Closing Bell: Australian stocks go higher, for longer on bets The Fed won’t have to

Via Getty

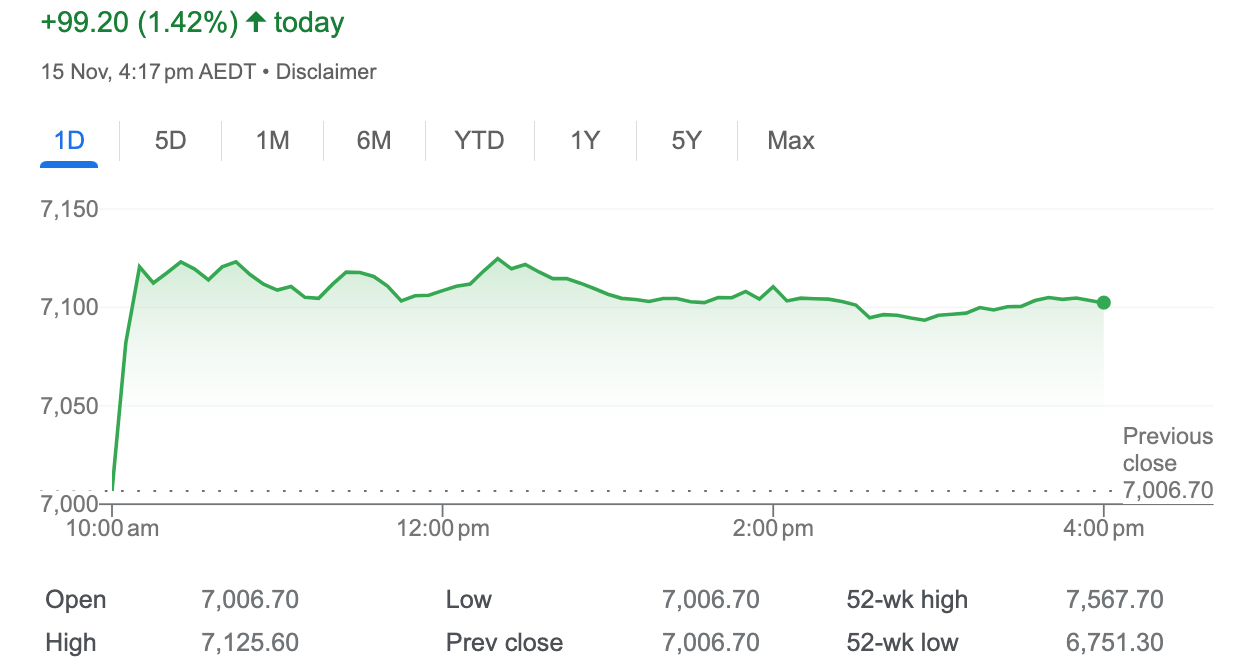

- The ASX has ended Wednesday jumping almost 100 points. Huge effort, everyone

- Energy Sector misses out on all the positive vibes

- Small caps led by Findi and Firebrick Pharma

The Australian sharemarket is in fine fettle on this Wednesday in mid-November. The benchmark is up like a Christmas tree in Westfield, Sydney and already looking back at where the 7,000 point psychological barrier is way below.

At match-out on Monday November 15, the S&P/ASX 200 (XJO) index was up about 99 points, or +1.42% at 7,105.9.

Just as Cat Stevens might’ve sung if he’d gone into banking instead of religion – everyone is higher and good news is all around.

Last night’s intensely anticipated US CPI drop revealed a slowdown in overall inflation, confirming recent Wall Street (and elsewhere) bets inflation has peaked and is now on the wane, stateside. Regional and local markets have taken the lead that the US Federal Reserve is done with rising rates and it’s been Action Jackson ever since.

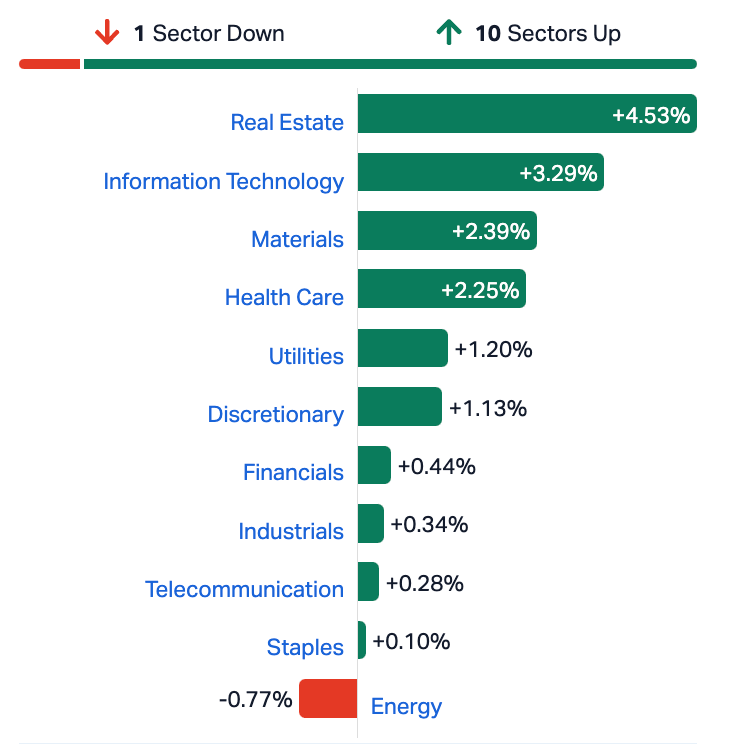

Making early hay were the major rate-sensitive sectors.

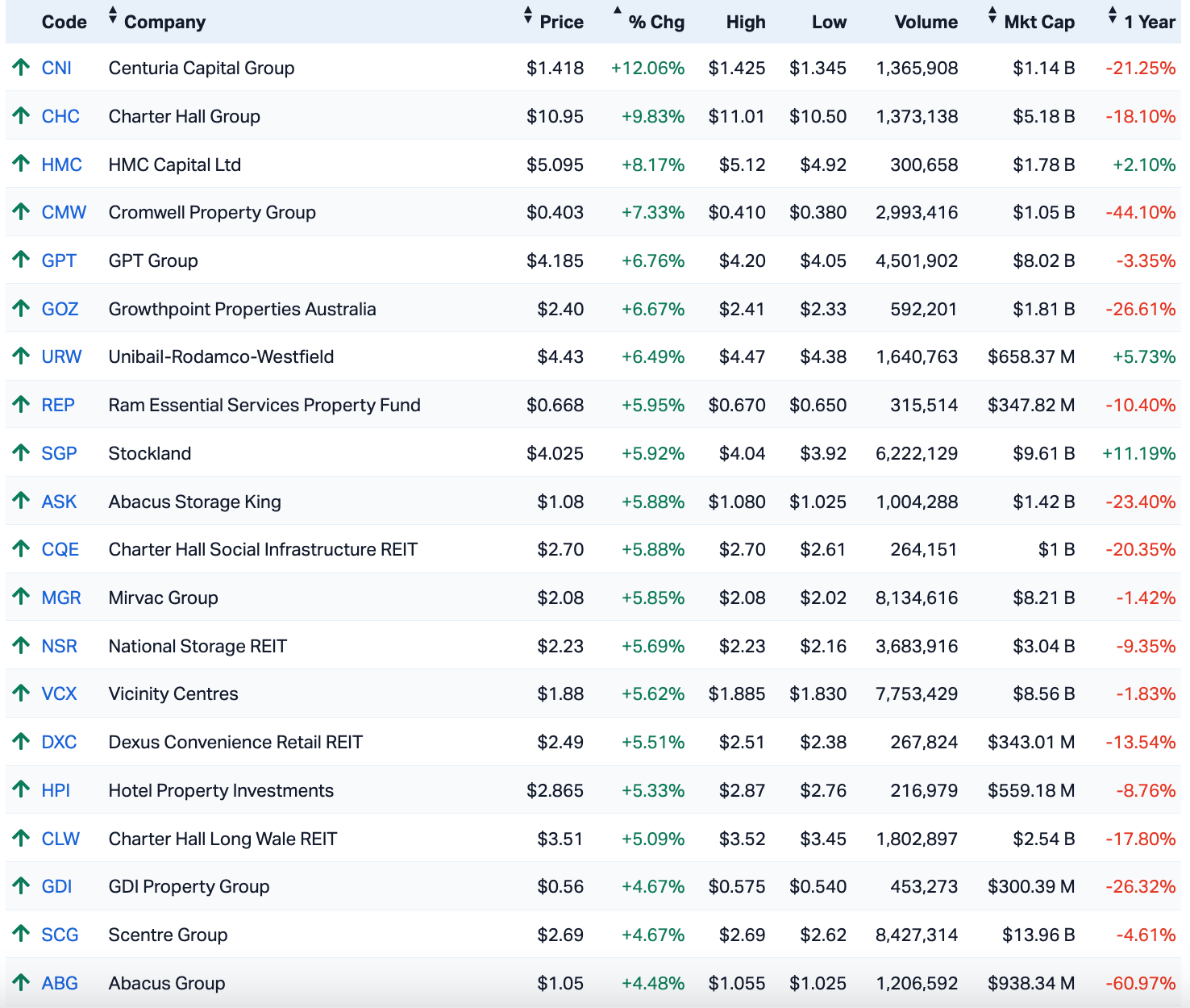

Property stocks and real estate investment trusts (REITs) have absolutely lost their minds.

The sector is up around 4.5% and here’s what a real leaderboard looks like:

S&P/ASX 200 Real Estate (XRE) Index (+4.53%)

The IT Sector ended the day up 3.3%, with WiseTech attracting much of the buying.

Lithium stocks have had a field day. Pilbara Minerals is back on its feet after a rough few sessions. (up 7.8 per cent), Then there’s Allkem soaking up the sentiment(up 7.4 per cent) and IGO has got its game on by circa 5%, last I looked

All the major iron ore stocks have continued to attract support. BHP (up 2 per cent), Fortescue (up 3.9 per cent) and Rio Tinto (up 3.4 per cent) also helped to lift the sector.

ASX SECTORS ON WEDNESDAY

In a target rich environment, local traders have had their choice, even the wretched Australian dollar was poking around at 65 US cents this morning, rising in concert with a bunch of major currencies vs the greenback.

Meanwhile, our own tale of the inflation tape was widely ignored when the Australian Bureau of Statistics dropped an expected surge in local wages – up by 1.3% QoQ , the most in 25 years. That didn’t touch the sides when, in China, industrial production jumped by 4.6% year-on-year for October.

After September’s 4.5% gain, the news came over the top of a 4.4% market concensus.

That was also the fastest pace in industrial production since April, mainly supported by mining and manufacturing with some great signs for local resources stocks as production grew for non-ferrous metals by +12.5%, chemical raw materials and products by +12.1% while cars were up about +11% and ferrous metals by +7.3%)

For the first ten months of this year, Chinese industrial output climbed by 4.1% on the pcp.

Ripped from the headlines

We’re watching Regional Markets

And over in India’s Bombay Stock market, the BSE Sensex also tracked the rise in Asian markets, jumping more than 600 points or 1% to a 4-week high.

US leads and the stronger-than-hoped for economic data out of China (also India’s top trading partner), including retail sales and industrial output follows some busy selling earlier this week after investors took some profits off the table after returning from a holiday.

We’re watching inflation

Just to recap, eh. The surprisingly weak US (CPI) inflation read has traders on their feet, especially the punchy ones who’ve invested into the hope that the US Federal Reserve is done lifting interest rates.

The CPI report showed that the US inflation rate slowed more than expected to 3.2% in October from 3.7% in September, while the core rate fell to 4%, the lowest level in more than two years.

The welcome data pushed back on the US greenback and helped US Treasury yields step off recent highs. As tracked by the CME’s FedWatch Tool, 99.8% of market participants expect no further rate hikes this year and, in a surprising twist, over 33% are betting the first rate cut could come in March 2024.

Bets for a rate cut in May next year increased to around 50%.

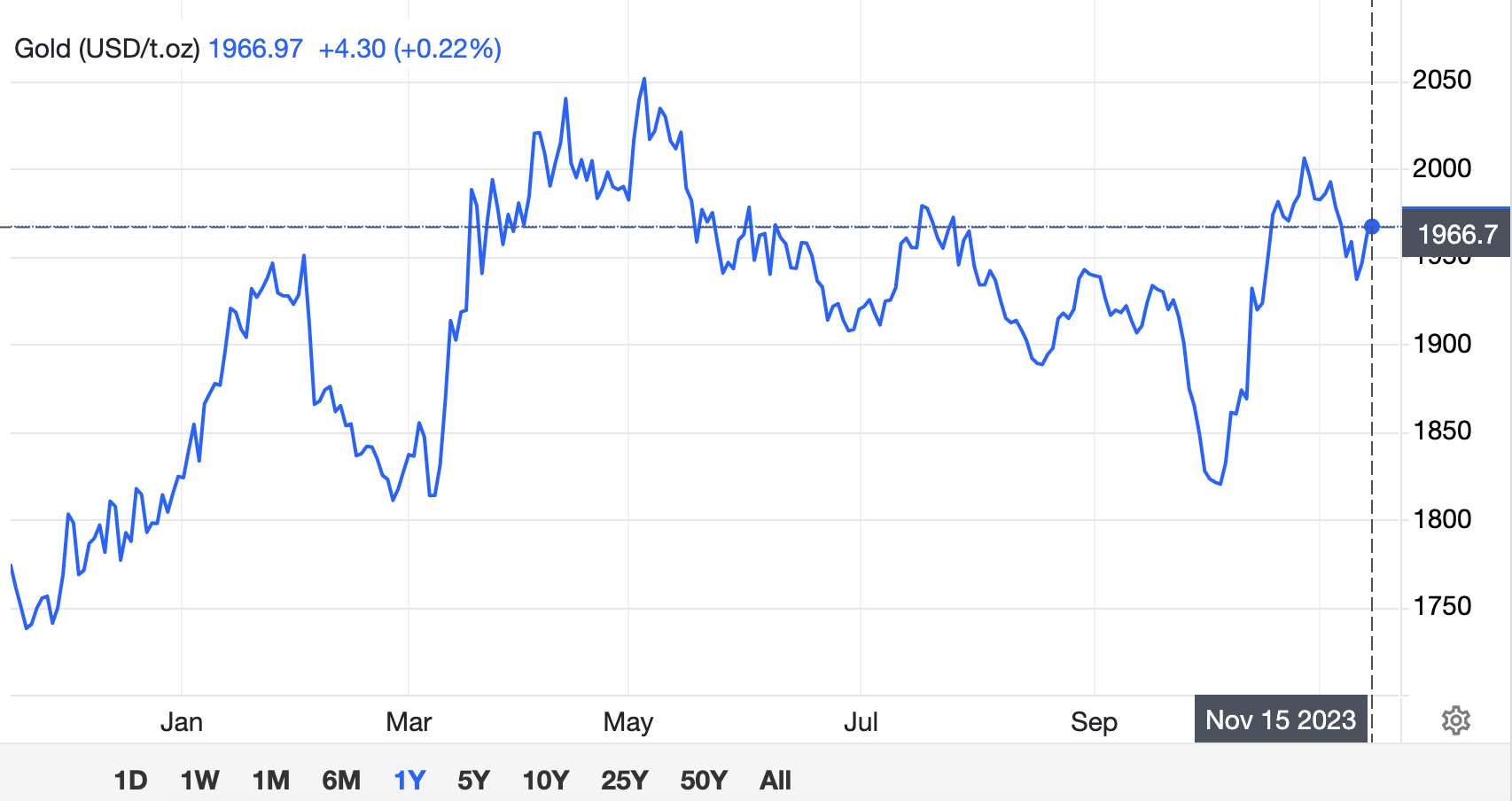

We’re still watching gold, too

Gold is looking handsome again after rising above $1,960 an ounce on Wednesday, extending gains for the third session on a weakened greenback and the easing inflation what did it.

The retreat in both yields and the greenback typically lifts demand for the yellow metal.

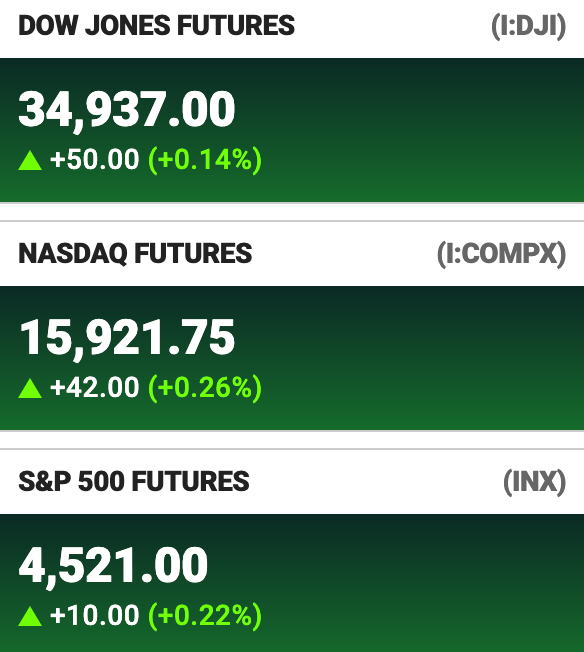

Meanwhile… US Futures suggest the buying’s not over in New York, late on Wednesday night…

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| FRE | Firebrickpharma | 0.069 | 86% | 9,157,395 | $4,200,025 |

| FND | Findi Limited | 1.23 | 55% | 1,085,912 | $29,302,597 |

| KGD | Kula Gold Limited | 0.021 | 50% | 13,736,189 | $5,224,967 |

| BP8 | Bph Global Ltd | 0.0015 | 50% | 274,285 | $1,615,563 |

| A11 | Atlantic Lithium | 0.565 | 47% | 1,864,662 | $235,713,039 |

| TSL | Titanium Sands Ltd | 0.014 | 40% | 4,032,887 | $17,718,047 |

| VAR | Variscan Mines Ltd | 0.014 | 40% | 832,746 | $3,566,147 |

| ACM | Aus Critical Mineral | 0.51 | 38% | 1,296,231 | $11,000,563 |

| LSA | Lachlan Star Ltd | 0.076 | 27% | 109,524 | $12,454,392 |

| ROC | Rocketboots | 0.145 | 26% | 7,374 | $3,741,928 |

| NNG | Nexion Group | 0.015 | 25% | 230,539 | $2,427,694 |

| E33 | East 33 Limited. | 0.025 | 25% | 39,700 | $10,381,774 |

| AD1 | AD1 Holdings Limited | 0.005 | 25% | 349,800 | $3,290,276 |

| ARD | Argent Minerals | 0.01 | 25% | 1,808,212 | $9,431,850 |

| FAU | First Au Ltd | 0.0025 | 25% | 300,000 | $2,903,987 |

| MOH | Moho Resources | 0.01 | 25% | 9,795,672 | $2,720,355 |

| ODE | Odessa Minerals Ltd | 0.01 | 25% | 73,534,203 | $7,576,895 |

| SFG | Seafarms Group Ltd | 0.005 | 25% | 1,375,648 | $19,346,397 |

| SIS | Simble Solutions | 0.005 | 25% | 2,000,000 | $2,411,803 |

| MCL | Mighty Craft Ltd | 0.013 | 24% | 2,079,961 | $3,826,646 |

| GCM | Green Critical Min | 0.008 | 23% | 3,857,091 | $7,387,803 |

| OSM | Osmondresources | 0.11 | 22% | 666,315 | $4,220,644 |

| MNS | Magnis Energy Tech | 0.062 | 22% | 19,054,351 | $61,174,406 |

| AKN | Auking Mining Ltd | 0.047 | 21% | 526,195 | $7,960,045 |

| ICN | Icon Energy Limited | 0.006 | 20% | 63,636 | $3,840,068 |

Up enormously this afternoon – it looks like Firebrick Pharma (ASX:FRE) has had a reprieve. And a good one at that.

Firebrick has been developing and commercialising a povidone-iodine nasal spray called Nasodine with all the international trademarks and patents – some of which have already been granted in the US, Europe and here.

There’s been six clinical trials to date for Nasodine, including a Phase 1 study, three Phase 2 studies and two Phase 3 studies, which have affirmed the product’s

safety and generally supported its efficacy as an antimicrobial nasal spray with utility in a range of uses.

But… Firebrick has been continuing its investigation into the results of the 2022-2023 Phase 3 common cold trial (2023 Trial), which in short, it reckons was a dud.

Now an indie expert agrees:

“The model outcomes strongly indicate major inaccuracies in the 2023 trial data, casting doubt on its reliability. This raises significant concerns about using the 2023

data to draw conclusions about the efficacy of the active versus placebo in that trial.”

So maybe the spray does cure the common cold after all…

Findi (ASX:FND) was up over 100% this morning and while buying has calmed some in the sharp light of arvo, the gains are still impressive.

Everything you need to know about FND is in this rather timely peice of journalism Eddy wrote till the wee hours and filed this morning. What a legend. What a gun. What a shame he’s too skint to put ten quid on the nose.

…because this morning FND dropped the news that its Indian subsidiary, Transaction Solutions International, has raised circa $38 million via placement ahead of its groundbreaking Indian IPO this week.

That money has come via leading Indian investment group, Piramal Alternatives, by way of Compulsory Convertible Debenture (no Gregor, not Compulsory Convertible Dentures), which are compulsorily convertible to equity at IPO.

“The entry equity valuation is based on an FY23 EBITDA multiple and reflects a pre-IPO market capitalisation of $153.0 million (post money $190.6 million) ahead of TSI India’s intended listing on the Bombay Stock Exchange,” Findi says.

Also up: lots of little ASX lithium miners.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AVE | Avecho Biotech Ltd | 0.003 | -40% | 2,625,924 | $13,491,460 |

| KEY | KEY Petroleum | 0.001 | -33% | 4,711,130 | $2,951,892 |

| MRQ | Mrg Metals Limited | 0.002 | -33% | 489,999 | $6,617,756 |

| MTC | Metalstech Ltd | 0.17 | -29% | 1,394,573 | $45,265,102 |

| IEC | Intra Energy Corp | 0.003 | -25% | 357,033 | $6,643,126 |

| PNX | PNX Metals Limited | 0.003 | -25% | 9,291 | $21,522,499 |

| LM1 | Leeuwin Metals Ltd | 0.23 | -25% | 2,518,950 | $13,659,425 |

| S66 | Star Combo | 0.1 | -23% | 2,285 | $17,560,788 |

| SOV | Sovereign Cloud Hldg | 0.08 | -20% | 28,253 | $33,940,067 |

| CAV | Carnavale Resources | 0.004 | -20% | 8,038,310 | $17,117,759 |

| GTG | Genetic Technologies | 0.002 | -20% | 50,000 | $28,854,145 |

| OAR | OAR Resources Ltd | 0.004 | -20% | 9,724,274 | $13,065,679 |

| BMG | BMG Resources Ltd | 0.009 | -18% | 183,280 | $6,971,769 |

| TEM | Tempest Minerals | 0.009 | -18% | 397,604 | $5,625,218 |

| BUR | Burleyminerals | 0.175 | -17% | 846,893 | $21,272,319 |

| ADV | Ardiden Ltd | 0.005 | -17% | 1,494,006 | $16,130,012 |

| FHS | Freehill Mining Ltd. | 0.0025 | -17% | 133,519 | $8,534,403 |

| IVX | Invion Ltd | 0.005 | -17% | 5,409,899 | $38,529,793 |

| YOJ | Yojee Limited | 0.005 | -17% | 8,610,884 | $6,811,227 |

| EBR | EBR Systems | 0.665 | -16% | 491,028 | $237,936,600 |

| CMP | Compumedics Limited | 0.16 | -16% | 11,150 | $33,660,960 |

| GBE | Globe Metals &Mining | 0.033 | -15% | 813,588 | $26,358,836 |

| MMM | Marley Spoon Se | 0.044 | -15% | 340,156 | $20,454,706 |

| RGL | Riversgold | 0.011 | -15% | 1,762,138 | $12,366,399 |

| HMD | Heramed Limited | 0.046 | -15% | 336,272 | $15,093,766 |

TRADING HALTS

Karoon Energy (ASX:KAR) – Pending an announcement regarding a potential transaction

Mithril Resources (ASX:MTH) – Pending an announcement in connection to the scheme of arrangement with Newrange Gold

Mako Gold (ASX:MKG) – Pending an announcement regarding a capital raising

Virdis Mining and Minerals (ASX:VNM) – Pending the release of an announcement in relation to drill assay results from the Company’s Colossus project

Panoramic Resources (ASX:PAN) – Pending an update on financial, strategic and operational matters

Asra Minerals (ASX:ASR) – Pending the release of an announcement in relation to a capital raising

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.