Closing Bell: ASX up 0.22pc after slow start; iron ore miners, REA weigh on market

The ASX ended higher on the first trading day of September after a slow start. Picture Getty

- The ASX ended higher after a slow start

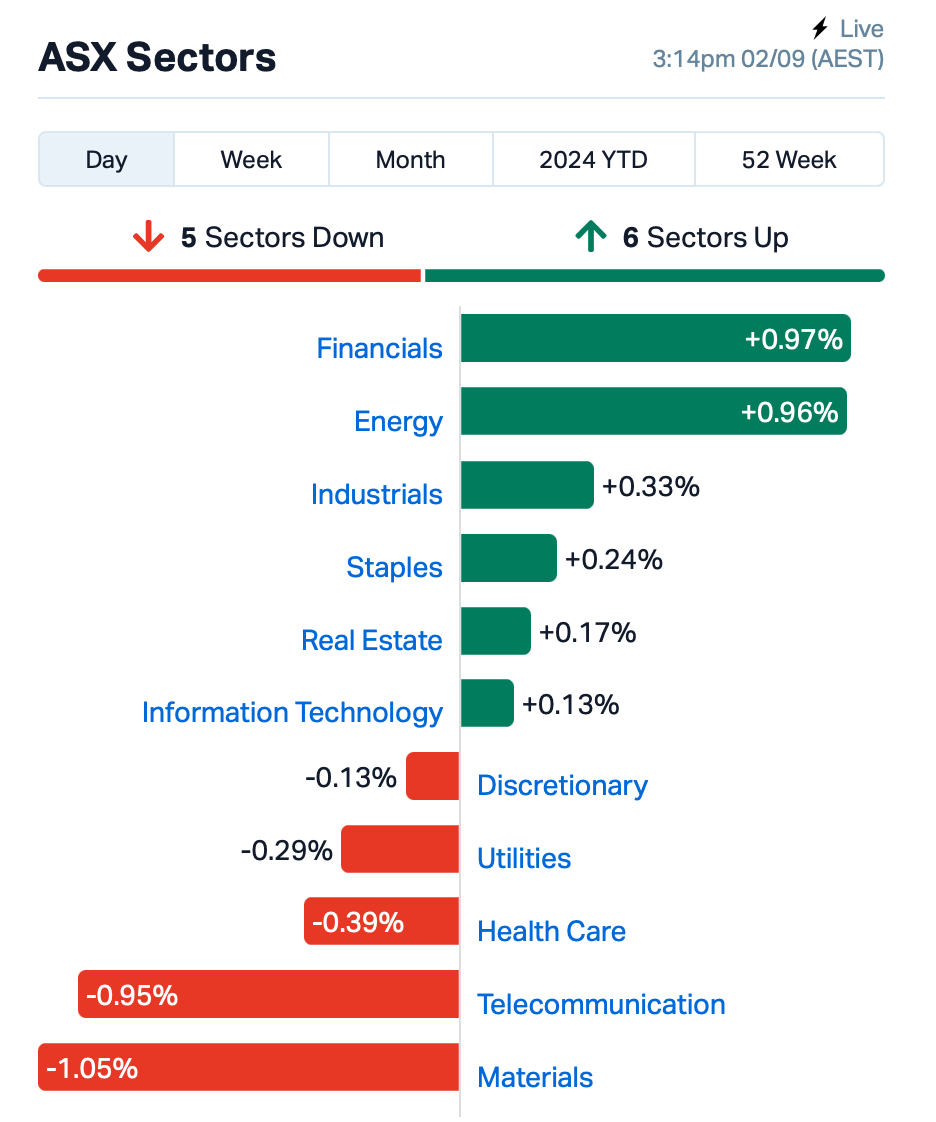

- Energy stocks leading while telcos and miners lagged

- Asian stocks mostly declined amid ongoing economic weakness

After a sluggish start, the ASX ended Monday higher by 0.22% as September trading began.

This follows a turbulent month for US stocks, which concluded on a strong note Friday after positive data on the Fed’s preferred inflation gauge.

The PCE (Personal Consumption Expenditures) reading, which showed prices increased in line with expectations in July, has further raised hopes for an interest rate cut starting in September.

On the ASX today, Energy led the sectors while Telcos and Miners lagged.

Iron-ore miners, in particular, struggled today as fresh data highlighted ongoing challenges in the Chinese economy.

Iron ore futures fell around 3% in Singapore to $US98 per tonne as over the weekend as China reported a fourth consecutive month of shrinking factory activity and falling new-home prices.

In the Telco sector, REA Group (ASX:REA) dragged down the index, falling 7% on reports it was considering a bid for UK-listed Rightmove.

REA hasn’t made any official overtures as yet, but the cat’s out of the bag on the company exploring options for a possible cash and share offer sometime in the near future

Casino operator, Star Entertainment (ASX:SGR) has had its trading suspended after failing to release its full-year results last week. Star is currently scrambling to raise funds and address the fallout from a critical review of its operations released by the regulator on Friday.

It’s unclear what’s happening inside SGR HQ at the moment, but the market is waiting on the company to deliver its report card for FY24 – and trading its shares will remain suspended until that happens.

What else is happening?

Across the region, Asian stocks mostly declined, with Hong Kong and mainland Chinese shares showing losses.

US stock futures also slipped with Wall Street closing for Labour Day today. Investors will now focus on the August jobs report, scheduled for release on Friday.

In China, despite a slight rise in the Caixin manufacturing PMI, the overall sentiment remains negative due to data howing factory activity contracting for the fourth consecutive month.

The ongoing property market slump and persistent weak demand are further dampening economic prospects.

September, a historically volatile month for global markets, is expected to continue this trend.

Traders are preparing for possible turbulence, with the US Cboe Volatility Index (VIX) rising each September in recent years.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GCR | Golden Cross | 0.003 | 50% | 49,147 | $2,194,512 |

| MTC | Metalstech Ltd | 0.260 | 44% | 3,262,335 | $35,434,509 |

| MQR | Marquee Resource Ltd | 0.019 | 41% | 14,321,599 | $5,621,189 |

| M24 | Mamba Exploration | 0.015 | 36% | 454,864 | $2,068,905 |

| DDT | DataDot Technology | 0.004 | 33% | 5,032 | $3,632,858 |

| TAS | Tasman Resources Ltd | 0.004 | 33% | 664,879 | $2,415,749 |

| CTT | Cettire | 1.358 | 29% | 9,836,578 | $400,300,131 |

| KPO | Kalina Power Limited | 0.009 | 29% | 6,847,011 | $17,404,758 |

| KLI | Killiresources | 0.165 | 27% | 5,884,318 | $18,229,087 |

| CRD | Conradasiaenergyltd | 1.145 | 27% | 352,132 | $104,032,084 |

| ECT | Env Clean Tech Ltd. | 0.003 | 25% | 88,648 | $6,343,621 |

| FGH | Foresta Group | 0.005 | 25% | 3,194,762 | $9,421,516 |

| SKN | Skin Elements Ltd | 0.005 | 25% | 1,272,000 | $2,357,944 |

| NAG | Nagambie Resources | 0.026 | 24% | 4,956,278 | $16,729,349 |

| NMR | Native Mineral Res | 0.026 | 24% | 142,870 | $5,508,576 |

| NIM | Nimyresourceslimited | 0.105 | 24% | 1,744,977 | $14,157,907 |

| FL1 | First Lithium Ltd | 0.135 | 23% | 59,940 | $8,761,896 |

| EXT | Excite Technology | 0.011 | 22% | 10,836,144 | $13,272,451 |

| RKT | Rocketdna Ltd. | 0.011 | 22% | 9,303,246 | $5,905,034 |

| SPQ | Superior Resources | 0.011 | 22% | 3,730,649 | $18,010,984 |

| MKR | Manuka Resources. | 0.033 | 22% | 2,469,221 | $21,053,727 |

| MXO | Motio Ltd | 0.018 | 20% | 676,561 | $4,022,975 |

| RFA | Rare Foods Australia | 0.018 | 20% | 145,545 | $4,079,749 |

| HOR | Horseshoe Metals Ltd | 0.006 | 20% | 886,132 | $3,316,408 |

| ODE | Odessa Minerals Ltd | 0.003 | 20% | 58,349 | $2,608,206 |

Imugene (ASX:IMU) stock surged 25% this morning following a major update on its Phase 1b trial of azer-cel, an allogeneic CAR T-cell therapy for diffuse large B-cell lymphoma (DLBCL). The trial showed promising results, with three patients achieving complete responses, and the addition of the cytokine IL-2 in Cohort B contributing to these outcomes. The company plans to continue enrolling patients and monitor response durability, aiming for a potential FDA Phase 2/3 trial. If successful, azer-cel could become the first approved allogeneic CAR T-cell therapy for blood cancer.

Conrad Asia Energy (ASX:CRD) was moving sharply on news it has signed a binding Gas Sales Agreement for the sale and purchase of the export portion of natural gas from the Mako gas field with Sembcorp Gas, a wholly owned subsidiary of Singapore-based Sembcorp Industries.

The contract term is until the end of the Duyung PSC in January 2037 and allows for the sale of around 76 billion British thermal units per day (Bbutd) equivalent to 76.9 million standard cubic feet per day (mmscfd), and contains provisions for the sale of up to an additional 35 Bbtud (around 35.4 mmscfd) should a tie-in pipeline not be built to the Indonesian domestic market in Batam.

Elsewhere, Marquee Resources (ASX:MQR) is the latest company with antimony news to announce, telling the market about its Mt Clement (Eastern Hills) project in the area from which Artemis Resources (ASX:ARV) has already revealed a maiden JORC complaint MRE of 13.2kt at 1.7% Sb (plus 18.7kt Pb, 7oz Au and 434 koz Ag) in 2013, building on exploration work in the 1990s by Taipan Resources.

That MRE only covers Artemis’ section of the identified mineralisation, and Marquee says that approximately 220m of known mineralisation from Taipan sits within Marquee Resources tenement E08/3214, and the structural trend extends for a further 800m onto Marquee ground, but the area has had “little to no exploration and thus remains open for the identification of further antimony bearing zones”.

RocketDNA (ASX:RKT) was higher on news that the company has signed two significant contracts for its xBot surveillance model (PatrolBot) with SSG Security Solutions, which involve the deployment of PatrolBot units across a number of mining sites for the monitoring and reporting of defined areas using drone or unmanned technology for the purpose of security overwatch and intelligence gathering.

Estrella Resources (ASX:ESR) was up on news that it has entered into a Subscription Agreement with a strategic investor to raise $350,000 at an issue price of $0.006 for each fully paid ordinary share, which represents a premium of 20% to the last closing price of $0.005 on August 28, 2024, with the finds earmarked to advance the company’s Timor-Leste Project.

Raiden Resources (ASX:RDN) was moving on news it has been granted a key E47/4062 tenement on the Andover South project, clearing the way for the company to continue its near-term drilling activity at the site.

Regener8 Resources (ASX:R8R) was moving on news that it has completed cultural heritage survey has been completed at priority locations of the Grasshopper and Hatlifter prospects by the Upurli Upurli Nguratja Aboriginal Corporation. Exploration planning is now underway including finalisation of drill hole locations and program extents, contractors and logistics, with drilling planned for Q4 2024.

And, niobium and REE anomalies have been detected at Rincon Resources (ASX:RCR)’s Avalon and Sheoak targets at its West Arunta project in WA. The West Arunta has a swarm of exploration of late, ever since WA1 Resources (ASX:WA1) exposed the region’s high-grade niobium with its 200Mt Luni deposit.

Thirteen RC holes and three DDH tails were drilled, encompassing 3,746 metres to test the four gravity anomaly targets – Avalon, Sheoak, K1, and K2 — outlined by ground gravity surveys earlier this year.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ENL | Enlitic Inc. | 0.060 | -35% | 936,455 | $7,241,918 |

| 1TT | Thrive Tribe Tech | 0.001 | -33% | 271 | $917,432 |

| AOA | Ausmon Resorces | 0.002 | -33% | 4,597 | $3,176,998 |

| NRZ | Neurizer Ltd | 0.004 | -30% | 148,304,510 | $10,905,597 |

| EDE | Eden Inv Ltd | 0.002 | -25% | 125,000 | $8,216,419 |

| WEL | Winchester Energy | 0.002 | -25% | 956,325 | $2,726,038 |

| NWF | Newfield Resources | 0.105 | -22% | 2,000 | $126,994,894 |

| AUH | Austchina Holdings | 0.002 | -20% | 1,191,760 | $5,250,959 |

| RNE | Renu Energy Ltd | 0.002 | -20% | 25,664,824 | $1,815,335 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 586,578 | $11,058,736 |

| PKD | Parkd Ltd | 0.021 | -19% | 115,475 | $2,704,361 |

| MKG | Mako Gold | 0.008 | -17% | 7,667,093 | $8,879,572 |

| WYX | Western Yilgarn NL | 0.025 | -17% | 42,831 | $3,001,786 |

| AL8 | Alderan Resource Ltd | 0.003 | -17% | 1,000,000 | $3,818,584 |

| AVE | Avecho Biotech Ltd | 0.003 | -17% | 500,000 | $9,507,891 |

| HFY | Hubify Ltd | 0.010 | -17% | 75,046 | $6,133,636 |

| LIO | Lion Energy Limited | 0.022 | -15% | 877,923 | $11,361,422 |

| STK | Strickland Metals | 0.098 | -15% | 7,269,754 | $253,795,195 |

| HCL | Highcom Ltd | 0.175 | -15% | 960,255 | $21,049,948 |

| OMX | Orangeminerals | 0.025 | -14% | 129,841 | $2,486,755 |

| MDR | Medadvisor Limited | 0.385 | -13% | 2,094,751 | $245,331,898 |

| PTL | Prestal Holdings Ltd | 0.078 | -13% | 1,673,076 | $15,341,355 |

| SKS | SKS Tech Group Ltd | 1.250 | -13% | 317,997 | $160,991,071 |

IN CASE YOU MISSED IT

AdAlta (ASX:1AD) continues to advance negotiations of several term sheets in respect of transactions associated with its AdSolis and AdCella strategies and will receive $1m under the previously announced institutional investments by New Life Sciences Capital and Meurs Group.

AdCella is a jointly owned entity to facilitate entry of innovative cellular immunotherapies from Asia into Western regulated markets, leveraging the company’s i-body technology, while AdSolis is looking to progress AD-214 into Phase II clinical trials for Idiopathic Pulmonary Fibrosis (IPF).

“We are pleased with the progress being made towards transactions in both our AdCella and AdSolis business units, enabled by the support of New Life Sciences Capital and the Meurs Group. We look forward to updating shareholders on further progress over coming months that will unambiguously demonstrate the true value of our i-body platform,” managing director Tim Oldham said.

Regener8 Resources (ASX:R8R) has completed a cultural heritage survey at priority locations within the Grasshopper and Hatlifter prospects ahead of planned drilling in Q4 2024.

Applicable Program of Works approvals have also been received by the Department of Energy, Mines, Industry Regulation and Safety (DEMIRS), which is a key step prior to on ground drilling.

Exploration planning is now underway including finalisation of drill hole locations and program extents, contractors and logistics.

Airtasker’s (ASX:ART) US operating company Airtasker USA has raised a combined US$9.75m (~A$14.4m) in media capital from the country’s number one audio company, iHeartMedia, and TelevisaUnivision – a leading Spanish-language content and media company. These deals will increase the company’s brand awareness in the US.

Anax Metals (ASX:ANX) has identified the potential to generate near-term revenue by processing existing Whim Creek waste rock into material that can be blended into road base products. It is working with Castle Civil on a commercial-scale trial.

Conrad Asia Energy (ASX:CRD) has signed a binding agreement for export gas sales from its Mako gas field in the West Natuna Sea offshore Indonesia with Singapore’s Sembcorp Gas. Along with the existing domestic sales agreement, all contingent gas resources at the field are now locked into sales agreements.

Prodigy Gold (ASX:PRX) has started a 13-hole drill program at the Hyperion deposit within the wider Tanami North project in the NT to evaluate the opportunity for development and expansion of the 407,000oz resource. This will focus on infilling areas to move the resource from inferred to the higher confidence indicated status.

QMines’ (ASX:QML) inaugural drill program at its Develin Creek project near Rockhampton, Queensland, has intersected copper mineralisation where expected in all holes. The 6000m program was aimed at upgrading the current 3.2Mt resource grading 1.05% copper, 1.22% zinc, 0.17 g/t gold and 5.9 g/t silver.

Raiden Resources (ASX:RDN) has been granted a new tenement – E47/4062 – that expands the footprint of its Andover South project. This comes as the company prepares to launch maiden diamond drilling.

RareX (ASX:REE) has identified a potentially cheaper pathway to extract phosphate from its flagship Cummins Range development. The company has also paused rare earths engineering while it waits for a recovery in magnet REE prices.

Ongoing drilling at Strickland Metals’ (ASX:STK) Horse Well Gold Camp has continued to uncover a high-grade gold system immediately below the existing shallow resource at the Warmblood deposit. Drilling has also extended high-grade mineralisation a further 150m along strike from the existing resource at Palomino.

Sun Silver’s (ASX:SS1) drilling has at the Maverick Springs project in Nevada has intersected up to 605g/t silver based on pXRF readings in extensional hole MR24-191. The inaugural drill program targets high-grade zones interpreted to trend to the northwest of the resource boundary along with infill drilling.

AdAlta (ASX:1AD) continues to advance negotiations of several term sheets in respect of transactions associated with its AdSolis and AdCella strategies and will receive $1m under the previously announced institutional investments by New Life Sciences Capital and Meurs Group.

AdCella is a jointly owned entity to facilitate entry of innovative cellular immunotherapies from Asia into Western regulated markets, leveraging the company’s i-body technology, while AdSolis is looking to progress AD-214 into Phase II clinical trials for Idiopathic Pulmonary Fibrosis (IPF).

“We are pleased with the progress being made towards transactions in both our AdCella and AdSolis business units, enabled by the support of New Life Sciences Capital and the Meurs Group. We look forward to updating shareholders on further progress over coming months that will unambiguously demonstrate the true value of our i-body platform,” managing director Tim Oldham said.

Regener8 Resources (ASX:R8R) has completed a cultural heritage survey at priority locations within the Grasshopper and Hatlifter prospects ahead of planned drilling in Q4 2024.

Applicable Program of Works approvals have also been received by the Department of Energy, Mines, Industry Regulation and Safety (DEMIRS), which is a key step prior to on ground drilling. Exploration planning is now underway including finalisation of drill hole locations and program extents, contractors and logistics.

TRADING HALTS

Anagenics (ASX:AN1) – pending an announcement by the Company in relation to the outcome of a Strategic Review.

NT Minerals (ASX:NTM) – pending an announcement regarding a proposed transaction in relation to the Redbank Copper Project.

Asra Minerals (ASX:ASR) – pending the release of an announcement in relation to the sale of the Tarmoola Pastoral Lease.

Chariot Corporation (ASX:CC9) – pending an ASX announcement to update the announcement of Friday, 30 August 2024 titled Chariot & Mustang Lithium LLC Update to comply with ASX listing rule 5.1.

Kalamazoo Resources (ASX:KZR) – pending the release of an announcement in relation to a capital raising.

Lotus Resources (ASX:LOT) – pending an announcement regarding a material agreement involving offtake and funding.

Almonty Industries (ASX:AII) – pending the release of an announcement in relation to providing further clarifications in relation to the announcement lodged 29 August 2024 titled: Almonty to Lead Global Supply Chain Re-entry of Tungsten in South Korea.

MetalsTech (ASX:MTC) – to allow the company time to identify and appoint a director to the Board to ensure it has the requisite 3 directors as required under the Corporations Act 2001.

At Stockhead, we tell it like it is. While AdAlta, Regener8 Resources, Airtasker, Anax Metals, Conrad Asia Energy, Prodigy Gold, QMines, Raiden Resources, RareX, Strickland Metals and Sun Silver are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.