Closing Bell: Flaming Chinese markets share the Monday heat with Aussie stocks

Via Getty

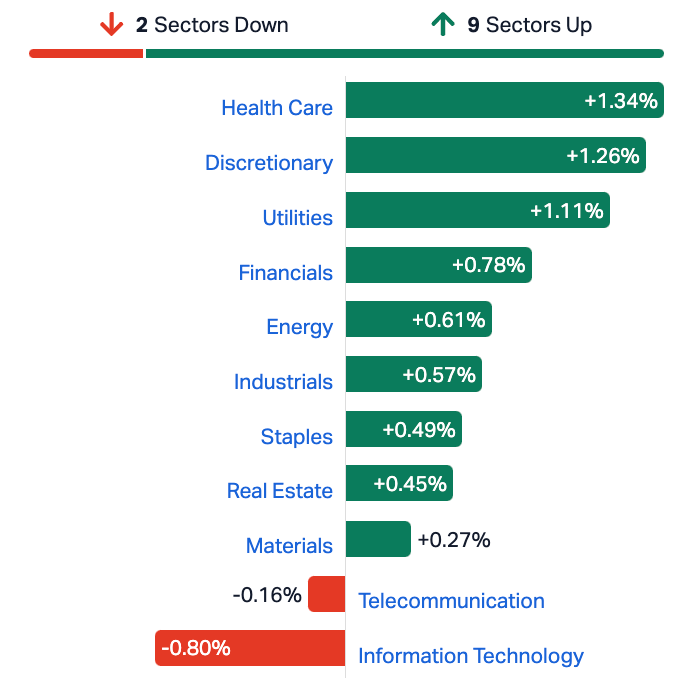

- ASX 200 closes 0.6% higher, Chinese markets surge

- IT and Telco only sectors not in the green

- Small cap winners led by Melbana Energy

The Australian share market, for once, has refused to give back in the PM all the money it made in the AM.

It wasn’t a heap. No one’s retiring tonight. But the effort has been noted and a gracious nation applauds you, sir.

Ahead by 0.6% at the lunchtime break (there’s no break) the benchmark found a second wind, as dormant Chinese mainland markets fired up.

The Shanghai Composite was almost 2.5% higher after surging beyond 5% in the hour after open.

In Hong Kong the tech index (HKEX) led out the door by Alibaba and BYD rallied hard in arvo trade, as a halving of China’s stamp duty and margin cuts did wonders for investor confidence.

China’s measures, while welcome, only came after a record exodus of foreign funds from onshore markets.

That said, excluded from any rally or self-confidence or compassion was our old mate, the delinquent property developer and disaster, China Evergrande, which crashed circa 87% on its first day back at school after an 18-month suspension over its self-inflicted, infectious debt crisis.

Decent sales data at home gave local Consumer Discretionary stocks a leg up. Healthcare also led.

IT and Telco’s sucked.

Here are the ASX sectors:

The ASX Small Ordinaries Index (XSO) ended 0.1% lower. The ASX Emerging Companies Index (XEC) was down by almost 2.0.%.

RIPPED FROM THE HEADLINES

August has been a bust

On Wall Street tonight begins the final week of August trade, with the major averages all set to close a crap month on a slightly more positive note. China, inconstancy, self-doubt, higher yields, unimpeachable former presidents, Fitch downgrades, shite banks… just about everything weighed on Wall St traders this month.

August-to-date, the Dow Jones Industrial Average is down 3%. The S&P 500 is lower by about 4%.

And, you guessed it, before trade begins later tonight, the tech-Heavy Nasdaq Composite has lost 5%.

Breaking up is easy

…to do in the West. As of breakfast, Andrew “Twiggy” Forrest is short one CEO and about $3bn in market cap after Fiona Hick jumped ship after a gruelling six months of pretty much nothing at Fortescue Metals Group (ASX:FMG) .

Now, as something of an aside, I used to watch FMG like a hawk back in the day, but with Messrs Chiat, Adams, Drummond, Badman et al, my powers can be used for good and I can leave the inner-meaning-of-a-rock-side of markets to the experts.

That said, when I was (picking coffee beans in Guatemala) working for Chinese state media, I’d pop round to Perth every few quarters and enjoy relaying messages to and fro between Beijing and the Bishop/Forrest hotline:

Ah. Friend Andrew. Do you have the rocks?

M’lord, I do. Have you the money?

…aaand so on.

Anyway. It’s not always about me. Fortescue informed the market this morning, their time (WA), in a panicked, slightly-legible missive written on the back of an unused 100 RMB note, that Hick’s exit was mutual and almost forgot to add that top-notch operations officer Dino Otranto is the new CEO, until another one can be broken. In.

Now I’m also seeing (courtesy of the internet) that Twiggy and Nicola Forrest have been separated since June! And that she’ll be enjoying a $50 million cash bonus thanks to the final dividend payout following FMG’s earnings result today.

Are the two events somehow connected?

No. That’s unlikely. In fact, it looked like I was moving to a point, but not everything needs a reason. Or reason.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AO1 | Assetowl Limited | 0.002 | 100% | 1,857,600 | $1,947,130 |

| CCE | Carnegie Clean Energy | 0.0015 | 50% | 3,000,000 | $15,642,574 |

| MAY | Melbana Energy Ltd | 0.087 | 40% | 84,253,389 | $208,952,654 |

| EOL | Energy One Limited | 5.45 | 35% | 160,422 | $121,285,431 |

| KNM | Kneomedia Limited | 0.004 | 33% | 103,006 | $4,514,356 |

| NES | Nelson Resources. | 0.008 | 33% | 1,108,000 | $3,681,566 |

| ZMI | Zinc of Ireland NL | 0.025 | 32% | 8,171 | $4,049,741 |

| SCT | Scout Security Ltd | 0.021 | 31% | 347,619 | $3,690,688 |

| 4DS | 4Ds Memory Limited | 0.175 | 30% | 89,731,022 | $220,393,335 |

| KNB | Koonenberrygold | 0.05 | 25% | 17,000 | $3,030,258 |

| CTN | Catalina Resources | 0.005 | 25% | 3,074,004 | $4,953,948 |

| DCX | Discovex Res Ltd | 0.0025 | 25% | 500,000 | $6,605,136 |

| SGA | Sarytogan | 0.23 | 24% | 4,857,652 | $14,235,733 |

| FNX | Finexia Financialgrp | 0.29 | 23% | 64,453 | $11,271,911 |

| BUX | Buxton Resources Ltd | 0.16 | 23% | 991,305 | $22,266,214 |

| TRT | Todd River Res Ltd | 0.011 | 22% | 3,101,674 | $5,863,928 |

| KLI | Killiresources | 0.042 | 20% | 419,099 | $2,085,127 |

| LML | Lincoln Minerals | 0.006 | 20% | 113,107 | $7,103,559 |

| TMX | Terrain Minerals | 0.006 | 20% | 4,064,540 | $5,415,997 |

| 3DA | Amaero International | 0.165 | 18% | 233,213 | $58,358,330 |

| AD1 | AD1 Holdings Limited | 0.007 | 17% | 250,013 | $4,935,414 |

| ATH | Alterity Therap Ltd | 0.007 | 17% | 959,079 | $14,639,386 |

| ACM | Aus Critical Mineral | 0.215 | 16% | 2,860,505 | $5,500,281 |

| REM | Remsense Technologies | 0.072 | 16% | 100,000 | $3,100,343 |

| LIN | Lindian Resources | 0.29 | 16% | 9,719,225 | $283,863,074 |

Melbana Energy (ASX:MAY) says the Alameda-2 just had a successful flow test of lighter oil to surface.

Bullies include:

– Peak flow to surface 1,903 barrels of oil per day from Unit 1B (stabilised average flow rate 1,235 barrels of oil per day)

– Significantly lighter (19° API) and lower viscosity (30 cP) oil compared to other units in the Amistad Formation

– Over 1,000 barrels of oil produced and trucked away during testing

– No formation water observed during the flow test or from logs

– Unit 1B now being completed to allow for future production

So, the Alameda-2 appraisal well produced oil to surface from Unit 1A, achieved strong flow rates of a higher quality crude from Unit 1B, proved the existence of moveable oil from Unit 3 and confirmed a significant increase in logged Net Pay to 615 metres TVD (with fractures) for the Amistad sheet in total – about 45% of the gross section, the company says.

MAY Boss Andrew Purcell:

“It has been a tremendous success and gives us more shorter-term production options to consider when finalising our field development plan.”

Shares are 41% higher.

Sarytogan Graphite (ASX:SGA) has continued its trouncing of Monday, finding lots of support on news that ‘thermal purification has far exceeded battery anode material grade’ for its Kazakh graphite deposit.

SGA is teets deep in graphite at its project in lovely graphite-rich Central Kazakhstan.

The company says that the thermal purification of its graphite has achieved a 99.99% Total Graphitic Carbon (TGC) result, with the sample being a “representative 50g sample of Sarytogan Graphite previously treated by flotation and alkaline roasting to 99.70% TGC”.

Good numbers. Badman knows more.

4DS Memory (ASX:4DS) pretty much makes computer semiconductor memory and it’s jumped another 29% or so. That’s a good story which happened last week. Seems it’s still a good story as the word spreads

Buxton Resources (ASX:BUX) returned “exceptional” assay results from its maiden diamond drill hole at its Copper Wolf project in Arizona, USA, which kicked off in April this year.

It’s the first exploration in the project area since 1993, with drillhole CW0001DD targeting areas proximal to and beneath historical hole RC-UC-17 which ended in porphyry style copper-molybdenum mineralisation.

The nice bits: returns of 83.76 metres at 0.86% CuEq from 527.91 metres with assays up to 2.35% CuEq.

And Energy One (ASX:EOL) is cruising at altitude after receiving one of those always welcome confidential, indicative, incomplete, conditional and non-binding proposal from the global investment firm, STG.

STG has nearly US$10 billion of assets under management and a portfolio that includes software and software-enabled services companies.

The Indicative Proposal, EOL told the ASX, is to acquire all of the issued shares in Energy One at an indicative price of A$5.85 cash per share by way of a scheme of arrangement.

Energy One has also entered into an exclusivity deed granting STG with an expedited period of exclusivity to allow STG to complete confirmatory due diligence.

Oh, here’s some background…

The EOL board says, if formalised into a binding offer, the proposal “represents compelling value to shareholders” as it indeed represents:

- a ~44% premium to Energy One’s undisturbed closing price of A$4.05 on 25 August 2023; and

- a ~43% premium to the 1 month volume weighted average price of Energy One’s shares prior

to 25 August 2023 of A$4.09 - a ~76% premium to the 3 month volume weighted average price of Energy One’s shares prior

to 25 August 2023 of A$3.33

Up 34% on Monday.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| GGX | Gas2Grid Limited | 0.001 | -50% | 26,901,125 | $8,154,204 |

| AVE | Avecho Biotech Ltd | 0.006 | -33% | 4,645,571 | $19,459,473 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 1,295,454 | $9,221,169 |

| APX | Appen Limited | 1.52 | -32% | 14,620,971 | $351,504,382 |

| NIS | Nickel Search | 0.047 | -31% | 4,152,484 | $6,502,866 |

| SYA | Sayona Mining Ltd | 0.091 | -27% | 359,853,568 | $1,286,662,002 |

| BCB | Bowen Coal Limited | 0.086 | -25% | 36,644,659 | $245,638,376 |

| ELE | Elmore Ltd | 0.003 | -25% | 11,947,143 | $5,597,535 |

| EMU | EMU NL | 0.0015 | -25% | 1,445,227 | $2,900,043 |

| GCR | Golden Cross | 0.003 | -25% | 72,097 | $4,389,024 |

| VAL | Valor Resources Ltd | 0.003 | -25% | 600,000 | $15,313,339 |

| WCG | Webcentral Ltd | 0.105 | -25% | 1,335,436 | $46,077,672 |

| IMR | Imricor Med Systems | 0.5 | -22% | 266,995 | $102,828,490 |

| C1X | Cosmos Exploration | 0.435 | -22% | 883,876 | $24,906,000 |

| RGS | Regeneus Ltd | 0.007 | -22% | 2,068,515 | $2,757,932 |

| OPT | Opthea Limited | 0.445 | -21% | 1,631,000 | $264,234,719 |

| ERW | Errawarra Resources | 0.155 | -21% | 1,127,818 | $11,798,280 |

| BFC | Beston Global Ltd | 0.008 | -20% | 10,212,858 | $19,970,469 |

| EDE | Eden Inv Ltd | 0.004 | -20% | 779,156 | $14,984,851 |

| GES | Genesis Resources | 0.004 | -20% | 30,000 | $3,914,206 |

| HNR | Hannans Ltd | 0.008 | -20% | 6,503,052 | $27,246,048 |

| NRX | Noronex Limited | 0.016 | -20% | 982,250 | $7,566,035 |

| RML | Resolution Minerals | 0.004 | -20% | 3,009,881 | $6,286,459 |

| PIM | Pinnacle Minerals | 0.08 | -19% | 274,874 | $2,531,925 |

| AHF | Aust Dairy Limited | 0.017 | -19% | 3,940,751 | $13,773,203 |

LAST ORDERS

Toubani Resources (ASX:TRE) says it is looking to raise circa $3.8 million, with a focus on advancing Africa’s next gold project of significance in the region – the Kobada Gold Project.

The raise will be by way of a two-tranche institutional placement via the issue of approximately 32.0 million new fully paid Chess Depositary Interests at A$0.12 per share, comprising:

- Tranche 1 to raise approximately $1.8 million utilising the Company’s existing placement capacity under ASX Listing Rule 7.1 (“Tranche 1”); and

- Tranche 2 to raise circa $2.0 million subject to shareholder approval to be sought at a Extraordinary General Meeting (“EGM”) to be held in October 2023 (“Tranche 2”).

TBR says it reserves the right to accept oversubscriptions of up to A$0.5 million under Tranche 2 of the Placement (for a maximum amount of approximately A$4.3 million).

The company’s Directors have said they intend to subscribe for approximately A$0.3 million as part of the Placement, subject to shareholder approval at a forthcoming EGM.

TRADING HALTS

Orora (ASX:ORA): Orora confirms that it is currently in discussions regarding a potential transaction involving a material acquisition

Matsa Resources (ASX:MAT): Pending an announcement in relation to a proposed capital raising

GCX Metals (ASX:GCX): Pending an announcement regarding the potential acquisition of a resource project

Toubani Resources (ASX:TRE): Proposed capital raising

Dundas Minerals (ASX:DUN): Pending an announcement regarding a project acquisition

Lodestar Minerals (ASX:LSR): Pending an announcement regarding a project acquisition

Firebird Metals (ASX:FRB): Pending release of an announcement in relation to the results of an updated scoping study for its flagship Oakover Manganese project

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.