Cosmo Metals shoots for the stars with $2.1m raising to complete Kanowna acquisition, launch gold exploration

Cosmo Metals has launched a $2.1m capital raising to fund its acquisition of the Kanowna gold project and for subsequent exploration. Pic via Getty Images

- Cosmo Metals raising $2.1m to complete acquisition of the Kanowna gold project near Kalgoorlie

- Proceeds will also be used to fully fund an aggressive maiden exploration and drilling program

- Kanowna has proven gold intersections and could be connected to the nearby producing Kanowna Belle mine

Special Report: Cosmo Metals is raising up to $2.1m to complete its acquisition of the highly prospective Kanowna gold project near Kalgoorlie.

In January, the company executed a terms sheet for the exclusive right to acquire La Zarza Minerals – the holder of Kanowna – to complement its existing Minjina zinc-lead-silver prospect and the advanced Mt Venn copper-nickel-cobalt project, both hosted within WA’s Yamarna region.

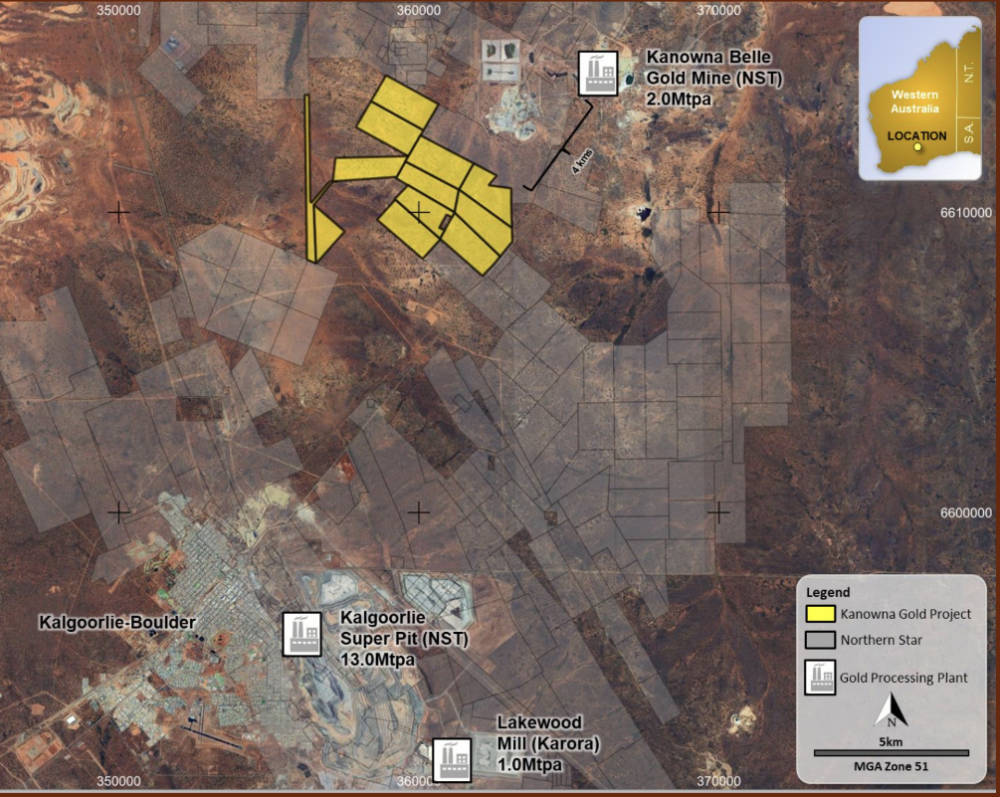

Kanowna covers >20km2 in 12 contiguous prospecting licences with heritage agreements in place just 13km from Kalgoorlie. It can be accessed via bitumen roads and is within trucking distance of multiple mills.

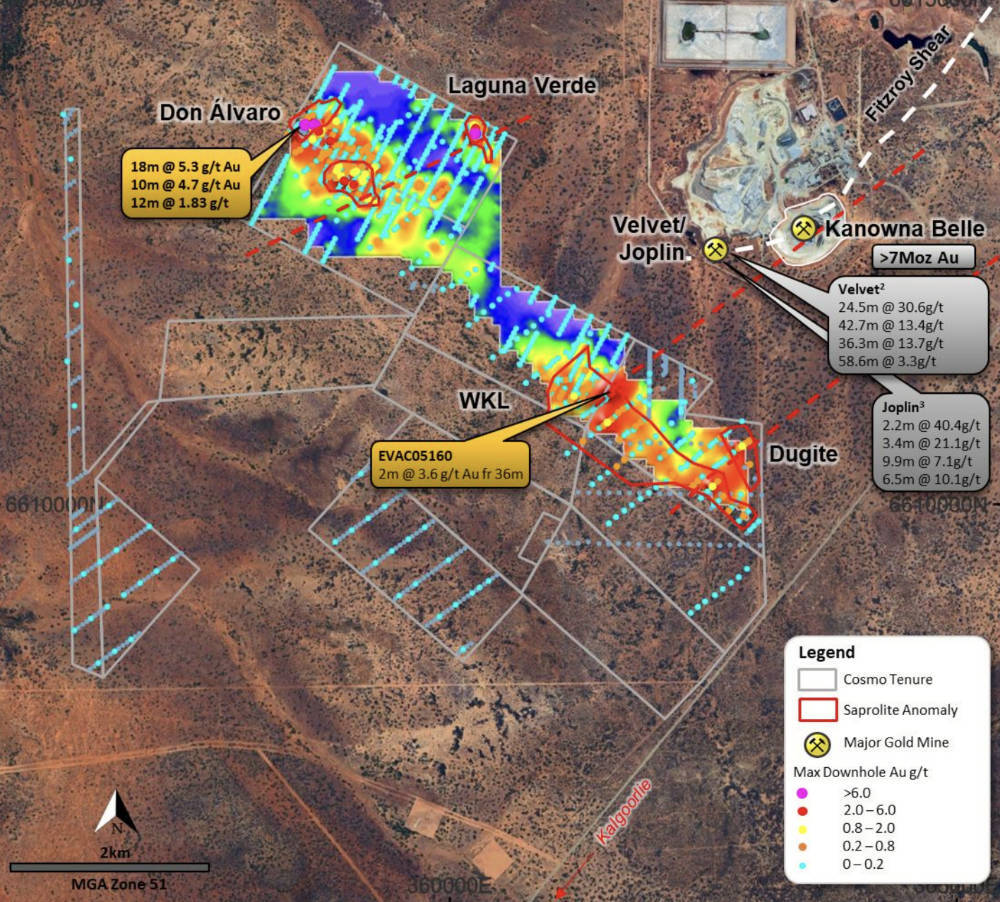

It is already known to contain significant near-surface gold with historical drilling returning notable results such as 44m grading 2.4g/t gold from a down-hole depth of 24m, including 18m @ 5.3g/t gold from 18m, and 50m @ 1.2g/t gold from 30m to end-of-hole, including 10m @ 4.7g/t gold from 32m.

Despite this proven gold endowment and proximity to Northern Star Resources’ (ASX:NST) adjacent Kanowna Belle mine – where +5.4Moz of gold has been produced since 1993 – the Kanowna project itself has seen just 12 deeper holes drilled by previous explorers.

However, a new geological model from Cosmo Metals (ASX:CMO) which identified untested structures connected to the Kanowna Belle system might well be the answer to unlocking Kanowna’s secrets, with several compelling aircore and RC targets earmarked for immediate follow-up.

Capital raising to fund acquisition and exploration

The company can now push ahead to test its new geological model after it exercised its option to acquire La Zarza Minerals (and the Kanowna gold project) for an initial payment of $200,000 in cash and 8 million CMO shares priced at 5c each with a further $200,000 cash payment due in six months.

To help fund this acquisition and fully fund an aggressive maiden exploration and drilling program, CMO is looking to raise $2.1m through a placement and an accelerated non-renounceable entitlement offer which has both institutional and retail components.

Highlighting the strong support from investors – no doubt supported by the strong gold price and favourable exchange rate, the company has already received binding commitments for ~$1m worth of shares through the placement and institutional entitlement offer.

New and existing high net worth investors, family offices and dedicated resource funds have committed to a single tranche placement to raise $356,000 through the issue of 8.9 million shares priced at 4c each and the institutional entitlement offer to raise ~$666,667.

The remaining funds will be raised through a fully underwritten retail entitlement offer which offers existing shareholders the opportunity to acquire two new shares priced at 4c each – a 24.9% discount to the 15-day volume weighted average price of 5.3c – for every three shares held.

“We are extremely pleased with the strong demand from our existing sophisticated shareholders and welcome a number of new investors to our company,” CMO managing director James Merrillees said.

“This successful capital raise is a strong validation of the KGP acquisition and the current strategy to create value from our WA gold and base metal asset portfolio.

“The acquisition of the Kanowna gold project complements the company’s existing base metals and lithium portfolio at Yamarna and is a low-cost entry into the prolific Eastern Goldfields adjacent to world-class projects with exceptional infrastructure.

“Investors can look forward to increased exploration activity coupled with strong news-flow in the coming months as we continue to work hard to deliver results and create value for our shareholders.”

Moving straight into exploration

While a significant part of the capital raising is aimed at fully funding its initial exploration plans for Kanowna, CMO has demonstrated its strong belief in the project’s prospectivity by diving immediately into on-ground exploration.

Reverse circulation and aircore drilling is also planned to start following completion of the capital raising and acquisition in late March/early April.

Initial prospects for follow-up are the Don Álvaro, WKL/Dugite and Laguna Verde prospects.

Don Álvaro is a structural target with scale potential that hosts high grade historical RC intersections such as 18m @ 5.3g/t gold and 10m @ 4.7g/t gold along with broad lower grade intervals, including 60m @ 0.46g/t gold from 40m to end-of-hole.

WKL/Dugite is a broad 1.2km by 500m supergene gold anomaly with consistent mineralisation at the basement interface and a top-down hole historical intercept from last hole on a drill line of 2m @ 3.6g/t gold from 36m.

Meanwhile, Laguna Verde includes high-grade RC drilling results of up to 3m @ 5.1g/t gold that have not been followed up on despite more recent aircore drilling reporting that is open along strike and at depth.

This article was developed in collaboration with Cosmo Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.