Ground Breakers: Fortescue pledges US$6.2bn to hit “real zero” by 2030 but New Hope shows coal still pays

Pic: Karl Tapales/Moment via Getty Images

- Fortescue Metals Group pledges US$6.2bn to hit ‘real zero’ by 2030, planning to produce emission-less-ish iron ore by next decade

- New Hope Corp will pay around $465 million in dividends after coal prices surge and profit rises over 1000% to $983 million

There are two competing but intertwined narratives dominating the investment landscape in 2022 — the drive to decarbonise the world’s power sources over the long-term and the radical need for fossil fuel supplies to cater to an energy starved Europe deprived of the fast gas and coal normally delivered by Russia.

That yin-yang dynamic was on full show this morning with two contrasting announcements from the large end of town.

On one side of the ledger was iron ore miner Fortescue Metals Group (ASX:FMG), one of Australia’s largest polluters, which is aiming to become a ‘green premium’ investment in the resources space.

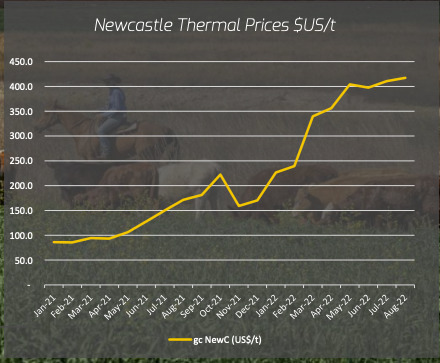

On the other is New Hope Corporation (ASX:NHC), a mid-tier coal firm revitalised by thermal coal’s record run to over US$400/t this year.

FMG targets ‘real zero’

Led by vocal billionaire Andrew Forrest, who has spent the past two years trying to convert part of FMG into a ‘green hydrogen’ business after a dramatic Mea Culpa about his firm’s impact on the environment, FMG has coined the term ‘real zero’ to describe its new 2030 target.

That is it plans to spent US$6.2 billion by 2030 to eliminate fossil fuels from its operations, producing iron ore for Asian customers with no scope 1 or 2 emissions.

That means no offsets or carbon credits, which are currently being used to reduce its overall emissions profile.

FMG thinks it will save US$818 million a year on its energy bill, avoiding 3Mt of CO2 equivalent a year, as much as 1% of the Federal Government’s legislated 43% CO2 reduction target.

That would deliver operating cost savings of US$3b by 2030 with capital payback by 2034, the company claims, and remove the risk associated with relying on carbon offsets and international carbon taxes.

Predominately focused on FY24-28, the investment would include the deployment of 2-3GW of renewables, battery storage and green mining fleet and locos run off electricity and hydrogen, displacing 700Ml of diesel and 15 million giga joules of gas per year by 2030.

“There’s no doubt that the energy landscape has changed dramatically over the past two years and this change has accelerated since Russia invaded Ukraine,” Forrest said.

“We are already seeing direct benefits of the transition away from fossil fuels – we avoided 78M litres of diesel usage at our Chichester Hub in FY22 – but we must accelerate our transition to the post fossil fuel era, driving global scale industrial change as climate change continues to worsen.

“It will also protect our cost base, enhance our margins and set an example that a post fossil fuel era is good commercial, common sense.

“Fortescue, FFI and FMG, is moving at speed to transition into a global green metals, minerals, energy and technology Company, capable of delivering not just green iron ore but also the minerals, knowledge and technology critical to the energy transition.

“Consistent with Fortescue’s disciplined approach to capital allocation, this investment in renewable energy and decarbonisation is expected to generate attractive economic returns for our shareholders through energy cost savings and a sharp reduction in carbon offset purchases, together with a lower risk cost profile and improvement in the integrity of our assets.”

Fortescue expects to see zero emission battery/hydrogen trucks on its mine sites by 2025, with battery/ammonia powered train engines and the infinity train, which generates power from its own momentum expected to be rolled out in the Pilbara in 2026.

Fortescue Metals Group (ASX:FMG) share price today:

New Hope delivers $465 million in dividends after bumper year for coal

But coal miners are still making hay while the sun shines very brightly for the controversial commodity.

Case in point New Hope, which today declared a 31c per share final dividend and 25c per share special dividend for FY22, equivalent to over $465 million after delivering a 1146% rise in profit after tax to $983 million.

Basically because thermal coal prices did this…

That took its final dividend payments to 86c for FY22, up from just 11c last year.

New Hope generated more than $2.5 billion in revenue, up from a tick over $1 billion a year earlier. It is something that could fly much higher, with average prices of $281.84/t Aussie well below current spot prices.

The 80% owned Bengalla mine in New South Wales delivered 9.3Mt of saleable production, down just 4% despite issues with Covid, labour and weather hitting almost 60,000 man hours.

Meanwhile, New Hope seems to be inching towards the approval of its expansion of the heavily contested New Acland mine in Queensland.

“The expansion of New Acland Mine achieved a series of significant approvals during the past year, including the Coordinator General’s Change Report, the Queensland Department of Environment and Science’s Environmental Authority and Mining Leases granted by Queensland Minister for Resources, Scott Stewart,” CEO Rob Bishop said.

“The Company is confident the chief executive of the Department administered by Queensland Minister for Water, Glenn Butcher, will grant New Acland Stage 3 the remaining primary approval, an Associated Water Licence as soon as possible, which will enable a restart of operations and employment opportunities for hundreds of local workers.”

While many fossil fuel players are shifting their focus long term to the energy transition and renewables, as seen in Origin Energy’s decision to sell out of its Beetaloo Basin gas assets yesterday, Bishop reiterated New Hope’s commitment to coal, having recently paid $94.4m for 15% of private met coal developer Malabar Resources, owner of the Maxwell mine near Muswellbrook in NSW.

“The acquisition diversifies our portfolio by providing exposure to metallurgical coal, mined by low impact underground methods, and is expected to provide attractive investment returns over the life of the project,” Bishop said.

“The Company believes the demand for high quality, low emission thermal coal, produced from our Australian operations is critical to supporting the transition to a decarbonised economy.

“The Company’s long-term strategy is to remain focussed on coal, both through its existing thermal portfolio and in new opportunities in either metallurgical or thermal coal production, which will provide shareholders with strong cash generation, and consistent returns.

“The Company believes that mining and resources is essential to Australia’s economy and is proud of the contributions it makes to local, state and federal Government departments, which help to underpin the living standards of all Australians.”

New Hope Corp (ASX:NHC) share price today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.