Closing Bell: Healthcare sector gives ASX a booster to rise 0.33pc

The healthcare sector has given the ASX a shot in the arm today, leading gains. Pic: Getty Images

- ASX lifts 0.33pc on healthcare sector strength

- CSL adds 2.4pc as UBS marks ASX healthcare sector as best EPS pick

- Chinese manufacturing data contracts, but shows signs of stirring

Are healthcare bulls returning?

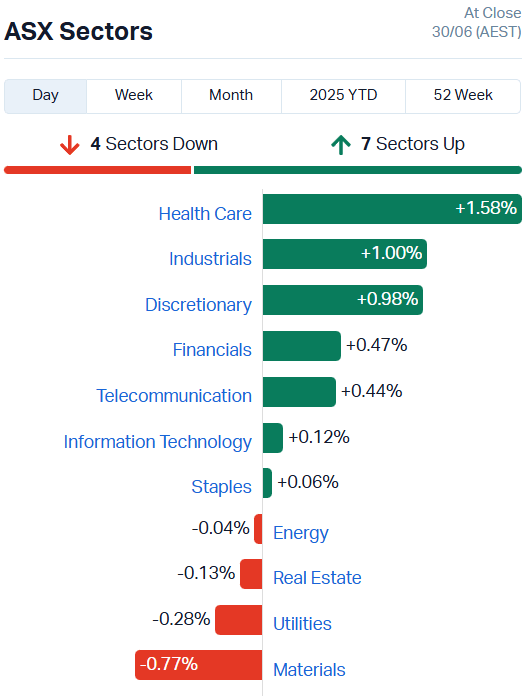

The ASX healthcare sector was the best performing of the ASX’s 11 subcategories in trade today, handily outperforming the other sectors with a 1.58% jump.

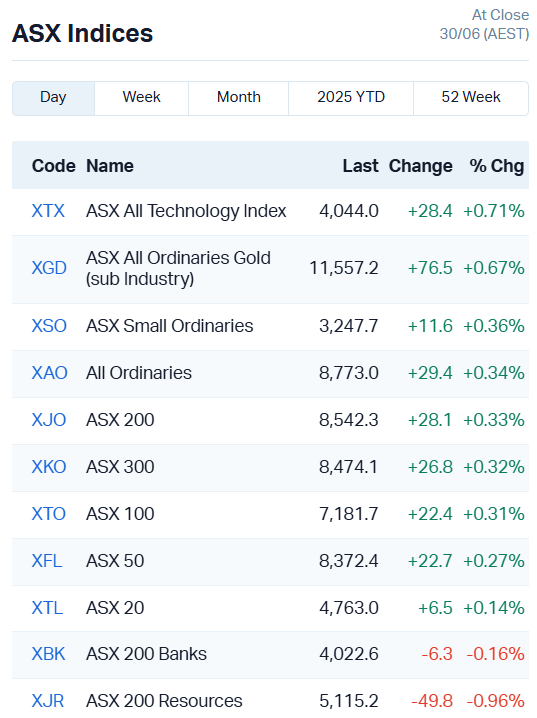

With support from industrials (+1%) and consumer discretionary (+0.98%), that was enough for the ASX 200 to make a convincing gain of 0.33% today, having had a steady run of momentum throughout trade.

Regis Healthcare (ASX:REG) added 3.2%, Ramsay Health Care (ASX:RHC) 1.9% and Summerset Group (ASX:SNZ) 1.3%.

As for our healthcare giants, CSL (ASX:CSL) gained 2.4%, Pro Medicus (ASX:PME) 2% and Cochlear (ASX:COH) 1.7%.

If financial giant UBS is to be believed, this may be the start of a bit of a bullish run for ASX biotech stocks, which have been suffering over the past few months.

UBS reckons the ASX healthcare sector is now undervalued, offering the best earnings-per-share growth of all sectors, and forecasting a 20% increase in the 2025-26 year.

“Investor sentiment towards the healthcare sector has broadly cooled over the past year, with some marked deterioration seen across many stocks,” UBS says.

“Cochlear in particular has seen investor apathy build over the last year, which represents a significant change of views.”

Back on the ASX today, the main drag was in the materials sector, down 0.77%.

The ASX 200 Resources index was also an anchor, shedding 0.96%, but it was outweighed by gains in the All Tech, Gold and Small Ords indices.

Chinese manufacturing data contracts again

While iron ore has been enjoying a small uptick in pricing the past five days or so, the latest data out of China isn’t the best news for Aussie base metal stocks.

Manufacturing activity from our largest trading partner fell again for a third month straight in June, despite Beijing’s attempts to stimulate the sector.

The official purchasing manager’s index did improve slightly from 49.5 in May to 49.7 in June, but remained below the 50-point benchmark which indicates whether the index is expanding or contracting.

Inventory and employment levels at factories fell as well, but the news wasn’t all bad.

The sub-index tracking manufacturing production rose to 51 and new orders lifted to 50.2, which could indicate the first stirrings of momentum beginning to build in China’s industrial activity.

Chinese Premier Li Qiang said Chinese authorities would implement measures to “make China a mega-sized consumption powerhouse” as well as a manufacturing one in a speech at the World Economic Forum’s annual conference in China.

“We still think that there are challenges [for China] this year, but I think it’s not as far-fetched as we thought before,” Oxford Economics lead economist for China Louise Loo said.

“However punitive tariffs are, I think in the near term, it’s quite hard to decouple China from global supply chains, and that means we will continue to see China exports, at least, remain quite competitive, and that should support economic growth for the Chinese.”

It remains to be seen if that will translate into higher demand for Australian iron ore, but one can hope.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| WEL | Winchester Energy | 0.002 | 100% | 165600 | $1,363,019 |

| LSR | Lodestar Minerals | 0.011 | 83% | 42455380 | $1,910,543 |

| ADD | Adavale Resource Ltd | 0.0015 | 50% | 15489651 | $2,287,279 |

| ADY | Admiralty Resources. | 0.006 | 50% | 1690337 | $10,517,918 |

| EEL | Enrg Elements Ltd | 0.0015 | 50% | 860601 | $3,253,779 |

| MPR | Mpower Group Limited | 0.01 | 43% | 5225088 | $2,405,923 |

| GTE | Great Western Exp. | 0.011 | 38% | 3625782 | $4,542,063 |

| MEG | Megado Minerals Ltd | 0.023 | 35% | 4786016 | $10,313,615 |

| ALM | Alma Metals Ltd | 0.004 | 33% | 2325000 | $5,261,182 |

| FCT | Firstwave Cloud Tech | 0.016 | 33% | 3070713 | $20,562,224 |

| FHS | Freehill Mining Ltd. | 0.004 | 33% | 15028446 | $10,241,561 |

| GTR | Gti Energy Ltd | 0.004 | 33% | 5538733 | $8,996,849 |

| SPX | Spenda Limited | 0.008 | 33% | 16838995 | $27,691,293 |

| GLH | Global Health Ltd | 0.068 | 33% | 176778 | $2,987,301 |

| AAU | Antilles Gold Ltd | 0.005 | 25% | 6046776 | $9,516,272 |

| ERL | Empire Resources | 0.005 | 25% | 692641 | $5,935,653 |

| RCM | Rapid Critical | 0.0025 | 25% | 1125000 | $2,831,556 |

| ROG | Red Sky Energy. | 0.005 | 25% | 120000 | $21,688,909 |

| TMX | Terrain Minerals | 0.0025 | 25% | 5339766 | $5,063,629 |

| VR1 | Vection Technologies | 0.036 | 24% | 40421798 | $51,255,235 |

| THR | Thor Energy PLC | 0.011 | 22% | 2677843 | $6,397,109 |

| KNB | Koonenberrygold | 0.039 | 22% | 46537381 | $32,790,159 |

| RPG | Raptis Group Limited | 0.063 | 21% | 185561 | $18,235,612 |

| NGX | Ngxlimited | 0.145 | 21% | 45773 | $10,873,421 |

| SDV | Scidev Ltd | 0.36 | 20% | 293999 | $57,026,459 |

Making news…

Lodestar Minerals (ASX:LSR) is looking to follow up on gold hits at its Chilean copper-gold projects with proceeds from a $2.2m two-tranche share placement.

LSR is offering $475k in the first tranche to clients of lead manager Oakley Capital Partners, with the rest hanging on shareholder approval.

Adavale Resources (ASX:ADD) is preparing to put drill bit to ground at the London Victoria Mine in NSW, which historically produced gold grades up to 43.8 g/t gold.

It’s the first exploration at the mine in 30 years; ADD will target shallow extensions to the existing mineral resource estimate, which currently sits at 115,000 ounces of gold.

FirstWave Cloud Technology (ASX:FCT) has inked a licensing agreement with Claro Dominican Republic to license its NMIS v9 network management software suite for an upfront fee of US$250k.

It’s a pure-profit contract, as the contract doesn’t require delivery, support or professional services.

GTI Energy (ASX:GTR) is locking in a $4.5m placement at an issue price of 0.035 cents a share, a 16.7% premium to the last close price of 0.030 cents. The money will be funnelled directly to resource expansion and infill drilling at the Lo Herma uranium project.

GTR’s recent scoping study revealed a potential pre-tax net present value of between $174m and $187m and an internal rate of return of between 52% and 66% for Lo Herma. Check out Stockhead’s Break it Down for more on GTR’s capital raising.

Spenda (ASX:SPX) has teamed up with APG Pay Pty Ltd to develop and commercialise a corporate credit platform.

The two companies will collab on a scaleable B2B payments space that can scale across multiple industries, starting with the travel industry. Spenda reckons the deal will bring in recurring profit of $1.7m per year.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| CT1 | Constellation Tech | 0.001 | -50% | 1322698 | $2,949,467 |

| IS3 | I Synergy Group Ltd | 0.002 | -50% | 3892995 | $2,002,920 |

| T3D | 333D Limited | 0.006 | -33% | 33333 | $1,585,651 |

| ADR | Adherium Ltd | 0.004 | -33% | 3436600 | $5,390,874 |

| TEG | Triangle Energy Ltd | 0.002 | -33% | 4164703 | $6,267,702 |

| TKL | Traka Resources | 0.001 | -33% | 135263 | $3,188,685 |

| L1M | Lightning Minerals | 0.043 | -28% | 1471249 | $6,199,699 |

| ZMM | Zimi Ltd | 0.008 | -27% | 616731 | $4,702,982 |

| FIN | FIN Resources Ltd | 0.003 | -25% | 557800 | $2,779,554 |

| GMN | Gold Mountain Ltd | 0.0015 | -25% | 1983598 | $11,239,518 |

| HLX | Helix Resources | 0.0015 | -25% | 1234287 | $6,728,387 |

| SFG | Seafarms Group Ltd | 0.0015 | -25% | 893383 | $9,673,198 |

| SRN | Surefire Rescs NL | 0.0015 | -25% | 334051 | $4,972,891 |

| TYX | Tyranna Res Ltd | 0.003 | -25% | 325000 | $13,153,701 |

| GLA | Gladiator Resources | 0.007 | -22% | 1626499 | $6,824,671 |

| YAR | Yari Minerals Ltd | 0.012 | -20% | 2978290 | $8,320,672 |

| AUK | Aumake Limited | 0.002 | -20% | 1177734 | $7,558,397 |

| MEM | Memphasys Ltd | 0.004 | -20% | 6329063 | $9,917,991 |

| MKL | Mighty Kingdom Ltd | 0.016 | -20% | 1737419 | $10,326,928 |

| PPG | Pro-Pac Packaging | 0.016 | -20% | 78233 | $3,633,754 |

| RAN | Range International | 0.002 | -20% | 2187661 | $2,348,226 |

| SKK | Stakk Limited | 0.004 | -20% | 2620995 | $10,375,398 |

| VEN | Vintage Energy | 0.004 | -20% | 1780465 | $10,434,568 |

| HIQ | Hitiq Limited | 0.014 | -18% | 1054211 | $7,814,865 |

| BDM | Burgundy D Mines Ltd | 0.029 | -17% | 604995 | $49,746,630 |

IN CASE YOU MISSED IT

QPM Energy (ASX:QPM) is powering up with plans for a new gas-fired plant at the Isaac Energy Hub.

Astute Metals (ASX:ASE) has identified four high-priority gold-silver targets at its Needles project in Nevada, USA, thanks to a data review.

Green Critical Minerals (ASX:GCM) has cleared another hurdle at the McIntosh graphite project with a PFS showcasing robust economics including $25m post-tax NPV, 25.3% IRR and a 32.5-year mine life.

LTR Pharma (ASX:LTP) has completed extractables studies for its Spontan intranasal spray for erectile dysfunction and kicked off a leachables study.

Ausgold (ASX:AUC) has released a positive definitive feasibility study for its Katanning gold project (KGP) in WA, highlighting robust returns over a 10-year mine life.

Theta Gold Mines’ (ASX:TGM) board has rubber stamped the TGME mine in South Africa’s Mpumalanga region as high gold prices stir investment in the historic mining district.

Break it Down: Anson Resources (ASX:ASN) has paired up with a Korean battery maker to develop a DLE demonstration plant at the Green River project in Utah.

Redcastle Resources (ASX:RC1) is on its way to becoming an integrated exploration and production company after lifting resources to 42,000oz at the Redcastle project.

TRADING HALTS

Australian Mines (ASX:AUZ) – cap raise and potential acquisition

AuKing Mining (ASX:AKN) – cap raise

Battery Age Minerals (ASX:BM8) – cap raise

Blackstone Minerals (ASX:BSX) – cap raise

archTIS (ASX:AR9) – cap raise

Lodestar Minerals (ASX:LSR) – cap raise

Liontown Resources (ASX:LTR) – executive changes

Olympio Metals (ASX:OLY) – cap raise

Peak Minerals (ASX:PUA) – response to ASX price query

Red Mountain Mining (ASX:RMX) – cap raise

Rent.com.au (ASX:RNT) – cap raise

Terra Uranium (ASX:T92) – acquisition and cap raise

Vitasora Health (ASX:VHL) – cap raise

At Stockhead, we tell it like it is. While GTI Energy is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.