Closing Bell: ASX’s September Shocker ends on a win as uranium spot clocks 15-yr high

Character building. Via Getty

- Benchmark index, up +0.34%, ends month on a positive after dropping -1.5% in September

- Materials Sector out front after strong run for iron ore, uranium prices

- Small caps led by, BIO, CXO and CZR

Local markets, led almost single-handedly by mining stocks, snapped a 3-day losing streak and a forlorn week of stuttering trade on Friday, though shares are on track for their worst month of 2023 to date.

The Small Ords (XSO) index climbed 0.7% and the Emerging Companies (XEC) index found 0.9%, (thank The God of Small Things) reducing the XEC’s losses since Monday from circa -5.0%, to just -4.0%.

With the final session of the month given to outbursts of grandeur by major index funds to reclaim some balance for the quarter a likely accelerant, the ASX200 tracked gains on Wall Street overnight after US equity markets got a brief respite from the rising USD, near two decade high US Treasury yields and fulsome oil prices.

The benchmark index ended up +0.34%, following a surge across the big end of tech town, with the Magnificent 7 lending its weight to catch the walk back in US Treasury yields, the US 10-year bond yield retreating from a 17-year high.

Still, the ASX200 index has retreated for the second straight month as the higher-for-longer interest rate scenario pressured financial markets throughout the traditionally crappest month of the year for equities.

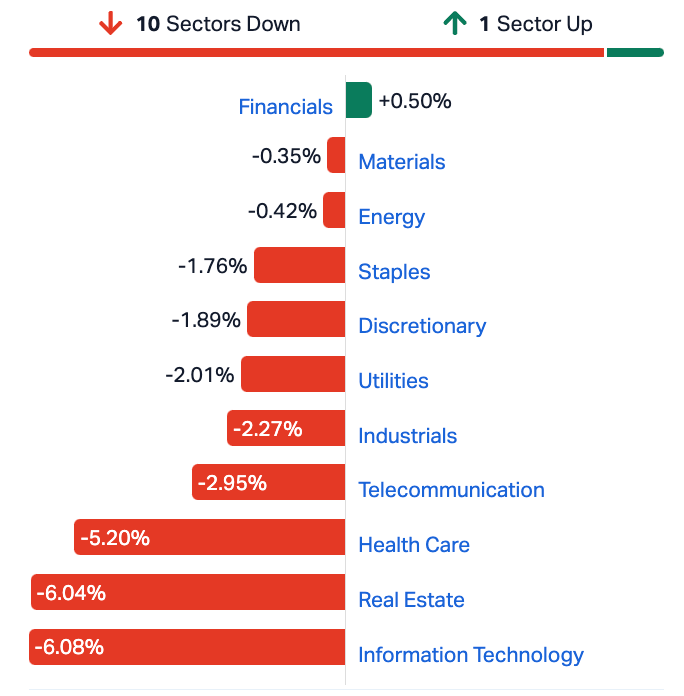

It was certainly a month to forget for the ASX Tech, Real Estate and Healthcare Sectors.

ASX Sectors in September:

All three US majors rallied ahead of the Federal Reserve’s preferred inflation gauge, the US personal consumption expenditures (PCE) index which drops Saturday morning early in Sydenham.

The Dow Jones Industrial Average climbed 0.35% The S&P 500 added 0.6%, and the Nasdaq Composite lurched some 0.85% higher.

Wall Street traders will also by keeping a close track on developments on Capitol Hill, as lawmakers try (or not) to agree on a spending bill before what would be a calamitous October 1 US government shutdown.

At home, the Mining Sector led by the heavyweight iron ore miners charged, although t’was Core Lithium and the uranium stoicks which took the cake, as CXO delivered a maiden profit and the uranium spot price smashed 15-year highs.

Ka-Boom! Spot #Uranium has just hit a new 15-year high going all the way back to tail of last U bull market with #Nuclear fuel brokers @Numerco Up +91c to $72.90/lb #U3O8 with sellers asking $75 for November delivery as Russia’s shipping problems add more rocket fuel. ️ pic.twitter.com/C2IKOgX6nN

— John Quakes (@quakes99) September 28, 2023

How high will it go? No one knows, but we are now at a price point where most ASX development projects can enter production and make good coin.

ASX uranium stocks are responding accordingly.

25 of the 37 companies on our list are up over the past week, while monthly uranium leaders: Bannerman Energy (ASX:BMN) , Deep Yellow (ASX:DYL) and Boss Energy (ASX:BOE) up a 50%, 48% and 43% respectively.

I’d read this for more. It’s timely and well written!

Another strong morning for yellowcake hopefuls as the #uranium spot price pushes relentlessly through 15-year highs. | #ASX https://t.co/sfqOFfPRSJ

— Stockhead (@StockheadAU) September 29, 2023

ASX by Sectors on Friday — Intraday — 52 Week Range — Week – Month – Year

Broker Moves on Friday

Praemium (ASX:PPS) – Initiation of Coverage – BUY – TP $0.92

Tom Tweedle at Moelis Australia has initiated coverage on PPS with a Buy Rating, and a Target Price of 0.92cents.

Tom says the investment platform industry is undergoing a significant change with the shift away from institutionally owned service providers to specialty platform providers, largely due to the significant regulatory drive for more transparent financial advice.

“These changes are shifting towards higher use of technology-as-a-service to implement business and more independent advice operators. In a growing demand environment of around 7% industry platform growth p.a., this backdrop has resulted in a strong set-up for the emergence of specialist platform providers.”

“Praemium has established itself as arguably #3 by scale of the specialist platform providers. Having begun life in 2001 offering solely non-custodial services, it now offers full non-custodial and custodial products.”

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.002 | 100% | 2,464,680 | $15,642,574 |

| BIT | Biotron Limited | 0.069 | 35% | 19,966,654 | $45,999,190 |

| ADS | Adslot Ltd. | 0.004 | 33% | 197,500 | $9,673,487 |

| PIQ | Proteomics Int Lab | 1.15 | 28% | 1,069,333 | $110,101,249 |

| CZR | CZR Resources Ltd | 0.14 | 27% | 224,468 | $25,930,811 |

| ARE | Argonaut Resources | 0.075 | 25% | 128,390 | $4,389,510 |

| EDE | Eden Inv Ltd | 0.0025 | 25% | 3,124,167 | $6,727,274 |

| SW1 | Swift Networks Group | 0.02 | 25% | 1,576,663 | $9,933,815 |

| EME | Energy Metals Ltd | 0.21 | 24% | 70,006 | $35,646,163 |

| FFF | Forbidden Foods | 0.017 | 21% | 477,909 | $2,616,048 |

| HFY | Hubify Ltd | 0.018 | 20% | 2,254,627 | $7,442,044 |

| ICG | Inca Minerals Ltd | 0.018 | 20% | 25,000 | $7,365,150 |

| G50 | Gold50Limited | 0.15 | 20% | 15,000 | $13,375,089 |

| JAT | Jatcorp Limited | 0.3 | 20% | 85,351 | $20,816,604 |

| T92 | Terrauraniumlimited | 0.15 | 20% | 289,253 | $6,450,645 |

| LML | Lincoln Minerals | 0.006 | 20% | 23,712,216 | $7,103,559 |

| BCB | Bowen Coal Limited | 0.155 | 19% | 7,960,600 | $277,678,164 |

| CXO | Core Lithium | 0.405 | 19% | 70,070,983 | $726,558,085 |

| PKD | Parkd Ltd | 0.025 | 19% | 43,500 | $2,138,185 |

| XST | Xstate Resources | 0.014 | 17% | 10 | $3,858,230 |

| PEN | Peninsula Energy Ltd | 0.145 | 16% | 11,815,964 | $157,224,773 |

| GLA | Gladiator Resources | 0.022 | 16% | 5,762,673 | $11,225,140 |

| LV1 | Live Verdure Ltd | 0.34 | 15% | 213,493 | $33,086,922 |

| AN1 | Anagenics Limited | 0.023 | 15% | 137,500 | $7,312,399 |

| FAL | Falconmetalsltd | 0.155 | 15% | 42,695 | $23,895,000 |

Biotron (ASX:BIT) shares totally spiked again on Friday arvo, securing the suspicion of the ASX highway police, who promptly issued a speeding ticket.

This follows a Tuesday message to shareholders from Michelle Miller CEO and MD of the Aussie pharmaceutical aspirant about the near-term outlook for BIT as it nears the final stage of three Phase 2 clinical trials for HIV‐1 and COVID‐19.

Biotron is developing a batch of new anti-viral therapies which potentially have broad applications. The stock is up ~125% for the week.

Emerging iron ore miner CZR Resources (ASX:CZR) enjoyed a the share price bump on Friday after the Pilbara Ports Authority (PPA) greenlit the submission of a Development Application for the POA Export Facility at the Port of Ashburton.

The Mark Creasy-backed CZR says, in quiet understatement, that the PPA’s consent ‘represents a significant development’ for the Robe Mesa project, which is the subject of a DFS.

Core Lithium (ASX:CXO) made a lot of headlines with its terrific Friday performance.

The Finniss lithium mine owner had lost about 60% YTD, on a series of downgrades that undermined investors’ faith.

Majorly discounted capital raises, disappointing Li2O recoveries and urgh production guidance for FY24 set at around 60% of Core’s 175,000tpa nameplate capacity were own goals, but lone Territorian spodumene producer has also been fortune’s fool this year – lithium prices are down well over 50% this year thanks to stalling demand growth in China.

But as Josh Chiat and Reuben Adams observed earlier today, once you’re in production it’s a margin game, and hard rock lithium is still selling at prices that give pretty much all producers the margin to prosper.

CXO spiked from the open after the $850 million battery metals miner has delivered a maiden profit for FY23 in its annual report today on shipments of just 5423dmt of spodumene concentrate and 14,774dmt of direct shipped lithium ore.

According to the lads, that pales in comparison to the 90,000-100,000t of spodumene concentrate it plans to sell this financial year, but still backed operating cash flows of $90.8m and an NPAT of $10.8m, from $50.6m in revenue and $14m in EBITDA.

Since June 30 Core’s sales have risen further, with the miner shipping 23,100dmt of spod and 15,000dmt of lithium fines to customers. While it pulled out of a deal to supply Elon Musk’s EV giant Tesla, it has major Chinese buyers Yahua and Ganfeng on its customer books.

Following a recent $111.4m placement and share purchase plan Core had $153m in the bank as of June 30.

CEO Gareth Manderson said delivering a maiden profit was a “significant achievement and a testament to the strategy to move quickly to production in a strong pricing environment.”

Core Lithium (ASX:CXO) share price today

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -33% | 2,000,000 | $8,737,021 |

| CT1 | Constellation Tech | 0.002 | -33% | 12,625,292 | $4,413,601 |

| VPR | Volt Power Group | 0.001 | -33% | 5,000,011 | $16,074,312 |

| BP8 | Bph Global Ltd | 0.0015 | -25% | 70,000 | $2,669,460 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | 664,000 | $15,569,766 |

| MTB | Mount Burgess Mining | 0.003 | -25% | 3,091,834 | $4,062,587 |

| WBEDC | Whitebark Energy | 0.038 | -24% | 27,800 | $7,339,661 |

| BMR | Ballymore Resources | 0.085 | -23% | 270,184 | $16,081,699 |

| L1M | Lightning Minerals | 0.105 | -22% | 678,020 | $5,307,957 |

| BPP | Babylon Pump & Power | 0.004 | -20% | 187,450 | $12,310,385 |

| TGM | Theta Gold Mines Ltd | 0.125 | -17% | 65,000 | $105,761,251 |

| AMD | Arrow Minerals | 0.0025 | -17% | 25,321,873 | $9,071,295 |

| EMU | EMU NL | 0.0025 | -17% | 286,511 | $4,350,064 |

| KTA | Krakatoa Resources | 0.021 | -16% | 385,015 | $10,872,448 |

| FFT | Future First Tech | 0.009 | -14% | 155,000 | $7,505,784 |

| AHN | Athena Resources | 0.006 | -14% | 150,000 | $7,493,273 |

| AYT | Austin Metals Ltd | 0.006 | -14% | 1 | $7,111,123 |

| DTR | Dateline Resources | 0.012 | -14% | 1,013,754 | $12,396,200 |

| VN8 | Vonex Limited. | 0.013 | -13% | 25,000 | $5,427,429 |

| EXL | Elixinol Wellness | 0.007 | -13% | 721,511 | $5,011,862 |

| VRC | Volt Resources Ltd | 0.007 | -13% | 65,691 | $31,515,391 |

| YPB | YPB Group Ltd | 0.0035 | -13% | 243,950 | $2,973,846 |

| SUV | Suvo Strategic | 0.029 | -12% | 710,875 | $26,746,932 |

| MZZ | Matador Mining Ltd | 0.044 | -12% | 264,802 | $15,771,702 |

| ASE | Astute Metals NL | 0.037 | -12% | 4,261 | $17,241,819 |

TRADING HALTS

Forrestania Resources (ASX:FRS) – in connection with a proposed equity capital raising

Heavy Rare Earths (ASX:HRE) – pending an announcement by the Company to the market in relation a significant upgrade to the Company’s Mineral Resources at its Cowalinya project, located in Western Australia

Buxton Resources (ASX:BUX) – Pending an announcement of results from the Double Magic Project

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.