Closing Bell: Benchmark bench presses over 1.3% as New Hope reveals monster 1146% profit

Via Getty

- ASX 200 jumps on blue cap strength

- Small caps skulk around parity

- New Hope Coal: So. Much. New. Hope.

The benchmark is killing Tuesday, it’s up about 1.3% on big performances from the banks and the miners. The small cap XEC index is flat. Tepid, even.

The RBA minutes dropped after lunch. So good.

We took note* that they took note and subsequently debated the merits of raising the cash rate by 25 basis points vs 50 basis points.

( *…well, I took note, the others don’t get pumped up over this stuff, except maybe Eddy and Bevis, but Bev doesn’t have enough time in the day for hobbies)

Spoiler: they took the 50bp route.

“Given the importance of returning inflation to target, the potential damage to the economy from persistent high inflation and the still relatively low level of the cash rate, the Board decided to increase the cash rate by a further 50basis points.”

Then the board got all dovish: although a lot has happened since then:

“(The RBA) is not on a pre-set path given the uncertainties surrounding the outlook for inflation and growth”

and that:

“The full effects of higher interest rates were yet to be felt in mortgage payments, and the broader effects on activity and inflation would take some time to be apparent.”

Tony Sycamore at City Index says none of that impacts his base case – and that’s for a 25bp rate hike in October.

“Which would see the cash rate rise to 2.60%, into mildly restrictive territory before year-end. The RBA is likely to pause then to allow time to assess the full impact of the rate hiking cycle on inflation, growth, and labour market data.”

Star Wow: A New Hope

A long time ago, in a galaxy for far away… It’s none of my business, after all I just do small caps and comic relief – but great scott! – New Hope Corp. (ASX:NHC)!

Certainly as far from a small cap as this coal cruncher has ever been.

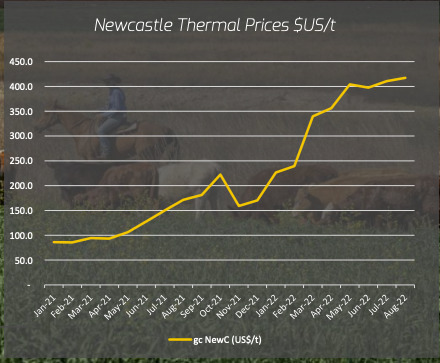

Josh Chiat’s latest is a great read (as ever) and he’s been watching New Hope quickly and quietly accumulate this:

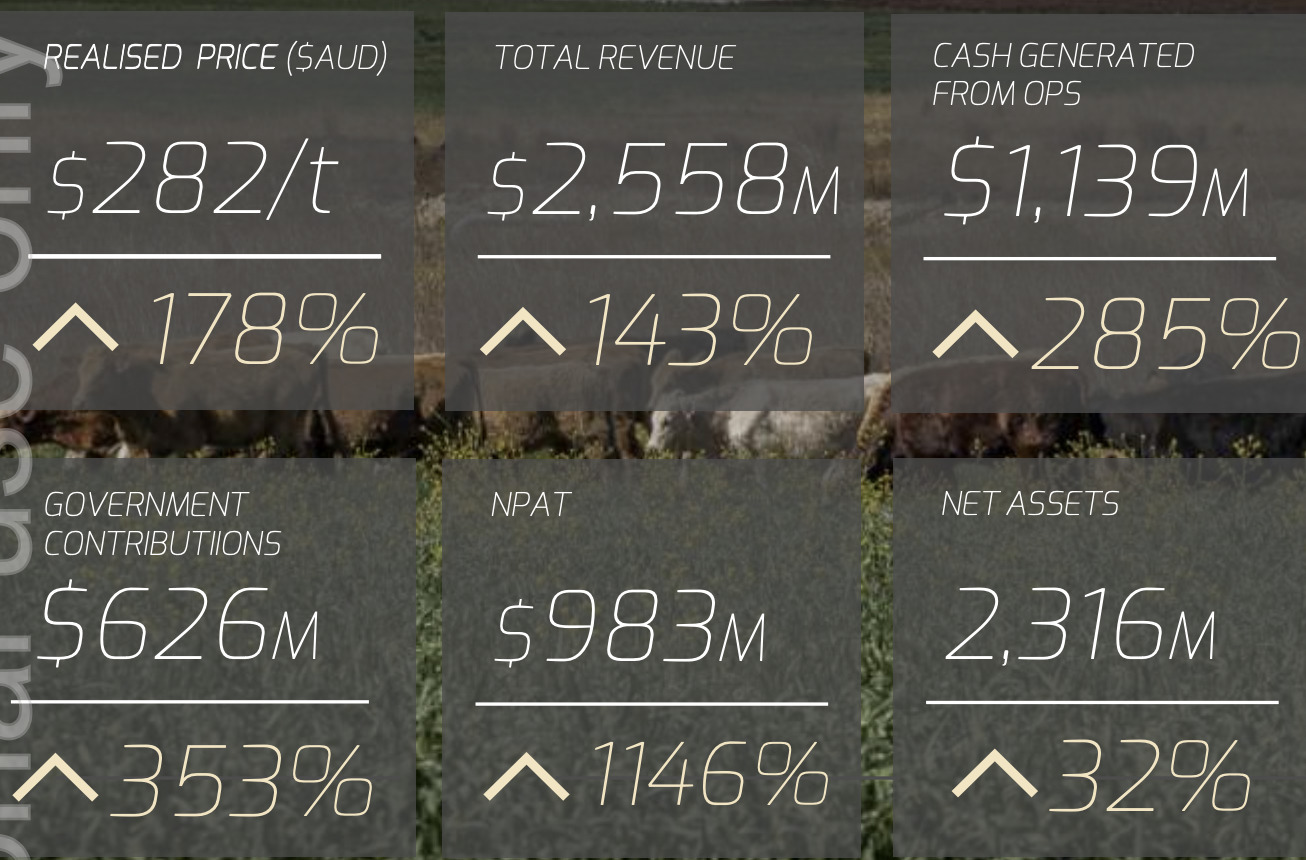

Before delivering this:

Which also explains this:

We particularly like the 1146% rise in net profit after tax (NPAT) to $983 million.

That took its final dividend payments to 86c for FY22, up from just 11c last year.

New Hope rewarded its shareholders with a special dividend of 25c per share, taking total payments to 56c per share. The share price is up about 7% today.

Around the grounds

Asian-Pacific markets are doing pretty well actually.

Japan’s Nikkei 225 is up 0.3% on its return to trade as Japan’s core inflation lifted 2.8% from a year ago, the fastest rate of increase since late 2014.

Mainland Chinese markets are in the green, the Hang Seng ahead by about 1% as China’s key interest paying loan – the loan prime rate (LPR) was left unchanged Tuesday as entirely expected. Japan and China remain – for now – the most inflation-proof of the major economies.

What else?

Well. The Roy Morgan, ANZ measure of consumer confidence says we all found about 0.4% extra confidence last week, largely eclipsing the slight fall of what was actually a great week, the week before.

I don’t know who the hell among us actually gained more confidence after last week’s shenanigans – but you’re not helping.

Stock futures on Wall Street tied to the Dow Jones Industrial Average, the Nasdaq and the S&P 500 futures have inch-wormed their creepy way ahead around 0.2% each at 1530pm Sydney time, the Federal Reserve looms over New York like a great big Damoclean Machine Gun.

JBWere’s Sally Auld told the NAB Morning Call podcast she knows which way The Fed is leaning,

“Central bank’s often talk about “the policy of least regret” – if we’re going to make a mistake.. which one would we prefer to make? The choice in this case is pretty stark: we can take the economy into a recession or… not tighten enough and risk inflation expectations getting unanchored,” she added.

“And I think faced with that choice… the mistake they’d prefer to make is the recession.”

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ACP | Audalia Res Ltd | 0.012 | 71% | 100,000 | $4,844,953 |

| CTO | Citigold Corp Ltd | 0.007 | 40% | 1,881,978 | $14,168,295 |

| MCM | Mc Mining Ltd | 0.92 | 37% | 83,179 | $132,428,763 |

| ARE | Argonaut Resources | 0.002 | 33% | 210,996 | $5,428,538 |

| GTG | Genetic Technologies | 0.004 | 33% | 195,348 | $27,701,895 |

| RIE | Riedel Resources Ltd | 0.008 | 33% | 3,068,181 | $6,430,242 |

| KGD | Kula Gold Limited | 0.03 | 30% | 5,386,348 | $6,186,299 |

| SYN | Synergia Energy Ltd | 0.0025 | 25% | 200,000 | $16,835,581 |

| VPR | Volt Power Group | 0.0025 | 25% | 24,926 | $18,689,067 |

| XST | Xstate Resources | 0.0025 | 25% | 3,700,819 | $6,430,363 |

| LRD | Lord Resources | 0.32 | 23% | 962,874 | $8,654,001 |

| FFG | Fatfish Group | 0.028 | 22% | 2,006,868 | $23,830,987 |

| NES | Nelson Resources | 0.017 | 21% | 548,794 | $4,120,160 |

| CBE | Cobre | 0.295 | 20% | 4,798,709 | $49,908,812 |

| AMD | Arrow Minerals | 0.006 | 20% | 11,443,430 | $10,168,825 |

| AYT | Austin Metals Ltd | 0.012 | 20% | 3,430,254 | $10,158,747 |

| CLE | Cyclone Metals | 0.003 | 20% | 4,394,850 | $15,291,842 |

| SIH | Sihayo Gold Limited | 0.003 | 20% | 132,500 | $15,255,320 |

| BKG | Booktopia Group | 0.28 | 19% | 2,297 | $32,279,435 |

| AL3 | Aml3D | 0.1 | 19% | 304,733 | $15,797,328 |

| NOR | Norwood Systems | 0.019 | 19% | 869,626 | $5,440,764 |

| FXG | Felix Gold Limited | 0.165 | 18% | 505,088 | $11,643,296 |

| ARO | Astro Resources NL | 0.0035 | 17% | 1,250,003 | $14,115,724 |

| FAU | First Au Ltd | 0.007 | 17% | 6,669,669 | $5,588,466 |

| GO2 | Thego2People | 0.014 | 17% | 658,467 | $4,879,659 |

Kula Gold (ASX:KGD), has jumped again, on top of yesterday’s late (but substantial) gains.

On Monday, KGD revealed plans to raise $1.8m to fast-track its WA lithium exploration and “assess new opportunities in the sector”.

Funds raised from the placement will focus on accelerating lithium exploration work at the company’s 100% owned Brunswick project in WA — ~45km from the Greenbushes lithium mine — as well as follow up recently identified Westonia Ni/PGE/Gold prospects adjacent to the Edna May gold mine, also in WA.

“Kula is also assessing new opportunities in the lithium sector that would complement the existing Brunswick lithium project,” it says.

This $7.5m market cap junior explorer is now up 40% since yesterday morning.

Meanwhile our colleague Cameron England over at The Oz, says it’s a Tuesday Revolution over at the renewable tech play 1414 Degrees (ASX:14D).

Cameron reports the original founders have ganged up to remove Dr Kevin Moriarty – who helped list the 1414 four years ago – from the company board.

Dr Moriarty resigned from the board last year, after failing to get the numbers for a tilt at control, but this year succeeded in sneaking back on to the board in June, where a vote to remove two directors and chair Tony Sacre failed.

1414 shares jumped 6% on the news, as the firm looks to build out its silicon-based renewable storage tech SiBox. For now however, it’s a bump to the stock price and lawyers at 50 paces.

Back to the diggers – and Ragusa Minerals (ASX:RAS) is flying about on Tuesday after snapping up another lithium exploration tenement in the NT.

The wider NT ‘Supergroup’ lithium project area is within the Litchfield Pegmatite Belt – host to Core Lithium’s (ASX:CXO) neighbouring Finnis Project, Lithium Plus (ASX:LPM), Charger Metals (ASX:CHR) and others.

Reuben reports, two more tenement applications are currently being processed by the NT Mineral Titles office.

“This is another very positive milestone that puts Ragusa in a strong position to rapidly accelerate the development of our project within a proven high-quality lithium district,” RAS chair Jerko Zuvela says.

ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.001 | -33% | 35,000 | $22,653,861 |

| GES | Genesis Resources | 0.009 | -25% | 844,796 | $9,394,096 |

| NAE | New Age Exploration | 0.009 | -25% | 44,407,444 | $17,230,787 |

| CLE | Cyclone Metals | 0.002 | -20% | 4,395,505 | $15,291,842 |

| TBN | Tamboran | 0.22 | -19% | 4,958,230 | $144,460,337 |

| NCL | Netccentric Ltd | 0.0665 | -18% | 49,043 | $22,923,945 |

| BHD | Benjamin Horngld Ltd | 0.215 | -17% | 21,679 | $6,280,363 |

| PHL | Propell Holdings Ltd | 0.039 | -17% | 225,003 | $4,988,262 |

| OAR | OAR Resources Ltd | 0.005 | -17% | 355,405 | $13,026,227 |

| KAI | Kairos Minerals Ltd | 0.038 | -16% | 37,609,411 | $88,384,207 |

| AVM | Advance Metals Ltd | 0.012 | -14% | 770,000 | $6,690,284 |

| CFO | Cfoam Limited | 0.003 | -14% | 3,738,669 | $2,568,442 |

| FGL | Frugl Group Limited | 0.012 | -14% | 6,640 | $2,837,131 |

| RNX | Renegade Exploration | 0.006 | -14% | 2,530,474 | $6,227,386 |

| TAR | Taruga Minerals | 0.03 | -14% | 1,767,923 | $20,231,688 |

| BME | Blackmountainenergy | 0.061 | -14% | 5,566 | $3,905,000 |

| SXG | Southern Cross Gold | 0.305 | -14% | 885,834 | $22,103,276 |

| WHK | Whitehawk Limited | 0.057 | -14% | 792,370 | $15,029,833 |

| HHI | Health House Int Ltd | 0.013 | -13% | 96,666 | $2,119,945 |

| ATU | Atrum Coal Ltd | 0.007 | -13% | 41,209 | $5,530,947 |

| CAV | Carnavale Resources | 0.007 | -13% | 2,700,000 | $21,748,414 |

| OCT | Octava Minerals | 0.21 | -13% | 1,654,163 | $8,919,003 |

| PIM | Pinnacleminerals | 0.14 | -13% | 12,200 | $3,900,000 |

| ECS | ECS Botanics Holding | 0.021 | -13% | 5,540,836 | $26,561,536 |

| VBS | Vectus Biosystems | 0.66 | -12% | 59,515 | $27,774,825 |

WHAT YOU MAY’VE MISSED

Yesterday’s news was all about Demetalllica (ASX:DRM) – which, as an aside, is an objectively hilarious ASX code given how hard Metallica (the band) drummer Lars Ulrich fought over Digital Rights Management (DRM) when the group famously went to war over people downloading illegal copies of their albums. But anyway…

Today’s news is from Metallica Minerals (ASX:MLM), (not the band) – with some drilling results from auger drilling at the western areas of Cape Flattery Project, which has hit some high-purity silica sand, including:

- WA150, 5m @ 99.49% SiO2 and 0.02% Fe2O3 from 0m1

- WA156, 5m @ 99.32% SiO2 and 0.03% Fe2O3 from 0m

- WA160, 5m @ 99.59% SiO2 and 0.03% Fe2O3 from 0m

- WA164, 5m @ 99.80% SiO2 and 0.04% Fe2O3 from 0m

- WA168, 5m @ 99.73% SiO2 and 0.03% Fe2O3 from 0m

- WA169, 5m @ 99.76% SiO2 and 0.05% Fe2O3 from 0m

Enter Sandman, indeed. (That one works on two levels, because of the band and the company name and I think you’ve probably already figured this out and moved on.)

Also in the news today is Yandal, the story of one young woman’s struggle to enter Rabbinical College. Wait… that’s Yentl. Sorry.

Yandal Resources (ASX:YRL) has some news about a resource upgrade, which has climbed to a Combined Inferred resource at Mt McClure totaling 2,225,000t @ 1.9g/t Au for 136,000oz – which is kind of a lot of gold.

The update comes on the heels of the completion of the MRE at Parmelia deposit within the 100% owned Mt McClure gold project in Yandal Greenstone Belt of Western Australia.

TRADING HALTS

Hold onto your hats, because here comes the Trading Halts Parade!

Victory Goldfields (ASX:1VG) – Capital Raise.

Consolidated Zinc (ASX:CZL) – Capital Raise.

Encounter Resources (ASX:ENR) – Capital Raise.

Estrella Resources (ASX:ESR) – Capital Raise.

And I think we can all agree that parade was a bit of a misfire. But good luck to everyone raising capital – may your vaults be overflowing and your investors be happy today, and forevermore.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.