Closing Bell: Gold gains carry ASX higher despite Woolworths losses

The ASX weathered Woolworth’s losses comfortably today, gaining 0.28% with a fine dusting of gold to show for it. Pic: Getty Images.

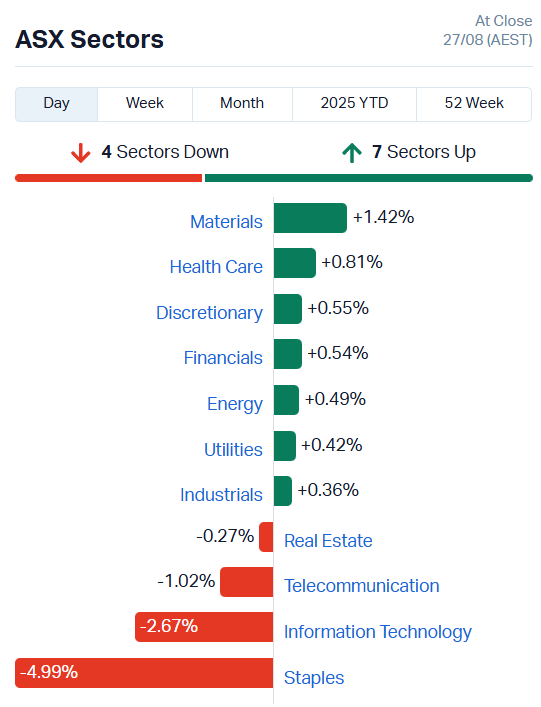

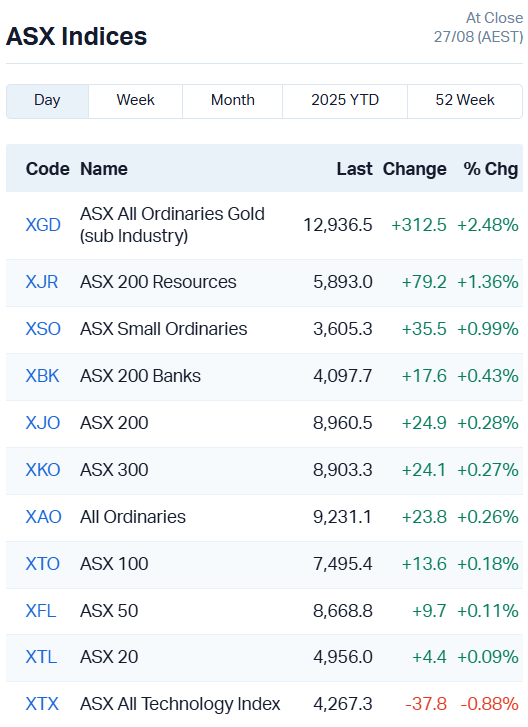

- ASX 200 climbs 0.28pc or 24.9 points

- Gold core driver of gains, with index up 2.48pc

- Consumer staples drags on market as WOL plunges

Gold demonstrates safe haven chops

While there’s a good argument that the Australian economy is too concentrated, with a lack of upstream processing or manufacturing, our position as the third largest gold producer in the world is certainly paying dividends.

As international markets grapple with chaotic US policy, unpredictable inflation and rising geopolitical tensions, the Australian share market has been making bank on all the uncertainty.

Gold has remained at elevated prices above US$3300 for multiple months now, and every slide in US dollar value or rise in the World Policy Uncertainty Index promises to push it higher – if only temporarily.

It’s given the ASX a bit of a buffer against volatility, a pattern that played out on the market again today.

The ASX All Ords Gold index added a healthy 2.48% today, pushing the materials sector up 1.42% at the same time.

That gave us a little bit of wiggle room when full year reports weren’t quite up to scruff today.

It wasn’t the only one with a disappointing report, but Woolworths (ASX:WOL) took a savaging from the bears, dragging the consumer staples sector down with it.

The largest supermarket chain in Australia fell 14.69% to $28.51 a share today. Bar April’s Liberation Day bloodletting, WOL shares haven’t been this low since mid-2019.

WiseTech, Flight Centre and Domino’s also missed the mark, doing us and their sectors no favours. Check out the Lunch Wrap for a run down on exactly how they fared.

That said, the market was in okay shape by end of trade; 7 of 11 sectors in the green and most of our major indices moving higher.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| IVZ | Invictus Energy Ltd | 0.13 | 145% | 89977577 | $84,984,534 |

| BSN | Basinenergylimited | 0.053 | 112% | 32138005 | $3,070,733 |

| M2R | Miramar | 0.003 | 50% | 1300541 | $2,019,711 |

| TMX | Terrain Minerals | 0.003 | 50% | 176000 | $5,163,629 |

| PR2 | Piche Resources | 0.185 | 48% | 752910 | $10,436,163 |

| AYM | Australia United Min | 0.004 | 33% | 29184 | $5,527,732 |

| MEM | Memphasys Ltd | 0.004 | 33% | 222875 | $5,950,794 |

| RGL | Riversgold | 0.004 | 33% | 9299365 | $5,051,138 |

| PFT | Pure Foods Tas Ltd | 0.033 | 32% | 60142 | $3,510,641 |

| DGR | DGR Global Ltd | 0.017 | 31% | 1520534 | $13,568,048 |

| S2R | S2 Resources | 0.11 | 29% | 2908464 | $42,624,868 |

| IFG | Infocusgroup Hldltd | 0.037 | 28% | 6691878 | $8,466,236 |

| ADG | Adelong Gold Limited | 0.005 | 25% | 16947339 | $9,267,345 |

| RDS | Redstone Resources | 0.005 | 25% | 2559542 | $4,137,069 |

| T92 | Terrauraniumlimited | 0.045 | 25% | 3990021 | $4,694,495 |

| TKL | Traka Resources | 0.0025 | 25% | 2461213 | $4,844,278 |

| VML | Vital Metals Limited | 0.205 | 24% | 1735861 | $19,453,379 |

| LDX | Lumos Diagnostics | 0.13 | 24% | 6921203 | $78,594,917 |

| TAH | TABCORP Holdings Ltd | 0.8775 | 24% | 21677250 | $1,623,236,372 |

| CDE | Codeifai Limited | 0.017 | 21% | 16492962 | $8,945,345 |

| AU1 | The Agency Group Aus | 0.023 | 21% | 1179354 | $8,351,955 |

| SDR | Siteminder | 6.59 | 21% | 6370301 | $1,530,884,731 |

| FL1 | First Lithium Ltd | 0.145 | 21% | 390371 | $9,558,432 |

| XGL | Xamble Group Limited | 0.024 | 20% | 773450 | $6,780,285 |

| AMI | Aurelia Metals Ltd | 0.215 | 19% | 38158551 | $304,663,075 |

In the news…

Basin Energy (ASX:BSN) is moving into the uranium and rare earths exploration space, nabbing three district-scale tenement packages in the prolific Mt Isa region of Queensland. The new projects sit right next door to Paladin Energy’s (ASX:PDN) Valhalla uranium deposit and Red Metal’s (ASX:RDM) Sybella rare earth find.

In total BSN is snapping up almost 6,000km² of prospective ground, host to three separate models of mineralisation. For uranium, BSN will be investigating a paleochannel network next door to the Sybella hot granites.

As for rare earths, Basin has two options – a hard rock granite system similar to Sybella, and a sediment-hosted ionic clay rare earth target. Results have so far peaked at 5m at 1951ppm TREO from an auger sample and 653ppm TREO in soils.

Invictus Energy (ASX:IVZ) is on the receiving end of a $37.8m cash injection from Qatar’s Al Mansour Holdings, which will be taking a 19.9% interest in the company.

The new cornerstone investor will also offer US$500m to finance the development of the Cabora Bassa gas project in Zimbabwe.

As part of the deal, the two companies will also incorporate a subsidiary, Al Mansour Oil & Gas, to explore for hydrocarbon assets across the African continent. Invictus will offer its technical expertise, while AMH brings the cash.

Tabcorp (ASX:TAH) has finally made it back into the black after losses of $1.36 billion in 2024, pulling in full year profits of $36.6 million.

Group revenue came in slightly above analyst expectations at $2.61 billion, and Australia’s largest gambling company managed operational expenditure savings of $39m, well ahead of its target of $30m.

SiteMinder (ASX:SDR) had a solid growth of year in 2025, expanding annualised recurring revenue 27.2% to $273.0m and total revenue 19.2% to $224.3m.

The hotel platform also added 5.6k properties, bringing its portfolio to 50.1k and marking the first year of positive annual underlying free cash flow.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HCD | Hydrocarbon Dynamics | 0.002 | -33% | 2500000 | $3,554,305 |

| DMP | Domino Pizza Enterpr | 15.19 | -22% | 5215365 | $1,828,518,817 |

| SDV | Scidev Ltd | 0.305 | -20% | 602471 | $72,233,515 |

| SHP | South Harz Potash | 0.033 | -18% | 704635 | $3,924,596 |

| SGA | Sarytogan | 0.091 | -17% | 119007 | $19,908,166 |

| NAE | New Age Exploration | 0.0025 | -17% | 5246144 | $8,117,734 |

| OMG | OMG Group Limited | 0.01 | -17% | 15404359 | $8,739,539 |

| SLZ | Sultan Resources Ltd | 0.005 | -17% | 4891146 | $1,566,501 |

| MCP | McPherson's Ltd | 0.26 | -16% | 574278 | $44,624,234 |

| RDY | Readytech Holdings | 2.385 | -15% | 359303 | $345,979,500 |

| MPP | Metro Perf.Glass Ltd | 0.035 | -15% | 12648 | $7,600,502 |

| EBO | Ebos Group Ltd | 30.24 | -15% | 264851 | $7,192,609,736 |

| SP3 | Specturltd | 0.018 | -14% | 330554 | $6,654,903 |

| AJX | Alexium Int Group | 0.006 | -14% | 14000 | $11,105,001 |

| ALY | Alchemy Resource Ltd | 0.006 | -14% | 75477 | $8,246,534 |

| BLZ | Blaze Minerals Ltd | 0.003 | -14% | 4498137 | $10,062,500 |

| SPX | Spenda Limited | 0.006 | -14% | 1141273 | $32,306,508 |

| TFL | Tasfoods Ltd | 0.006 | -14% | 106705 | $3,059,669 |

| WOW | Woolworths Group Ltd | 28.88 | -14% | 13064134 | $40,825,716,029 |

| BPH | BPH Energy Ltd | 0.013 | -13% | 3953831 | $18,273,492 |

| PV1 | Provaris Energy Ltd | 0.02 | -13% | 1810914 | $18,237,033 |

| AEV | Avenira Limited | 0.007 | -13% | 59750 | $34,069,152 |

| AZL | Arizona Lithium Ltd | 0.007 | -13% | 4368969 | $43,042,516 |

| CXU | Cauldron Energy Ltd | 0.007 | -13% | 609714 | $14,329,288 |

| ECS | ECS Botanics Holding | 0.007 | -13% | 2002558 | $10,368,397 |

In Case You Missed It

ADX Energy (ASX:ADX) now has 24 drill-ready prospects in Upper Austria that have total mean prospective resources of 374Bcf of gas and 31MMbbl of oil.

Greenvale Energy’s (ASX:GRV) first crack at drilling at Oasis uranium project in Queensland is well underway, with seven holes down and 1000m in the bag.

Ark Mines (ASX:AHK) continues drilling at its Sandy Mitchell rare earths project, looking to increase the resource before the program wraps up in September.

Critical Metals Corp has signed a LOI with Ucore Rare Metals for the annual supply of up to 10,000 tonnes of rare earth concentrate from Tanbreez.

Trading halts

Accent Resources (ASX:ACS) – response to ASX aware letter

archTIS (ASX:AR9) – entitlement offer

Blue Energy (ASX:BLU) – cap raise

Core Lithium (ASX:CXO) – cap raise

Finexia Financial Group (ASX:FNX) – pending response to AFR article

Sipa Resources (ASX:SRI) – exploration results

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.