Closing Bell: Commodity prices, resurgent rate fears drag ASX to third straight loss

Via Getty

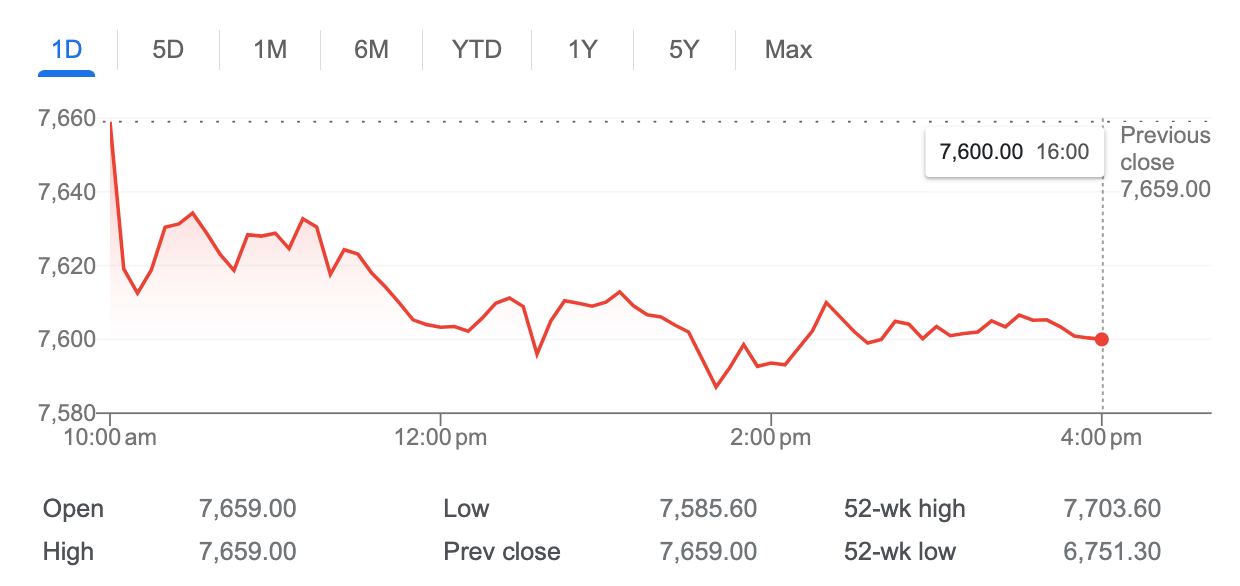

- ASX200 drops about 0.7pc on Wednesday

- Consumer Staples craters, as WOW CEO departs

- Small Caps led by diggers IXR, AW1 and the biopharma Alterity

The ASX200 has ended lower on Wednesday, tracking losses in New York as traders brace – ahead of the release of February’s US Federal Reserve meeting minutes – for the return of the higher-for-longer interest rate scenario.

At 4.15pm on February 21, the S&P/ASX200 was down 50.6 points or 0.66% to 7,608.4…

ASX200 (XJO)

Morose local traders once again wrestled needlessly with the theoretical implications of resurgent inflation – either here or in the US.

With a conga line of US officials set to speak to the minutes which will be released tomorrow in the US, one can assume the next few days will be about a return to the Fed’s higher-for-longer setting as traders continue to run with growth bets on US tech stocks.

More inflation flavoured data dropped from the bureau of inflation earlier, Q4’s seasonally adjusted wage price index actually jumped by 4.2% – well above market forecasts and marking local wage growth’s best improvement since 2009.

Public sector wages jumped 4.3%, the most since Q1 of 2010.

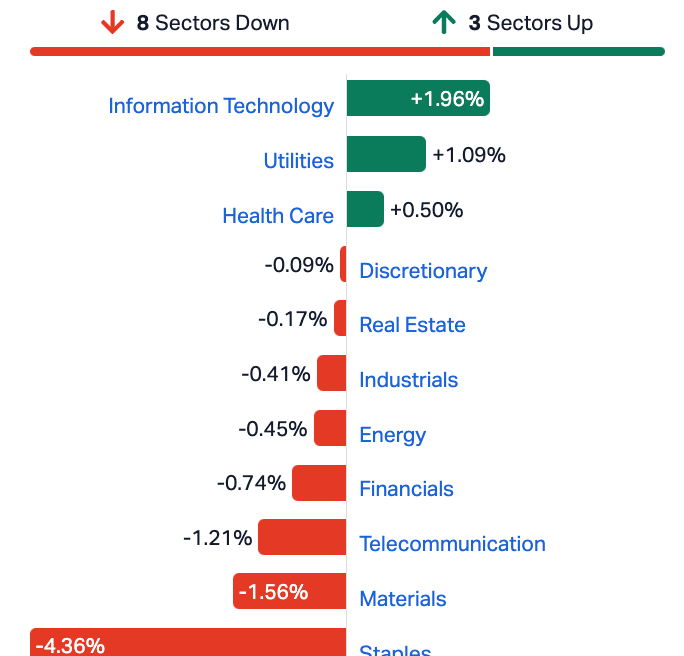

The ASX would do well to follow Wednesday’s Tech sector, which led the gains regardless of the overnight tech losses on Wall Street overnight.

It was hard to ignore the double digit climb by local blue chip WiseTech Global (ASX:WTC) after the logistics software maker dolled out a massive interim dividend almost 20% more than last time, after revealing it’s due to pull in more than $1bn in FY revenue.

That’s where the good news pretty much stopped uptown.

Woolworths (ASX:WOW) has taken a midweek dive and taken the broader Consumer Staples sector with it.

All this chatter of a supermarket price war and price gouging and the price of tea in China… doesn’t come into it with the sector in a state of surprise after WOW’s CEO Brad Banducci called it enough after eight years at the top.

Coles Group (ASX:COL) and Endeavour Group (ASX:EDV) were both more than 3% lower.

The Materials sector also weighed on Wednesday. As iron ore falls, so too do the heavyweights.

Fortescue (ASX:FMG) was down 5% this arvo.

Global oil prices fell nearly 2% on Tuesday as the Fed’s higher-for-longer chatter and Asian originating demand-side uncertainties weighed on traders.

Local energy stocks followed materials lower.

ASX Sectors on Wednesday

We’re watching China…

Shares in Hong Kong are near two-month highs on Wednesday at lunch, rising for the second straight session, amid mounting bets that China’s central bank may deliver more policy easing this year following a record cut in the five-year loan prime rate Tuesday as policymakers seek to bolster economic growth.

The Shanghai Composite jumped 1% to around 2,950 while the Shenzhen Component gained 0.9% to 8,990 on Wednesday, as the further monetary easing boosted market sentiment. On Tuesday, the People’s Bank of China slashed its five-year loan prime rate by 25 basis points to 3.95%, more than forecasts for a 15 bps cut.

It was the most aggressive cut since that rate was introduced in 2019 as China seeks to boost growth. The PBOC also reduced banks’ reserve requirements by 50 bps earlier this month, unleashing about 1 trillion yuan in long-term capital.

The icing on the cake is this recent missive from the new boss at China’s markets regulator – the Broker Butcher vowing to listen to all suggestions and criticism and act on anything which makes sense.

Good to hear, but I would personally not be putting my hand up.

US Markets…

US stocks tumbled on Tuesday in New York as all the President’s investors returned from the Presidents Day weekend.

Traders are now looking ahead to the minutes from the Fed’s latest policy meeting and lots of Fedspeak due from about six Fed officials later this week.

The Dow Jones Industrial Average fell about 60 points, or 0.2%, while the Nasdaq Comp shed 0.9% and the S&P 500 dipped 0.6%.

The Vix (CBOE’s Volatility Index), spiked 8.2%.

Outside of earnings, US card company Capital One lifted slightly as it moves ahead with a $US35bn buyout of Discover Financial Services. Discover stock jumped about 14%.

US stocks one should note are still nestled near all-time highs, driven up by the frenzy around possible rate cuts and artificial intelligence.

Last night’s most exciting development on this front was the mini-crash from Magnifico Mega tech, Nvidia which lost US$78bn in market cap, the largest one-day market cap decline in its history as shares dropped 4.4% ahead of the AI chip maker’s earnings.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AUZ | Australian Mines Ltd | 0.022 | 29% | 99,591,201 | $19,210,670 |

| TG6 | TG Metals | 0.33 | 27% | 585,387 | $14,062,403 |

| BMG | BMG Resources Ltd | 0.015 | 25% | 17,445,339 | $7,605,566 |

| ATH | Alterity Therap Ltd | 0.005 | 25% | 1,184,017 | $17,531,019 |

| CAV | Carnavale Resources | 0.005 | 25% | 2,098,500 | $13,694,207 |

| SIT | Site Group Int Ltd | 0.0025 | 25% | 1,000,000 | $5,204,980 |

| TMK | TMK Energy Limited | 0.005 | 25% | 5,698,732 | $24,490,317 |

| DEM | De.Mem Ltd | 0.1175 | 22% | 740,829 | $23,549,411 |

| NYR | Nyrada Inc. | 0.022 | 22% | 745,454 | $2,808,157 |

| NGL | Nightingale Intel | 0.067 | 22% | 693,036 | $5,908,860 |

| BMO | Bastion Minerals | 0.012 | 20% | 16,351,661 | $3,114,441 |

| NKL | Nickelxltd | 0.043 | 19% | 943,659 | $3,161,346 |

| TOY | Toys R Us | 0.013 | 18% | 3,293,302 | $10,807,099 |

| CSR | CSR Limited | 7.95 | 17% | 4,323,643 | $3,231,886,884 |

| SRT | Strata Investment | 0.17 | 17% | 113,753 | $24,566,419 |

| C7A | Clara Resources | 0.021 | 17% | 158,742 | $3,402,703 |

| CUL | Cullen Resources | 0.007 | 17% | 454,493 | $3,421,039 |

| NET | Netlinkz Limited | 0.0035 | 17% | 215,480 | $11,635,345 |

| TIA | Tian An Aust Limited | 0.25 | 16% | 38,981 | $18,620,898 |

| AYA | Artryalimited | 0.33 | 16% | 144,510 | $22,414,963 |

| SHO | Sportshero Ltd | 0.015 | 15% | 1,863,928 | $8,031,827 |

| CDA | Codan Limited | 9.68 | 15% | 1,052,099 | $1,523,055,349 |

| MQR | Marquee Resource Ltd | 0.023 | 15% | 1,518,543 | $8,267,688 |

| RCR | Rincon | 0.046 | 15% | 26,915,343 | $8,846,055 |

| AML | Aeon Metals Ltd | 0.008 | 14% | 380,202 | $7,674,804 |

Alterity Therapeutics (ASX:ATH) was out in front on Wednesday, rising steadily on new baseline biomarker data for its well-loved ATH434 ongoing Phase 2 randomised, double blind clinical trial. Phew. The data was presented at the American Academy of Neurology (AAN) 2024 Annual Meeting in Denver, Colorado on Tuesday. And was apparently well received.

Australian Mines (ASX:AUZ) rose on news of a second exploration target prospective for niobium and rare earths at the Jequie Rare Earth Project located within the state of Bahia in Fabulous Brazil.

Rincon Resources (ASX:RCR) is still riding the glow of Monday’s announcement that the company has grown its tenement size in the West Arunta region to more than 260km2, after a new exploration licence application was granted over an area that contains the historic ‘Mantati’ copper-lead-zinc occurrence.

Singular Health Group (ASX:SHG) has raised exactly $4,123,142 through a recent capital raising via institutional, sophisticated and professional investors, resulting in the issue of 37,483,101 fully paid ordinary shares. Stock is up.

Argent Minerals (ASX:ARD) has clocked extensive gold, silver, copper, lead and zinc mineralisation has been confirmed by a rock chip reconnaissance program over the Henry prospect within the Kempfield project in NSW, returning high-grade polymetallic assays up to 14.05g/t Au, 85.2g/t Ag, 0.5% Cu, 0.41% Pb and 0.28% Zn.

NickelX (ASX:NKL) was back in the news, after issuing an amended announcement relating to the identification of uranium mineralisation and priority target areas from data compilation and review at the Elliot Lake uranium project in Ontario, Canada.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MRQ | MRG Metals Limited | 0.0015 | -25% | 40,000 | $4,942,682 |

| AQN | Aquirian | 0.18 | -22% | 10,000 | $18,555,013 |

| KME | Kip McGrath Education | 0.38 | -21% | 185,296 | $27,284,408 |

| MRL | Mayur Resources Ltd | 0.25 | -21% | 919,699 | $105,871,877 |

| AMD | Arrow Minerals | 0.004 | -20% | 18,742,885 | $17,368,825 |

| ROG | Red Sky Energy. | 0.004 | -20% | 4,354,694 | $27,111,136 |

| TAS | Tasman Resources Ltd | 0.004 | -20% | 245,218 | $3,563,346 |

| TMX | Terrain Minerals | 0.004 | -20% | 3,880,000 | $7,158,353 |

| WML | Woomera Mining Ltd | 0.004 | -20% | 25,246 | $6,090,695 |

| CTD | Corp Travel Limited | 16.02 | -19% | 5,145,552 | $2,904,566,058 |

| 5GN | 5G Networks Limited | 0.14 | -18% | 6,053,497 | $58,198,709 |

| ABE | Ausbond Exchange | 0.025 | -17% | 42,000 | $3,380,043 |

| CHL | Camplify Holdings | 2 | -17% | 704,618 | $171,600,838 |

| GCM | Green Critical Min | 0.005 | -17% | 1,001,636 | $6,819,510 |

| M4M | Macro Metals Limited | 0.0025 | -17% | 250,783 | $8,436,233 |

| NTM | Nt Minerals Limited | 0.005 | -17% | 554,375 | $5,159,417 |

| TMB | Tambourah Metals | 0.088 | -16% | 239,948 | $8,708,737 |

| NC1 | Nico Resources | 0.185 | -16% | 106,112 | $24,024,127 |

| ERW | Errawarra Resources | 0.048 | -16% | 707,134 | $5,467,478 |

| ME1 | Melodiol Global Health | 0.012 | -14% | 4,673,016 | $3,946,177 |

| POS | Poseidon Nick Ltd | 0.006 | -14% | 6,318,436 | $25,994,743 |

| RIM | Rimfire Pacific | 0.031 | -14% | 4,071,654 | $79,928,810 |

| REC | Recharge Metals | 0.076 | -14% | 29,413 | $9,798,974 |

| DXB | Dimerix Ltd | 0.205 | -13% | 6,275,143 | $102,727,032 |

| 1TT | Thrive Tribe Tech | 0.014 | -13% | 50,004 | $4,745,944 |

ICYMI – PM Edition

Ionic Rare Earths (ASX:IXR) has received a welcome boost ahead of the impending resource update for its Makuutu project in Uganda with the latest batch of results from the Phase 5 infill and extension drilling program intersecting clay-hosted rare earths in all 52 holes.

American West Metals (ASX:AW1) has received commitments for $10 million to expand an exploration program at its Storm copper-silver project at Somerset Island in Nunavut, Canada, on the back of releasing an impressive maiden resource last month.

Australian Mines (ASX:AUZ) moved to acquire Jequie and the Resende lithium project in Brazil’s Bahia state, to expose shareholders to additional opportunities in the battery metals space with the potential for Tier-1 critical mineral discoveries.

Vertex Minerals’ (ASX:VTX) decision to acquire a Gekko gold gravity processing plant looks to be a wise one with a new engineering study finding that it will lower capex for its Reward mine development and enable early cashflow.

Lithium Energy (ASX:LEL) ticked off another important step in the development process, after a 10,000L laboratory test work program undertaken by Xi’an Lanshen New Material Technology Co exceeded expectations, achieving resin recovery of 92% lithium from Solaroz brine.

Godolphin Resources (ASX:GRL) has secured a sizeable chunk of land around its flagship 94.9Mt @ 739ppm TREO Narraburra REE project in NSW in search of mineralisation extensions to the current JORC 2012 compliant resource.

Initial surface assay results have returned from initial exploration at Belararox’s (ASX:BRX) Toro targets – part of its Toro-Malambo-Tambo (TMT) copper-gold project in Argentina – strengthening the interpretation that the area contains porphyry and/or epithermal mineralisation.

Cosmo Metals (ASX:CMO) is raising up to $2.1m to complete its acquisition of the highly prospective Kanowna gold project near Kalgoorlie, after exercising a term sheet in January for the exclusive right to acquire La Zarza Minerals.

Initial soil sampling at Kingsland Minerals’ (ASX:KNG) Lake Johnston project in WA has demonstrated huge lithium potential after uncovering a 6.5km x 3km soil anomaly on the western fringes of the greenstone belt which bears the project’s name.

Crucial licence approvals for White Cliff Minerals’ (ASX:WCN) Radium Point project have been granted, allowing the company to sign up contractors and plan exploration activities in an area known for its highly prospective iron oxide copper gold (IOCG) uranium mineralisation.

Three priority targets have been identified from desktop studies of NickelX’s new, highly prospective Elliot Lake uranium project in Canada, with preparations now under way for a potential drill program later this year.

Lithium Universe (ASX:LU7) has secured prime industrial property in the Bécancour Waterfront Industrial Hub (BWIP) for its multi-purpose battery-grade lithium carbonate refinery – which will form part of the company’s Québec Lithium Processing Hub (QLPH) strategy.

A geophysical induced polarisation survey (IP) has demonstrated potential for mineralisation extensions over the B2 deposit at Mt Sholl, correlating with Raiden Resources’ (ASX:RDN) modelled exploration target.

Neurotech (ASX:NTI) reports paediatric patients in the PANDAS/PANS Phase I/II clinical trial extension phase continue to show significant improvements between 12 and 24 weeks of treatment.

QX Resources (ASX:QXR) could be on the cusp of finding an iron ore deposit with potential for direct shipping ore after rock chip sampling at its Western Shaw project in WA’s Pilbara region returned grades up to 58.5% iron.

Trading Halts

Orica (ASX:ORI) – pending an announcement in relation to a corporate transaction and an associated equity raising.

Allegra Orthopaedics (ASX:AMT) – pending the release of an announcement regarding discussions with financiers regarding the company’s financing arrangements.

Global Uranium and Enrichment (ASX:GUE) – pending the release of an announcement in relation to a capital raising.

American Rare Earths (ASX:ARR) – pending an announcement by the company in relation to a capital raising.

Lotus Resources (ASX:LOT) – pending an announcement regarding a proposed placement.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.