Closing Bell: Gold rules a rising ASX

Via Getty

- The ASX200 has kicked higher

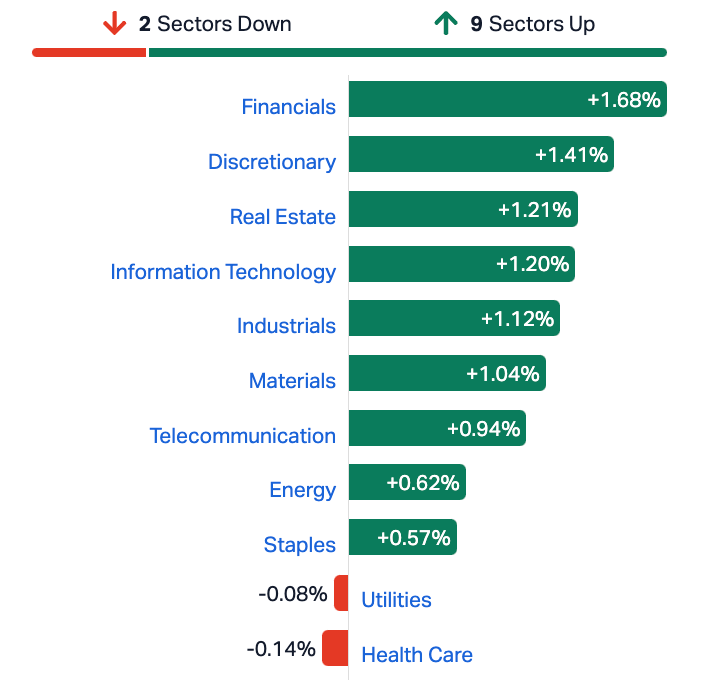

- All Sectors in the green, Healthcare and Utilities the only laggards

- Small Caps led by Australian Strategic Materials, Cokal

We are higher on Thursday. So is the ASX.

Once Wall Street hit more record highs on Wednesday in New York, it looked academic for local markets.

The S&P/ASX 200 index at match out:

Thursday on the ASX wavered like a Monday but came good like a Friday.

Stocks got trimmed ahead of lunchtime, when a monster unemployment read shook the confidence of local traders who’d begun to happily bake in a Reserve Bank interest rates cut all their own.

The US central bank held its cash rate steady, although the mantra traders took to bed on the NYSE appears to have been: the US Federal Reserve is likely to cut interest rates three times this year.

With the dream of looser monetary policy in the US, all but reaffirmed by the Fed, if not the RBA, all 11 local sectors except healthcare began to make solid inroads.

Utilities faltered in afternoon trade.

The price of Gold rose above US$2,200 an ounce, and added 1% during the session, extending earlier gains to clock another new record high as the US Fed maintained its outlook.

The All Gold index (XGD) added almost 4% as the major gold producers Evolution (4.5%), Northern Star (2.3%) and Newmont (up 3.6%) led the major winners.

Financials were led higher by the big 4, Property stocks enjoyed the outing were also stronger as Goodman Group gained 1.7 per cent, Mirvac added 1.6 per cent and Scentre climbed 1.2 per cent.while Healthcare was dragged down by cochlear and CSL.

The Small Ords (XSO) and the Emerging Co’s (XEC) both climbed.

The Aussie dollar is up about 0.8% since the RBA decision.

ASX Sectors at 3.45pm on Thursday

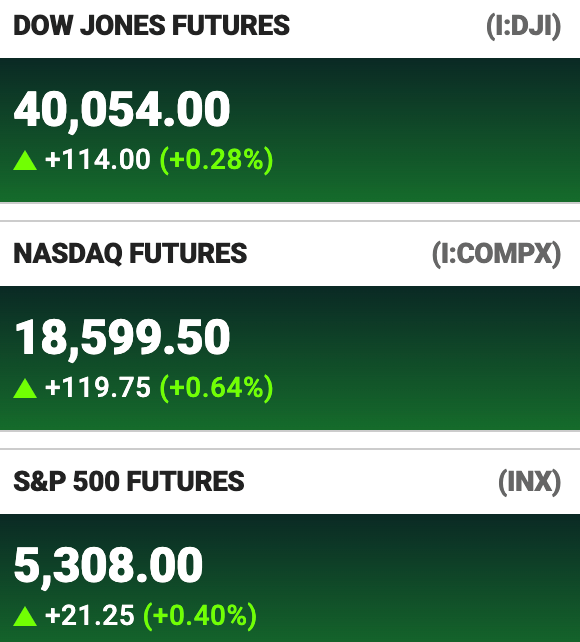

US stock futures are slightly lower on Thursday in Sydney:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AOA | Ausmon Resorces | 0.003 | 50% | 350,000 | $2,117,999 |

| AXP | AXP Energy Ltd | 0.0015 | 50% | 8,566,842 | $5,824,681 |

| AYM | Australia United Min | 0.003 | 50% | 1,359,547 | $3,685,155 |

| SIH | Sihayo Gold Limited | 0.0015 | 50% | 250,000 | $12,204,256 |

| SIT | Site Group Int Ltd | 0.003 | 50% | 17,361 | $5,204,980 |

| SRL | Sunrise | 0.65 | 41% | 191,073 | $41,504,649 |

| GMN | Gold Mountain Ltd | 0.004 | 33% | 70,396,407 | $8,926,517 |

| LNU | Linius Tech Limited | 0.002 | 33% | 2,054,907 | $7,795,111 |

| CKA | Cokal Ltd | 0.093 | 31% | 1,936,458 | $76,605,378 |

| FRX | Flexiroam Limited | 0.022 | 29% | 1,940,003 | $11,230,322 |

| MRZ | Mont Royal Resources | 0.085 | 29% | 87,216 | $5,611,966 |

| CLZ | Classic Min Ltd | 0.018 | 29% | 6,541,657 | $3,609,224 |

| EXT | Excite Technology | 0.009 | 29% | 409,549 | $9,304,692 |

| CC9 | Chariot Corporation | 0.28 | 27% | 431,605 | $17,992,999 |

| NHE | Nobleheliumlimited | 0.115 | 25% | 3,042,976 | $33,678,602 |

| EFE | Eastern Resources | 0.01 | 25% | 27,373,251 | $9,935,572 |

| PRX | Prodigy Gold NL | 0.005 | 25% | 3,230,000 | $7,004,431 |

| TAS | Tasman Resources Ltd | 0.005 | 25% | 1,378,394 | $2,850,677 |

| GBE | Globe Metals &Mining | 0.043 | 23% | 259,199 | $23,655,366 |

| AKG | Academies Aus Grp | 0.245 | 23% | 4,004 | $26,522,893 |

| AUA | Audeara | 0.055 | 22% | 141,644 | $6,507,348 |

| ASM | Ausstratmaterials | 1.435 | 21% | 2,813,872 | $198,482,459 |

| LDR | Lode Resources | 0.085 | 20% | 360,697 | $7,581,674 |

| ILT | Iltani Resources Lim | 0.155 | 19% | 1,000 | $4,421,366 |

| LIS | Lisenergylimited | 0.155 | 19% | 562,322 | $83,226,030 |

Aussie coal miner, with an Indonesian twist, Cokal (ASX:CKA) says it’s just secured 12 months of revenue after striking a transport deal at the Bumi Barito Mineral (BBM) project.

MD & CEO Karan Bangur says it’s all part of “…Cokal’s undeterred vision for becoming a successful mine-logistics operator in Central Kalimantan… to ensure that coal product can be delivered to the market in a timely manner.”

The company says securing x2 barges along with the infrastructure development of the Batu Tuhup Jetty to cater for large volumes of coal product, is an important step towards the development of an integrated supply chain infrastructure.

The company has also increased its funding facilities by US $2m to assist in the transition to regular coal sales and regulatory payments of land reclamation bond.

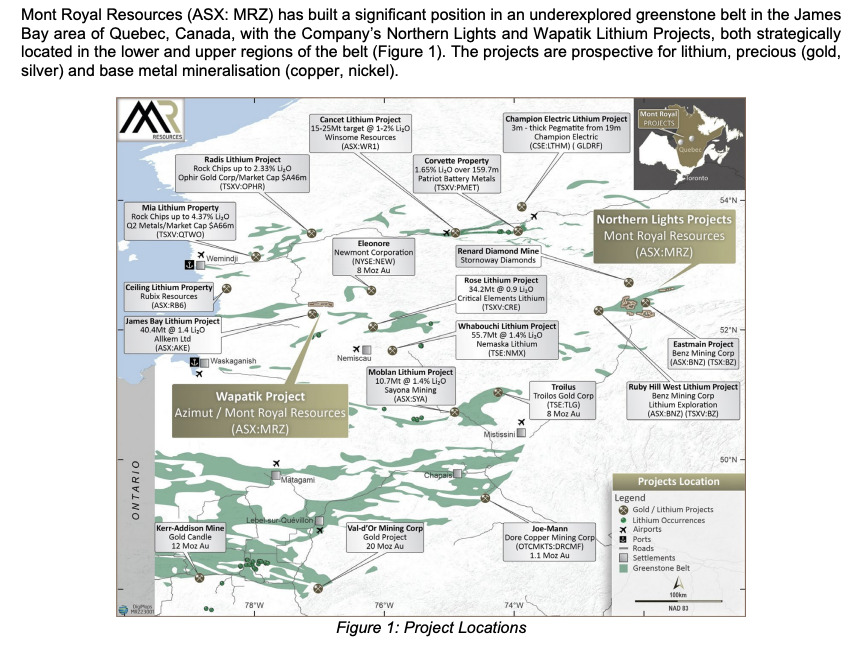

Up on no news yet is Quebec-focused, Aussie-listed Mont Royal Resources (ASX:MRZ) .

The principal activity of the MRZ group over the six months to the start of this month was the farm-in and exploration of the Wapatik GoldCopper Project and the exploration on the Northern Lights Minerals projects in the Upper Eastmain Greenstone Belt.

Also up strongly was mine developer Australian Strategic Materials (ASX:ASM).

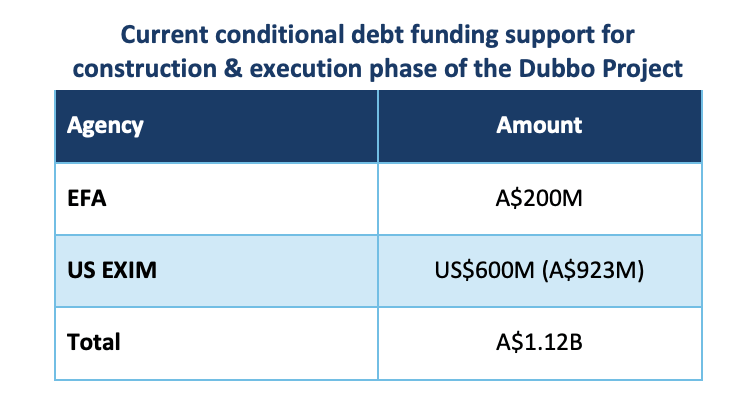

ASM says it’s received a non-binding Letter of Interest from the Export-Import Bank (EXIM) of the United States for debt funding up to US$600m (A$923m) to build the Dubbo rare earths and critical minerals project.

The US EXIM is the official export credit agency of the US federal government and a fine friend to have throwing money your way when it comes to strategic partners.

ASM says that US government support is “a catalyst to increase customer and financing focus” in North America.

Certainly, there’s movement at the funding station in Dubbo…

The company says funding follows Export Finance Australia’s previous conditional finance support of A$200 million debt funding.

And just quickly, Namoi Cotton (ASX:NAM) has been thwacked with a surprise a 59¢ a share takeover bid from Olam Agri Holdings.

The Olam offer comes after the Louis Dreyfus Company popped the question previously at a mere 51¢ a pop.

NAM’s Board has told shareholders to stay put. It’s a bit of a quandry actually, as NAM’s directors will need to think hard about the latest offer in the context of its exclusivity obligations to Louis Dreyfus.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| OSX | Osteopore | 0.005 | -44% | 1,628,878 | $929,582 |

| SCT | Scout Security Ltd | 0.008 | -33% | 4,800 | $2,789,129 |

| AML | Aeon Metals Ltd. | 0.006 | -25% | 440,188 | $8,771,205 |

| CTN | Catalina Resources | 0.003 | -25% | 50,000 | $4,953,948 |

| LSR | Lodestar Minerals | 0.0015 | -25% | 1,023,160 | $4,046,795 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | 1,019,608 | $15,569,766 |

| TTI | Traffic Technologies | 0.006 | -25% | 4,223,830 | $6,061,361 |

| IS3 | I Synergy Group Ltd | 0.007 | -22% | 138,326 | $2,736,723 |

| AU1 | The Agency Group Aus | 0.028 | -20% | 504,517 | $15,000,181 |

| NWF | Newfield Resources | 0.1 | -20% | 2 | $113,837,865 |

| 1CG | One Click Group Ltd | 0.008 | -20% | 65,590 | $6,881,788 |

| CAV | Carnavale Resources | 0.004 | -20% | 8,422,730 | $17,117,759 |

| HLX | Helix Resources | 0.004 | -20% | 27,401,991 | $11,615,729 |

| ME1 | Melodiol Glb Health | 0.004 | -20% | 186,397 | $1,964,980 |

| TMR | Tempus Resources Ltd | 0.004 | -20% | 375,000 | $3,654,994 |

| LIO | Lion Energy Limited | 0.029 | -19% | 2,313,101 | $15,731,199 |

| 1AI | Algorae Pharma | 0.009 | -18% | 3,119,529 | $18,274,877 |

| MXO | Motio Ltd | 0.023 | -18% | 168,651 | $7,509,554 |

| BEX | Bikeexchange Ltd | 0.35 | -18% | 14,147 | $7,921,279 |

| LRD | Lordresourceslimited | 0.063 | -17% | 1,992,318 | $2,822,041 |

| MHC | Manhattan Corp Ltd | 0.0025 | -17% | 438,453 | $8,810,939 |

| PNX | PNX Metals Limited | 0.005 | -17% | 27,189 | $32,283,748 |

| SIS | Simble Solutions | 0.005 | -17% | 570,000 | $4,194,234 |

| XST | Xstate Resources | 0.016 | -16% | 48,936 | $6,108,864 |

| AUZ | Australian Mines Ltd | 0.011 | -15% | 18,197,512 | $16,984,643 |

ICYMI – PM Edition

Legacy Minerals (ASX:LGM) has acquired the Drake gold-copper project, giving the company majority control of a large mineralised district within NSW’s highly prospective New England Fold Belt.

Brightstar Resources (ASX:BTR) and its partner BML Ventures are expected to yield ~$26.61 million from the production of 43 gold doré bars following completion of small-scale mining and processing at the Gwalia process plant under the Selkirk JV.

Cosmo Metals (ASX:CMO) has increased its landholding at the Kanowna gold project to more than 22km2 after adding two new tenement applications to its budding portfolio in WA’s Eastern Goldfields.

BPM Minerals (ASX:BPM) has defined a coherent +1km long, +100ppb gold in regolith anomaly at the Louie prospect which appears to be a supergene halo within its Claw project, immediately along strike from the 3.24Moz Mt Gibson gold project being developed by Capricorn Metals (ASX:CMM).

ASX newcomer Litchfield Minerals (ASX:LMS) is preparing to launch its maiden drilling and exploration program at Silver King, the first cab off the rank at the company’s Mount Doreen copper project in the Northern Territory.

Torque Metals (ASX:TOR) has raised $4.25 million via a heavily oversubscribed share placement and a drill-for-equity commitment to advance gold and lithium drilling at its Penzance project near Widgiemooltha.

Prospect Resources (ASX:PSC) has entered an agreement to pick up the remaining 60% interest in the Omaruru lithium project it does not already own, as Phase 2 exploration begins to define the strike extent and depth of key lithium-mineralised pegmatites.

Bubalus Resources (ASX:BUS) has delineated 22 targets for further investigation at its Nolans East project in the Northern Territory – just 15km from where Arafura Rare Earths (ASX:ARU) is constructing Australia’s next REE mine – following an extensive sampling program.

And with peak energy demand in WA soaring to a record of 4.23GW last month, Frontier Energy (ASX:FHE) believes its solar farm and battery strategy could prove critical in meeting future electricity requirements.

At Stockhead, we tell it like it is. While BPM Minerals, Brightstar Resources, Bubalus Resources, Cosmo Metals, Frontier Energy, Legacy Minerals, Litchfield Minerals, Prospect Resources and Torque Metals are Stockhead advertisers, they did not sponsor this article.

Trading Halts

Gratifii (ASX:GTI) – Pending a capital raise announcement

Electro Optic Systems (ASX:EOS) – Pending a capital raise announcement

Pioneer Credit (ASX:PNC) – This halt relates to a share placement which is being conducted to fund the acquisition of additional Purchased Debt Portfolios.

ChemX Materials (ASX:CMX) – Pending a capital raise announcement

Warriedar Resources (ASX:WA8) – Pending a capital raise announcement

Sunshine Metals (ASX:SHN) – Pending a capital raise announcement

Power Minerals (ASX:PNN) – Pending an announcement relating to a capital raise and a strategic acquisition at the Salta Lithium Project.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.