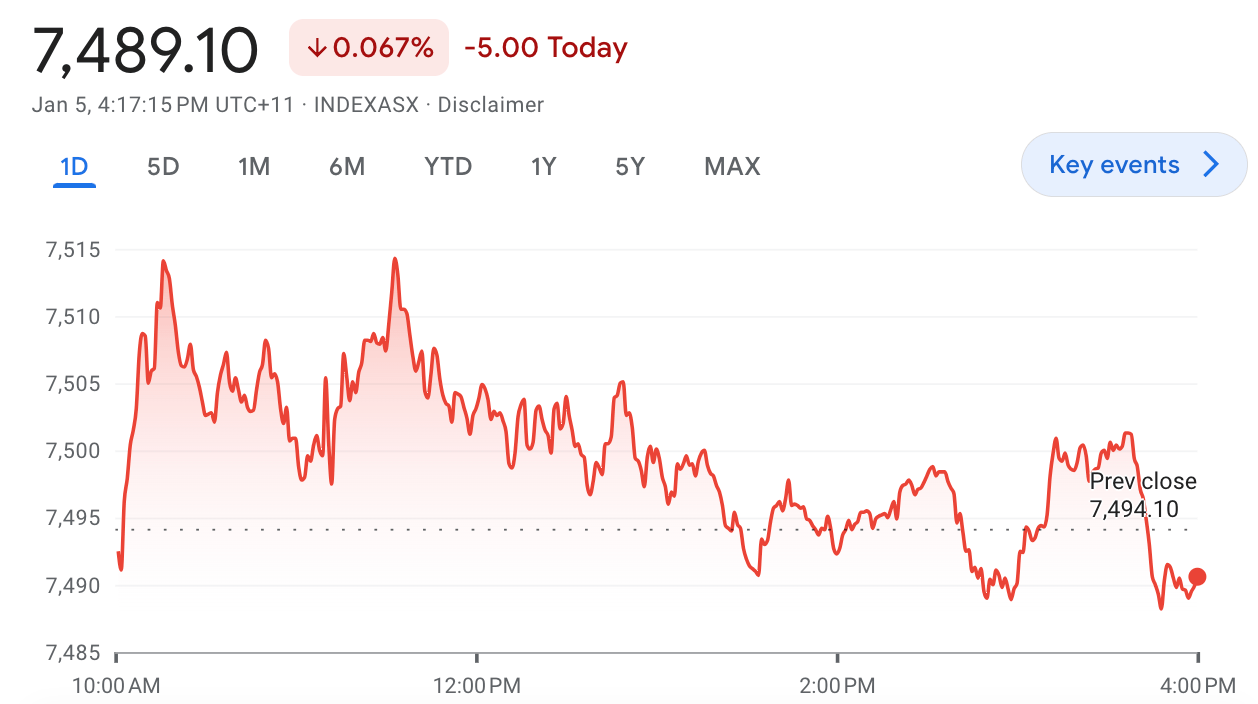

- ASX200 has fallen at the last, down 0.07pc for the session and 1.64pc for the week (and the YTD!)

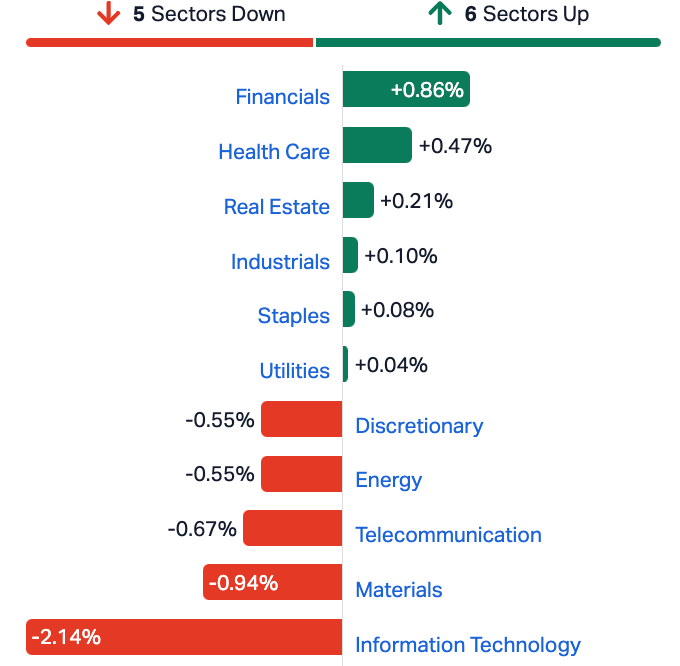

- Financials fail to offset broader losses led by IT Sector

- Small Cap Winners led by Calima Energy and BlueBet.

Inflation. I bet you thought we’d be done with this in 2024.

With exactly 16 minutes left of trade on Friday, the Australian benchmark dipped peevishly into the red for the first time, with the major banks no longer able to offset broader afternoon losses as Asian markets were left in turn to ponder anew the trajectory of US rate cuts.

At 4.15pm on Friday, the ASX200 was five points or 0.07% lower at 7489:

Real Estate, Healthcare and the banks had managed to hold green at lunchtime on Friday despite a negative lead from Wall Street where reports showed the US job market was stronger than expected, dampening the chance of rate cuts.

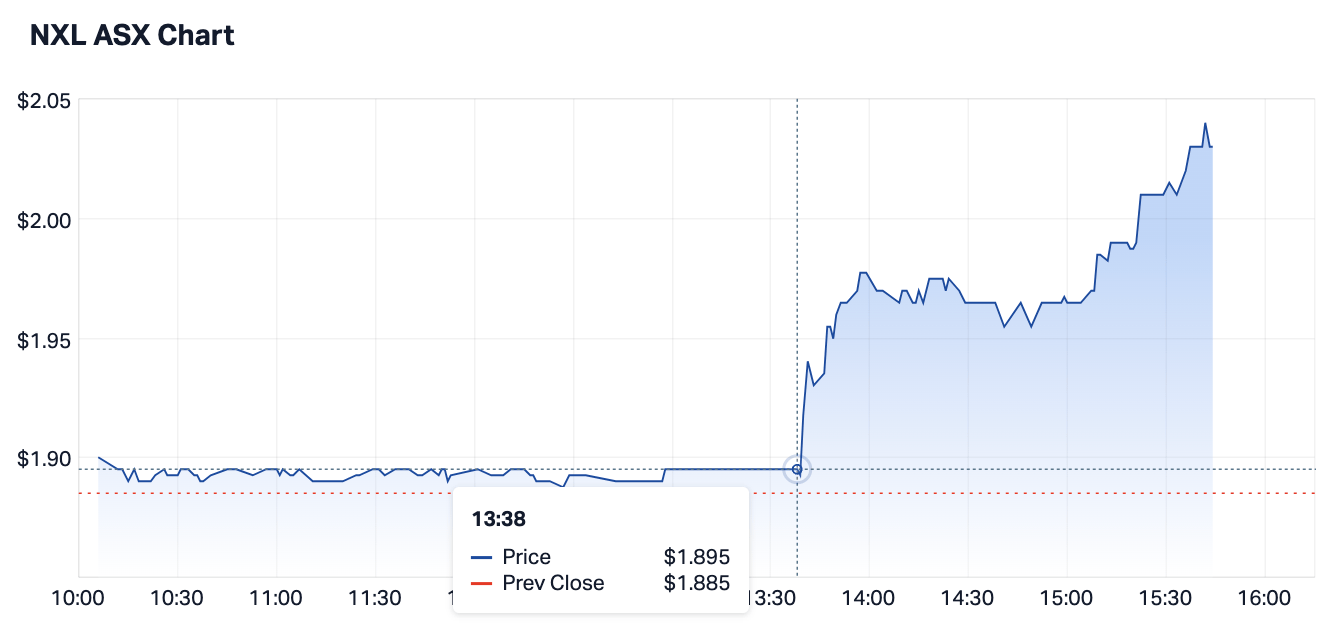

Meanwhile, something’s going on with Nuix (ASX:NXL) this arvo. On a day where the IT Sector has crashed by over 2.2%, Nuix has come home about 7% higher, lurching awake at about 1.30pm as this graph, graphically shows. (below)

I’m sure it’s all entirely above board.

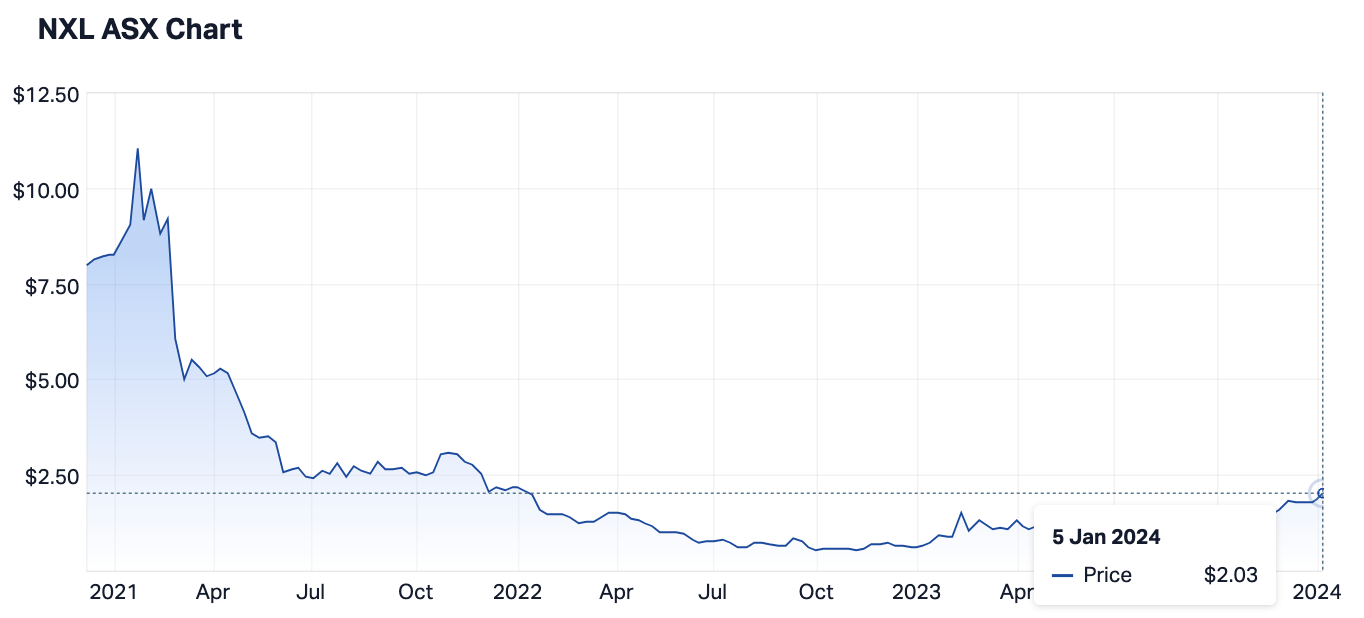

For those who’ve somehow forgotten the SaaS company’s disastrous float and subsequent trip to the Federal Court at the behest of the markets regulator, we last saw Nuix in November, getting sued under the Corporations Act for alleged continuous disclosure breaches and for making misleading or deceptive statements to the market.

ASIC’s been on the Nuix case since the biggest IPO of 2020 landed with a whimper, obliterating billions of Macquarie-backed market value from punters frantically sold on the promise of a homegrown tech giant – when Nuix was in fact just a very good enterprise software firm.

Worth noting.

Anyhoo.

Back on the actual bourse… it was the big banks which first came to the rescue and then needed rescuing, falling away late in the day to ensure the ASX copped a third straight session of losses.

The Materials Sector weighed, while the lightweight IT Sector followed the Nasdaq Composite down an exciting rates-related hole.

ASX SECTORS at 4pm on FRIDAY

Around the ‘hood, Asian-Pacific equity markets were mixed at 3pm in Sydney. Everyone’s a bit directionless after US investors went to work in the overnight session with little audacity and not a lot of hope, preferring to prod cautiously before tonight’s (Sydney time) US jobs data drop and the clues it could provide on the US Fed’s cash rate trajectory.

Japan’s Nikkei 225 advanced, the South Korean Kopsi, Hong Kong’s Hang Seng and the various mainland Chinese markets all equivocated either side of parity.

WTI crude futures steadied above $72 per barrel in the states with weakening US demand offsetting these supply worries nout of Libya.

Both WTI and Brent Crude walked back more than -2.2% on Thursday when the IEA revealed US gasoline inventories jumped by 10.9 million barrels last week, the largest week-on-week increase in more than three decades.

Overnight, the Dow Jones IA racked up 10 points, to close a painful 0.03% higher.

The losses on the S&P 500 and the tech-heavy Nasdaq were a bit more pronounced – down 0.34% and 0.56%, respectively.

All 3 US majors look like emphatically putting Wall Street’s cracking nine-week winning streak to bed at the end of tomorrow session.

With a revivified Greenback and 10-yr US Treasury yields (now pushing 4%0, US punters have been paring back their ostentatious pre-Xmas bets all week, now that the mist has cleared a little and the rhythm of US interest rate cuts appears with the latest FOMC minutes indicating a high level of uncertainty on the policy outlook.

Eight out of the 11 S&P500 sectors finished lower, with Energy leading the bleeding.

US stockmarket futures at 4.30pm on Friday in Sydney:

Finally, Bitcoin and its ilk were back heading higher on Thursday in New York.

As mentioned several times this week: Euphoria that the US government will soon approve Bitcoin exchange-traded funds has flowed more than ebbed into the New Year, but there’s doubt now, and it’s creeping.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CE1 | Calima Energy | 0.1025 | 58% | 21,421,578 | $40,671,850 |

| FHS | Freehill Mining Ltd. | 0.009 | 50% | 13,165,882 | $17,099,007 |

| M4M | Macro Metals Limited | 0.003 | 50% | 1,258,607 | $4,934,156 |

| LYN | Lycaonresources | 0.235 | 47% | 332,791 | $7,049,000 |

| KZR | Kalamazoo Resources | 0.15 | 36% | 1,441,548 | $18,850,642 |

| AUH | Austchina Holdings | 0.004 | 33% | 115,523 | $6,233,651 |

| BP8 | Bph Global Ltd | 0.002 | 33% | 51,964 | $2,753,345 |

| BDG | Black Dragon Gold | 0.048 | 33% | 541,392 | $7,224,122 |

| BBT | Bluebet Holdings Ltd | 0.255 | 31% | 1,052,259 | $39,214,262 |

| ODE | Odessa Minerals Ltd | 0.009 | 29% | 830,742 | $6,629,783 |

| PXX | Polarx Limited | 0.009 | 29% | 2,823,110 | $11,477,317 |

| HCD | Hydrocarbon Dynamic | 0.005 | 25% | 984,000 | $3,078,664 |

| SI6 | SI6 Metals Limited | 0.005 | 25% | 3,701,122 | $7,975,438 |

| AW1 | Americanwestmetals | 0.165 | 22% | 2,672,459 | $58,925,557 |

| BPH | BPH Energy Ltd | 0.067 | 22% | 33,021,303 | $56,425,982 |

| FFG | Fatfish Group | 0.028 | 22% | 21,755,420 | $31,975,513 |

| TIG | Tigers Realm Coal | 0.006 | 20% | 1,000,000 | $65,333,512 |

| STN | Saturn Metals | 0.215 | 19% | 719,721 | $40,195,477 |

| NGY | Nuenergy Gas Ltd | 0.039 | 18% | 169,335 | $48,871,531 |

| PRM | Prominence Energy | 0.013 | 18% | 235,257 | $1,720,140 |

| VR1 | Vection Technologies | 0.026 | 18% | 2,427,226 | $24,784,957 |

| AMN | Agrimin Ltd | 0.235 | 18% | 303,253 | $61,937,164 |

| CRS | Caprice Resources | 0.035 | 17% | 2,227,570 | $6,702,608 |

| HYD | Hydrix Limited | 0.021 | 17% | 131,513 | $4,575,939 |

| ECT | Env Clean Tech Ltd. | 0.007 | 17% | 2,235,195 | $17,185,862 |

Friday’s big winner is Calima Energy (ASX:CE1), which popped a very healthy 61.5% gain in the AM after it struck a ‘definitive agreement’ for flogging its Canadian subsidiary Blackspur Oil Corp to Astara Energy, for the princely sum of C$75 million – roughly

83.3 million of our puny Australian dollarydoos.

Which is, of course, big news – but the major reason why Calima’s gone absolutely gangbusters is this little nugget in the announcement:

“It is the Company’s objective to distribute no less than 85% of the funds received from the Blackspur Sale to Calima shareholders in the most tax effective form and the Company will seek an ATO ruling on this matter in a timely fashion.”

Calima is currently trading at $0.105, which comes with a free hit at a slice of just under $71 million, depending on how the ATO decides to rule on the offer.

International bookie Michael Sullivan’s Bluebet (ASX:BBT) is up more than 25% this morning, after releasing a boilerplate non-denial of media speculation about a possible merger between it and rival Matt Tripp’s BetR.

“BlueBet is regularly involved in discussions with third parties regarding strategic initiatives, including Betr, aimed at maximising value for its shareholders,” the company said.

So that’s a very firm “possibly”, which was enough to get the more punt-friendly investors away from the pokies for a few minutes this morning.

And MTM Critical Metals (ASX:MTM) is still making the most of its recent news about rare earth element (REE) and niobium (Nb) mineralisation over broad intervals in previously untested parts of the Pomme carbonatite complex – the same news that saw the company shed 27% to $0.07 the day it dropped has since seen the company’s price climb 85.7% to $0.13… What a time to be alive.

Later in the day, BPH Energy (ASX:BPH) saw a flurry of activity for no particular reason that I was able to spot during a slightly-more-than-perfunctory look at the headlines, climbing around 22% to close out the week up by more than 43%.

Havilah Resources (ASX:HAV) made a late play for the headlines, dropping an announcement that it has found graphite at its Birksgate prospect in the Curnamona Province of northeastern South Australia, located approximately 50 km north-northwest of Kalkaroo.

But… it looks like it missed the mark, hardly surprising since the announcement came mid-afternoon on a very slow Friday, with results from a single drillhole, with a peak graphite interception of 4.9% over 21m from 36m – which, in the grand scheme of things, isn’t a show-stopper.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.0015 | -25% | 1,326,330 | $2,176,231 |

| YOJ | Yojee Limited | 0.003 | -25% | 9,958,248 | $5,223,941 |

| EDE | Eden Inv Ltd | 0.002 | -20% | 10,856,298 | $9,167,534 |

| AKM | Aspire Mining Ltd | 0.15 | -19% | 678,946 | $93,912,842 |

| NWF | Newfield Resources | 0.135 | -18% | 82,713 | $149,031,700 |

| MDX | Mindax Limited | 0.051 | -18% | 5,000 | $126,824,644 |

| HRN | Horizon Gold Ltd | 0.25 | -17% | 29,807 | $43,451,977 |

| AL8 | Alderan Resource Ltd | 0.005 | -17% | 4,607,773 | $6,641,168 |

| AMD | Arrow Minerals | 0.005 | -17% | 4,622,418 | $20,842,591 |

| CHK | Cohiba Min Ltd | 0.0025 | -17% | 3,753,332 | $7,590,691 |

| IS3 | I Synergy Group Ltd | 0.005 | -17% | 11,764 | $1,824,482 |

| OAR | OAR Resources Ltd | 0.0025 | -17% | 3,996,666 | $7,931,183 |

| RDS | Redstone Resources | 0.005 | -17% | 121,991 | $5,528,271 |

| PAM | Pan Asia Metals | 0.18 | -16% | 454,424 | $36,080,607 |

| LRD | Lordresourceslimited | 0.055 | -15% | 1,134,981 | $2,413,588 |

| WWG | Wisewaygroupltd | 0.042 | -14% | 191,676 | $8,197,400 |

| PRX | Prodigy Gold NL | 0.006 | -14% | 50,000 | $12,257,755 |

| TMK | TMK Energy Limited | 0.006 | -14% | 2,999,891 | $42,858,055 |

| VML | Vital Metals Limited | 0.006 | -14% | 1,682,406 | $41,265,469 |

| ZNC | Zenith Minerals Ltd | 0.12 | -14% | 281,147 | $49,333,324 |

| TBN | Tamboran | 0.19 | -14% | 734,652 | $433,747,072 |

| TSI | Top Shelf | 0.19 | -14% | 28,713 | $45,644,689 |

| GML | Gateway Mining | 0.02 | -13% | 654,846 | $7,829,565 |

| AGD | Austral Gold | 0.028 | -13% | 300,000 | $19,593,963 |

| EMT | Emetals Limited | 0.007 | -13% | 4,300 | $6,800,000 |

Trading Halts

Kingsrose Mining (ASX:KRM) regarding government approval to commence drilling at the Porsanger Project in Norway

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.